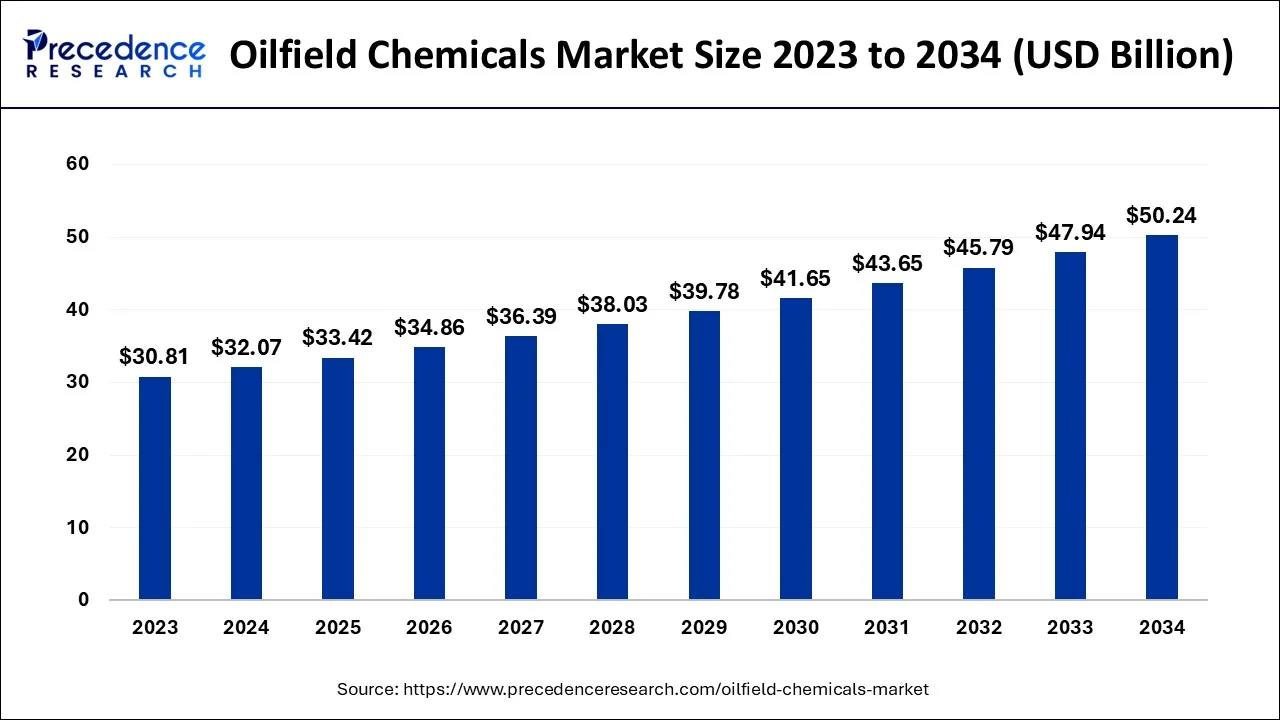

Ottawa, Dec. 05, 2024 (GLOBE NEWSWIRE) -- The global oilfield chemicals market size is predicted to increase from USD 33.42 billion in 2025 to approximately USD 50.24 billion by 2034, According to Precedence Research. The Middle East and Africa oilfield chemicals market size accounted for USD 12.68 billion in 2024.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3075

By increasing the productivity and efficiency of the oil drilling and petroleum refining processes, oilfield chemicals, chemical components of different compounds—are used in oil and gas extraction activities to enhance these operations. For the oil and gas sector to continue growing and adapting to new problems year after year, oilfield chemicals and their continuous innovation are essential.

