Pune, Jan. 25, 2025 (GLOBE NEWSWIRE) -- Payment Security Software Market Size Analysis:

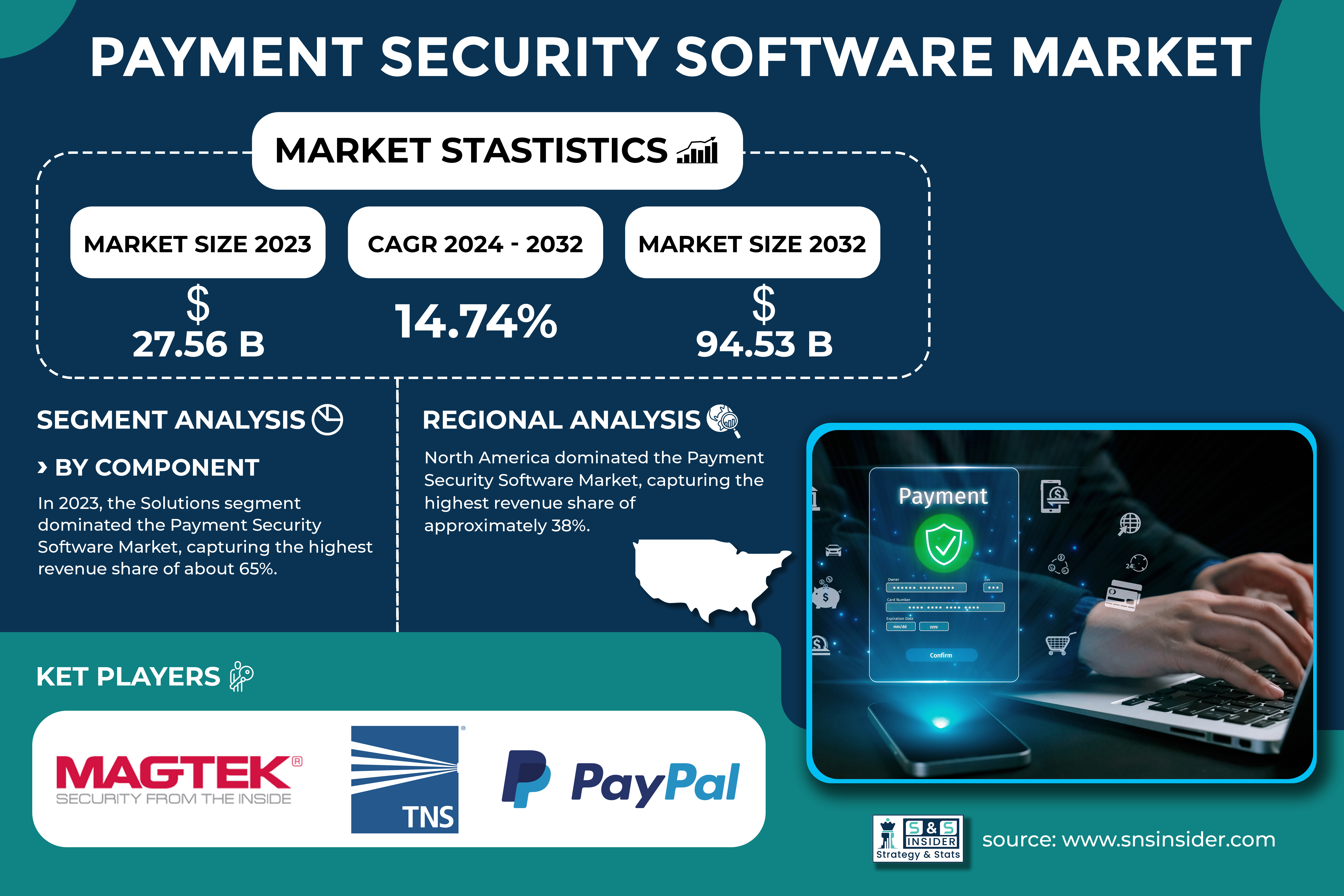

“The Payment Security Software Market was valued at USD 27.76 Billion in 2023 and is projected to reach USD 94.53 Billion by 2032, growing at a compound annual growth rate (CAGR) of 14.74% from 2024 to 2032.”

Payment Security Software Market Experiences Robust Growth Driven by E-Commerce, Mobile Payments, and Enhanced Fraud Prevention Efforts

The payment security software market is rapidly growing because of the increase in digital transactions and the rising anxiety about cybercrime and fraud. In 2023, the overall value of digital payment transactions in the U.S. was estimated to hit USD 2.04 trillion, indicating a change toward digital commerce. As retail e-commerce revenues are predicted to exceed USD 4.1 trillion worldwide in 2024, companies are progressively allocating resources to sophisticated security measures such as encryption and multi-factor authentication. The increase in mobile transactions, online banking, and regulatory requirements is additionally propelling the market, as demonstrated by Visa’s acquisition of Featurespace in December 2024 to improve fraud protection.

Looking ahead, emerging markets present significant growth opportunities in the payment security software sector. The integration of AI and machine learning will drive more advanced fraud detection solutions, while the growing trend of mobile commerce offers chances for innovation. Mastercard's adoption of passwordless payments and biometric authentication in late 2024 highlights the demand for secure, seamless digital transactions.

Get a Sample Report of Payment Security Software Market@ https://www.snsinsider.com/sample-request/4146

Major Players Analysis Listed in this Report are:

- MagTek Inc. (MagTek Card Readers, MagTek Secure Payment Solutions)

- Transaction Network Services Inc. (TNS Payment Gateway, TNS Secure Payments)

- PayPal (PayPal Fraud Protection, PayPal Commerce Platform)

- Forter (Forter Fraud Prevention, Forter Account Protection)

- CyberSource (CyberSource Fraud Management, CyberSource Payment Gateway)

- Verifi (Verifi Chargeback Prevention, Verifi Order Insight)

- Symantec (Broadcom) (Symantec Data Loss Prevention, Symantec Endpoint Protection)

- Thales (Thales CipherTrust, Thales HSM)

- Gemalto (Gemalto SafeNet, Gemalto Identity Protection)

- SecurePay (SecurePay Fraud Prevention, SecurePay Payment Gateway)

- RSA Security (RSA FraudAction, RSA SecurID)

- Visa (Visa Advanced Authorization, Visa Risk Manager)

- Mastercard (Mastercard SecureCode, Mastercard Identity Check)

- TransUnion (TransUnion Fraud Detection, TransUnion Credit Risk)

- Fiserv (Fiserv Fraud Detection, Fiserv Payment Gateway)

- Ingenico Group (Ingenico Payment Gateway, Ingenico Fraud Detection)

- Worldpay (Worldpay Fraud Prevention, Worldpay Payment Gateway)

- BlueSnap (BlueSnap Fraud Prevention, BlueSnap Payment Solutions)

- Payoneer (Payoneer Payment Gateway, Payoneer Fraud Prevention)

- Trustwave (Trustwave Managed Security Services, Trustwave Threat Detection)

- Sift (Sift Digital Trust Platform, Sift Account Protection)

- ACI Worldwide (ACI Worldwide Fraud Detection, ACI Worldwide Payments Hub)

- Kount (Kount Fraud Prevention, Kount Payment Gateway)

- TokenEx (TokenEx Tokenization, TokenEx Payment Gateway)

Payment Security Software Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 27.76 Bn |

| Market Size by 2032 | US$ 94.53 Bn |

| CAGR | CAGR of 14.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Escalating Cybersecurity Threats Due to Digitalization of Payment Systems Fueling Demand for Advanced Payment Security Software Solutions • Expansion of E-Commerce and Online Retail Pushing the Demand for Robust Payment Security Solutions to Combat Fraud and Data Theft |

Do you have any specific queries or need any customization research on Payment Security Software Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/4146

Solutions Segment Leads, While Services Segment Emerges as the Fastest Growing

In 2023, the Solutions segment led the Payment Security Software Market with the largest revenue share of about 65%. This dominance is due to the growing demand for advanced security solutions that safeguard digital payment transactions. As businesses increase their digital presence, they require robust tools like encryption, tokenization, and multi-factor authentication to protect sensitive customer data and meet regulatory requirements, further boosting the market share of the solutions category.

The Services segment is projected to grow at the fastest CAGR of around 16.52% from 2024 to 2032. This growth is driven by the rising need for tailored support, consulting, and ongoing maintenance services to optimize payment security systems. As cyber threats evolve and security needs become more complex, organizations seek expert assistance for seamless integration, continuous updates, and real-time monitoring, fueling the expansion of the services segment.

BFSI Sector Leads, While IT and Telecommunications Segment Becomes the Fastest Growing

In 2023, the Banking, Financial Services, and Insurance segment dominated the Payment Security Software Market, accounting for approximately 27% of the revenue. This dominance is due to the high volume of sensitive financial transactions that require robust security measures to prevent data breaches and fraud. As financial institutions and insurers increasingly adopt digital payment systems, the need for secure solutions to ensure compliance and protect customer data has driven significant investment in payment security within this sector.

The IT and Telecommunications segment is expected to experience the fastest growth, with a projected CAGR of around 17.02% from 2024 to 2032. This growth is driven by the expanding use of digital communication channels and cloud-based services, which have heightened the risk of cyber threats. As online engagement grows, the demand for secure and efficient payment solutions in the IT and telecommunications sectors continues to rise, particularly for seamless integration and secure data transmission.

Payment Security Software Market Segmentation:

By Component

- Services

- Solutions

By Mode of Payment

- Mobile Payment Security Software

- Point-of-sale systems and security

- Online Payment Security Software

By Industry Verticals

- Banking, Financial Services and Insurance

- Retail

- Healthcare

- Government

- IT and Telecommunications

- Others

Buy an Enterprise-User PDF of Payment Security Software Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/4146

North America Leads, While Asia Pacific Emerges as the Fastest Growing Region

In 2023, North America led the Payment Security Software Market, holding a dominant revenue share of approximately 38%. This leadership can be attributed to the region's advanced technological infrastructure, widespread use of digital payment methods, and stringent regulatory standards like PCI-DSS. The presence of major financial institutions, e-commerce companies, and tech giants has also fueled the demand for robust payment security solutions to address cybersecurity risks and maintain consumer trust.

The Asia Pacific region is expected to experience the fastest growth, with a projected CAGR of 16.82% from 2024 to 2032. This growth is driven by the rapid adoption of digital payments, particularly in emerging markets where mobile payments and e-commerce are gaining traction. With increased investment in technology and a growing emphasis on cybersecurity, Asia Pacific is well-positioned for significant expansion in the payment security software market.

Key Developments in the Payment Security Software Market

- In April 2024, Transaction Network Services introduced Complete Commerce, an all-in-one payment solution integrating TNS' portfolios to simplify digital payment systems.

- In 2024, MagTek and InVue partnered to launch an innovative mobile payment solution, combining secure payment technology and retail solutions to enhance security and functionality.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Payment Security Software Market Segmentation, By Component

8. Payment Security Software Market Segmentation, By Mode of Payment

9. Payment Security Software Market Segmentation, By Industry Verticals

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Payment Security Software Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/payment-security-software-market-4146

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.