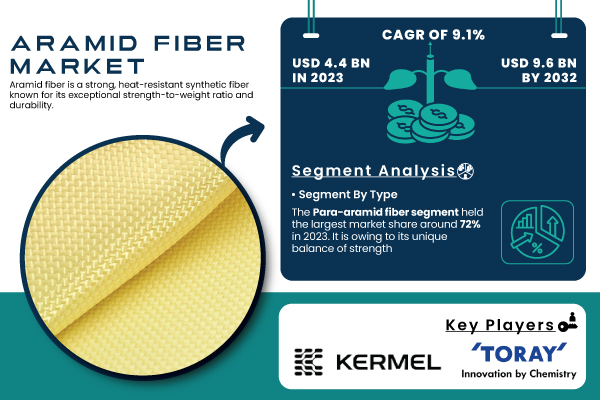

Austin, Dec. 16, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Aramid Fiber Market is projected to reach a valuation of USD 9.6 billion by 2032, growing at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2032.”

Key Trends Fueling the Aramid Fiber Market

The aramid fiber market demand is rising due to high strength and weight requirements which are used in various industries such as automotive, aerospace, defense, and construction. Aramid fiber has been widely applied in wear-resistant and protective fabrics, due to its outstanding tensile strength, high thermal stability, and anti-abrasion properties. The market is expected to have a key aspect of expansion through the manufacturing of bulletproof vests and fabrics that are heat resistant as well as automotive components and industrial components where para-aramid fibers such as Kevlar and Meta-aramid fibers including Nomex are extensively employed.

In particular, the governments and corresponding regulatory agencies are focusing on adopting advanced materials such as aramid fibers for meeting safety, energy efficiency, and environmental goals. Reduction of fuel consumption and energy efficiency enhancement are important for the automotive and aerospace sectors' performance, wherein the weight of the materials is typically critical so aramid fiber composites are now used more widely in the automotive and aerospace sectors.

Download PDF Sample of Aramid Fiber Market @ https://www.snsinsider.com/sample-request/2132

Key Players:

- Kermel (Kermel HT, Kermel Tech)

- Toray Industries, Inc. (Torayca, Teflon Aramid)

- Kolon Industries Inc. (Heracron, Wonderex)

- Teijin Ltd. (Twaron, Technora)

- DuPont De Numerous, Inc. (Kevlar, Nomex)

- SRO Aramid (Jiangsu) Co. Ltd. (Aramid 1313, MetaStar)

- Hyosung Corp. (Conex, Tansome)

- China National Bluestar (Group) Co., Ltd. (Bluestar Aramid, MetaStar)

- Huvis Corporation (MetaOne, Aramid 1414)

- Yantai Tayho Advanced Materials Co., Ltd. (Taparan, NewStar)

- BASF SE (Ultramid, Ultradur)

- DSM N.V. (Dyneema, Arnitel)

- Toyobo Co., Ltd. (Zylon, Vestaron)

- Evonik Industries AG (VESTAMID, P84)

- Sinopec Yizheng Chemical Fiber Co., Ltd. (Aramid Y1414, Y1166)

- Asahi Kasei Corporation (Leona, Tenac)

- Mitsubishi Chemical Corporation (Pyrofil, Kyron)

- Kaneka Corporation (Kanekalon, Apilon)

- AKSA Acrylic Chemical Co. (Aksa Aramid, Acrylux)

- Kolon Global Corporation (Xincore, Superfin)

Aramid Fiber Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 4.4 Billion |

| Market Size by 2032 | USD 9.6 Billion |

| CAGR | CAGR of 9.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Meta-Aramid Fiber, Para-Aramid Fiber) • By Application (Security & Protection, Frictional Materials, Industrial Filtration, Optical Fibers, Rubber Reinforcement, Tire Reinforcement, Electrical Insulation, Others) |

| Key Drivers | • Increasing demand from the aerospace and defense sectors for lightweight, high-strength materials. • Growing adoption in automotive applications to achieve lightweight and improve fuel efficiency. |

If You Need Any Customization on Aramid Fiber Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2132

Innovations in Aramid Fiber Manufacturing

Advancements in aramid fibre manufacturing processes have also helped increase its usage in the industry. The addition of new production processes is further strengthening aramid technologies by providing increased flexibility and temperature resistance, higher durability and UV resistance from new types of coatings, and even added functionality with integrated sensors and built-in protective capabilities. Aramid fiber products are experiencing higher efficiency, precision, and gradation reduction through the utilization of automated manufacturing systems and advanced weaving technology, increasing cost-efficiency, and enhancing the performance of end applications.