Oilfield Chemicals Market Highlights:

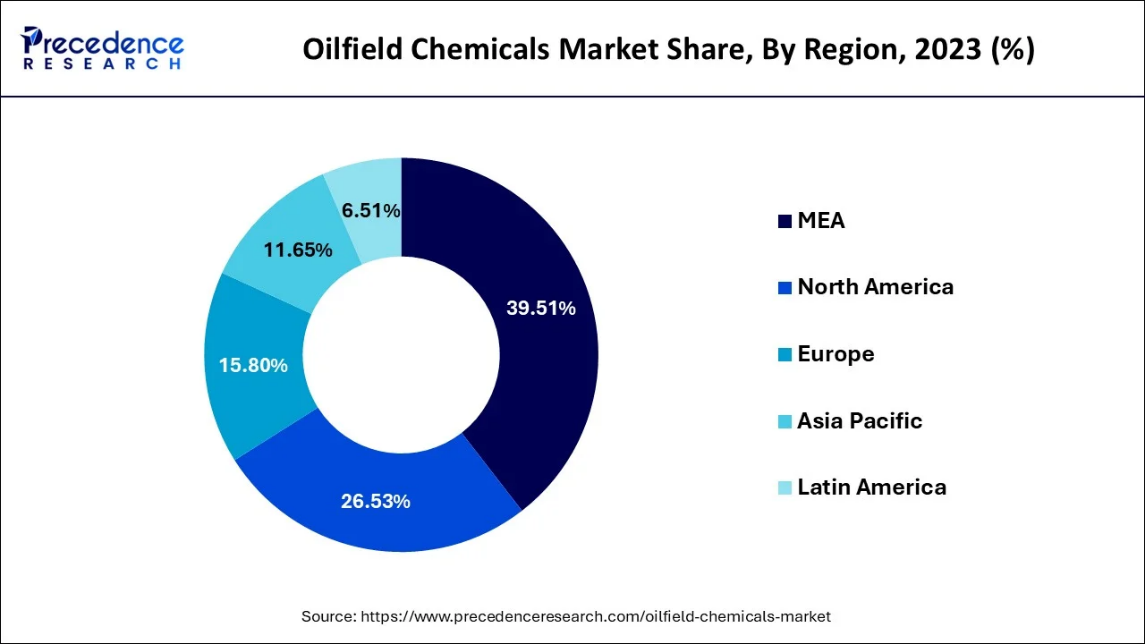

- Middle East and Africa accounted for the largest market share of 39.51% in 2023.

- North America generated more than 26.53% of revenue share in 2023.

