Pune, Dec. 16, 2024 (GLOBE NEWSWIRE) -- Insurance Fraud Detection Market Size Analysis:

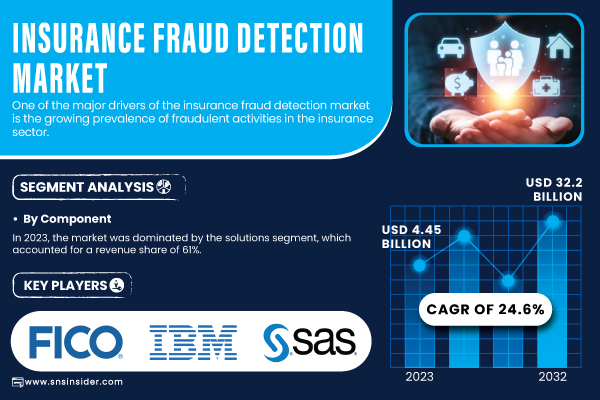

“The SNS Insider report indicates that the Insurance Fraud Detection Market size was valued at USD 4.45 billion in 2023 and is expected to grow to USD 32.2 billion by 2032, registering a compound annual growth rate (CAGR) of 24.6% over the forecast period of 2024-2032.”

Increasing Complexity Of Fraudulent Activities And The Rapid Adoption Of Effective Fraud Detection Technologies

Insurance fraud made up an estimated 5–10% of all claims worldwide in 2023 and could lead to more than USD 40 Billion in losses each year in the U.S. alone. It justifies the significant losses due to fake claims that insurers are losing money from the need for strong raid detection systems. Aside from the monetary aspect, fraud tarnishes the name of the insurance firms, and they start using high-tech tools to protect their business.

The integration of technology like artificial intelligence, machine learning, and big data analytics into fraud detection systems is aiding insurers in overcoming these challenges. Artificial Intelligence machine systems can read millions of transactions in real time and identify patterns that might otherwise be missed in such traditional methods. Take for example predictive analytics, which allows insurers to flag high-risk claims early on. Estimates from the coalition against insurance fraud suggest that AI-driven systems have reduced the number of insurance fraud claims by 10% to 30%, generating significant improvements in the bottom line for insurers.

The implementation of new regulatory frameworks moving towards combating insurance fraud in 2024, is again fuelling the need for a comprehensive fraud detection system. Laws including the European Union's General Data Protection Regulation (GDPR) and equivalent legislation global in reach also mean insurers must implement end-to-end fraud detection solutions that adhere to privacy and data protection regulations.

Get a Sample Report of Insurance Fraud Detection Market@ https://www.snsinsider.com/request-analyst/4653

Major Players Analysis Listed in this Report are:

- FICO (FICO Falcon Fraud Manager, FICO Insurance Fraud Solution)

- IBM Corporation (IBM Safer Payments, IBM Counter Fraud Management)

- SAS Institute Inc. (SAS Fraud Framework, SAS Detection and Investigation for Insurance)

- Oracle Corporation (Oracle Insurance Fraud Analytics, Oracle Financial Services Analytical Applications)

- SAP SE (SAP Fraud Management, SAP Business Integrity Screening)

- DXC Technology (DXC Fraud Detection Solution, DXC Insurance Suite)

- Experian plc (Experian Fraud Risk Management, Experian Fraud Shield)

- BAE Systems (NetReveal Fraud Detection, BAE Systems Fraud Detection Platform)

- Shift Technology (Force Fraud Detection, Shift Claims Fraud Detection)

- ACI Worldwide (ACI Fraud Management for Insurance, ACI Enterprise Payments Fraud Management)

Insurance Fraud Detection Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 4.45 Billion |

| Market Size by 2032 | USD 32.2 Billion |

| CAGR | CAGR of 24.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • The growing prevalence of insurance fraud across sectors like healthcare and motor insurance is prompting insurers to invest in advanced fraud detection solutions to safeguard against significant financial losses. • Stricter regulations such as KYC and AML necessitate robust fraud detection systems to avoid penalties and ensure compliance, driving demand in the market. |

Do you have any specific queries or need any customization research on Insurance Fraud Detection Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/4653

Segment Analysis

By Organization Size

In 2023, The large organization segment dominated the market and represented a significant revenue share of more than 65%. The rise of innovative technologies like artificial intelligence (AI) and predictive analytics are shaping the future of countless industries, allowing businesses that utilize these technologies to extract significant competitive advantages over their counterparts. As a result, the rising prevalence of fraud concerning damage claims, vehicle theft, unwarranted processes, and fraudulent health insurance billing has compelled insurers to adopt innovative solutions to counter such malpractices. In addition, the capacity of big institutions to spend a higher price on the support of technology, training of personnel, risk management, and fraud detection services additionally contributes to the expansion of this segment.

The Small and Medium organization segment is also expected to register the fastest growth rate over the forecast period. These Construction Insurance brokers tend to offer their clients a decent level of insurance. The relatively smaller customer base and less allocated funds towards fraud detection coupled with higher vulnerability and exposure to potential frauds as well as the development of better technology tools without features override are some of the key growth-driving factors driving for this segment.

Insurance Fraud Detection Market Segmentation:

By Component

- Solutions

-

- Fraud Analytics

- Authentication

- Governance, Risk, and Compliance

- Others

- Services

- Professional Services

- Managed Services

By Organization

- SMB

- Large Organization

By Deployment

- Cloud

- On-Premise

By End-user Industry

- Autootive

- BFSI

- Healthcare

- Retail

- Others

Buy an Enterprise-User PDF of Insurance Fraud Detection Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/4653

Regional Analysis

In 2023, North America held the largest revenue share in the market at 45%. Organizations like FICO, IBM, Oracle, etc play an important role in this market. Furthermore, stringent regulatory requirements and increasing incidences of fraud are driving industry demand for insurance fraud solutions. As the nature of fraudulent activity morphs and adapts, insurance firms are allocating resources toward innovative solutions involving machine learning, artificial intelligence, and big data analytics.

The fastest CAGR is expected in the Asia Pacific insurance fraud detection market during the forecast period. Companies in the region take a proactive approach by investing in high-end technology to reduce the number of insurance fraud cases. Furthermore, growing investment in better methods for governing and processing claims to ensure consumer satisfaction and allegiance is expected to contribute to regional expansion. In addition, broader awareness of fraud detection methods is expected to increase demand for fraud detection solutions.

Recent Developments

January 2024: SAS Institute announced the launch of a new AI-powered fraud detection solution that leverages machine learning and predictive analytics to identify fraudulent claims in real-time. The solution is designed to help insurers reduce false positives and improve fraud detection accuracy.

February 2024: FICO launched an upgraded version of its fraud detection platform, incorporating advanced data analytics and AI algorithms to improve fraud detection capabilities. The platform aims to enhance the detection of complex fraud patterns and reduce operational costs for insurers.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Insurance Fraud Detection Market Segmentation, By Component

8. Insurance Fraud Detection Market Segmentation, By Organization

9. Insurance Fraud Detection Market Segmentation, By Deployment

10. Insurance Fraud Detection Market Segmentation, By End-user Industry

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Insurance Fraud Detection Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/insurance-fraud-detection-market-4653

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

SNS Insider

SNS Insider is a market research company that delivers evidence based strategies for clients seeking growth.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.