Aust, Jan. 23, 2025 (GLOBE NEWSWIRE) -- Robotic Vision Market Size & Growth Insights:

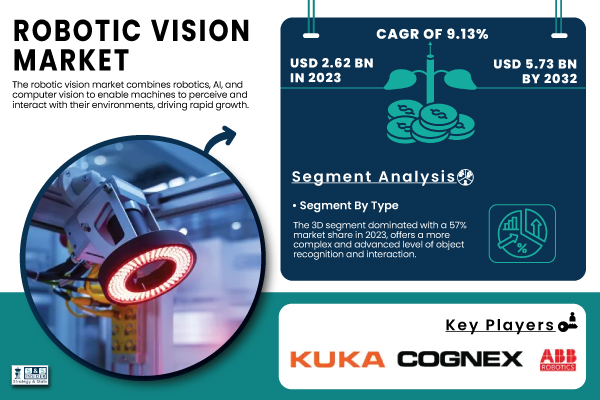

According to the SNS Insider, “The Robotic Vision Market Size was valued at USD 2.62 Billion in 2023 and is expected to reach USD 5.73 Billion by 2032 and grow at a CAGR of 9.13% over the forecast period 2024-2032.”

Transforming Automation through the Rise and Impact of Robotic Vision

The robotic vision market is rapidly growing, combining robotics, AI, and computer vision to enable machines to perceive and interact with their surroundings. A key driver of this growth is the increasing demand for automation in industrial manufacturing, with over 3.4 million industrial robots in use globally as of 2024. Manufacturing companies, dedicating 25% of their capital to automation, leverage robotic vision for critical tasks like quality control and assembly line operations, inspecting products for defects and ensuring consistent production standards. In industries like automotive manufacturing, robotic vision systems are used to inspect welds, detect paint flaws, and assist with complex component assembly, reducing waste and enhancing productivity. Beyond manufacturing, robotic vision is transforming retail and logistics by streamlining warehouse operations and enabling automated checkout systems in stores. As e-commerce continues to rise, the need for robotic vision to optimize order fulfillment and inventory management is further accelerating its adoption.

Get a Sample Report of Robotic Vision Market Forecast @ https://www.snsinsider.com/sample-request/1553

Leading Market Players with their Product Listed in this Report are:

- ABB Robotics (YuMi, IRB 6700)

- Cognex Corporation (In-Sight 7000, VisionPro)

- KUKA Robotics (LBR iiwa, KUKA AGILUS)

- OMRON Corporation (F150 Vision Sensor, OMRON V-SERIES)

- Fanuc Corporation (R-30iB Plus Controller, iRVision)

- Keyence Corporation (CV-X200, CV-5000 Series)

- Basler AG (ace 2, dart Series)

- SICK AG (Visionary-T, SICK InspectorP)

- Teradyne (Universal Robots) (UR5, UR10e)

- National Instruments (NI Vision Builder AI, LabVIEW Vision)

- Denso Robotics (VS-050, VP-Series)

- MVTec Software GmbH (HALCON, MERLIC)

- Sony Corporation (XCL-SG, IMX Series Sensors)

- Teledyne Technologies (JAI Spark, Teledyne Dalsa Genie Nano)

- Intel Corporation (Intel RealSense D435i, Intel RealSense LiDAR Camera L515)

- LMI Technologies (Gocator 3500, Gocator 2000 Series)

- Matrox Imaging (Matrox 4Sight GP, Matrox Solios)

- Epson Robotics (Epson G-Series, Epson C-Series)

- Zebra Medical Vision (Zebra Medical Vision AI, VisionAI platform)

- STMicroelectronics (VL53L1X, VL53L0X).

Robotic Vision Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.62 Billion |

| Market Size by 2032 | USD 5.73 Billion |

| CAGR | CAGR of 9.13% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (2D, 3D) • By Components (Hardware, Software) • By Industry (Automotive, Electrical & Electronics, Chemical, Rubber, & Plastic, Metals & Machinery, Food & Beverages, Precision Engineering & Optics, Pharmaceuticals & Cosmetics, Others) |

| Key Drivers | • Artificial intelligence (AI) and machine learning (ML) are two significant technological innovations driving the growth of the robotic vision market. • The increasing need for automation in various sectors is a major factor in driving the growth of the robotic vision market. |

Do you Have any Specific Queries or Need any Customize Research on Robotic Vision Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/1553

Market Leadership and Growth Drivers in 3D and 2D Segments, Hardware and Software Components of Robotic Vision

By Type

In 2023, the 3D segment led the market with a 57% share, offering advanced object recognition and interaction capabilities for tasks like precise manipulation, autonomous navigation, and quality control in complex environments. This segment is growing rapidly in industries such as healthcare, robotics, and automotive. For example, KUKA Robotics uses 3D vision systems for precise automotive component assembly.

Meanwhile, the 2D segment is expected to experience the fastest growth from 2024 to 2032. Utilized in applications like inspection and sorting, 2D systems, such as those provided by Cognex, support automation in industries like food, beverage, and automotive.

By Component

In 2023, the hardware segment led with a 57% market share, enabling robots to capture images, process data, and make decisions. Advancements in image processing, sensor resolution, and system integration are driving growth, with companies like ABB and KUKA Robotics using vision systems for tasks like quality control and assembly inspections.

The software segment, expected to grow fastest from 2024-2032, leverages AI, machine learning, and deep learning to enhance robot autonomy and precision, as seen with FANUC and Universal Robots.

Asia-Pacific's Dominance and Growth in the Robotic Vision Market

In 2023, Asia-Pacific held the largest market share of 38% in the robotic vision market, with sustained growth expected from 2024 to 2032. This growth is fueled by rapid industrialization, technological advancements, and the presence of major manufacturing hubs like China, Japan, and South Korea. The region's strong adoption of robotics across industries such as automotive, electronics, and consumer goods plays a crucial role in market expansion. Automation in manufacturing and logistics helps reduce labor costs and improve operational efficiency. Key players like Fanuc Corporation, KUKA Robotics, Omron Corporation, and Keyence Corporation are leading the way, integrating robotic vision technologies for tasks like assembly, material handling, quality control, and product inspection. Government incentives further support this growth.

Purchase Single User PDF of Robotic Vision Market Report (33% Discount) @ https://www.snsinsider.com/checkout/1553

Recent Development

- On August 2024, Cognex Corporation (NASDAQ: CGNX) launched an AI-powered counting tool for its In-Sight SnAPP™ vision sensor. This innovation simplifies counting inspections for manufacturers, enhancing accuracy and efficiency while enabling easy automation of assembly verification and quantity checks, even for challenging part types like reflective and distorted objects.

- On December 2024, STMicroelectronics unveiled its STM32N6 microcontroller series, the first to integrate accelerated machine learning capabilities. This new MCU, featuring the Neural-ART Accelerator, delivers 600 times more machine-learning performance than previous STM32 models, enabling cost-sensitive, low-power customers to access AI-driven applications like computer vision and audio processing at the edge.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Robotic Vision R&D Spending Trends

5.2 Installation & Adoption Rates

5.3 Regulatory & Policy Impact

5.4 Product/Service Innovation Index

6. Competitive Landscape

7. Robotic Vision Market Segmentation, by Type

8. Robotic Vision Market Segmentation, by Components

9. Robotic Vision Market Segmentation, by Industry

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access More Research Insights of Robotic Vision Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/robotic-vision-market-1553

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.