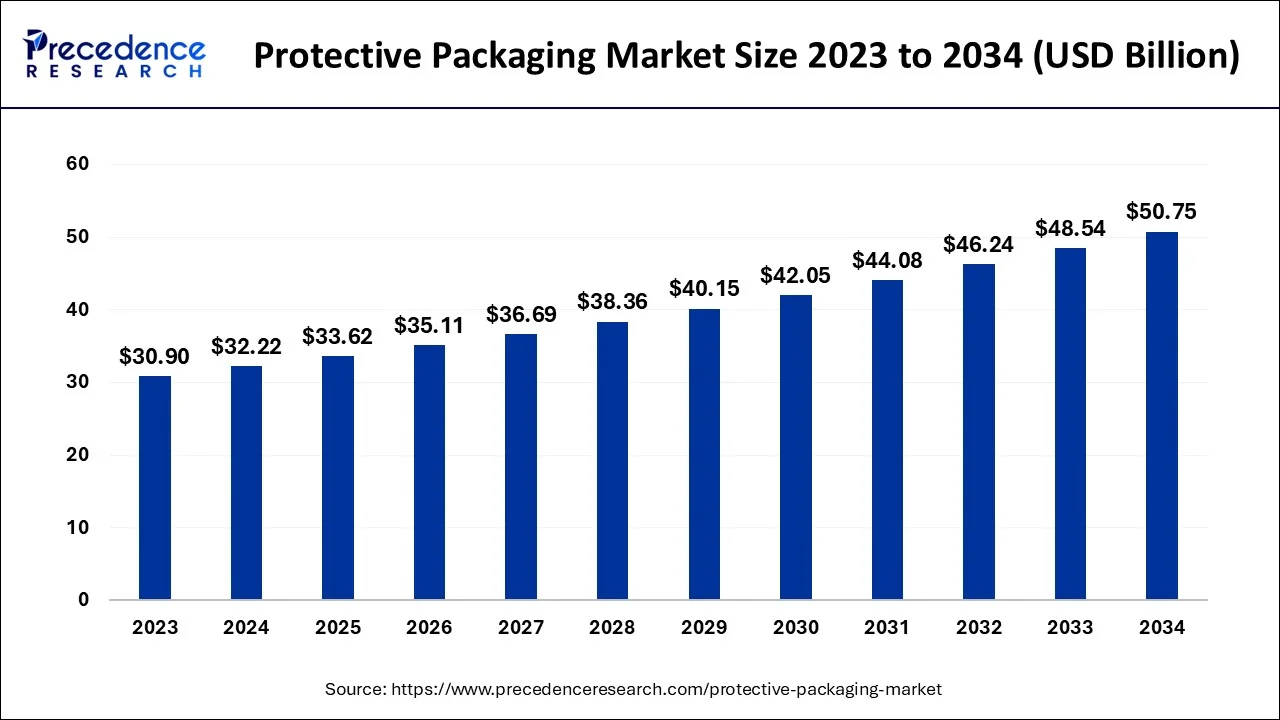

Ottawa, Dec. 17, 2024 (GLOBE NEWSWIRE) -- In terms of revenue, the global protective packaging market accounted for USD 33.62 billion in 2025 and is projected to surpass around USD 48.54 billion by 2033. A large number of products are shipped and distributed on a daily basis, which are prone to damage and destruction. Hence, protective packaging is highly essential to prevent product damage.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2679

Protective Packaging Market Overview

Packaging that is specially made to shield, insulate, and buffer goods from harm or destruction during the sometimes-unexpected transportation process is referred to as protective packaging. Numerous materials, such as cardboard, plastic, metal, and more, can be used to create protective packaging. Furthermore, protective packaging can serve as either a primary or supplementary packaging component. Businesses are putting a lot of effort into adopting protective packaging to improve user experience as well as product safety.

Protective Packaging Market Key Points:

- Asia Pacific led the protective packaging market and contributed the biggest market share of 34.89% in 2024.

- North America region is expected to grow at a CAGR of 4.3% during the forecast period.

- By type, the flexible packaging segment has held a major market share of 43.85% in 2023.

- By material, the plastics segment accounted for the largest market share of 44.30% in 2024.

- By function, the insulation segment recorded a maximum market share of 28.22% in 2024.

- By application, the food and beverage segment captured the highest market share of 34.82% in 2024.

Protective Packaging Market Segments Revenue Analysis

Protective Packaging Market Revenue (USD Billion), By Material, 2021 to 2023

| Material | 2021 | 2022 | 2023 |

| Paper & Paperboard | 9.31 | 9.81 | 10.29 |

| Plastics | 12.73 | 13.27 | 13.76 |

| Others | 6.26 | 6.57 | 6.85 |

Protective Packaging Market Revenue (USD Billion), By Type, 2021 to 2023

| Type | 2021 | 2022 | 2023 |

| Rigid Protective Packaging | 7.00 | 7.44 | 7.86 |

| Flexible Protective Packaging | 12.15 | 12.82 | 13.45 |

| Foam Protective Packaging | 9.15 | 9.39 | 9.59 |

Protective Packaging Market Revenue (USD Billion), By Function, 2021 to 2023

| Function | 2021 | 2022 | 2023 |

| Cushioning | 7.10 | 7.47 | 7.82 |

| Blocking & Bracing | 4.81 | 5.03 | 5.23 |

| Void Fill | 3.38 | 3.54 | 3.67 |

| Insulation | 7.95 | 8.34 | 8.71 |

| Wrapping | 5.06 | 5.27 | 5.47 |

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2679

Growth Factors in the Protective Packaging Market

- Rise in consumer-based and product sales: Due to the growing population, the consumer base has grown significantly. Apart from this rise in e-commerce activities, social media and the internet have also increased sales of products as more and more people have access to products across the globe.

- Used in various industries: Among the many sectors that employ protective packaging are electronics, electrical appliances, automobiles, medicines, food and beverage, and more. These businesses require a great deal of dependable protective packaging since some of their products are extremely sensitive and fragile.

- Cost-saving: Because protective packaging reduces the chance of product damage, it can result in considerable cost savings. When clients ask for exchanges or refunds, damaged items result in losses and decreased income.

Opportunities in the Protective Packaging Market

- In August 2024, the board of Pakka, a well-known producer of biodegradable packaging solutions, authorized INR 244.7 crore in investment. With these finances, the business intends to build the first biodegradable flexible packaging factory in the world in Ayodhya, India.

- In July 2024, Columbia, South Carolina Bubble Paper received a $250,000 investment from SC Launch Inc., an investment subsidiary of the South Carolina Research Authority, as part of a $10 million Series A capital round. With a more effective, environmentally friendly alternative to the plastic shipping options of the past, the Greenville-based firm is transforming the packaging sector.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Protective Packaging Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 32.22 Billion |

| Market Size in 2025 | USD 33.62 Billion |

| Market Size by 2034 | USD 50.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.7% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Material, Function, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Analysis of Key Regions