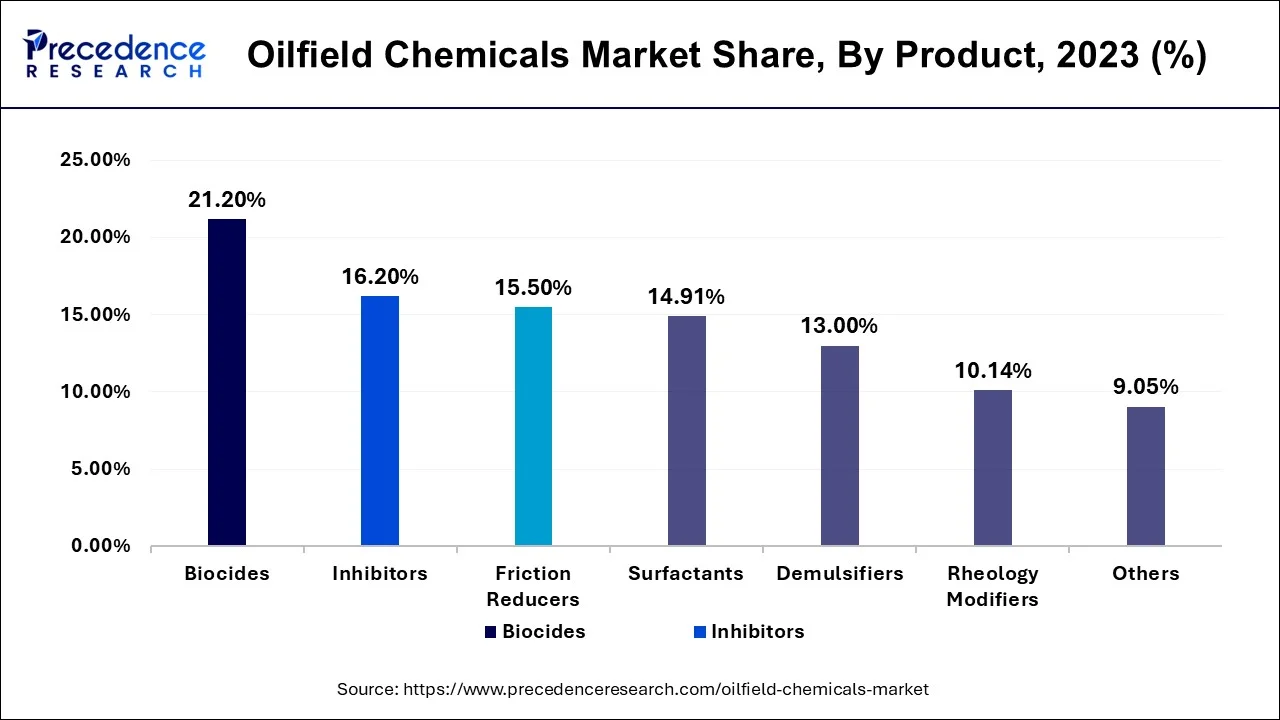

- By Product, the biocides modifiers segment contributed the biggest market share of 21.20% in 2023.

- By Application, the production chemicals segment is expected to witness the fastest CAGR of 5% during the forecast period.

- By Location, the onshore segment generated the highest market share of 70.15% in 2023.

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

Oilfield Chemicals Market Revenue (USD Million), By Application, 2021 to 2023

| Application | 2021 | 2022 | 2023 |

| Drilling Fluid | 5,399.3 | 5,574.9 | 5,761.5 |

| Production Chemicals | 5,742.2 | 5,990.0 | 6,254.4 |

| Cementing | 3,128.2 | 3,232.2 | 3,342.9 |

| Workover & Completion | 14,298.2 | 14,856.4 | 15,451.2 |

Oilfield Chemicals Market Revenue (USD Million), By Location, 2021 to 2023

| By Location | 2021 | 2022 | 2023 |

| Onshore | 20,011.8 | 20,787.1 | 21,613.2 |

| Offshore | 8,556.1 | 8,866.4 | 9,196.8 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3075

Growth Factors in the Oilfield Chemicals Market

- Growing demand: The oilfield chemicals industry is expanding due to rising product demand in a variety of petroleum activities, including improved oil recovery, hydraulic fracturing, well stimulation, drilling, cementing, and production.

- Better oil extractions: In the process of increased oil recovery, oilfield chemicals are essential. They are employed to increase the oil's mobility and change the characteristics of the reservoir rock, which facilitates extraction.

Oilfield Chemicals Market Opportunities

- In November 2024, with a business valuation of more than US$80 billion, the Abu Dhabi National Oil Company (ADNOC) announced the establishment of XRG, a revolutionary global lower-carbon energy and chemicals investment firm, subsequent to the Board's strategic endorsement.

- In October 2024, Kuwait, a member of OPEC, intends to release bids for the construction of an oilfield. Four international companies will be invited to submit bids for the Mutraba field when the Kuwait Petroleum Corporation (KPC) issues tenders soon.

