New York, USA, Dec. 18, 2024 (GLOBE NEWSWIRE) -- MET Targeting Therapies Market Set for Significant Growth by 2034: Key Trends and Insights | DelveInsight

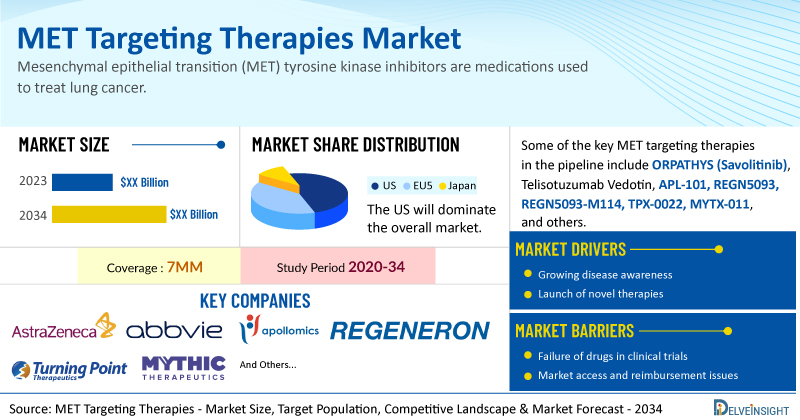

The MET targeting therapies market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of MET-targeting therapies, and the increasing number of MET-targeting therapies that are under clinical trials and filed for approval by various companies.

DelveInsight’s MET Targeting Therapies Market Insights report includes a comprehensive understanding of current treatment practices, emerging MET targeting therapies, market share of individual therapies, and current and forecasted MET targeting therapies market size from 2020 to 2034, segmented into the 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the MET Targeting Therapies Market Report

- The management of cancers that are hard to treat, such as colorectal cancer (CRC), gastric cancer, pancreatic cancer, non-small cell lung cancer (NSCLC), and others, is changing as a result of the development of targeted medicines. Growing interest and clinical development for biomarker-directed therapies point towards the increasing significance of molecular profiling to identify actionable mutations and further treatment selections.

- The total incident cases of non-small cell lung cancer (NSCLC) in the 7MM comprised around 531,800 cases in 2023. Up to 6% of individuals with NSCLC have MET alterations, including METex14 skipping and MET amplification. In addition, around 25% of patients with EGFR wild-type nonsquamous NSCLC have tumors that overexpress c-Met protein.

- Several selective MET-tyrosine kinase inhibitors (TKIs) have been approved by the US Food and Drug Administration (FDA) in recent years, and this has significantly altered how patients with METex14-containing NSCLC are treated. For metastatic NSCLC with the MET exon 14 skipping mutation, TABRECTA (capmatinib) or TEPMETKO (tepotinib) is frequently the recommended first-line therapy. In March 2020, TEPMETKO became the first MET-TKI to receive regulatory approval for the treatment of METex14 skipping NSCLC in Japan. TABRECTA received FDA approval in the US in May 2020, and ORPATHYS (savolitinib) was approved in China in June 2021.

- Among the cMet-targeting therapies Johnson & Johnson's anti-EGFR x cMet bispecific antibody RYBREVANT is also approved for the treatment of EGFR+ NSCLC patients.

- Antibody-drug conjugates (ADCs) are emerging as a novel treatment approach for the MET-expressed cancers. AbbVie leads the cMet ADC space with two met-targeting ADCs: one in Phase III (telisotuzumab adizutecan for colorectal cancer) and one submitted to the FDA (Teliso-V).

- In September 2024, AbbVie submitted a biologics license application (BLA) to the FDA seeking accelerated approval for telisotuzumab vedotin (Teliso-V) in patients with previously treated nonsquamous NSCLC with c-Met protein overexpression.

- Leading MET targeting therapies companies such as AstraZeneca, AbbVie, Apollomics, Regeneron Pharmaceuticals, Turning Point Therapeutics, Mythic Therapeutics, and others are developing novel MET targeting therapies that can be available in the MET targeting therapies market in the coming years.

- Some of the key MET targeting therapies in the pipeline include ORPATHYS (Savolitinib), Telisotuzumab Vedotin, APL-101, REGN5093, REGN5093-M114, TPX-0022, MYTX-011, and others.

Discover which therapies are expected to grab the MET targeting therapies market share @ MET targeting therapies Market Report

MET targeting therapies Market Dynamics

The MET targeting therapies’ market is a rapidly evolving segment within the oncology therapeutics landscape. One of the driving forces in the MET targeting therapies market is the growing understanding of MET's role in oncogenesis and the development of drug resistance, particularly in NSCLC.

Competition within the MET targeting therapies market is intensifying, as numerous pharmaceutical companies are actively pursuing the development of next-generation inhibitors. These companies are focusing on improving the efficacy, safety, and resistance profiles of their drugs, which has led to a dynamic pipeline of MET inhibitors in various stages of clinical development. Partnerships and collaborations between biotech firms and large pharmaceutical companies have also played a crucial role in advancing the development and commercialization of these therapies. For example, collaborations between companies like Novartis and Incyte have accelerated MET inhibitors' clinical trials and regulatory approvals. TABRECTA was discovered by Incyte and licensed to Novartis in 2009. Under the terms of the Agreement, Incyte granted Novartis exclusive worldwide development and commercialization rights to TABRECTA and certain backup compounds in all indications.

Regulatory approvals and the evolving landscape of precision medicine are also key factors shaping the MET targeting therapies market. As the understanding of biomarkers and patient stratification improves, regulatory agencies have become more receptive to approving therapies based on robust clinical data that demonstrate significant benefits for specific patient subsets. This has led to an increase in the number of accelerated approvals for MET inhibitors, especially in cases where they fulfill unmet medical needs. However, the market also faces challenges related to pricing, reimbursement, and access, particularly in regions with strict healthcare budgets.

In summary, the MET targeting drugs market is characterized by its rapid growth and intense competition, driven by scientific advancements, strategic partnerships, and regulatory dynamics. The market's future trajectory will likely be shaped by ongoing innovations in drug development, the successful navigation of regulatory pathways, and the ability to address unmet needs in oncology. As the market continues to evolve, stakeholders will need to adapt to the changing landscape to capitalize on the opportunities presented by this promising area of cancer therapeutics.

MET targeting therapies Treatment Market

MET-TKIs, monoclonal antibodies, and antibody-drug conjugates (ADCs) are the three types of MET-targeted treatments. Several MET-TKIs have been developed and approved (TABRECTA, and TEPMETKO), for the treatment of c-MET NSCLC. These targeted therapies have provided new options for patients who may not respond well to traditional chemotherapy or other targeted therapies, thereby expanding the patient population eligible for treatment and driving market growth.

TEPMETKO is prescribed for adults with lung cancer that has either metastasized or cannot be surgically removed. It is administered when cancer cells have an alteration in the MET gene and when previous treatments have failed to control the disease. The US FDA has recognized TEPMETKO with breakthrough therapy and orphan drug designations. TEPMETKO was first approved by Japan's Ministry of Health, Labour, and Welfare (MHLW) in 2020, received accelerated approval from the FDA in 2021, and was later approved by the European Commission in 2022. In 2024, the FDA granted regular approval for TEPMETKO specifically for treating metastatic NSCLC.

TABRECTA is a prescription medication used to treat adults with metastatic NSCLC that has spread to other parts of the body and has tumors with an abnormal MET gene. TABRECTA, the active ingredient, works by inhibiting the phosphorylation of MET, which is triggered by hepatocyte growth factor or MET amplification. TABRECTA received standard FDA approval in August 2022, following its initial accelerated approval in 2020, when it was also granted breakthrough therapy and orphan drug designations.

In NSCLC, both of the approved c-met inhibitors have demonstrated outstanding efficacy, with notably high response rates. However, certain variables, like the fact that TEPMETKO is a once-day medicine and TABRECTA needs to be taken twice daily, might influence the uptake of both therapies.

Learn more about the FDA-approved MET targeting therapies @ MET targeting therapies Drugs

Key Emerging MET Targeting Therapies and Companies

Several key players, including AstraZeneca (ORPATHYS), AbbVie (Telisotuzumab Vedotin, and Telisotuzumab adizutecan), Regeneron Pharmaceuticals (REGN5093; REGN5093-M114), Mythic Therapeutics (MYTX-011), and others, are involved in developing drugs for MET targeting therapies for various indications such as NSCLC, renal cell carcinoma, thyroid cancer, and others.

ORPATHYS (savolitinib) is an oral, highly potent, and selective MET tyrosine kinase inhibitor that has shown effectiveness in treating advanced solid tumors. It targets and inhibits abnormal activation of the MET receptor tyrosine kinase pathway caused by mutations (like exon 14 skipping or other point mutations), gene amplification, or protein overexpression. For patients with EGFR-mutant NSCLC who have progressed on targeted treatments, chemotherapy is currently the standard care.

Results from the SAVANNAH study indicate that combining savolitinib with TAGRISSO during disease progression might offer these biomarker-selected patients a potentially less toxic and more effective treatment option. The global SAFFRON Phase III trial will compare the combination of TAGRISSO and savolitinib against platinum-based doublet chemotherapy in patients with EGFR mutations, MET overexpression, and/or amplification, who have locally advanced or metastatic NSCLC following TAGRISSO. Patients are selected based on high MET levels identified in SAVANNAH. The SAFFRON trial began in Q3 2022, with the first estimated filing expected in 2024. In January 2023, the US FDA granted fast-track designation to the savolitinib and TAGRISSO combination.

Telisotuzumab vedotin (ABBV-399; Teliso-V) is a pioneering ADC that combines a recombinant humanized monoclonal antibody targeting c-MET (ABT-700) with monomethyl auristatin E (MMAE), a potent microtubule polymerization inhibitor, linked by a cleavable linker. When administered intravenously, the monoclonal antibody component binds to c-MET on tumor cells. Following binding, internalization, and enzymatic cleavage, MMAE is released into the cytosol, exerting its cytotoxic effects.

The company is conducting multiple trials to assess telisotuzumab vedotin for treating patients with NSCLC. In January 2022, AbbVie reported that the FDA granted Breakthrough Therapy Designation to telisotuzumab vedotin for treating advanced or metastatic EGFR wild-type NSCLC with high c-MET overexpression, particularly for cases progressing after platinum-based therapy.

The anticipated launch of these emerging therapies are poised to transform the MET targeting therapies market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the MET targeting therapies market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about MET targeting therapies clinical trials, visit @ MET targeting therapies Treatment Drugs

MET targeting therapies Overview

Mesenchymal epithelial transition (MET) tyrosine kinase inhibitors are medications used to treat lung cancer. MET tyrosine kinase is a receptor located on the surface of various cells, with a ligand known as hepatocyte growth factor (HGF). When HGF binds to these MET receptors, it typically promotes cell formation and wound healing in healthy cells. However, mutations in MET can lead to excessive cell activity, contributing to tumor development. MET tyrosine kinase inhibitors work by binding to MET, preventing HGF from attaching, and ultimately causing the death of tumor cells.

These inhibitors are specifically used to treat NSCLC in adults, where alterations in the MET proto-oncogene are recognized as key drivers of the disease. Since MET was identified as a potential therapeutic target, extensive clinical trials have been conducted. Consequently, MET-targeted therapies, including MET tyrosine kinase inhibitors, monoclonal antibodies, and MET antibody-drug conjugates, have become crucial components of standard treatment for MET-altered NSCLC, significantly improving outcomes for patients with MET-driven tumors.

MET targeting therapies Epidemiology Segmentation

Among the 7MM, the United States accounts for the highest number of incident cases of non-small cell lung cancer in 2023. The MET targeting therapies market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of Selected Indication for MET targeting Therapies

- Total Eligible Patient Pool for MET targeting Therapies in Selected Indication

- Total Treatable Cases in Selected Indication for MET Targeting Therapies

Download the report to understand what epidemiologists are saying about how MET targeting therapies patient trends in 7MM @ MET targeting therapies Epidemiological Insights

| MET targeting therapies Report Metrics | Details |

| Study Period | 2020–2034 |

| MET targeting therapies Report Coverage | 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key MET targeting therapies Companies | AstraZeneca, AbbVie, Apollomics, Regeneron Pharmaceuticals, Turning Point Therapeutics, Mythic Therapeutics, Merck, Novartis, and others |

| Key MET targeting therapies | ORPATHYS, Telisotuzumab Vedotin, Vebreltinib (APL-101), REGN5093, REGN5093-M114, telisotuzumab adizutecan, TPX-0022, MYTX-011, TEPMETKO, TABRECTA, and others |

Scope of the MET Targeting Therapies Market Report

- MET targeting therapies Therapeutic Assessment: MET targeting current marketed and emerging therapies

- MET targeting therapies Market Dynamics: Conjoint Analysis of Emerging MET targeting Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, MET targeting therapies Market Access and Reimbursement

Discover more about MET targeting therapies drugs in development @ MET targeting therapies Clinical Trials

Table of Contents

| 1. | Key Insights |

| 2. | Report Introduction |

| 3. | Executive Summary of MET Targeting Therapies |

| 4. | Key Events |

| 5. | Market Forecast Methodology |

| 6. | MET Targeting Therapies Market Overview at a Glance in the 7MM |

| 6.1. | Market Share (%) Distribution by Therapies in 2020 |

| 6.2. | Market Share (%) Distribution by Therapies in 2034 |

| 7. | MET targeting therapies: Background and Overview |

| 8. | Treatment and Management |

| 9. | Target Patient Pool |

| 9.1. | Key Findings |

| 9.2. | Assumptions and Rationale: 7MM |

| 9.3. | Epidemiology Scenario in the 7MM |

| 9.3.1. | Total Cases in Selected Indications for MET targeting therapies in the 7MM |

| 9.3.2. | Total Eligible Patient Pool for MET targeting therapies in Selected Indications in the 7MM |

| 9.3.3. | Total Treated Cases in Selected Indications for MET targeting therapies in the 7MM |

| 10. | Marketed Therapies |

| 10.1. | Key Competitors |

| 10.2. | TEPMETKO (tepotinib): Merck |

| 10.2.1. | Product Description |

| 10.2.2. | Regulatory milestones |

| 10.2.3. | Other developmental activities |

| 10.2.4. | Clinical development |

| 10.2.5. | Safety and efficacy |

| 10.3. | TABRECTA (capmatinib): Novartis |

| 10.3.1. | Product Description |

| 10.3.2. | Regulatory milestones |

| 10.3.3. | Other developmental activities |

| 10.3.4. | Clinical development |

| 10.3.5. | Safety and efficacy |

| List to be continued in the report | |

| 11. | Emerging Therapies |

| 11.1. | Key Competitors |

| 11.2. | ORPATHYS (Savolitinib): AstraZeneca |

| 11.2.1. | Product Description |

| 11.2.2. | Other developmental activities |

| 11.2.3. | Clinical development |

| 11.2.4. | Safety and efficacy |

| 11.3. | Telisotuzumab Vedotin: AbbVie |

| 11.3.1. | Product Description |

| 11.3.2. | Other developmental activities |

| 11.3.3. | Clinical development |

| 11.3.4. | Safety and efficacy |

| List to be continued in the report | |

| 12. | MET Targeting Therapies: Seven Major Market Analysis |

| 12.1. | Key Findings |

| 12.2. | Market Outlook |

| 12.3. | Conjoint Analysis |

| 12.4. | Key Market Forecast Assumptions |

| 12.4.1. | Cost Assumptions and Rebates |

| 12.4.2. | Pricing Trends |

| 12.4.3. | Analogue Assessment |

| 12.4.4. | Launch Year and Therapy Uptakes |

| 12.5. | Total Market Size of MET targeting therapies in the 7MM |

| 12.6. | Market Size of MET Targeting Therapies by Indications in the 7MM |

| 12.7. | The United States Market Size |

| 12.7.1. | Total Market Size of MET targeting therapies in the United States |

| 12.7.2. | Market Size of MET Targeting Therapies by Indications in the United States |

| 12.7.3. | Market Size by Therapies in the United States |

| 12.8. | EU4 and the UK Market Size |

| 12.8.1. | Total Market Size of MET targeting therapies in EU4 and the UK |

| 12.8.2. | Market Size of MET Targeting Therapies by Indications in EU4 and the UK |

| 12.8.3. | Market Size by Therapies in EU4 and the UK |

| 12.9. | Japan Market Size |

| 12.9.1. | Total Market Size of MET Targeting Therapies in Japan |

| 12.9.2. | Market Size of MET Targeting Therapies by Indications in Japan |

| 12.9.3. | Market Size by Therapies in Japan |

| 13. | SWOT Analysis |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | Market Access and Reimbursement |

| 17. | Appendix |

| 17.1. | Bibliography |

| 17.2. | Report Methodology |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

c-MET Metastatic Non-small Cell Lung Cancer Market

c-MET Metastatic Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key c-MET mNSCLC companies, including Novartis, Apollomics Inc., Abbvie, Janssen Research and Development, among others.

Non-small Cell Lung Cancer Market

Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NSCLC companies, including EMD Serono, Merck, Cellular Biomedicine Group, Inc., Celgene, CellSight Technologies, Inc., BeyondSpring Pharmaceuticals Inc., J Ints Bio, Forward Pharmaceuticals Co., Ltd., AstraZeneca, Bristol-Myers Squibb, Teligene US, Rain Oncology Inc, ReHeva Biosciences, Inc., Amgen, Novartis, RedCloud Bio, Parexel, Vitrac Therapeutics, LLC, Mythic Therapeutics, Instil Bio, Mirati Therapeutics Inc., Daiichi Sankyo, Inc., AstraZeneca, Precision Biologics, Inc, Promontory Therapeutics Inc., Palobiofarma SL, Regeneron Pharmaceuticals, Revolution Medicines, Inc., Cullinan Oncology, LLC, Iovance Biotherapeutics, Inc., Innate Pharma, among others.

Non-small Cell Lung Cancer Pipeline

Non-small Cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key non-small cell lung cancer companies, including BridgeBio Pharma, Daiichi Sankyo, EMD Serono, Merck, BridgeBio Pharma, Abbvie, Pfizer, Eli Lilly and Company BioNTech SE, Shenzhen TargetRx, Taiho Pharmaceutical, Chong Kun Dang, Bristol Myers Squibb, Innovent Biologics, Xuanzhu Biopharmaceutical, Bayer, GeneScience Pharmaceuticals, InventisBio, Apollomics, Imugene, Ono Pharmaceutical, Pierre Fabre, Jiangsu Hengrui Medicine Co., Bristol-Myers Squibb, Surface Oncology, Inhibrx, Sinocelltech, Mirati Therapeutics, REVOLUTION Medicines, Yong Shun Technology Development, Iovance Biotherapeutics, Galecto Biotech, among others.

Small-Cell Lung Cancer Market Insight, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key SCLC companies, including Medicine Invention Design, Inc, Advenchen Laboratories, LLC, Bristol-Myers Squibb, Clovis Oncology, Inc., Cardiff Oncology, Legend Biotech USA Inc, Bellicum Pharmaceuticals, Genentech, Inc., Phanes Therapeutics, AbbVie, Amgen, Daiichi Sankyo, Inc., HiberCell, Inc., Hoffmann-La Roche, Harpoon Therapeutics, BioNTech SE, Boehringer Ingelheim, Chipscreen Biosciences, Ltd., Andarix Pharmaceuticals, Telix International Pty Ltd, Syros Pharmaceuticals, Jacobio Pharmaceuticals Co., Ltd., Cybrexa Therapeutics, among others.

Small-Cell Lung Cancer Pipeline

Small-Cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key small-cell lung cancer companies, including Ascentage Pharma, Merck & Co, AstraZeneca, Advenchen Laboratories, GlaxoSmithKline, Advanced Accelerator Applications, Trillium Therapeutics, Vernalis, Oncoceutics, NewBio Therapeutics, Wigen Biomedicine, Linton Pharm, Carrick Therapeutics, Xencor, Jiangsu HengRui Medicine, Aileron Therapeutics, Roche, Ipsen, Celgene, Lee's Pharmaceutical Limited, AbbVie, G1 Therapeutics, Chipscreen Biosciences, Luye Pharma Group, Shanghai Henlius Biotech, CSPC ZhongQi Pharmaceutical Technology, Impact Therapeutics, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter