Pune, Dec. 08, 2024 (GLOBE NEWSWIRE) -- Cyber Insurance Market Size Analysis:

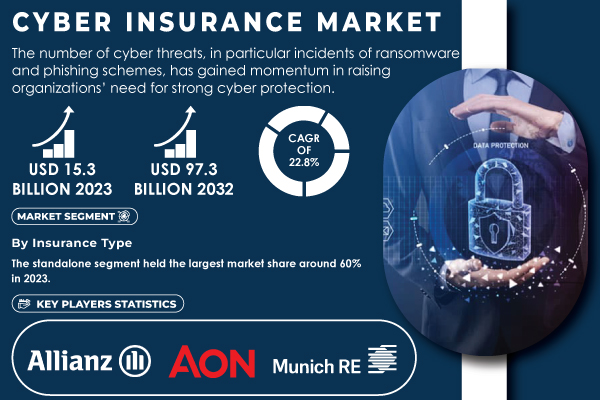

“The SNS Insider report indicates that the Cyber Insurance Market size was valued at USD 15.3 billion in 2023 and is expected to grow to USD 97.3 billion by 2032, expanding at a CAGR of 22.8% over the forecast period of 2024-2032.”

The Cyber Insurance Market is growing significantly, owing to the complexity and numbers of cyberattacks taking place and the need for local businesses to protect themselves from financial harm in this digital age. With the ongoing digital transformation of organizations, they become more susceptible to threats like ransomware, phishing, and data breaches, thus increasing the need for end-to-end cybersecurity solutions. One of the stronger drivers behind this growth is the more restricting regulatory environment, like the General Data Protection Regulation (GDPR) in Europe which is forcing businesses to implement increased levels of cyber protection, and cyber insurance. The International Risk Management Institute (IRMI) reported that more than 60% of organizations with 500 or more employees have cyber insurance policies, an industry-wide growth trend in the adoption of such products. Secondly, the spike in targeted cyberattacks on essential infrastructure sectors ranging from healthcare and finance to energy has prompted insurers to develop sector-specific coverages for these sectors are considered high-risk. According to Aon's State of Cyber Security 2024 survey, 40% of healthcare organizations experienced an increase in cyber insurance claims during 2021, driven by ransomware attacks that both disrupted operations and threatened patient data.

The market is also driven by advancing technology. Artificial intelligence (AI) and machine learning will give insurers the ability to better evaluate risks and support dynamic pricing models. It has allowed companies to track live cybersecurity risks which, in turn, has provided them intelligence to make more informed coverage decision-making. 80%+ cyber insurance has adopted AI in 2024 according to Cyber Insurance Insights — automating risk and claims handling by cyber insurance providers

Additionally, the increasing adoption of cloud computing and the Internet of Things (IoT) is also propelling the market. The need to secure interconnected systems is becoming more urgent, while demand for cyber insurance products is rapidly growing as businesses increasingly depend on them. According to a report from the Global Data Protection Regulation Survey, 70% of those small and medium-sized enterprises (SMEs) who experienced data breaches in 2023 would have not fully recovered without additional coverage provided by cyber insurance policies.

Get a Sample Report of Cyber Insurance Market@ https://www.snsinsider.com/sample-request/1268

Major Players Analysis Listed in this Report are:

- Allianz (Allianz Cyber Protect)

- American International Group, Inc. (AIG) (CyberEdge)

- Aon plc (Cyber Solutions)

- AXA (AXA Cyber Secure)

- Berkshire Hathaway Inc. (Cyber Liability Insurance)

- Lloyd’s of London Ltd. (Cyber Cover)

- Lockton Companies, Inc. (Lockton Cyber Risk Solutions)

- Munich Re (Cyber Re)

- The Chubb Corporation (Cyber Enterprise Risk Management)

- Zurich (Security and Privacy Protection)

- Beazley plc (Beazley Breach Response)

- CNA Financial Corporation (CNA CyberPrep)

- Travelers Companies, Inc. (CyberRisk)

- Hiscox Ltd. (Hiscox CyberClear)

- Liberty Mutual Insurance (Liberty Cyber Suite)

- Sompo International (Cyber Solutions Plus)

- Tokio Marine HCC (NetGuard Plus)

- Hartford Steam Boiler (HSB) (HSB Total Cyber™)

- QBE Insurance Group (Cyber Event Protection)

- Argo Group (Argo Cyber Suite)

Cyber Insurance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 15.3 Bn |

| Market Size by 2032 | USD 97.3 Bn |

| CAGR | CAGR of 22.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Policymakers and regulatory organizations have made steps to bolster defenses. • Firms' proactive actions to prevent losses. |

Do you have any specific queries or need any customization research on Cyber Insurance Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/1268

Segmentation Analysis

By Coverage Type

In 2023, the first-party coverage segment counts for a market share of around 56%, leading the market. First-party insurance applies to accidents where the insured is directly involved. This enables businesses to get covered in financial assistance and, consequently, lessen the impact of data breaches or cyber warfare. First-Party–This segment is also anticipated to grow having a surge in online thievery, hacking occurrences, extortion, and data obliteration.

The liability/third-party coverage segment is expected to be the fastest-growing segment during the forecast period. Liability insurance is being increasingly popular as it is now the key part of Enterprise risk management programs designed to shelter enterprises from a network protection failure. This liability coverage is customized for the needs of commercial clients. Additional coverages include: losses due to business interruption; costs associated with data breach and restoration; forensic assistance defending claims from third parties; and coverages not found in typical general liability policies. Therefore, numerous businesses dealing with sensitive information belonging to customers are selecting different protections with the help of third-party insurance policies.

Cyber Insurance Market Segmentation:

By Insurance Type

- Standalone

- Tailored

By Coverage Type

- First-Party

- Liability Coverage

By Enterprise Size

- SMEs

- Large Enterprise

By End-User

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Others

Buy an Enterprise-User PDF of Cyber Insurance Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/1268

Regional Landscape

North America dominated the Cyber Insurance Market and represented a significant revenue share in 2023, The main reasons for this are the increasing number of cyberattacks and the regulations in the field of data protection — the General Data Protection Regulation (GDPR) and industry standards in finance and health. Single-handedly, the U.S. takes dominance in the market as an unrelenting bid to minimize financial losses from data breaches and ransomware attacks. Continued digital transformation in verticals such as healthcare, finance, and energy, underpins this growth

APAC is anticipated to witness the highest CAGR during the forecast period. Some of the factors driving this include fast digitalization, a rise in awareness regarding cybersecurity risks, and an increase in cyber threats associated with developing nations such as India and China. With increasing data protection regulations and the growing prevalence of cybercrimes, businesses here are starting to take up cyber insurance. The APAC market will continue to grow as countries push the development of digital infrastructure and other SMEs are becoming aware of the importance of cyber insurance.

Recent Developments

April 2024: Zurich Insurance has launched a new cyber insurance policy tailored for small and medium-sized enterprises (SMEs). This policy includes coverage for ransomware attacks, data breaches, and business interruption, addressing the growing demand for affordable cyber risk management solutions for SMEs.

May 2024: American International Group (AIG) announced the expansion of its cyber insurance offerings with enhanced coverage options, including cybercrime and business interruption caused by cyberattacks. This expansion is designed to cater to the increased complexity of cyber risks faced by businesses globally.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cyber Insurance Market Segmentation, By Insurance Type

8. Cyber Insurance Market Segmentation, By Coverage Type

9. Cyber Insurance Market Segmentation, By Enterprise Size

10. Cyber Insurance Market Segmentation, By End-User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Cyber Insurance Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/cyber-insurance-market-1268

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.