Oilfield Chemicals Market Regional Analysis

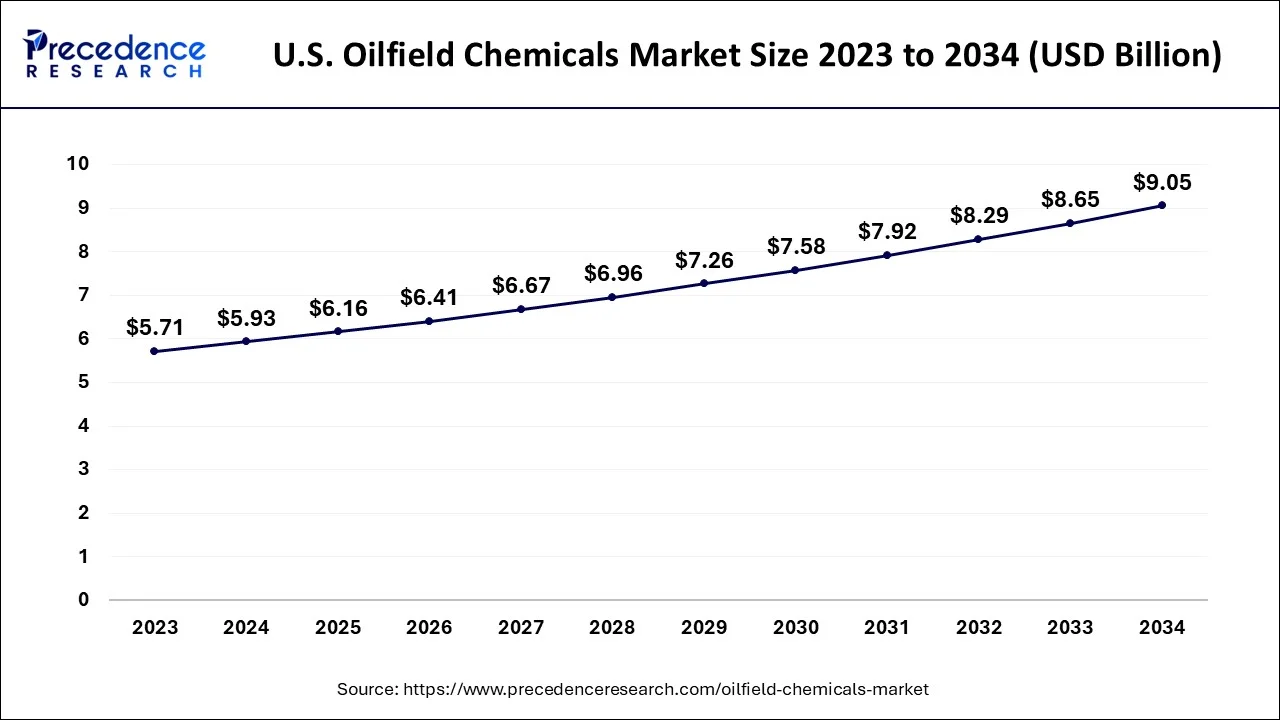

U.S. Oilfield Chemicals Market Size and Forecast 2024 to 2034

The U.S. oilfield chemicals market size is calculated at USD 5.93 billion in 2024 and is anticipated to reach around USD 9.05 billion by 2034, expanding at a CAGR of 4.2% from 2024 to 2034.

Presence of Large Oil Reservoirs: Middle East & Africa Dominated in 2023

Middle East and Africa led the oilfield chemicals market in 2023. These markets are mostly a result of increased drilling and oil exploration efforts to satisfy the world's demand for crude oil and natural gas. Saudi Arabia is strategically located and close to other OPEC nations, which is why few businesses are considering local production there.

One of the top ten countries in the world for oil production is the United Arab Emirates (UAE). Abu Dhabi is home to around 96% of the nation's approximately 100 billion barrels of known oil reserves, placing it sixth in the world. 3.2 million barrels of petroleum and liquids are produced daily on average in the United Arab Emirates.

Leading the oil and gas sector globally, Abu Dhabi National Oil Company (ADNOC) operates in every sector of the business. By 2030, ADNOC anticipates that its highest sustainable production capacity will be 5 million barrels. According to data cited by the U.S. Energy Information Agency, the United Arab Emirates possesses more than 215 trillion cubic feet of confirmed natural gas reserves, ranking it sixth in the world.

ADNOC stated in February 2023 that it has inked deals worth $4.63 billion with 23 UAE and foreign firms for local production possibilities across a wide spectrum of vital industrial items. In keeping with the "Make it in the Emirates" campaign and the "Abu Dhabi Industrial Strategy," the agreements specify the firms' plans to produce these goods in the United Arab Emirates.

Strategic Mergers to Expand North America’s Presence in the Industry

North America held the second-largest share of the oilfield chemicals market in 2023. due to the fact that it is a significant producer of gas and oil, home to well-known oil firms, and actively participates in strategic mergers and acquisitions to increase its market share. Because of its enormous oil and gas deposits and ongoing technical developments in extraction techniques, the United States, in particular, dominates the North American oilfield chemicals market.

An average of 20.28 million barrels per day (b/d) of petroleum were consumed in the United States in 2022, of which 1.17 million b/d were biofuels (1.002 b/d of gasoline ethanol and 0.164 b/d of biodiesel, renewable diesel, and other biofuels combined).1 The United States consumed almost 2% more petroleum in 2022 than it did in 2021. In the US, gasoline is the most widely used petroleum product.

- About 8.78 million barrels per day (369 million gallons per day) of finished motor gasoline were consumed on average in 2022, accounting for almost 43% of all petroleum consumption in the United States.

Fuel ethanol is a component of finished motor gasoline. About 3.96 million barrels per day (166 million gallons per day) of distillate fuel oil were consumed on average in 2022, accounting for 20% of all petroleum consumption in the United States.

Industry Expansion & Demand for Shale Gases: Asian Countries to Expand at the Fastest Rate

Asia Pacific is estimated to grow at a significant rate in the oilfield chemicals market in 2023. Industry expansion is responsible for the region’s fast urbanization, population growth, and increased demand for shale gas from a variety of businesses. Growing exploration efforts in Southeast Asian nations, India, Mainland China, and the South China Sea are the primary drivers of the regional market expansion. Asia Pacific is at the forefront of economic development due to the rising demand for petroleum and crude oil, as well as massive investments in the energy industry.

By 2045, it is anticipated that India’s oil consumption will have doubled to 11 million barrels per day. By 2029–2030, the demand for diesel in India is predicted to quadruple to 163 MT, and by 2045, 58% of the country’s oil needs will be met by gasoline and diesel. With India’s GDP predicted to reach US$ 8.6 trillion by 2040, primary energy consumption is predicted to almost double to 1,123 million tonnes of oil equivalent, according to the IEA (India Energy Outlook 2021).

In the past ten years, India's refining capacity has grown from 215.1 million metric tons per annum (MMTPA) to 256.8 MMTPA. By 2028, it is anticipated to rise to 309.5 MMTPA. India is predicted to be one of the main drivers of the increase in non-OECD petroleum consumption worldwide. Between fiscal years 2013–14 and 2023–24, the consumption of petroleum products grew from 158.4 million metric tons (MMT) to 234.3 MMT.

Oilfield Chemicals Market Report Coverage

| Report Attribute | Key Statistics |

| Market Size in 2024 | USD 32.07 Billion |

| Market Size by 2034 | USD 50.24 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.5% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Location |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oilfield Chemicals Market Segmentation Analysis

By Product Analysis:

The biocides segment held the largest share of the oilfield chemicals market in 2023 and is expected to grow at the fastest rate during the forecast period. A family of chemical compounds known as oilfield biocides has been developed especially to control and eliminate the growth of microorganisms in oil and gas production systems. Because they efficiently control microbial populations and mitigate associated issues, biocides are essential to oilfield chemical treatments.

By Application Analysis:

The workover & completion segment dominated the oilfield chemicals market in 2023. Workover fluid is a type of workover fluid that is used to stimulate or repair an existing production well in order to restore, extend, or improve hydrocarbon output. A solids-free fluid called completion fluid is used to "complete" an oil or gas well. The production chemicals segment is estimated to grow at the fastest rate during the forecast period. From cementing wells to maximizing high-performance drilling, among other things, oilfield production chemicals are crucial to the oilfield industry.

