Pune, Dec. 09, 2024 (GLOBE NEWSWIRE) -- Cloud Encryption Market Size Analysis:

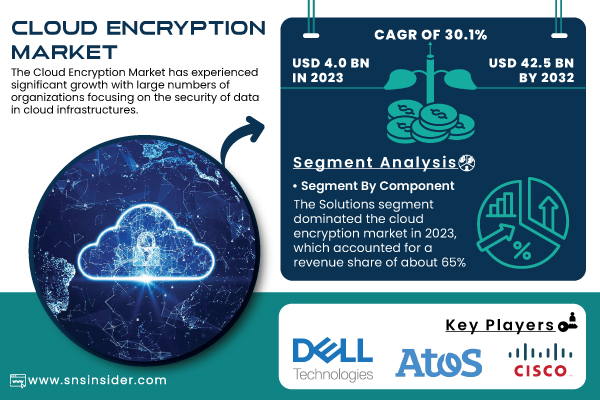

“The global Cloud Encryption Market, valued at USD 4.0 billion in 2023, is expected to reach USD 42.5 billion by 2032, registering a compound annual growth rate (CAGR) of 30.1% from 2024 to 2032.”

Trends In the Cloud Encryption Market

As enterprises migrate critical workloads to cloud environments, data security has become a primary concern, driving the adoption of advanced encryption solutions. The demand for end-to-end encryption, along with robust data protection mechanisms, has grown significantly as organizations strive to safeguard sensitive information against cyber threats. The rise of Software-as-a-Service (SaaS) platforms has further fueled market growth. Cloud encryption solutions tailored for SaaS platforms ensure that data remains secure in motion and at rest, addressing security challenges posed by the dynamic nature of cloud environments. Moreover, the proliferation of stringent data protection regulations such as GDPR, HIPAA, and CCPA has intensified the focus on cloud encryption as a compliance necessity.

Another key trend is the adoption of zero-trust security models, where encryption plays a pivotal role in protecting data across hybrid and multi-cloud ecosystems. Organizations are integrating encryption solutions with advanced technologies like artificial intelligence (AI) and machine learning (ML) to enhance threat detection and automate responses to potential breaches.

Get a Sample Report of Cloud Encryption Market@ https://www.snsinsider.com/sample-request/2936

Major Players Analysis Listed in this Report are:

- Atos (Atos Cloud Encryption, Atos Secure Cloud)

- Cisco Systems, Inc (Cisco Cloudlock, Cisco Encrypted Traffic Analytics)

- Dell Technologies (Dell Data Protection Cloud, Dell EMC Cloud Tiering Appliance)

- Hewlett Packard Enterprise (HPE Cloud Volumes, HPE Secure Compute)

- Hitachi Solutions, Ltd (Hitachi Content Platform, Hitachi Data Instance Governance)

- IBM (IBM Cloud Data Encryption, IBM Guardium Data Protection)

- Micro Focus International plc (Micro Focus Voltage SecureData, Micro Focus Secure Content Management)

- Microsoft (Azure Information Protection, Microsoft BitLocker)

- Netskope Inc. (Netskope Cloud Security, Netskope Encryption)

- Skyhigh Security (Skyhigh Cloud Security Platform, Skyhigh Data Protection)

- Sophos Group plc (Sophos Cloud Optix, Sophos SafeGuard)

- Thales Group (Thales CipherTrust Data Security Platform, Thales Cloud Encryption Gateway)

- TWD Industries (TWD Data Encryption Services, TWD Secure Cloud Services)

- WinMagic (WinMagic SecureDoc, WinMagic Cloud Encryption)

- McAfee (McAfee MVISION Cloud, McAfee Complete Data Protection)

- Amazon Web Services (AWS) (AWS Key Management Service, AWS CloudHSM)

- Google Cloud (Google Cloud Data Loss Prevention, Google Cloud Key Management)

- Box (Box KeySafe, Box Encryption Services)

- Vormetric (part of Thales) (Vormetric Data Security Platform, Vormetric Transparent Encryption)

- CipherCloud (CipherCloud Data Protection, CipherCloud Secure Data Exchange)

Cloud Encryption Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.0 Billion |

| Market Size by 2032 | US$ 42.5 Billion |

| CAGR | CAGR of 30.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Growing Demand for Enhanced Data Security Solutions Drives Cloud Encryption Market Growth • Rapid Adoption of Cloud Computing Across Industries Fuels Cloud Encryption Market Expansion |

Do you have any specific queries or need any customization research on Cloud Encryption Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/2936

Market Segmentation

By Component

In 2023, the Solutions segment led the cloud encryption market accounted for a 65% revenue share. These solutions include encryption software, key management systems, and secure access controls designed to protect data stored in or transmitted through cloud environments. As cloud usage expands, enterprises are increasingly relying on advanced solutions to secure data across multiple layers. Key management services, in particular, are gaining traction as organizations seek centralized control over encryption keys, ensuring data confidentiality and compliance with regulatory standards.

By Service Model

The Software-as-a-Service (SaaS) segment dominated the market in 2023 and held a 50% share. SaaS applications are widely used across industries, creating a pressing need for encryption solutions tailored to these platforms. SaaS-based encryption provides scalability, seamless integration, and enhanced flexibility, enabling businesses to secure data without compromising performance. Industries such as BFSI, healthcare, and retail are increasingly adopting SaaS-based encryption solutions to meet their evolving security needs.

By End-Use Vertical

The Banking, Financial Services, and Insurance (BFSI) sector has established itself as the dominant end-use vertical in the cloud encryption market, accounting for around 35% of the market share in 2023. This leadership stems from the critical need to safeguard vast amounts of sensitive financial data, which include customer details, transaction records, and confidential business information. As financial institutions increasingly migrate their operations to cloud environments, the adoption of robust encryption solutions has become a necessity to maintain data integrity and security.

The sector operates in a heavily regulated environment, requiring strict adherence to compliance standards such as PCI DSS, GDPR, and SOX. Cloud encryption helps these institutions meet these regulations by protecting data both in transit and at rest. With the growing popularity of digital banking, online transactions, and fintech applications, BFSI organizations face heightened risks of cyberattacks, data breaches, and unauthorized access.

Cloud Encryption Market Segmentation:

By Component

- Solutions

- Services

- Professional Service

- Support and Maintenance

- Training and Education

- Planning and Consulting

- Managed services

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Service Model

- Infrastructure-as-a-Service

- Software-as-a-Service

- Platform-as-a-Service

By End-use Vertical

- BFSI

- Healthcare

- Government and Public Utilities

- Telecommunication and IT

- Retail

- Aerospace and Defense

- Others

Regional Analysis

In 2023, North America dominated the cloud encryption market, holding a 40% market share. The region's leadership is attributed to the widespread adoption of cloud technologies and a robust regulatory framework emphasizing data security and privacy The United States, in particular, is a key contributor to market growth, driven by investments in advanced encryption technologies and the presence of leading cloud providers. The BFSI, healthcare, and technology sectors in North America are heavily reliant on encryption solutions to protect sensitive information and ensure regulatory compliance.

APAC region is projected to grow with the fastest CAGR during the forecast period 204-2032. Countries like China, India, Japan, and South Korea are rapidly adopting cloud technologies, creating significant opportunities for cloud encryption providers. Government initiatives such as India's Digital India program and China's Cybersecurity Law are promoting secure digital transformation, driving demand for encryption solutions. Additionally, the region’s growing e-commerce sector, coupled with the increasing adoption of SaaS platforms, is boosting market growth. Europe is another key region, with a strong emphasis on data privacy driven by regulations such as GDPR. Enterprises in sectors like BFSI, manufacturing, and retail are actively investing in encryption solutions to comply with stringent data protection laws and enhance their security posture.

Buy an Enterprise-User PDF of Cloud Encryption Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/2936

Recent Developments

- In 2023, Leading cloud encryption provider Thales Group introduced a comprehensive key management solution designed to enhance data security for SaaS platforms and hybrid cloud environments.

- In 2023, IBM partnered with a global financial institution to deploy a cutting-edge quantum-safe encryption solution, addressing emerging threats posed by quantum computing.

- In 2023, AWS expanded its encryption services portfolio by integrating machine learning capabilities, enabling automated detection and response to potential data breaches.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cloud Encryption Market Segmentation, by Component

8. Cloud Encryption Market Segmentation, by Organization Size

9. Cloud Encryption Market Segmentation, by Service Model

10. Cloud Encryption Market Segmentation, by End-use Vertical

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Cloud Encryption Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/cloud-encryption-market-2936

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.