Protective Packaging Market Revenue (USD Billion), By Region, 2021 to 2023

| Region | 2021 | 2022 | 2023 |

| North America | 6.91 | 7.22 | 7.50 |

| Europe | 8.67 | 9.09 | 9.48 |

| Asia Pacific | 9.73 | 10.24 | 10.73 |

| LAMEA | 2.99 | 3.1 | 3.19 |

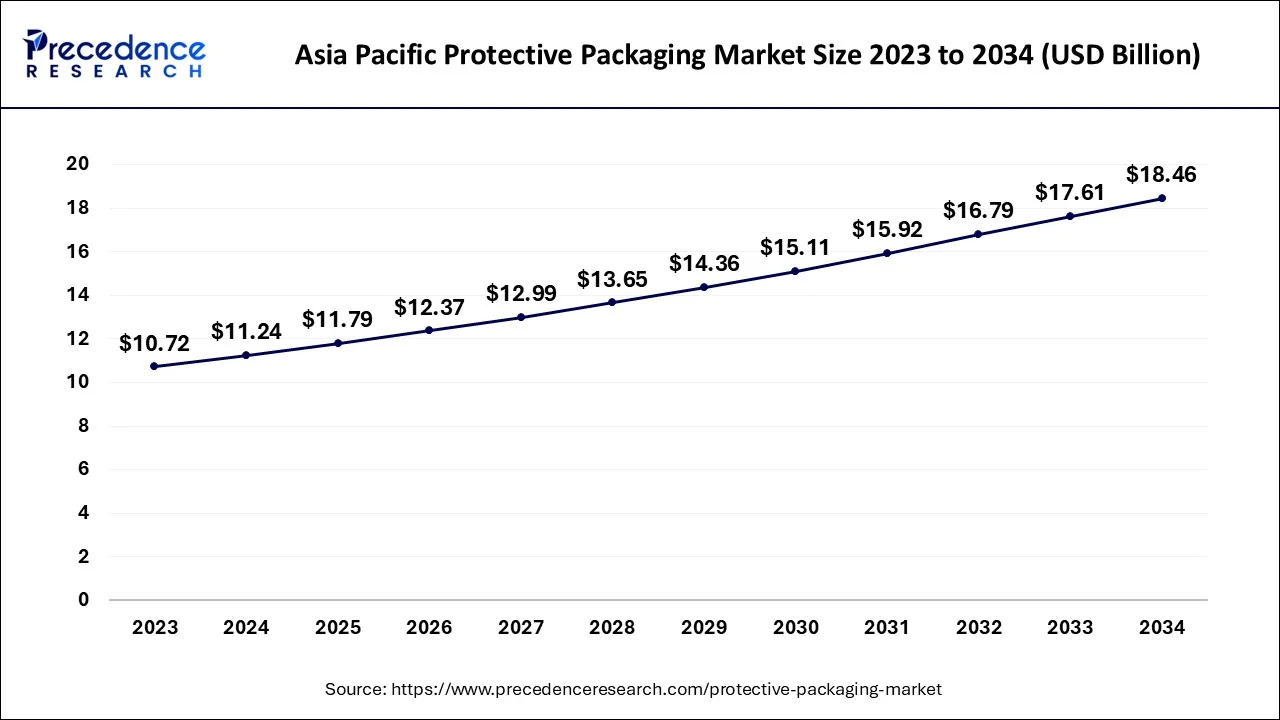

Asia Pacific Protective Packaging Market Size and Forecast 2024 to 2034

The Asia Pacific protective packaging market size is worth USD 11.24 billion in 2024 and is predicted to reach around USD 18.46 billion by 2034. The market is growing at a CAGR of 5.1% from 2024 to 2034.

Large Consumer Base: Asia Pacific’s Dominance to Sustain

Asia Pacific dominated the protective packaging market in 2023 due to the growing e-commerce industry's demand for product safety during shipping. The market for protective packaging is anticipated to expand even more as a result of continual automation advancements, more consumer spending, and improved manufacturing activities in the area. Throughout the forecast period, the presence of economies with sizable populations is fostering the expansion of the e-commerce sector, which in turn is anticipated to propel the growth of the protective packaging market in the area.

In the first half of 2024, China's e-commerce industry grew rapidly, which fueled the second-largest economy in the world's rebound in spending. According to figures issued by the Ministry of Commerce (MOC), online retail sales during this time increased 9.8% year over year to 7.1 trillion yuan (about 996 billion US dollars), with retail sales of products reaching 5.96 trillion yuan, or an 8.8% rise.

According to government data, fixed-asset investment in China's electronic information manufacturing sector increased by 9.3% annually in 2023 as the industry recovered. The report showed that among key items, mobile phone production increased 6.9 percent year over year to 1.57 billion units, with smartphones accounting for 1.9 percent of this growth to 1.14 billion units. Data released on Saturday by the China Association of Automobile Manufacturers indicated that the country's car sector is on the rise, with both vehicle production and sales rising significantly in the first nine months of 2024. China produced over 21.47 million cars between January and September 2024, an increase of 1.9% from the previous year. In comparison to the same time previous year, auto sales increased by 2.4% to 21.57 million vehicles.

The use of smartphones and the internet has increased dramatically in India in recent years. Thanks to the "Digital India" initiative, there were 895 million internet connections in India as of June 2023, a huge rise. Indian business practices have been revolutionized by the country's e-commerce industry.

The Indian e-commerce market is expected to develop significantly and reach US$ 325 billion by 2030. The robust use of online services like e-commerce and edtech in India is predicted to propel the country's consumer digital economy to a US$ 1 trillion industry by 2030, up from US$ 537.5 billion in 2020. India's electronics industry has grown quickly; in FY23, it was valued at USD 155 billion.

The manufacturing of mobile phones, which currently account for 43% of all electronics output, virtually quadrupled from USD 48 billion in FY17 to USD 101 billion in FY23. 99% of smartphones are currently made in India, greatly reducing the country's need for imports.

Strong Presence of Various Industries Drives Europe’s Growth

Europe held the second-largest share of the protective packaging market in 2023. The market for protective packaging in Europe is a well-established and developed sector that is essential to the protection of a wide range of goods from various industries. Protective packaging solutions guarantee the integrity and functioning of commodities throughout handling, storage, and transportation, whether they are perishable food items, industrial gear, fragile electronics, or medicines. The European protective packaging market is anticipated to continue expanding in the upcoming years due to stricter laws, an increased emphasis on e-commerce efficiency, and a growing consumer desire for sustainable practices.

The overall B2C European e-commerce revenue grew by a moderate 3% in 2023, rising from €864 billion to €887 billion. 92% of those polled in 2023 accessed the Internet, and 70% of them placed online orders or purchases in the 12 months before the study. In 2023, the demand from the 25–34 and 35–44 age groups drove e-commerce in the EU. In 2023, 85% and 87% of people in these age categories, respectively, placed online orders for products or services.

Protective Packaging Market Segmentation Analysis

By Material Analysis:

The plastics segment dominated the protective packaging market in 2023. Because it increased the shelf life of fresh food, made it possible for vital health uses, made shipping lighter and safer, and reduced emissions, plastic completely changed the packaging industry. Several qualities, including flexibility, strength, lightweight, stability, impermeability, and ease of sterilizing, contribute to its effectiveness as a packaging material.

By Type Analysis:

The flexible protective packaging segment registered its dominance in the protective packaging market in 2023. The flexible packaging industry is a domestic and international sector. Flexible packaging accounts for around 19% of the $177 billion U.S. packaging industry, making it the second largest packaging category in the country, according to the Flexible Packaging Association. There are many uses for flexible packaging in industries, including food and beverage, medicine, cosmetics, and agricultural goods.

By Function Analysis

The insulation segment held the largest share of the protective packaging market in 2023. The market for thermal insulation packaging includes a wide range of sectors. The materials differ according to the industry and the type of application a business seeks. It keeps the items inside the package from being impacted by the outside temperature and guarantees that they are within the anticipated temperature range, preserving their quality and security.

By Application Analysis

The industrial goods segment captured the majority of the protective packaging market share in 2023. The industrial products sector is a vital component of the economy despite the fact that consumers and other end users do not directly engage with it. This is because it gives manufacturers of products and services the capital goods (equipment, machinery, etc.) they need to build the vehicles, airplanes, clothes, tools, equipment, and other items we require on a daily basis.

Discover More Market Research Reports

- Food Packaging Market: The global food packaging market was valued at USD 377.05 Billion in 2023 and is expected to reach USD 679.71 Billion by 2033 and is poised to grow at a compound annual growth rate (CAGR) of 6.11% during the forecast period 2024 to 2033.

- Fresh Food Packaging Market: The global fresh food packaging market size was USD 126.76 billion in 2023, accounted for USD 131.7 billion in 2024, and is expected to reach around USD 185.84 billion by 2033, expanding at a CAGR of 3.9% from 2024 to 2033.

- Pharmaceutical Packaging Market: The global pharmaceutical packaging market size accounted for USD 146.14 billion in 2024 and is predicted to reach around USD 342.16billion by 2034, with a CAGR of 8.88% from 2024 to 2034.

- Beverage Packaging Market: The global beverage packaging market size was USD 120.61 billion in 2023, accounted for USD 127.61 billion in 2024, and is expected to reach around USD 224.25 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034.

- Paperboard Packaging Market: The global paperboard packaging market size accounted for USD 183.87 billion in 2024 and is expected to be worth around USD 272.18 billion by 2034, at a CAGR of 4% from 2024 to 2034.

- Corrugated Packaging Market: The global corrugated packaging market size was valued at USD 298.52 billion in 2023 and is expected to reach over USD 459.18 billion by 2033, poised to grow at a CAGR of 4.4% from 2024 to 2033.

- Aluminum Foil Packaging Market: The global aluminum foil packaging market size surpassed USD 47.96 billion in 2023 and it is expected to be worth around USD 73.85 billion by 2033, poised to grow at a CAGR of 4.50% during the forecast period from 2024 to 2033.

- Cosmetic Packaging Market: The global cosmetic packaging market size is accounted for USD 36.36 billion in 2024 and is anticipated to reach around USD 59.80 billion by 2034, growing at a CAGR of 5.10% from 2024 to 2034.

- Green Packaging Market: The global green packaging market size was estimated at US$ 300 billion in 2022 and is expected to hit US$ 524.70 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 5.80% during the forecast period 2023 to 2032.

- Cold Chain Packaging Market: The global cold chain packaging market size was valued at USD 26.95 billion in 2023 and is expected to surpass around USD 88.21 billion by 2033, growing at a CAGR of 12.61% during the forecast period 2024 to 2033.

Competitive Landscape & Major Breakthroughs in the Protective Packaging Market

Protective packaging is highly essential for ensuring product safety, quality, and integrity, which can be disturbed during storage, transportation, and distribution; companies make efforts and conduct research to develop the most efficient packaging to ensure product quality.

Protective Packaging Market Companies

- Smurfit KAPPA Group

- Westrock Company

- Sealed Air Corporation

- Sonoco Products Company

- Huhtamaki OYJ

- DS Smith PLC

- Pregis LLC

- Pro-Pac Packaging Limited

- Storopack Hans Reichenecker Gmbh

- The DOW Chemical Company

- Cascades Corporation

* Interested in Company Profiles? Click to download a Detailed Profiles

What is Going Around the Globe?

- In December 2024, the VTT Technical Research Center of Finland has partnered with Aalto University and Finnish industry partners to develop a new method for shaping cardboard, a continuous process that creates structures for fiber-based protective packaging materials that resemble reel-to-reel origami.

- In September 2024, the new recyclable Protective Mailers, which are constructed completely of paper, were introduced by Mondi, a world pioneer in environmentally friendly packaging and paper. The creative mailers, created in partnership with Amazon, allow eCommerce businesses to safely send products without using plastic bubble wrap.

Segments Covered in the Report

By Type

- Rigid Protective Packaging

- Flexible Protective Packaging

- Foam Protective Packaging

By Material

- Foam Plastics

- Paper & Paperboard

- Plastics

- Others

By Function

- Cushioning

- Blocking & Bracing

- Void Fill

- Insulation

- Wrapping

By Application

- Food & Beverage

- Industrial Goods

- Healthcare

- Automotive

- Cushioning

- Household Appliances

- Others

By Regions

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Note: The global Protective Packaging Market Report is Readily Available for Immediate Delivery.

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2679

For questions or customization requests, please reach out to us at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsevsolutions.com

Get Recent News:

https://www.precedenceresearch.com/news

For Latest Update Follow Us: