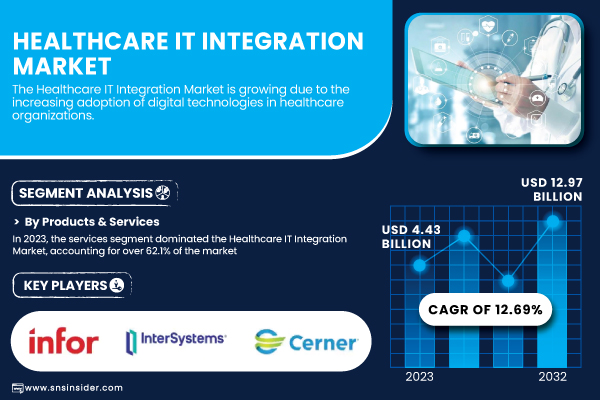

Pune, Jan. 16, 2025 (GLOBE NEWSWIRE) -- According to SNS Insider, the Healthcare IT Integration Market size was valued at USD 4.43 billion in 2023 and is projected grow at a CAGR of 12.69% to reach USD 12.97 billion by 2032 during the forecast period 2024-2032.

This market growth is primarily driven by the increasing adoption of electronic health records (EHRs), telemedicine, and AI-based diagnostic tools, alongside growing regulatory pressure for data interoperability and better patient care outcomes.

Healthcare IT Integration Market Overview

The demand for healthcare IT integration is expanding as healthcare providers strive to modernize their systems, streamline workflows, and ensure regulatory compliance. Integration of various IT systems like EHR, Laboratory Information Management Systems, and Clinical Decision Support Systems is crucial for ensuring smooth data exchange, improving operational efficiencies, and reducing medical errors. The growth in this sector is also influenced by the rise of cloud-based healthcare solutions and telemedicine, which requires effective integration to enhance patient care. This demand is further amplified by the ongoing push for healthcare systems to achieve digital transformation and interoperability.

As hospitals, clinics, and other healthcare entities embrace more advanced technology, integration plays a central role in creating a cohesive infrastructure. Moreover, the shift towards value-based care, which emphasizes patient outcomes and cost reduction, is driving healthcare organizations to adopt integrated systems that can facilitate comprehensive data analysis and collaborative care models.

Get a Sample Report of Healthcare IT Integration Market@ https://www.snsinsider.com/sample-request/1769

Key Statistical Insights

- The demand for healthcare IT solutions is heavily influenced by the increasing prevalence of chronic diseases such as diabetes, heart disease, and hypertension. In 2023, chronic diseases were responsible for around 60-70% of all global healthcare expenditures, with healthcare IT solutions playing a crucial role in providing continuous monitoring and management.

- According to the World Health Organization (WHO), the global prevalence of chronic diseases has risen sharply, with over 50% of the global population now suffering from one or more chronic conditions, which drives the need for integrated healthcare systems.

- The adoption of telemedicine platforms and AI diagnostic tools has seen a surge in 2023, reflecting a shift towards digital health technologies. Prescription trends in the U.S. show an increase of 15-20% in the use of telemedicine and 20-25% in AI-driven diagnostic tools in integrated healthcare setups.

- The device volume related to cloud-based healthcare IT solutions in North America is expected to rise by 25% year-over-year, reflecting the growing preference for scalable, flexible digital solutions.

Major Players Analysis Listed in this Report are:

- Infor - Cloverleaf Integration Suite

- InterSystems Corporation - HealthShare, TrakCare

- Cerner Corporation - Millennium, PowerChart

- Orion Health - Integration Engine, Concerto

- NextGen Healthcare, Inc. - EHR, Healthcare Interoperability

- iNTERFACEWARE, Inc. - Iguana

- Allscripts Healthcare Solutions, Inc. - Sunrise, Open Platform

- Epic Systems Corporation - EpicCare EHR, Bridges

- AVI-SPL, Inc. - Healthcare Integration Solutions

- Corepoint Health (Lyniate) - Corepoint Integration Engine

- Oracle Corporation - Health Sciences Cloud, Cerner

- General Electric Company (GE Healthcare) - Centricity

- IBM Corporation - Watson Health

- Siemens Healthcare GmbH - Healthineers Teamplay

- Summit Healthcare - Summit Integration Software

Healthcare IT Integration Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.43 billion |

| Market Size by 2032 | US$ 12.97 billion |

| CAGR | CAGR of 12.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | Rising adoption of electronic health records (EHRs), telemedicine, remote patient monitoring (RPM), and advanced technologies such as AI and machine learning |

Segmentation Analysis

By Products & Services

In 2023, the services segment dominated the Healthcare IT Integration Market, accounting for over 62.1% of the market share. This dominance is attributed to the rising demand for specialized services for implementing and integrating IT systems within healthcare organizations. With the integration of systems such as Electronic Health Records (EHR), telemedicine platforms, and AI-driven diagnostic tools, expert services are required to ensure seamless operation and data flow between different platforms. Healthcare organizations increasingly rely on these services to mitigate risks, enhance system performance, and ensure compliance with healthcare regulations.

By End User

Hospitals dominated the Healthcare IT Integration Market in 2023, accounting for over 72.3% of the total market share. Hospitals are the major consumers of integrated IT systems that enhance clinical decision-making, streamline workflows, and meet regulatory requirements. Integrated solutions enable seamless data exchange across departments, leading to improved operational efficiency and better patient outcomes. The need for advanced technology to reduce costs, improve care quality, and comply with regulations continues to drive hospital adoption of healthcare IT integration systems.

Need any customization research on Healthcare IT Integration Market, Enquire Now@ https://www.snsinsider.com/enquiry/1769

Healthcare IT Integration Market Segmentation:

By Products & Services

- Products

-

- Interface/Integration Engines

- Medica Device Integration Software

- Media Integration Software

- Other Integration Tools

- Services

- Support and Maintenance Services

- Implementation and Integration Services

- Training and Education Services

- Consulting Services

By End User

- Hospitals

- Laboratories

- Clinics

- Diagnostic Imaging Centres

- Other

Recent Developments

November 2024: HealthPlix Technologies announced an integration with Google to enhance healthcare accessibility. This collaboration allows patients to book appointments directly with doctors through HealthPlix’s EMR software, linked to clinics with a Google business profile.

July 2024: Ontrak, Inc., a leader in AI-powered behavioral healthcare, adopted the Comprehensive Healthcare Integration (CHI) framework to enhance its care delivery model. This integration aims to provide high-quality, holistic care by combining physical health, behavioral health, and social determinants of health.

Regional Insights

In 2023, North America dominated the Healthcare IT Integration Market, accounting for over 57.3% of the global market share. This dominance is primarily due to the high adoption rate of advanced healthcare technologies, including EHR systems and telemedicine, as well as the stringent regulatory requirements for data interoperability. The presence of major healthcare IT providers and the increasing demand for value-based care are further driving growth in this region.

The Asia Pacific region is expected to grow at the fastest rate during the forecast period, owing to the rising adoption of healthcare IT solutions, particularly in countries like China and India. These nations are investing heavily in healthcare infrastructure and digital health technologies to address the growing healthcare needs of their populations. The increased focus on healthcare reforms and expanding healthcare access in these regions is likely to accelerate the demand for IT integration services and products.

Buy a Single-User PDF of Healthcare IT Integration Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1769

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

7. Healthcare IT Integration Market by Products & Services

8. Healthcare IT Integration Market by End User

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Details of Healthcare IT Integration Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/healthcare-it-integration-market-1769

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.