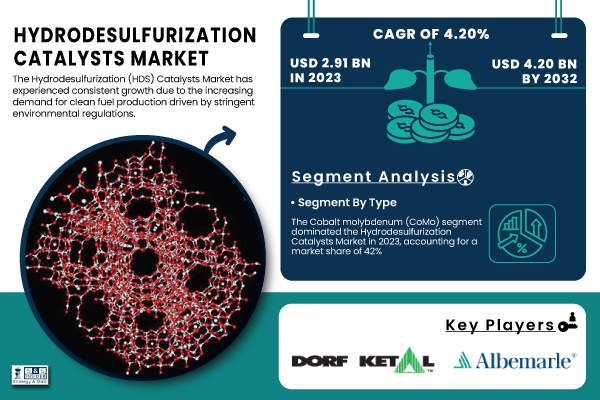

Austin, Jan. 25, 2025 (GLOBE NEWSWIRE) -- As per the latest research report of SNS Insider, “The Hydrodesulfurization Catalysts Market size was valued at USD 2.91 billion in 2023 and is expected to reach USD 4.20 billion by 2032 and grow at a CAGR of 4.20% over the forecast period of 2024-2032.”

Growth and Innovation Driving the Hydrodesulfurization Catalysts Market Towards Cleaner Fuel Production

The Hydrodesulfurization (HDS) Catalysts Market has seen steady growth driven by the increasing need for clean fuel production to meet stringent environmental regulations aimed at reducing sulfur content in fuels, which is crucial for air quality and health. This rising demand has spurred technological advancements in catalyst formulations, with manufacturers investing in the development of more efficient, sustainable solutions that provide higher performance in sulfur removal while lowering operating costs. Innovations such as cobalt-molybdenum-based and nickel-molybdenum-based catalysts have significantly improved desulfurization processes, enabling refineries to meet the rising demand for ultra-low sulfur fuels. Additionally, the growing need for low sulfur diesel, gasoline, and jet fuels, especially in emerging economies, has further expanded the market. Companies have also focused on developing customized hydroprocessing catalysts to optimize fuel production based on specific regional and operational needs, and have enhanced catalyst regeneration techniques to improve longevity and reduce environmental impact. As the industry moves towards greener chemistry and cleaner production processes, these advancements position the HDS catalysts market for sustained growth.

Download PDF Sample of Hydrodesulfurization Catalysts Market @ https://www.snsinsider.com/sample-request/2607

Key Companies:

- Albemarle Corporation (Octolig, K-Pure)

- Axens (HySWEET, G.HDS)

- China Petroleum & Chemical Corporation (Sichuan Refining Catalyst, HYDRODESULF)

- Clariant AG (RDS Plus, SulfaTreat)

- Dorf Ketal Chemicals (DorfKetal HDS Catalysts, DorfKetal Hydroprocessing Catalysts)

- HaldorTopsoe (TK-325, TK-119)

- Honeywell International Inc (UOP ISAL, UOP Naphtha Hydrodesulfurization Catalysts)

- Johnson Matthey (Shincat, HDS-10)

- JGC Catalysts and Chemicals Ltd (JGC-HDS, JGC-600)

- Lubrizol Corporation (LZ-HDS, LZ-4200)

- Mitsubishi Chemical Corporation (Mitsubishi HDS Catalyst, MSC-1000)

- National Oilwell Varco (NOV Hydrodesulfurization Catalysts, NOV HDS-500)

- Nippon Ketjen Co. Ltd (Ketjen HDS Catalyst, Ketjen UltraFine)

- Oil & Gas Technology Ltd (OGT HDS, OGT-DS)

- OXEA GmbH (OXEA Hydrotreating Catalysts, OXEA HDS 400)

- PetroChina Company Limited (PC-Desulfurization Catalyst, PetroHDS)

- Royal Dutch Shell PLC (Shell HDS Catalyst, Shell Hydrocracking Catalyst)

- Saybolt LLC (Saybolt HDS, Saybolt Catalyst 100)

- Sinopec Limited (Sinopec HDS Catalysts, HYDROKAT)

- UNICAT Catalyst Technologies, LLC (UNICAT HDS, UNIDEC)

Hydrodesulfurization Catalysts Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.91 Billion |

| Market Size by 2032 | USD 4.20 Billion |

| CAGR | CAGR of 4.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Cobalt molybdenum (CoMo), Nickel based (NiMo), Palladium, Others) •By Technology (Fixed Bed, Moving Bed, Fluidized Bed) •By Application (Petroleum Refining, Diesel Hydrotreating, Gasoline Hydrotreating, Others) •By End-User (Refineries, Petrochemical Industries) |

| Key Drivers | •Growing Urbanization and Industrialization in Emerging Economies Boosting Fuel Consumption and Catalyst Demand •Stringent Environmental Regulations Increasing Demand for Low-Sulfur Fuels and Catalysts in Refining Industries |

If You Need Any Customization on Hydrodesulfurization Catalysts Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2607

By Type: Cobalt Molybdenum (CoMo) Dominates Market Due to Effective Sulfur Removal and High Stability

The Cobalt Molybdenum (CoMo) segment dominated the Hydrodesulfurization Catalysts Market in 2023 with a share of 42%, favored for its effectiveness in sulfur removal, especially in diesel hydrotreating. Its high stability and performance under harsh conditions make it ideal for refineries in regions with stringent sulfur regulations like Europe and North America.

