New York, USA, Jan. 21, 2025 (GLOBE NEWSWIRE) -- Bronchiectasis Market to Show Positive Growth at a CAGR of 13.7% by 2034 | DelveInsight

The bronchiectasis market is expected to experience steady growth, with a strong CAGR projected from 2024 to 2034. This growth in the 7MM will be fueled by the launch of new treatments like Brensocatib and CMS I-neb, along with advancements in diagnostic methods and the increasing incidence of bronchiectasis.

DelveInsight’s Bronchiectasis Market Insights report includes a comprehensive understanding of current treatment practices, emerging bronchiectasis drugs, market share of individual therapies, and current and forecasted bronchiectasis market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Bronchiectasis Market Report

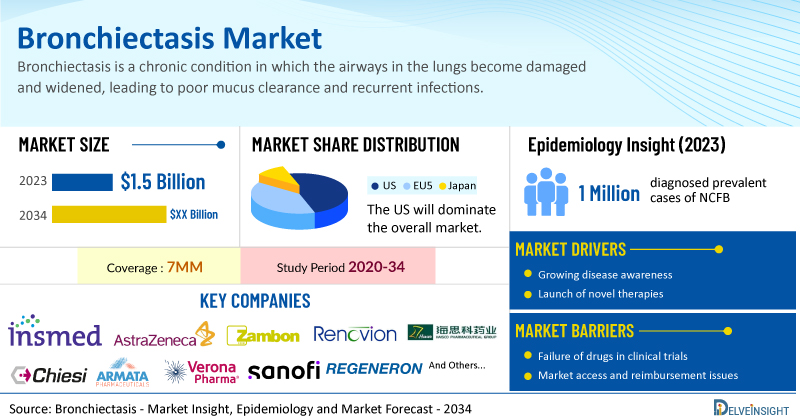

- According to DelveInsight’s analysis, the market size of bronchiectasis in the 7MM reached USD 1.5 billion in 2023 and is expected to increase by 2034.

- Among the currently used therapies, the majority of the market share was of bronchodilators, with a revenue of approximately USD 1 billion in 2023 among the 7MM.

- According to DelveInsight’s estimates, in 2023, there were approximately 1 million diagnosed prevalent cases of NCFB in the 7MM. Of these, the US accounted for approximately 37% of the cases.

- Prominent companies working in the domain of bronchiectasis, including Insmed, AstraZeneca, Zambon, Renovion, Haisco Pharmaceutical Group, Chiesi Farmaceutici S.p.A, Armata Pharmaceuticals, Verona Pharma, Sanofi, Regeneron Pharmaceuticals, Boehringer Ingelheim, CSL, and others, are actively working on innovative bronchiectasis drugs. These novel bronchiectasis therapies are anticipated to enter the bronchiectasis market in the forecast period and are expected to change the market.

- Some of the key bronchiectasis treatments include Brensocatib, Inhaled Colistimethate Sodium (CMS I-neb), FASENRA (benralizumab), ARINA-1 (RVN-301), HSK31858, AP-PA02, Ensifentrine (Nebulizer), Itepekimab, BI 1291583, CHF 6333, CSL787, and others.

- In January 2025, Insmed provided a business update at the J.P. Morgan Healthcare Conference, announcing that it had submitted a New Drug Application (NDA) for brensocatib for patients with bronchiectasis with the US FDA in December 2024 and if priority review is granted by the FDA, the company plans to launch the drug in the US by the third quarter of 2025. Also, regulatory submissions for brensocatib in the EU, UK, and Japan are planned for 2025, with commercial launches anticipated in 2026.

- In December 2024, Armata Pharmaceuticals shared positive results from the Phase II study of inhaled AP-PA02 in non-cystic fibrosis bronchiectasis (NCFB) subjects with chronic pulmonary Pseudomonas aeruginosa infection. Results showed that inhaled AP-PA02 provides a durable reduction of Pseudomonas aeruginosa in the lung, while maintaining a favorable safety and tolerability profile.

- In October 2024, Insmed shared positive late-breaking subgroup data from the Phase III ASPEN study of brensocatib for patients with bronchiectasis at the CHEST 2024 Annual Meeting.

Discover which therapies are expected to grab the bronchiectasis market share @ Bronchiectasis Market Report

Bronchiectasis Overview

Bronchiectasis is a chronic condition in which the airways in the lungs become damaged and widened, leading to poor mucus clearance and recurrent infections. The main causes of bronchiectasis include chronic respiratory infections, such as pneumonia or tuberculosis, autoimmune disorders, cystic fibrosis, and genetic conditions. In addition, environmental factors such as smoking and exposure to toxins can contribute to the condition. Symptoms of bronchiectasis typically include chronic cough, excessive sputum production, wheezing, shortness of breath, and frequent chest infections. Some individuals may also experience fatigue, hemoptysis, and weight loss.

The diagnosis of bronchiectasis is often confirmed through imaging, with a high-resolution CT scan of the chest being the gold standard. This imaging test can reveal the characteristic features of bronchial dilation and thickening. In some cases, sputum cultures, pulmonary function tests, and blood tests may also be conducted to identify underlying causes and assess the severity of the disease. Early diagnosis and management are crucial to improving quality of life and preventing further lung damage.

Bronchiectasis Epidemiology Segmentation

The bronchiectasis epidemiology section provides insights into the historical and current bronchiectasis patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The bronchiectasis market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases of NCFB

- Gender-specific Diagnosed Prevalent Cases of NCFB

- Severity-specific Diagnosed Prevalent Cases of NCFB

- Etiology-specific Diagnosed Prevalent Cases of NCFB

- Microbiology of NCFB Patients

- Total Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis

- Gender-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis

- Age-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis

- Microbiology of Cystic Fibrosis Bronchiectasis Patients

Download the report to understand which factors are driving bronchiectasis epidemiology trends @ Bronchiectasis Epidemiological Insights

Bronchiectasis Treatment Market

The management of bronchiectasis focuses on identifying and treating underlying causes, such as past severe respiratory infections, allergic bronchopulmonary aspergillosis, impaired ciliary clearance, immunodeficiency, COPD, and severe asthma. Treatment primarily aims at relieving symptoms and improving lung function through methods like mucus clearance, infection control with antibiotics, and the use of bronchodilators or corticosteroids to ease airflow obstruction. Supportive care, including smoking cessation and vaccinations, is also essential, while advanced cases may require surgery or lung transplants.

However, the lack of disease-modifying therapies represents a significant treatment gap, as current methods mainly address symptoms without tackling the underlying causes of bronchiectasis. While inhaled corticosteroids and long-term macrolide therapies show potential, their effectiveness remains uncertain due to small sample sizes and short trial durations, emphasizing the critical need for more comprehensive research to develop targeted treatments that can reverse structural damage and enhance long-term outcomes for patients.

Learn more about the market of bronchiectasis @ Bronchiectasis Treatment

Bronchiectasis Emerging Drugs and Companies

Key players Insmed/AstraZeneca (Brensocatib), Zambon (Inhaled Colistimethate Sodium (CMS I-neb)), AstraZeneca (FASENRA), Renovion (ARINA-1), and others are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products to treat bronchiectasis.

Brensocatib, an oral small-molecule inhibitor of dipeptidyl peptidase 1 (DPP1), is being developed by Insmed to treat bronchiectasis, CRSsNP, and other conditions driven by neutrophils. By blocking DPP1, it reduces inflammation by preventing the activation of neutrophil serine proteases (NSPs), such as neutrophil elastase, during neutrophil development in the bone marrow. Insmed announced positive topline results from the Phase III ASPEN trial in bronchiectasis patients, paving the way for a New Drug Application (NDA) submission to the US FDA by late 2024.

If approved, brensocatib could launch in the US by mid-2025, with European and Japanese launches anticipated in early 2026. In October 2024, Insmed presented promising subgroup data from the ASPEN study at the CHEST 2024 Annual Meeting. Additionally, the EMA approved a Pediatric Investigational Plan for brensocatib in bronchiectasis, and the drug has received PRIME scheme access and Breakthrough Therapy Designation for adult bronchiectasis patients.

The CMS I-neb is an investigational inhaled therapy designed for adults with bronchiectasis colonized by Pseudomonas aeruginosa, offering a potential first-in-class treatment option. It utilizes colistimethate sodium, a prodrug of colistin—a polymyxin antibiotic that targets aerobic Gram-negative pathogens, including drug-resistant P. aeruginosa. Colistin disrupts bacterial cell membranes, leading to cell death, and is often used as a last-resort treatment for severe infections like carbapenem-resistant P. aeruginosa.

In September 2024, Zambon published Phase III PROMIS-I and PROMIS-II study results in The Lancet Respiratory Medicine. The PROMIS-I trial showed a significant reduction in pulmonary exacerbation rates, while PROMIS-II, although terminated early due to the pandemic, reported pre-pandemic results consistent with PROMIS-I. Zambon is collaborating with regulatory agencies to accelerate patient access. The US FDA has granted CMS I-neb Breakthrough Therapy Designation (BTD), along with Qualified Infectious Disease Product (QIDP) and Fast Track Designation (FTD).

FASENRA (benralizumab) is a monoclonal antibody designed to bind to the IL-5 receptor alpha on eosinophils, promoting the recruitment of natural killer cells to trigger apoptosis. This process leads to a swift and nearly complete reduction of eosinophils in the blood and tissues of most patients. FASENRA is being explored as a treatment for adults with NCFB (non-cystic fibrosis bronchiectasis) associated with eosinophilic inflammation. As of April 2024, Phase III clinical trials for this indication have been completed.

The other pipeline therapies for bronchiectasis include

- HSK31858: Haisco Pharmaceutical Group/Chiesi Farmaceutici S.p.A

- AP-PA02: Armata Pharmaceuticals

- Ensifentrine (Nebulizer): Verona Pharma

- Itepekimab: Sanofi/Regeneron Pharmaceuticals

- BI 1291583: Boehringer Ingelheim

- CHF 6333: Chiesi Farmaceutici S.p.A.

- CSL787: CSL

The anticipated launch of these emerging therapies are poised to transform the bronchiectasis market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the bronchiectasis market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about bronchiectasis clinical trials, visit @ Bronchiectasis Treatment Drugs

Bronchiectasis Market Dynamics

The bronchiectasis market is set for substantial growth, driven by advancements in both pharmacological and non-pharmacological treatments targeting the disease's complex pathophysiology. Current therapies include a variety of options such as medications, chest physical therapy, hydration, and, in severe cases, oxygen therapy. Inhaled antibiotics have shown effectiveness in managing chronic bacterial infections and reducing flare-ups.

New treatments like Brensocatib, a Dipeptidyl Peptidase 1 (DPP1) inhibitor, and BI 1291583, a cathepsin C inhibitor, focus on reducing neutrophilic inflammation through different mechanisms, providing new approaches to improve patient outcomes. Investigational therapies such as CMS I-neb and monoclonal antibodies like FASENRA and Itepekimab also target specific inflammatory pathways linked to eosinophilic inflammation.

Non-pharmacological methods, particularly Airway Clearance Techniques (ACTs), further enhance pharmacological treatments by promoting mucus clearance and infection prevention. Furthermore, many potential therapies are being investigated for the treatment of bronchiectasis, and it is safe to predict that the treatment space will significantly impact the bronchiectasis market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the bronchiectasis market in the 7MM.

However, challenges remain, including the lack of unified treatment guidelines and limited research into therapies like mucolytics and hyperosmolar agents, which may hinder optimal management. Moreover, bronchiectasis treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the bronchiectasis market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the bronchiectasis market growth.

Despite these challenges, ongoing clinical trials and progress in drug development emphasize the potential for new treatments to address current gaps in bronchiectasis management, ultimately enhancing patients' quality of life and easing the strain on healthcare systems. With a promising pipeline of therapies at different stages of development, the future of bronchiectasis treatment looks increasingly hopeful, highlighting the importance of continued research and clinical validation to fully capitalize on these opportunities.

| Bronchiectasis Report Metrics | Details |

| Study Period | 2020–2034 |

| Bronchiectasis Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Bronchiectasis Market CAGR | 13.7% |

| Bronchiectasis Market Size in 2023 | USD 1.5 Billion |

| Key Bronchiectasis Companies | Insmed, AstraZeneca, Zambon, Renovion, Haisco Pharmaceutical Group, Chiesi Farmaceutici S.p.A, Armata Pharmaceuticals, Verona Pharma, Sanofi, Regeneron Pharmaceuticals, Boehringer Ingelheim, CSL, and others |

| Key Bronchiectasis | Brensocatib, Inhaled Colistimethate Sodium (CMS I-neb), FASENRA (benralizumab), ARINA-1 (RVN-301), HSK31858, AP-PA02, Ensifentrine (Nebulizer), Itepekimab, BI 1291583, CHF 6333, CSL787, and others |

Scope of the Bronchiectasis Market Report

- Bronchiectasis Therapeutic Assessment: Bronchiectasis current marketed and emerging therapies

- Bronchiectasis Market Dynamics: Conjoint Analysis of Emerging Bronchiectasis Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Pricing Analysis, Market Access and Reimbursement

Discover more about bronchiectasis in development @ Bronchiectasis Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Market Overview at a Glance |

| 3.1 | Market Share (%) Distribution of Bronchiectasis in 2020 |

| 3.2 | Market Share (%) Distribution of Bronchiectasis in 2034 |

| 4 | Epidemiology and Market Forecast Methodology |

| 5 | Executive Summary |

| 6 | Key Events |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Signs and Symptoms |

| 7.3 | Etiology and Manifestations |

| 7.4 | Risk Factors |

| 7.5 | Pathogenesis |

| 7.6 | Pathophysiology |

| 7.7 | Diagnosis |

| 7.7.1 | Diagnostic Algorithm |

| 7.7.2 | Diagnostic Guidelines |

| 7.7.2.1 | British Thoracic Society Diagnostic Guidelines for Bronchiectasis in Adults |

| 7.8 | Treatment and Management |

| 7.8.1 | Treatment Guidelines |

| 7.8.1.1 | British Thoracic Society Management Guideline for Bronchiectasis in Adults: 2013 |

| 7.8.1.2 | European Respiratory Society Guidelines for the Management of Children and Adult with Bronchiectasis: 2021 |

| 7.8.1.3 | Comparison of Guideline Recommendations in Different Bronchiectasis Guidelines |

| 8 | Patient Journey |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumption and Rationale |

| 9.3 | NCFB |

| 9.3.1 | Total Diagnosed Prevalent Cases of NCFB |

| 9.3.2 | Severity-specific Diagnosed Prevalent Cases of NCFB |

| 9.3.3 | Gender-specific Diagnosed Prevalent Cases of NCFB |

| 9.3.4 | Etiology-specific Diagnosed Prevalent Cases of NCFB |

| 9.3.5 | Microbiology of NCFB Patients |

| 9.4 | Cystic Fibrosis Bronchiectasis |

| 9.4.1 | Total Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis |

| 9.4.2 | Gender-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis |

| 9.4.3 | Age-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis |

| 9.4.4 | Microbiology of Cystic Fibrosis Bronchiectasis Patients |

| 9.5 | Total Diagnosed Prevalent Cases of Bronchiectasis in the 7MM |

| 9.6 | Total Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in the 7MM |

| 9.7 | The US |

| 9.7.1 | Total Diagnosed Prevalent Cases of Bronchiectasis in the US |

| 9.7.2 | Gender-specific Diagnosed Prevalent Cases of Bronchiectasis in the US |

| 9.7.3 | Severity-specific Diagnosed Prevalent Cases of Bronchiectasis in the US |

| 9.7.4 | Etiology-specific Diagnosed Prevalent Cases of Bronchiectasis in the US |

| 9.7.5 | Microbiology of Bronchiectasis patients in the US |

| 9.7.6 | Total Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in the US |

| 9.7.7 | Gender-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in the US |

| 9.7.8 | Age-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in the US |

| 9.7.9 | Microbiology of Cystic Fibrosis Bronchiectasis Patients in the US |

| 9.8 | EU4 and the UK |

| 9.8.1 | Total Diagnosed Prevalent Cases of Bronchiectasis in EU4 and the UK |

| 9.8.2 | Gender-specific Diagnosed Prevalent Total Diagnosed Prevalent Cases of Bronchiectasis in EU4 and the UK |

| 9.8.3 | Severity-specific Diagnosed Prevalent Cases of Bronchiectasis in EU4 and the UK |

| 9.8.4 | Etiology-specific Diagnosed Prevalent Cases of Bronchiectasis in EU4 and the UK |

| 9.8.5 | Microbiology of Bronchiectasis patients in EU4 and the UK |

| 9.8.6 | Total Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in EU4 and the UK |

| 9.8.7 | Gender-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in EU4 and the UK |

| 9.8.8 | Age-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in EU4 and the UK |

| 9.8.9 | Microbiology of Cystic Fibrosis Bronchiectasis Patients in EU4 and the UK |

| 9.9 | Japan |

| 9.9.1 | Total Diagnosed Prevalent Cases of Bronchiectasis in Japan |

| 9.9.2 | Gender-specific Diagnosed Prevalent Cases of Bronchiectasis in Japan |

| 9.9.3 | Severity-specific Diagnosed Prevalent Cases of Bronchiectasis in Japan |

| 9.9.4 | Etiology-specific Diagnosed Prevalent Cases of Bronchiectasis in Japan |

| 9.9.5 | Microbiology of Bronchiectasis patients in Japan |

| 9.9.6 | Total Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in Japan |

| 9.9.7 | Gender-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in Japan |

| 9.9.8 | Age-specific Diagnosed Prevalent Cases of Cystic Fibrosis Bronchiectasis in Japan |

| 9.9.9 | Microbiology of Cystic Fibrosis Bronchiectasis Patients in Japan |

| 10 | Emerging Drugs |

| 10.1 | Key Cross Competition |

| 10.2 | Brensocatib: Insmed/AstraZeneca |

| 10.2.1 | Drug Description |

| 10.2.2 | Other Developmental Activities |

| 10.2.3 | Clinical Trials Information |

| 10.2.4 | Safety and Efficacy |

| 10.2.5 | Analysts’ View |

| 10.3 | Inhaled Colistimethate Sodium (CMS I-neb): Zambon |

| 10.3.1 | Drug Description |

| 10.3.2 | Other Developmental Activities |

| 10.3.3 | Clinical Trials Information |

| 10.3.4 | Safety and Efficacy |

| 10.3.5 | Analysts’ View |

| 10.4 | FASENRA (benralizumab): AstraZeneca |

| 10.4.1 | Drug Description |

| 10.4.2 | Other Developmental Activities |

| 10.4.3 | Clinical Trials Information |

| 10.5 | ARINA-1 (RVN-301): Renovion |

| 10.5.1 | Drug Description |

| 10.5.2 | Other Developmental Activities |

| 10.5.3 | Clinical Trials Information |

| 10.5.4 | Safety and Efficacy |

| 10.5.5 | Analysts’ View |

| 10.6 | HSK31858: Haisco Pharmaceutical Group/Chiesi Farmaceutici S.p.A |

| 10.6.1 | Drug Description |

| 10.6.2 | Other Developmental Activities |

| 10.6.3 | Clinical Trials Information |

| 10.7 | AP-PA02: Armata Pharmaceuticals |

| 10.7.1 | Drug Description |

| 10.7.2 | Clinical Trials Information |

| 10.8 | Ensifentrine (Nebulizer): Verona Pharma |

| 10.8.1 | Drug Description |

| 10.8.2 | Other Developmental Activities |

| 10.8.3 | Clinical Trials Information |

| 10.9 | Itepekimab: Sanofi/Regeneron Pharmaceuticals |

| 10.9.1 | Drug Description |

| 10.9.2 | Clinical Trials Information |

| 10.1 | BI 1291583: Boehringer Ingelheim |

| 10.10.1 | Drug Description |

| 10.10.2 | Clinical Trials Information |

| 10.10.3 | Safety and Tolerability |

| 10.11 | CHF 6333: Chiesi Farmaceutici S.p.A. |

| 10.11.1 | Drug Description |

| 10.11.2 | Clinical Trials Information |

| 10.12 | CSL787: CSL |

| 10.12.1 | Drug Description |

| 10.12.2 | Clinical Trials Information |

| 11 | Bronchiectasis: Market Analysis |

| 11.1 | Key Findings |

| 11.2 | Key Market Forecast Assumptions |

| 11.2.1 | Cost Assumptions and Rebates |

| 11.2.2 | Pricing Trends |

| 11.2.3 | Analogue Assessment |

| 11.2.4 | Launch Year and Therapy Uptake |

| 11.3 | Market Outlook |

| 11.4 | Conjoint Analysis |

| 11.5 | Total Market Size of Bronchiectasis in the 7MM |

| 11.6 | Total Market Size of Bronchiectasis by Therapies in the 7MM |

| 11.7 | Total Market Size of Bronchiectasis in the US |

| 11.7.1 | Total Market Size of Bronchiectasis |

| 11.7.2 | The Market Size of Bronchiectasis by Therapies in the US |

| 11.8 | Market Size of Bronchiectasis in EU4 and the UK |

| 11.8.1 | Total Market Size of Bronchiectasis in EU4 and the UK |

| 11.8.2 | The Market Size of Bronchiectasis by Therapies in the EU4 and the UK |

| 11.9 | Market Size of Bronchiectasis in Japan |

| 11.9.1 | Total Market Size of Bronchiectasis in Japan |

| 11.9.2 | The Market Size of Bronchiectasis by Therapies in Japan |

| 12 | Key Opinion Leaders’ Views |

| 13 | SWOT Analysis |

| 14 | Unmet Needs |

| 15 | Market Access and Reimbursement |

| 15.1 | The United States |

| 15.1.1 | Centre for Medicare & Medicaid Services (CMS) |

| 15.2 | In EU4 and the UK |

| 15.2.1 | Germany |

| 15.2.2 | France |

| 15.2.3 | Italy |

| 15.2.4 | Spain |

| 15.2.5 | The United Kingdom |

| 15.3 | Japan |

| 15.3.1 | MHLW |

| 16 | Appendix |

| 16.1 | Bibliography |

| 16.2 | Acronyms and Abbreviations |

| 16.3 | Report Methodology |

| 17 | DelveInsight Capabilities |

| 18 | Disclaimer |

| 19 | About DelveInsight |

Related Reports

Bronchiectasis Epidemiology Forecast

Bronchiectasis Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted bronchiectasis epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Bronchiectasis Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key bronchiectasis companies, including AstraZeneca, Insmed Incorporated, SolAeroMed, Boehringer Ingelheim, CSL Behring, Thirty Respiratory Limited, RedHill Biopharma Limited, Chiesi Farmaceutici S.p.A., Armata Pharmaceuticals, Alaxia, Parion Sciences, Santhera Pharmaceuticals, Zambon S.p.A., among others.

Non-Cystic Fibrosis Bronchiectasis Market

Non-Cystic Fibrosis Bronchiectasis Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NCFB companies, including Insmed, Zambon, AstraZeneca, Renovion, Sanofi, among others.

Non-Cystic Fibrosis Bronchiectasis Pipeline

Non-Cystic Fibrosis Bronchiectasis Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, including clinical and non-clinical stage products, and the key NCFB companies, including Zambon SpA, Insmed, Armata Pharmaceuticals, Verona Pharma, Haisco Pharmaceutical Group, Infex therapeutics, Boehringer Ingelheim, Regeneron Pharmaceuticals, Sanofi, Renovion, 30 TECHNOLOGY, Arrowhead Pharmaceuticals, Spexis, AstraZeneca, CSL Behring, Spexis, NovaBiotics, Alveolus Bio, SpliSense, Parion Sciences, Vast Therapeutics, among others.

Cystic Fibrosis Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key cystic fibrosis companies, including Verona Pharmaceuticals, Laurent Pharmaceuticals Inc., Vertex Pharmaceuticals, SpliSense Ltd., Krystal Biotech, Inc., Aridis Pharmaceuticals, Inc., 4D Molecular Therapeutics, Sound Pharmaceuticals, Incorporated, Clarametyx Biosciences, Inc., BiomX, Inc., Boehringer Ingelheim, Respirion Pharmaceuticals Pty Ltd, Anagram Therapeutics, Inc., among others.

Cystic Fibrosis Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key cystic fibrosis companies, including Krystal Biotech, Vertex Pharmaceuticals, Translate Bio, Novartis, Algi Pharma, Verona Pharma, Atlantic Healthcare, Calithera Biosciences, Horizon Therapeutics, Santhera Pharmaceuticals, Reveragen Biopharma, Spli Sense, GlaxoSmithKline, EmphyCorp, Abbvie, Galapagos NV, Vertex Pharmaceuticals, PathBio Analytics, AstraZeneca, Axentis Pharma AG, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter