Pune, Dec. 06, 2024 (GLOBE NEWSWIRE) -- Banking as a Service Market Size Analysis:

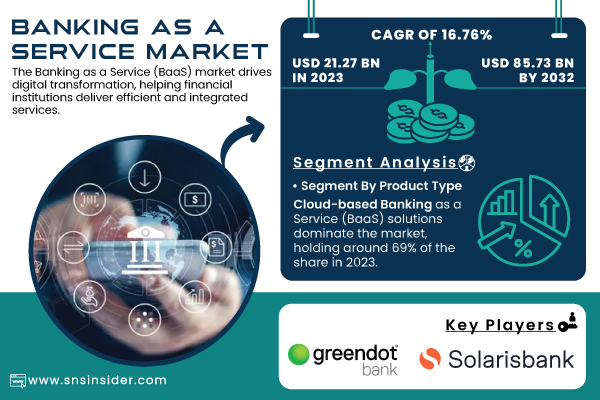

“The SNS Insider report indicates that the Banking as a Service Market size was valued at USD 21.27 billion in 2023 and is expected to grow to USD 85.73 billion by 2032, growing at a CAGR of 16.76% over the forecast period of 2024-2032.”

The Banking as a Service (BaaS) market has transformed dramatically and the growth of technology and the increasing demand for digital-first financial services have driven this evolution. Banking as a Service (BaaS) enables enterprises to provide the financial products and services they need by partnering with licensed banks without needing to build their banking infrastructure. The trend is taking off amongst non-bank financial institutions, fintech startups, and even legacy tech companies wanting to offer banking. With consumers moving more and more toward digital banking with banks, credit unions, and other financial institutions catering to their every financial desire with mobile apps and online banking, the changes keeping boomers in check will only stand to increase.

One of the key factors propelling the growth in BaaS across the world is mobile banking becoming popularized and the overall digitalization of financial services. While mobile devices are becoming the most-used instrument by businesses and consumers to carry out financial transactions, there is an increasing search by both retailers and consumers for an integrated solution that would be embedded within the digital assets of businesses for facilitating payments, lending, and other banking services. According to the International Monetary Fund (IMF), global mobile money transactions will grow to USD 1.1 trillion by 2025, signaling the rising demand for digital payment solutions and the increasingly significant role that BaaS has to play.

Another important driver for market growth is the emergence of new bank players including neobanks and challenger banks. The BaaS platforms enable these digital-only banks to deliver digital-first offerings that are more innovative, economical, and better aligned with the growing consumer preference for digital banking. Buoyed by the success of neobanks, traditional financial institutions are collaborating with fintechs to embed BaaS in their offerings and maintain their competitive edge as the digital banking landscape evolves.

Meanwhile, aligned regulatory evolution is making BaaS growth go even faster. Various jurisdictions are now implementing frameworks aimed at facilitating digital banking and open banking activities. As an illustration, open banking is the goal of the European Union's revised Payment Services Directive (PSD2) by making it easier for third parties to access banking data and create new services. Such changing regulations are disruptive while fostering new opportunities in providing a wider palette of offerings to both businesses and consumers, further fueling an expansion of the BaaS market.

Get a Sample Report of Banking as a Service Market@ https://www.snsinsider.com/sample-request/3302

Major Players Analysis Listed in this Report are:

- Green Dot Bank (Prepaid Cards, Mobile Banking, and Financial Technology Solutions)

- Solarisbank AG (API-driven BaaS Platform, Digital Banking Infrastructure)

- PayPal Holdings, Inc. (Digital Payments, Peer-to-Peer Payments, BaaS Solutions)

- Fidor Solutions AG (Open API Banking, Digital Banking Platform)

- Moven Enterprise (Financial Wellness Tools, Digital Banking Solutions)

- The Currency Cloud Ltd. (Cross-Border Payments, Multi-Currency Accounts)

- Treezor (White-Label BaaS Platform, Payment Processing)

- Match Move Pay Pte Ltd. (Digital Wallets, Prepaid Cards, BaaS Solutions)

- Block, Inc. (formerly Square, Inc.) (Digital Payments, Financial Services Infrastructure)

- Bnkbl Ltd. (formerly Bankable) (White-Label Banking Solutions, Payment Systems)

- ClearBank (Cloud-Based Clearing Bank, API Banking)

- Railsr (formerly Railsbank) (Embedded Finance Platform, Open Banking)

- Marqeta, Inc. (Card Issuing, Payment Processing, BaaS Solutions)

- Tink AB (Open Banking Platform, Account Aggregation)

- Finastra (Financial Software, Open Banking Solutions)

- Temenos (Core Banking Software, Digital Banking Solutions)

- Plaid (API Connectivity for Financial Services, Open Banking)

- Others

Banking as a Service Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 21.27 Billion |

| Market Size by 2032 | USD 85.73 Billion |

| CAGR | CAGR of 16.76%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Meeting the Rising Tide of Consumer Expectations in Banking |

Do you have any specific queries or need any customization research on Banking as a Service Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3302

Segmentation Analysis

By Component

The platform segment dominated the market and represented a significant revenue share in 2023. Banking-as-a-service platforms allow companies to embed banking services that banks have traditionally provided. Services such as monetary account opening, issuing cards, and even loans. These services can be incorporated directly into the company through BaaS platforms. Customers can handle cash flows, make payments, or approach funds via the company website powered by BaaS platforms. The segment is driven by the benefit of the BaaS platform that includes improved customer experience, higher brand loyalty, product branding & marketing.

The services segment is expected to register a high CAGR during the forecast period. BaaS is transforming the banking value chain and facilitating distributors to offer banking products and services via third-party platforms. The BaaS service provides integration, deployment, and maintenance of the BaaS platform that includes cloud storage, database, hosting platforms, user authentication, and push notifications. BaaS providers have different services that make the software process smooth while they provide end-to-end support to the clients. Those services are predicted to be widely deployed in the forecast period due to the ease of use and efficiency they impart.

Banking as a Service Market Segmentation:

By Product Type

- API

- Cloud-based BaaS

By Component

- Platform

- Services

By Enterprise Size

- Large

- SME

By End-User

- Banks

- FinTech Corporation

- NBFC

- others

Regional Landscape

North America is a major player in the Banking as a Service (BaaS) market, capturing approximately 41% of the total revenue share in 2023. This dominance stems from a strong fintech ecosystem, favorable regulatory frameworks, and high technological adoption among financial institutions. The United States is home to numerous innovative fintech startups that rapidly leverage BaaS solutions to meet consumer demands and market trends, fostering competition and growth. Regulatory initiatives, such as "Banking as a Service 2.0," encourage collaboration between traditional banks and fintech firms, promoting the adoption of digital banking solutions while ensuring consumer protection.

Asia Pacific is rapidly emerging as the fastest-growing region in the Banking as a Service (BaaS) market, driven by significant digital transformation, increasing fintech adoption, and favorable regulatory frameworks. In 2023, countries like China, India, and Singapore are leading a digital revolution in finance, where a surge of fintech companies is fostering competition and innovation, thus driving demand for BaaS solutions. Regulatory bodies, such as Singapore’s Monetary Authority, are implementing policies to support digital banking solutions and facilitate partnerships between traditional banks and fintech firms. Moreover, BaaS platforms address the critical issue of financial inclusion, providing tailored banking services to unbanked and underbanked populations in rural areas. With substantial investments in technology, including cloud computing and artificial intelligence, financial institutions in the region are enhancing operational efficiency while meeting the growing consumer demand for convenient and personalized banking experiences.

Buy an Enterprise-User PDF of Banking as a Service Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3302

Recent Developments

FinTech Innovators Ltd. announced in March 2024 that they would be expanding their BaaS platform to include additional services such as cryptocurrency wallets and decentralized finance (DeFi) solutions, aiming to provide a more comprehensive suite of offerings for tech-savvy customers.

Global Banktech Solutions revealed in June 2024 that they had secured a strategic partnership with leading fintech startup FinEdge, which will integrate BaaS technology into their cloud-based financial services platform. This partnership is expected to enable more seamless and secure financial transactions for businesses of all sizes, further cementing the role of BaaS in the financial ecosystem.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Banking As a Service Market Segmentation, by Product Type

8. Banking As a Service Market Segmentation, by Component

9. Banking As a Service Market Segmentation, by Enterprise Size

10. Banking As a Service Market Segmentation, by End-User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Banking as a Service Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/banking-as-a-service-market-3302

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.