OREM, Utah, Jan. 21, 2025 (GLOBE NEWSWIRE) -- Complete Solaria, Inc. d/b/a Complete Solar (“Complete Solar” or the “Company”) (Nasdaq: CSLR), a solar technology, services, and installation company, today will present its preliminary unaudited Q4’24 results via webcast at 2:00pm ET. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: investors.completesolar.com/news-events/events.

Complete Solar Chairman and CEO, T.J. Rodgers commented, “Our Q4’24 results are subject to a full-year audit, which is currently in progress and involves historical SunPower financials, a complication that is forecasted to delay our audited Q4’24 results into mid-March. By that time, I want to be talking to investors about Q2’25, only two weeks away, not analyzing 2024 history. That’s why we are providing this preliminary, unaudited report which focuses on just Q4’24 and our forecast for Q1’25. The risk of this decision is that the audit process may change some of the results, but probably not revenue, and certainly not the Q1’25 forecast. We have a 57-person finance group comprised of people from two public companies that I trust to report one quarter properly. The Q1’25 forecast is mine.

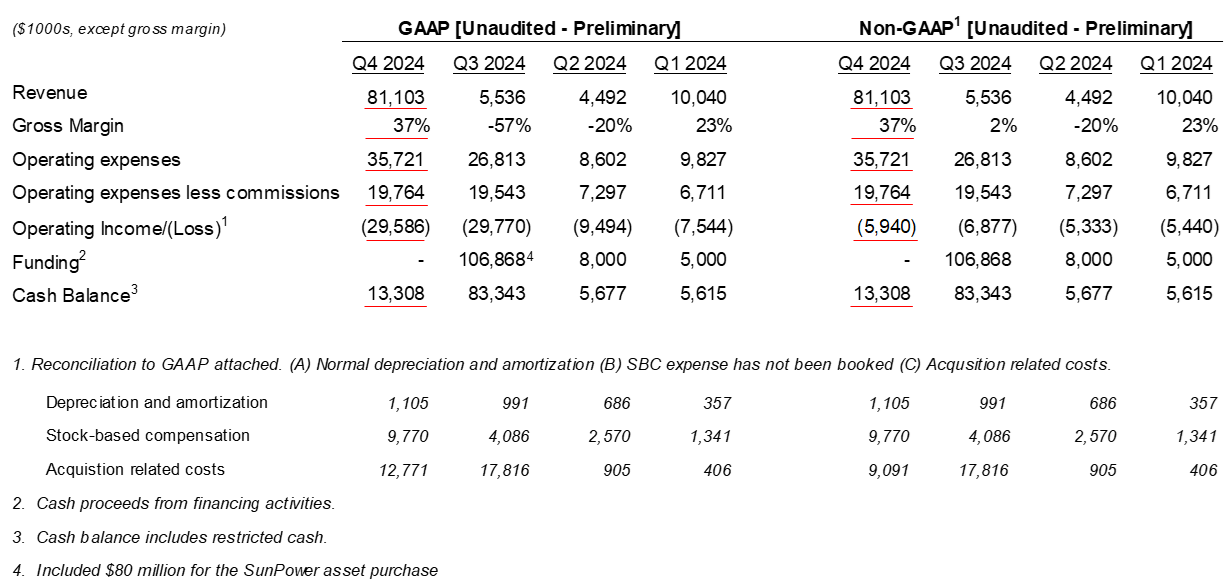

Rodgers added, “We will give GAAP and non-GAAP results for those quarters with commentary focusing on the non-GAAP results, unless otherwise stated. My philosophy is that “non-GAAP” results should be as close to GAAP results as possible, but without 1) stock earnings charges added onto the dilution impact of share count we already report, 2) amortization of intangible assets, and 3) charges for special one-time events, both negative and positive.”

