New York, Dec. 10, 2024 (GLOBE NEWSWIRE) -- Overview

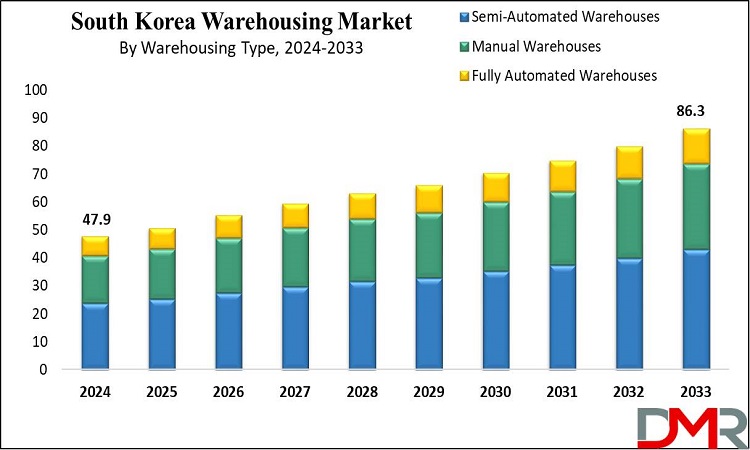

The South Korea Warehousing Market is projected to reach USD 47.9 billion in 2024 which is further anticipated to reach USD 86.3 billion by 2033 at a CAGR of 6.8%.

The South Korean warehousing market is growing rapidly due to the development of its e-commerce industry, the globalization of supply chains, and the growing usage of third-party logistics services.

Geographically positioned amidst major economies like China and Japan, the South Korean market has become a significant player in the global logistics chain. Major companies in this region, such as CJ Logistics and Lotte Global Logistics, are working toward achieving efficiencies in the mushrooming area of e-commerce with automation, robotics, and even artificial intelligence.

Cold chain logistics have great significance for the pharmaceutical and food industry, hence becoming popular. Companies are taking a greater interest in private warehousing due to better control these are prevailing now.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/south-korea-warehousing-market/request-sample/

Important Insights

- Market Value Insights: This market is estimated at USD 47.9 billion in 2024 and is projected to reach USD 86.3 billion by 2033.

- Warehousing Technology Segment Insights: Semi-automated warehouses are expected to dominate this segment, holding 49.9% of the market share in 2024.

- Ownership Segment Insights: Private warehouses are set to lead the market in 2024, commanding the highest market share in this segment.

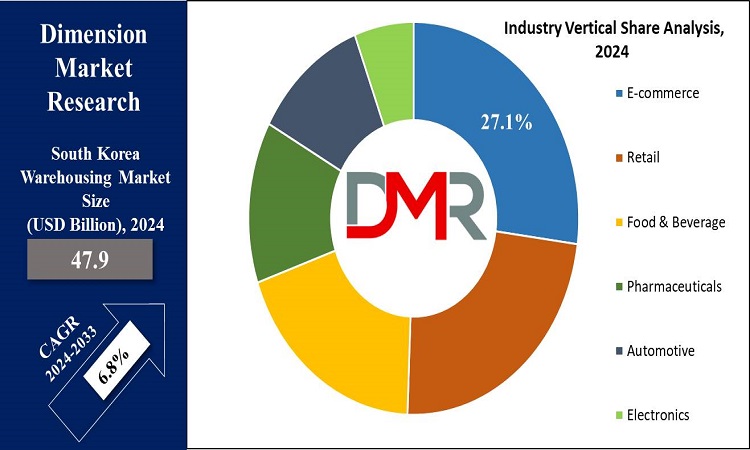

- Industry Vertical Segment Insights: E-commerce is forecasted to hold 27.1% of the market share by the end of 2024.

- Key Players: Leading players include CJ Logistics Corporation, Pantos Logistics, DSV, Toll Holdings Limited, Hyundai Glovis, LS Networks, and DB Schenker.

- Growth Rate Insights: The market is growing at a CAGR of 6.8% over the forecast period.

Latest Trends

- One prominent trend in the South Korean warehousing market is the increased adoption of automation and AI technologies by logistics firms like CJ Logistics and Lotte Global Logistics, who use autonomous guided vehicles, robotic arms, and AI inventory management systems to increase efficiency while cutting operational costs in line with South Korea's wider digital transformation initiative, driven by government incentives and market competition.

- As South Korean e-commerce continues to boom, so does demand for cross-border logistics solutions. Leading e-commerce platforms Coupang and Amazon view South Korea as an integral hub in Asia Pacific operations, consequently, this growth necessitates dedicated fulfillment facilities located near logistics hubs like Busan and Incheon for efficient customs clearance and quick deliveries.

South Korea Warehousing Market: Competitive Landscape

The nature of the competition landscape in the South Korean warehousing market is highly competitive, with players both at the domestic and international levels. Major participants include CJ Logistics, Lotte Global Logistics, and Hyundai Glovis.

A glimpse into CJ Logistics shows that the organization has developed expertise in the provision of warehousing and distribution services, offering value addition in third-party logistics. It has invested massively in automation using a bunch of e-commerce and cold-chain logistics services.

Lotte Global Logistics specializes in e-commerce fulfillment and cold chain solutions, catering to the pharmaceuticals and food sectors with temperature-controlled storage. Hanjin Transportation utilizes expertise in international trade by offering bonded and general warehousing facilities to respond to increasing demand for third-party logistics and e-commerce fulfillment.

Some of the prominent market players:

- CJ Logistics Corporation

- Pantos Logistics

- DSV

- Kuehne + Nagel

- Toll Holdings Limited

- Hyundai Glovis

- LS Networks

- DB Schenker

- Samsung SDS

- Ryder System

- Nippon Express

- Seah Logistics

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/south-korea-warehousing-market/download-reports-excerpt/

South Korea Warehousing Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 47.9 Bn |

| Forecast Value (2033) | USD 86.3 Bn |

| CAGR (2024-2033) | 6.8% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Warehousing Type, By Warehousing Technology, By Ownership Type, By Industry Vertical |

| Regional Coverage | South Korea |

Market Analysis

Semi-automated warehouses are expected to lead the South Korean warehousing market, holding 49.9% of the market share in 2024. It offers a perfect balance between cost-effectiveness and operational efficiency; hence, semi-automated warehouses are becoming quite feasible among different types of industries.

Companies like CJ Logistics and Lotte Global Logistics have embraced technologies by deploying AGVs and conveyor belts to improve productivity while retaining flexibility. These systems improve the efficient use of throughput and space utilization efforts with limited changes in infrastructure.

More importantly, adaptability in their implementation means integrating them into the existing environments, making them suitable for firms like Samsung and LG, given their diverse product portfolios and their dependence on efficient inventory management.

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/south-korea-warehousing-market/

South Korea Warehousing Market Segmentation

By Warehousing Type

- General Warehousing

- Cold Storage Warehousing

- Automated Warehousing

- Bonded Warehousing

- Distribution Centers

By Warehousing Technology

- Manual Warehouses

- Semi-Automated Warehouses

- Fully Automated Warehouses

By Ownership Type

- Private Warehouses

- Public Warehouses

- Contract Warehouses

By Industry Vertical

- E-commerce

- Retail

- Food & Beverage

- Pharmaceuticals

- Automotive

- Electronics

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/south-korea-warehousing-market/request-sample/

Growth Drivers

- E-commerce platforms like 11Street and Gmarket have become an engine of expansion in the warehousing market, pushing consumer expectations for faster deliveries, product variety, and easier returns further forward than ever. E-commerce firms must therefore invest significantly in solutions designed to accommodate order fulfillment and last-mile delivery services to satisfy these consumer expectations.

- South Korea's strategic location makes it an ideal logistics hub in Southeast Asia, connecting key markets in China, Japan, and Southeast Asia with world-class ports like Busan and Incheon that play an essential part in global supply chains driving demand for large warehousing facilities like those owned by Hyundai Glovis are capitalizing on this advantage.

Restraints

- Logistics costs in the South Korean warehousing market present a serious obstacle. With real estate prices increasing rapidly in urban centers such as Seoul and Busan, as well as labor expenses rising quickly with investments made into automation systems; logistics firms struggle with expanding operations at smaller and mid-sized firms looking for ways to scale.

- With rapid urbanization has come limited land availability for warehouse use in Seoul and associated higher leasing and purchasing costs for businesses looking for storage solutions, necessitating them either settling for smaller, efficient designs or seeking fewer central areas that might lower operational efficiency overall.

Growth Opportunities

- The demand for temperature-controlled storage is rapidly increasing, particularly in pharmaceuticals, biotechnology, and food sectors. Companies like CJ Logistics are investing in cold chain infrastructure to support the rising need for perishable goods, offering logistics providers new growth avenues.

- Outsourcing to third-party logistics providers is on the rise, providing significant growth opportunities. Manufacturers in sectors like electronics and automotive are increasingly using 3PL services to streamline operations. Major players like CJ Logistics and Lotte Global Logistics are expanding their 3PL offerings, which will boost the market during the forecast period.

Discover additional reports tailored to your industry needs

- Vending Machine Market is forecasted to reach USD 12.9 billion by the end of 2024 and grow to USD 46.9 billion in 2033, with a CAGR of 15.5%.

- Infrared Sensors Market is forecasted to reach USD 804.2 million by the end of 2024 and grow to USD 2,351.4 million in 2033, with a CAGR of 12.2%.

- Industrial Filtration Market is forecasted to reach USD 38.8 billion by the end of 2024 and grow to USD 60.7 billion in 2033, with a CAGR of 5.1%.

- Data Extraction Software Market is projected to reach USD 1.5 billion in 2024 and grow at a compound annual growth rate of 14.2% from there until 2033 to reach a value of USD 4.9 billion.

- U.S. Medical Billing Outsourcing Market is expected to reach a value of USD 5.9 billion in 2024, and it is further anticipated to reach a market value of USD 16.9 billion by 2033 at a CAGR of 12.5%.

- South Korea Warehouse Automation Market size is expected to reach a value of USD 4,137.8 million in 2024, and it is further anticipated to reach a market value of USD 14,024.2 million by 2033 at a CAGR of 14.5%.

- Stained-Glass Market is expected to reach a market value of USD 4.8 billion in 2024 which is further expected to grow up to USD 7.7 billion by 2033, at a CAGR of 5.5%.

- Industrial Distribution Market size is expected to reach a value of USD 8,153.1 billion in 2024, and it is further anticipated to reach a market value of USD 12,975.4 billion by 2033 at a CAGR of 5.3%.

- Filter Rolling System Market is projected to reach USD 17.5 billion by the end of 2024 and is anticipated to value USD 36.2 billion in 2033 at a CAGR of 8.4%.

- Stainless Steel Cannula Market is projected to reach USD 187.0 million by the end of 2024 and grow exponentially until an anticipated value of USD 397.0 million in 2033 at a CAGR of 8.7%.

Recent Developments in the South Korea Warehousing Market

- October 2024: To improve the efficiency of the e-commerce market and provide fast delivery for e-shops, CJ Logistics increased the number of automated warehousing spaces in the Seoul Metropolitan Area.

- August 2024: Lotte Global Logistics has recently initiated an innovative cold chain warehouse for Busan, aiming to meet the increasing demand in temperature-sensitive industries such as pharmaceuticals and perishables.

- July 2024: Hanjin Transportation recently implemented an Artificial intelligent driven warehouse technique at Incheon logistics center aimed at enhancing stock control and order management.

- May 2024: Amazon partnered with a local logistics provider to open a new e-commerce fulfillment center near Seoul, serving as a regional hub for fast deliveries.

- February 2024: Hyundai Glovis launched a new bonded warehousing facility for catering to the growing cross-border shipment of electronic goods and automobiles from Incheon City in South Korea.

- October 2023: Lotte Global Logistics aimed and furthered its warehousing network development in Gwangju to satisfy the growing demand for domestic retail and e-commerce logistics.

About Dimension Market Research (DMR)

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.