By Technology: Fixed Bed Technology’s Popularity in Large-Scale Operations Drives Market Share

The Fixed Bed segment dominated the Hydrodesulfurization Catalysts in 2023, with a revenue share of 52% due to its simplicity, cost-effectiveness, and high capacity. It is commonly used in large-scale petroleum refineries across the Middle East and Asia-Pacific, offering efficient sulfur removal at relatively lower operational costs.

By Application: Growing Demand for Low-Sulfur Fuels Boost Petroleum Refining Segment Growth

Petroleum Refining dominated the market with 63% of the share in 2023, driven by the increasing need for low-sulfur fuels. Strict environmental regulations, such as Euro VI standards, have spurred demand for hydrodesulfurization catalysts in refineries, particularly in North America and Europe.

By End-User: Refineries Remain the Largest Consumers of Hydrodesulfurization Catalysts in 2023

Refineries dominated the Hydrodesulfurization Catalysts market with a revenue share of 72% in 2023, driven by stringent sulfur content regulations and high demand for ultra-low sulfur fuels. Significant investments in catalyst technologies by refineries in regions like North America and the Middle East have strengthened their position as the largest end-users.

Regional Analysis

North America’s Dominance in Hydrodesulfurization Catalysts Market

In 2023, North America dominated the Hydrodesulfurization Catalysts Market with a 35% share, driven by strict U.S. and Canadian regulations mandating advanced technologies for ultra-low sulfur fuels, along with significant investments by refineries and the presence of key manufacturers like Albemarle Corporation and Johnson Matthey.

Asia-Pacific Emerges as the Fastest-Growing Region in the Market

Asia-Pacific emerged as the fastest growth in the Hydrodesulfurization Catalysts Market in 2023, with an estimated CAGR of 6.5%. This growth is fueled by expanding refining capacities in China, India, and Japan, and increasing regulatory demands for cleaner fuels. China’s refining capacity, exceeding 17 million barrels per day, and India’s expanding refinery sector have significantly boosted demand for hydrodesulfurization catalysts to meet sulfur content regulations. Japan also continues investing in advanced technologies, driving regional market growth.

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2607

Recent Developments

- December 2024: Evonik launched Octamax, a sustainable catalyst combining NiMo and CoMo technologies to enhance sulfur removal in cracked gasoline HDS units, offering refineries a cost-effective solution for meeting fuel standards and sustainability goals.

- August 2023: The IMO reduced sulfur limits in marine fuels from 3.5% to 0.5%, driving growth in the HDS catalyst market as refineries upgraded to comply with the new environmental standards.

The Hydrodesulfurization (HDS) Catalysts Market is driven by growing demand for low-sulfur fuels and stringent environmental regulations. Technological advancements in catalysts, such as CoMo and NiMo-based solutions, enhance performance and cost-effectiveness. Stricter sulfur limits in regions like North America, Europe, and Asia-Pacific are boosting market demand, while innovations in regeneration technologies and sustainability initiatives are shaping its growth.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Regulatory Influence on Technology Adoption, by Region, 2023

5.2 Cost-Benefit Analysis of Different Catalyst Types, 2023

5.3 Supply Chain and Raw End-User Analysis, by Region, 2023

5.4 Impact of Fuel Type on Catalyst Demand, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.4 Strategic Initiatives

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hydrodesulfurization Catalysts Market Segmentation, by Type

7.1 Chapter Overview

7.2 Cobalt molybdenum (CoMo)

7.3 Nickel based (NiMo)

7.4 Palladium

7.5 Others

8. Hydrodesulfurization Catalysts Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Fixed Bed

8.3 Moving Bed

8.4 Fluidized Bed

9. Hydrodesulfurization Catalysts Market Segmentation, by Application

9.1 Chapter Overview

9.2 Petroleum Refining

9.3 Diesel Hydrotreating

9.4 Gasoline Hydrotreating

9.5 Others

10. Hydrodesulfurization Catalysts Market Segmentation, by End-User

10.1 Chapter Overview

10.2 Refineries

10.3 Petrochemical Industries

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Buy Full Research Report on Hydrodesulfurization Catalysts Market 2024-2032 @ https://www.snsinsider.com/checkout/2607

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.