By location Analysis:

The onshore segment held the largest share of the oilfield chemicals market in 2023. Oilfield chemicals, such as corrosion inhibitors and demulsifiers, are commonly used in onshore oil and gas operations because they rapidly separate water from crude oil, reducing the cost of subsequent water treatment steps. As more onshore oil and gas projects are being developed worldwide, there is an increasing demand for oil field chemicals.

Browse More Research Reports with Market Size and Growth Analysis

- Specialty Oilfield Chemicals Market: The global specialty oilfield chemicals market size was USD 10.12 billion in 2023, calculated at USD 10.57 billion in 2024 and is expected to reach around USD 15.58 billion by 2033, expanding at a CAGR of 4.41% from 2024 to 2033.

- Specialty Chemicals Market: The global specialty chemicals market size was estimated at USD 869.88 billion in 2023 and is projected to hit USD 1,244.13 billion by 2032, expanding growth at a CAGR of 4.06% from 2023 to 2032.

- Pharmaceutical Chemicals Market: The global pharmaceutical chemicals market size was USD 115.45 billion in 2023, calculated at USD 123.42 billion in 2024 and is projected to surpass around USD 240.52 billion by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

- Detergent Chemicals Market: The global detergent chemicals market size was USD 63.05 billion in 2023, calculated at USD 68.53 billion in 2024 and is projected to surpass around USD 157.83 billion by 2034, expanding at a CAGR of 8.7% from 2024 to 2034.

- Crop Protection Chemicals Market: The global crop protection chemicals market size was estimated at USD 72.86 billion in 2023 and is expected to reach USD 125.65 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 5.6% during the forecast period 2024 to 2033.

- Digital Oilfield Market: The global digital oilfield market size was USD 30.4 billion in 2023, calculated at USD 32.5 billion in 2024 and is expected to reach around USD 63.33 billion by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

- Cosmetic Chemicals Market: The global cosmetic chemicals market size was estimated at USD 24.91 billion in 2023 and is expected to hit around USD 49.48 billion by 2033, growing at a CAGR of 7.10% during the forecast period 2024 to 2033.

- Pine Derived Chemicals Market: The global pine derived chemicals market size was USD 5.82 billion in 2023, calculated at USD 6.08 billion in 2024 and is expected to reach around USD 9.06 billion by 2033, expanding at a CAGR of 4.52% from 2024 to 2033.

- Aroma Chemicals Market: The global aroma chemicals market size was reached at USD 5.32 billion in 2023 and it is expected to increase around USD 8.59 billion by 2033, expanding at a CAGR of 4.95% during the forecast period from 2024 to 2033.

- Basic Chemicals Market: The global basic chemicals market size accounted for USD 721.36 billion in 2024, grew to USD 749.49 billion in 2025 and is predicted to surpass around USD 1057.56 billion by 2034, representing a healthy CAGR of 3.90% between 2024 and 2034.

Oilfield Chemicals Market Top Companies

- SMC Global

- BASF SE

- Solvay

- BERRYMAN CHEMICAL

- Thermax Limited

- Oilfield Chemicals

- SVS Chemical Corporation LLP

- SEATEX LLC

- Kemira

- Hawkins

- Chemiphase

- SicagenChem

- SAHARA Middle East Petroleum Services, Ltd.

* Interested in Company Profiles? Click to Download a Detailed Profiles

What is Going Around the Globe?

- In May 2024, at its facility in Tarragona, Spain, BASF intends to increase the capacity of its Basoflux line of paraffin inhibitors to be produced globally. Due to this investment, the Oilfield Chemicals division of BASF will be able to supply the oil and gas industry's present and future needs for innovative paraffin inhibitors.

Segments Covered in the Report

By Product

- Demulsifiers

- Inhibitors

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

By Application

- Drilling Fluid

- Production Chemicals

- Cementing

- Workover & Completion

By Location

- Onshore

- Offshore

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3075

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsevsolutions.com

Get Latest News:

https://www.precedenceresearch.com/news

For Latest Update Follow Us: