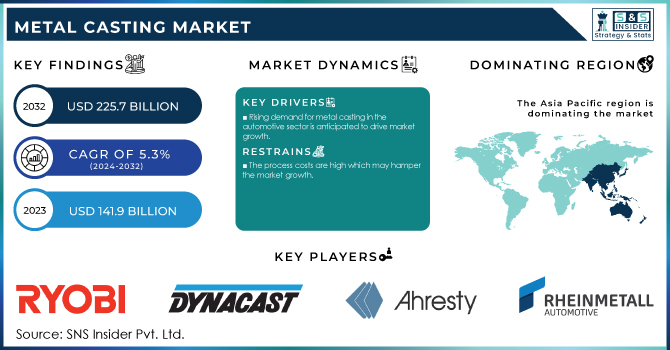

Austin, Dec. 10, 2024 (GLOBE NEWSWIRE) -- The Metal Casting Market Size Growth is projected to reach a valuation of USD 225.7 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2032.

Book Your Sample PDF for Composite Resin Market Report @ https://www.snsinsider.com/sample-request/1909

Key Trends Fueling the Metal Casting Market

Metal castings are used by the automotive and aerospace sectors and are among the largest consumers, as they need complex and lightweight components with superior durability and strength. The automotive industry has been witnessing this shift with a focus on reducing the weight of vehicles to improve fuel efficiency and environmental compliance, which has ultimately increased the demand for aluminum and magnesium castings owing to their high strength-to-weight ratio. Likewise, metal casting is utilized within the aerospace sector for critical engine components, structural components, and landing gear systems. Investment casting; and die casting as advanced casting techniques minimize material wastage and improve product efficiency with the result that these components are formed using an exact dimension through manufacturing.

Another key factor propelling the metal casting market is the accelerated production in the electric vehicles (EV) segment. In addition to that, as automobile manufacturers are transitioning towards electric mobility, they are also adopting metal casting technologies for the production of metal components specifically designed for EVs such as battery housings, and structural frames among others, thereby driving market demand.

Technological innovations continue to drive the metal casting industry toward higher efficiency, better material performance, and cost reduction. The adoption of 3D printing (additive manufacturing) in the metal casting process is one of the key trends shaping the market. By utilizing 3D-printed molds and cores, manufacturers can produce highly complex and customized metal parts with reduced lead times and lower production costs.

Additionally, the development of new casting alloys and improved casting techniques is contributing to the market's growth. For example, advanced casting methods like centrifugal casting and continuous casting allow manufacturers to produce parts with superior mechanical properties, enhanced resistance to wear and corrosion, and greater precision. These advancements are especially important in industries that require high-performance components, such as aerospace and defense.

If you need any customization in the Report as per your Business Requirement OR Schedule Analyst Call @ https://www.snsinsider.com/request-analyst/1909

Shift Toward Sustainable and Eco-Friendly Casting Solutions

As industries worldwide face increasing pressure to meet sustainability goals, the metal casting industry is also making strides toward more eco-friendly practices. The growing emphasis on reducing energy consumption, improving material efficiency, and minimizing emissions is driving the demand for cleaner casting technologies. For instance, the use of low-carbon foundry processes, such as green sand casting and water-based coatings, is gaining traction as foundries seek to lower their environmental impact.

Moreover, the development of recycled metal casting is playing a crucial role in reducing the carbon footprint of the industry. Recycling metal scrap and using secondary raw materials instead of virgin metals can significantly reduce energy consumption and greenhouse gas emissions, positioning metal casting as a more sustainable manufacturing option.

Stringent Regulations and the Need for Compliance

The metal casting industry is also influenced by the increasing regulatory requirements surrounding environmental and safety standards. Governments across the globe are tightening regulations on emissions, waste disposal, and worker safety, which is driving the industry toward more sustainable and compliant practices. For example, the European Union’s RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations are pushing foundries to adopt cleaner and safer materials in their processes. Compliance with these regulations is fueling the development of new alloys and casting methods that reduce harmful emissions and improve overall sustainability.

Which Material Segment Led the Market in 2023?

In 2023, aluminum had approximately 40% of the market share. This is due to its lightweight as well as comparatively low cost at such high volume and its capability to be used in a wide range of industries. Aluminum is among the single most materials specifically utilized in many automotive, aerospace, building, and construction sectors due to the increasing requirement for a lightweight material with strength and durability. Combine that with its brilliant resistance to corrosion, simple to make with shaping, and real recyclability and it becomes clear why. For example, aluminum casting is a standard application in the auto business for automotive hardware parts similar to engine blocks, transmission instances, and chassis components to cut back weight and improve gas effectivity. Its excellent mechanical properties at a relatively low price compared to titanium or magnesium also make aluminum the metal of choice in high-volume manufacturing, as well as custom applications.

Which Application Segment Led the Market in 2023?

Automotive & transportation sector accounted for the largest market, with nearly 55% share in 2023. Metal casting is significant in the manufacturing of a host of automotive parts, like engine blocks, transmission components, wheels, suspension, and body structures. Casting-friendly metals are not new to us, but with the constant drive for weight savings in the automobile to improve fuel economy and lower emissions, metals like aluminum and magnesium are front and center. The widespread use of lightweight cast components for better battery performance and increased range in EVs has made EV production one of the key drivers of automotive casting.

Which Region Dominated the Market in 2023?

In 2023, the Asia-Pacific region held the largest market share, accounting for approximately 46% of the global metal casting market. This dominance can be attributed to the rapid automation and infrastructure development in emerging economies like India and China. These countries have become major manufacturing hubs for metal castings, supplying a wide range of industries, including automotive, consumer goods, and construction. The increasing demand for automobiles, coupled with the rising production of electric vehicles, is further driving the demand for metal castings in the region.

Moreover, the presence of key players in the region, including large foundries and casting manufacturers, is strengthening the market. These companies are investing in state-of-the-art casting technologies and expanding their production capacities to meet the growing demand from both domestic and international markets.

Recent Developments in the Market

- In 2023, General Electric (GE) Aviation announced the expansion of its investment casting capabilities with the opening of a new state-of-the-art facility in the United States. The new facility is expected to support the production of advanced turbine engine components for the aerospace sector.

- In 2023, India-based foundry manufacturer, Bharat Forge, launched a new line of high-performance aluminum casting products designed specifically for electric vehicle (EV) applications. The company’s expansion into the EV market reflects the growing demand for lightweight and high-strength castings in the automotive sector.

- In 2023, the German automotive supplier, ZF Friedrichshafen, announced the launch of an advanced die-casting technology that improves the production of aluminum and magnesium components for electric vehicles. This technology promises faster production cycles and improved quality control, further driving the shift toward EV manufacturing.

Conclusion

The Metal Casting Market is poised for sustained growth, driven by increasing demand from key industries such as automotive, aerospace, and industrial machinery, along with advancements in casting technologies. As industries continue to emphasize sustainability, the market is shifting toward eco-friendly practices, such as the use of recycled materials and cleaner casting methods. Furthermore, stringent environmental regulations and the need for high-performance parts are pushing manufacturers to innovate and develop new alloys and casting technologies.

With continued investments in research and development, the metal casting industry is expected to witness robust growth over the coming years. As the demand for efficient, durable, and eco-friendly metal components rises across various sectors, the market will remain a critical segment of the global manufacturing landscape.

Buy this Exclusive Report Which Includes @ https://www.snsinsider.com/checkout/1909

BENEFITS:

1 No. Of Pages: 350 Pages Report

2 Regions/Countries:

- North America (3 Countries)

- Europe (~15 Countries)

- Asia Pacific (~10 Countries)

- Latin America (~5 Countries)

- Middle East & Africa (~5 Countries) (Including Israel)

3 ME Sheet: Market Estimation in Excel Format

4 Company Analysis:

- Major 16 companies covered in final report.

- Additional 5 companies will be covered as per client demand complimentary.

5 Statistical Insights and Trends Reporting:

- Vehicle Production and Sales Volumes, 2020-2032, by Region

- Emission Standards Compliance, by Region

- Vehicle Technology Adoption, by Region

- Consumer Preferences, by Region

6 Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

Read Full Report Description @ https://www.snsinsider.com/reports/metal-casting-market-1909

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.