Research into advanced coatings and multi-layered fiber constructions will enhance the current toughness afforded by aramid fiber. Multi-functional composites with aramid fibers, in particular, are becoming more and more attractive, where mechanical and thermal loads are implicated or combined. It would enable manufacturers to cater to the growing requirements of aramid fiber products across various applications such as aerospace and automotive sectors; these for example, products with the valuable aramid fiber.

Rising Demand from the Automotive Sector

The automotive industry is another key driver of the aramid fiber market. As manufacturers shift toward lightweight vehicles to improve fuel efficiency and reduce carbon emissions, the demand for materials like aramid fiber composites is rising. Aramid fibers are being incorporated into vehicle interiors, exteriors, and under-the-hood components due to their strength, durability, and light weight.

Aramid fiber composites are increasingly used in the production of high-performance tires, brake pads, clutch linings, and engine components. These materials are particularly valued for their fire-resistant and heat-resistant properties, which make them suitable for use in extreme conditions, contributing to their growing adoption.

Which Type Led the Market in 2023?

In 2023, Para-aramid fibers held the largest market share, accounting for more than 72% of the total market revenue. Para-aramid fibers, such as Kevlar, are known for their high tensile strength, lightweight, and resistance to abrasion, which makes them ideal for use in ballistic protection, automotive applications, and aerospace components. They are also used in the marine industry for producing high-strength ropes and cables.

The demand for para-aramid fibers is driven by the increasing need for safety and performance materials in various industries. As technology advances, the performance of these fibers continues to improve, making them an even more attractive option for a wide range of applications.

Which Application Segment Led the Market in 2023?

The security and protection sector dominated the aramid fiber market in 2023, accounting for around 38% of global market revenue. The increasing demand for bulletproof vests, helmets, and body armor in the military and law enforcement industries has significantly contributed to the growth of this segment. Additionally, personal protective equipment (PPE) made from aramid fibers is gaining popularity among workers in hazardous industries such as construction, mining, and oil & gas. Aramid fibers are also widely used in the manufacture of military vehicles, aircraft, and missile defense systems, further driving market growth in the defense sector.

Which Region Dominated the Market in 2023?

Europe held the largest market share around 35% in 2023. It is owing to the strong drive forces of industrial infrastructure, demand for safety and protection products, and supporting Government regulations. A well-established presence of leading manufacturers, such as Teijin Aramid, DSM Dyneema, and Hyosung in the European market has a great influence on the production and innovation of aramid fibers. In addition, Europe has long been known for industries like automotive, aerospace, and defense, which make extensive use of the unique features of aramid fibers, for light cars, bulletproof vests, and aircraft parts.

Also because of industrial power, Europe has a strong emphasis on sustainability and safety which has also fueled the market. As a result of the regional focus on stringent environmental regulations and high penetration of green technology, industries are opting for lightweight, high-strength materials such as aramid fibers for reduced impact on emissions and energy efficiency. For instance, the automotive sector in the European continent, which stands in a prominent position, is gaining traction towards the usage of aramid fibers with the implementation of strict fuel efficiency targets and safety regulations.

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2132

Recent Developments in the Aramid Fiber Market

- In 2023: Teijin Aramid launched a high-performance para-aramid fiber suitable for usage in body armor and automotive parts. The next generation of impact & thermal upgrading fibers itself is to be used in various applications from low-end to high-end products.

- In 2023: DowDuPont (now DuPont) has opened a new para-aramid fiber manufacturing plant in the United States, expanding its Kevlar production capabilities. Moreover, the facility is intended to facilitate the increasing use of high-performance fibers in automotive, defense, and industrial applications.

Conclusion

The Aramid Fiber Market is poised for significant growth, driven by the increasing adoption of high-performance materials across various industries. Technological advancements, sustainability goals, and the rising demand for lightweight and durable materials are propelling the market forward. As manufacturers continue to innovate and optimize production techniques, aramid fibers will play a pivotal role in shaping the future of industries like defense, automotive, aerospace, and construction.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 By Type Benchmarking

6.3.1 By Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Aramid Fiber Market Segmentation, By Type

7.1 Chapter Overview

7.2 Meta-Aramid Fiber

7.3 Para-Aramid Fiber

8. Aramid Fiber Market Segmentation, by Application

8.1 Chapter Overview

8.2 Security & Protection

8.3 Frictional Materials

8.4 Industrial Filtration

8.5 Optical Fibers

8.6 Rubber Reinforcement

8.7 Tire Reinforcement

8.8 Electrical Insulation

8.9 Others

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Buy Full Research Report on Aramid Fiber Market 2024-2032 @ https://www.snsinsider.com/checkout/2132

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.