Summary of CSLR’s Q4’24 Accomplishments

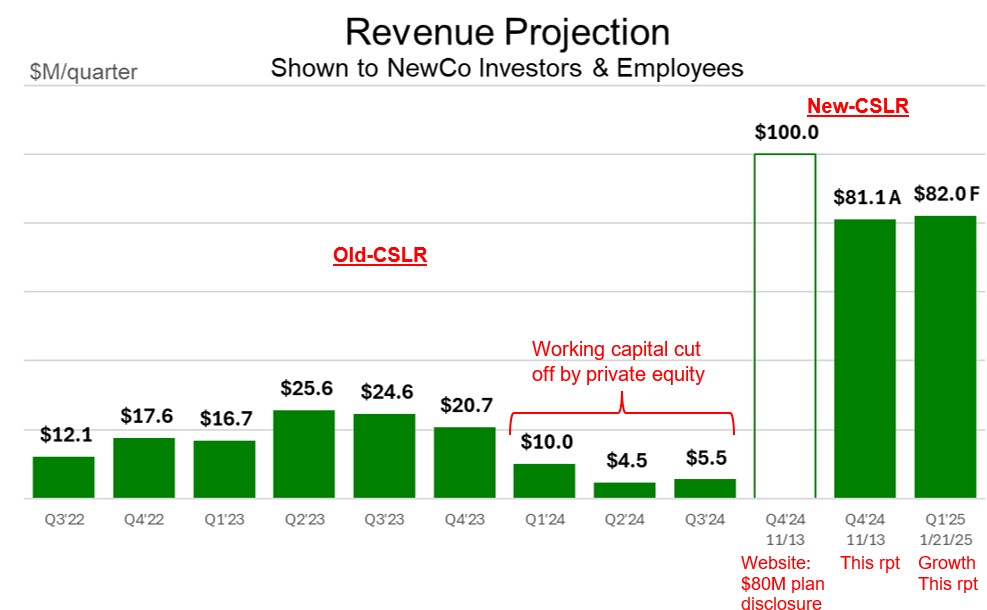

In our November 13 Third Quarter Report, we presented an operating plan for Complete Solar predicated on our successful $45 million acquisition of business unit assets from SunPower to form a Complete Solar “NewCo” (herein called CSLR). This plan called for two big accomplishments that have now been achieved: 1) that the old-CSLR, a small solar company with little cash and only $5.5 million of prior-quarter revenue, would acquire and integrate assets of the SunPower corporation, which was founded in 1985 and about 10 times bigger than old-CSLR, and 2) that, as we wrote in our Third Quarter Report, “our revenue would be $80 million in Q4’24,” the quarter after the asset purchase. This report presents Q4’24 combined company results on a GAAP-compliant basis and certain non-GAAP results and our Q1’25 forecast. The narrative is based on the non-GAAP financial results, unless otherwise noted:

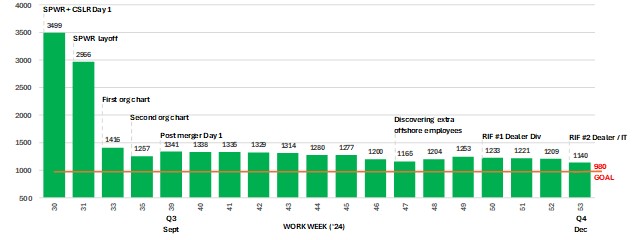

- The SunPower Integration is substantially complete. On the last day of Q3’24, September 30, we closed the acquisition, six days after a Delaware bankruptcy court approved our asset purchase of three SunPower business units, which have now been substantially integrated (including their MRP systems) into CSLR as its two sole operating divisions, New Homes and Blue Raven Solar. That asset integration raised our headcount from 109 to 1,341 on September 30. Our original target of 1,225 was achieved in December, as shown on the included headcount chart. We raised $80 million on September 24 to fund the $45 million SunPower asset purchase price plus the expected added operating capital required to get to profitability.

- Our $81.1 million Q4 revenue beat expectations. CSLR’s consolidated revenue for Q4’24 jumped to $81.1 million, up 14.7 times vs. old-CSLR’s $5.5 million third quarter revenue on a standalone basis, and beat the $80 million revenue forecasted in our Third Quarter Report.

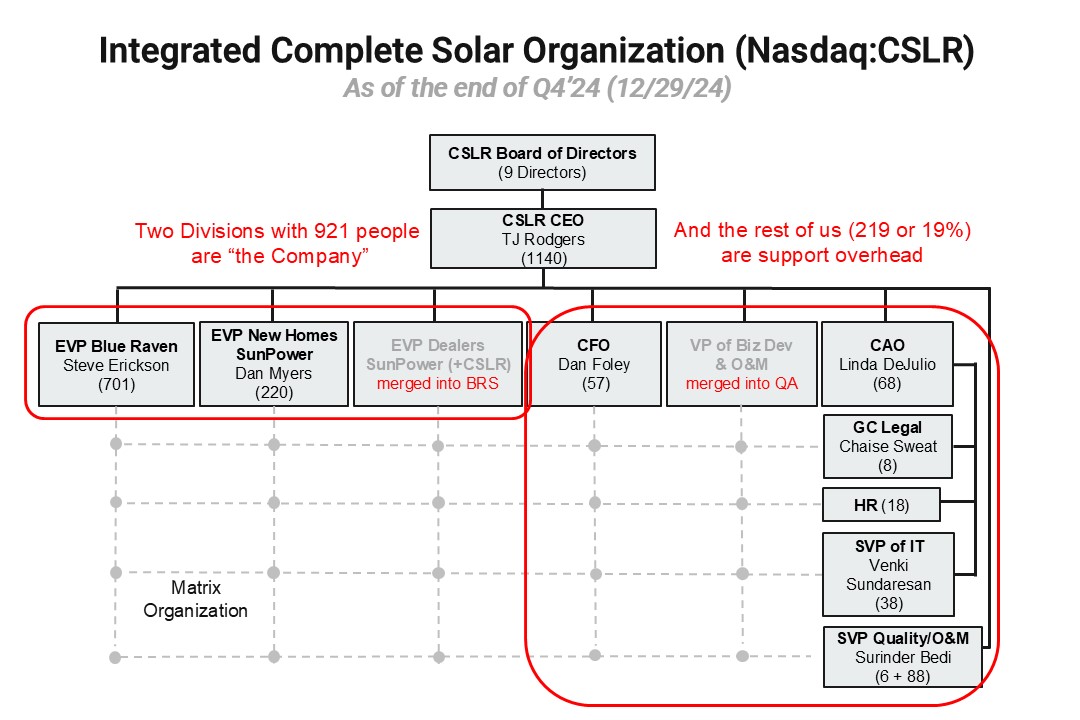

- New Divisional EVP/GMs are in place. We announced the promotion of Blue Raven’s Dan Myers as the EVP and GM of the New Homes Division on October 15, 2024 (here). And one month ago, we hired veteran operations manager Steve Erickson, who was promoted six times at three Salt Lake “Solar Valley” companies since 2011, to be the EVP and GM of the Blue Raven Solar Division.

- We are forecasting revenue growth next quarter. Despite the typical industry seasonality that reduces solar industry revenue by 5%-14% in the Q1 winter quarter, we are forecasting modest quarter-on-quarter revenue growth to $82.0 million in Q1’25.

- The Company is almost at its “fighting weight.” The combined headcount of the two companies started at 3,499 on October 1 and was reduced by 67% to 1,140 by the end of Q4’24, as shown in the embedded org chart. Our final headcount target for the combined company is 980.

- Our operating expense has been cut by a factor of two. The headcount reduction led to a total non-GAAP operating expense reduction from $94.0 in Q3’24 million for the added expenses of the two companies to $35.7 million in Q4’24 for the combined and cost-reduced company. The operating expenses less sales commissions were $84.0 million in Q3’24, down to $19.8 million in Q4’24, a 4x reduction. Our forecast is to drop operating expense less commissions by another 30% in Q1’25.

- We are forecasting operating income breakeven in Q1’25. Given our current backlog and cost-cutting plan, we are forecasting non-GAAP operating income at breakeven in Q1’25.

- Our cash balance will grow. We finished Q4’24 with $13.3 million in cash, our lowest quarter since raising the $80 million in funding. We plan to grow cash from operations during 2025.

Fellow Shareholders:

Our revenue, earnings and cashflow for the stand-alone old-CSLR (Q1-Q3) and the post-merger CSLR (Q4), preliminary and unaudited, are given below showing identical Q4’24 GAAP and non-GAAP results, except for GAAP operating income, which still contains charges from merger write-offs:

The Noah’s Ark Model

Our primary cost reductions in Q4’24 were achieved by reducing headcount in both companies:

CSLR Total Headcount By Work Week

So far, we have reduced our headcount from 3,499 to 1,140 employees, using the Noah’s Ark model in which the 65-employee old-CSLR made employment offers to only 1,219 SunPower and Blue Raven Solar employees to get them “on the Ark” that, we believe, will shelter them from the flood of high interest rates that has already has put over 70 solar companies out of business.

When we were raising the $80 million in Q4’24 for the merger, the first five-quarter plan presented to investors called for $100 million in revenue in Q4’24, and an operating loss of $1.0 million, followed by breakeven operating income in Q2’25. After the backlog uncertainty caused by order cancellations due to the SPWR bankruptcy, we revised our post-integration Q4’24 revenue estimate to $80 million from $100 million in our November 13 Third Quarter Report – and also gave an improved breakeven revenue forecast of $80 million to our shareholders, which, in turn, reduced the allowable number of employees CSLR would support from 1,225 to 980.

Actual 510-foot Oak Noah’s Ark Model – Williamsburg, KY

The Ark merger theory is actually nothing but a typical Silicon Valley startup plan in disguise. Instead of a big company in trouble asking for and getting too much money (SunPower asked for $750 million) – and then being burdened for years with losses and layoffs from debt, the Ark Theory asserts, “Your old company has great assets. Get venture funding for those assets (in our case, $80 million) and build a new organization that can make a profit with what you’ve got.”

Since this org chart was shown last quarter, we have merged the Dealer business unit into the Blue Raven business unit and the O&M (Operations and Maintenance to support our customers) into our Quality Group, with a new Senior VP of quality, Surinder Bedi, who headed Advanced Product Quality at Lucid Motors. Other new executives include Chaise Sweat, our General Counsel from ADT Solar, and Venki Sundaresan, our VP of IT, who ran IT groups at Cypress Semiconductor and Enphase.

This Friday, January 24, 2025, at our Orem, Utah HQ, we will present this report to over 1,000 employees and our board. We will also cover the details of our 2025 Rev. 6 Annual Operating Plan which currently shows operating income profitability in 2025.

Complete Solar CEO, T.J. Rodgers said, “The board honored our fourth quarter performance with a modest $1.14 million bonus (1.4% of revenue) – even in a loss quarter, which is rare. Management chose to give the bonus money to all hands equally to recognize that the rank-and-file employees made the quarter for us. The management team holds significant restricted stock and will get rewarded by the market when they 'meet and beat the street,' by producing a series of quarters that impresses Wall Street.

Rodgers continued, “Our $81.1 million revenue last quarter re-defined our Company with an annualized revenue of $324 million and a $5.94 million quarterly loss that will not survive in 2025, as Muhammad Ali might have said.

Rodgers concluded, “We would like to thank our shareholders for funding our company and giving us the opportunity to re-build an iconic solar company.”

The NASA Helios airplane had 14 electric motors that used SunPower all-black high-efficiency cells to take off and land on its own power. In 2001, it set an all-time altitude record of 96,863 feet, which still stands. The F-15 Eagle, a mach 2.5 fighter, capable of accelerating while climbing vertically, has a service ceiling of 72,000 feet.

About Complete Solar

With its recent acquisition of SunPower assets, Complete Solar has become a leading residential solar services provider in North America. Complete Solar’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.completesolar.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), Complete Solar provides an additional financial metrics in this press release that are not prepared in accordance with GAAP ("non-GAAP"). Management believes the non-GAAP financial measures, in addition to GAAP financial measures, are useful measures of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Complete Solar’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of the company’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of Complete Solar’s GAAP financial results and should only be used as a supplement to, not as a substitute for, Complete Solar’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included in the financial table above and related footnotes. We encourage investors to carefully consider our preliminary results under GAAP, as well as our preliminary non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our Q1’25 revenue projection, our expectations regarding our Q4’24 and fiscal 2025 financial performance, including with respect to our Q4’24 and fiscal 2024 combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to when we achieve breakeven operating income and positive operating income, including our forecast to be operating income breakeven in Q1/25. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, the completion of our audit and financial statements for Q4/24 and fiscal 2024, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 1, 2024, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solar assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Preliminary Unaudited Financial Results

The selected unaudited financial results for the Q4’24 and fiscal 2024 in this press release are preliminary and subject to our quarter and year-end accounting procedures and external audit by our independent registered accounting firm. As a result, the financial results presented in this press release may change in connection with the finalization of our closing and reporting processes and financial statements for Q4’24 and fiscal 2024 and may not represent the actual financial results for such quarter and full year. In addition, the information in this press release is not a comprehensive statement of our financial results for Q4’24 or the 2024 fiscal year, should not be viewed as a substitute for full, audited financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

Company Contacts:

| Dan Foley | Sioban Hickie |

| CFO | VP Investor Relations & Marketing |

| dfoley@completesolar.com | InvestorRelations@completesolar.com |

| (801) 477-5847 |

| COMPLETE SOLARIA, INC. | ||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | ||||||||||||

| (In Thousands) | ||||||||||||

| COMPLETE SOLARIA, INC. - REPORTED Unaudited | PRELIMINARY - Unaudited | |||||||||||

| 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended | |||||||||

| March 31, 2024 | June 30, 2024 | September 29, 2024 | December 29, 2024 | |||||||||

| GAAP operating loss from continuing operations | Note | (7,544 | ) | (9,494 | ) | (29,770 | ) | (29,586 | ) | |||

| Depreciation and amortization | A | 357 | 686 | 991 | 1,105 | |||||||

| Stock based compensation | B | 1,341 | 2,570 | 4,086 | 9,770 | |||||||

| Restructuring charges | C | 406 | 905 | 17,816 | 12,771 | |||||||

| Total of Non-GAAP adjustments | 2,104 | 4,161 | 22,893 | 23,646 | ||||||||

| Non-GAAP net loss | (5,440 | ) | (5,333 | ) | (6,877 | ) | (5,940 | ) | ||||

| Notes: | ||||||||||||

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures. | |||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense GAAP entry has not been booked as of 12/27/24. | |||||||||||

| (C) | Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severence), legal, professional services (i.e. historical carveout audits) and due diligence. | |||||||||||

Source: Complete Solar, Inc.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c4c76594-b9af-470a-b427-09757f513d28

https://www.globenewswire.com/NewsRoom/AttachmentNg/cb1d8bc9-1fbf-4ebc-9920-0fb8d863d61a

https://www.globenewswire.com/NewsRoom/AttachmentNg/201e9649-2104-4a97-8e8b-ea7312752e43

https://www.globenewswire.com/NewsRoom/AttachmentNg/5440715a-c46c-42a2-8594-447c5511fc54

https://www.globenewswire.com/NewsRoom/AttachmentNg/d88b29c2-a59e-4ae6-8a73-ef6a2df3ad56

https://www.globenewswire.com/NewsRoom/AttachmentNg/48a09639-b022-493a-946c-85ed5a966721