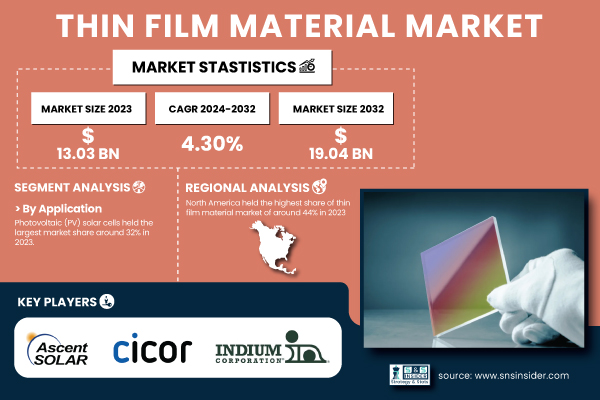

Austin, Feb. 07, 2025 (GLOBE NEWSWIRE) -- The Thin Film Material Market is projected to reach USD 19.04 billion by 2032, growing at a compound annual growth rate (CAGR) of 4.30% from 2024 to 2032.

The thin film material market is growing due to the rising requirement for light-weight materials that consume less energy.

As an intermediate source of materials, thin films are functional and invaluable for applications such as solar energy harvesting, electronic displays, and semiconductors owing to their unique properties imparted because they are at the nanoscale. Photovoltaic cells, which are a core element in solar energy systems, are commonly made from thin films. As the world is paying more attention to sustainable energy and the transition to renewable energy, thin film materials for solar panels have been increasingly in demand.

In addition, thin film materials are gaining traction due to the miniaturization of electronic devices such as smartphones, wearable devices, and flexible electronics. With the growing need for technology, there is a rise in technology with the use of these thin films in manufacturing semiconductors, displays, and microelectromechanical systems (MEMS). Also, there is an increasing demand for thin film materials, driven primarily by the developments in organic light-emitting diode (OLED) technology.

Moreover, the rising demand for advanced coatings and materials having superior optical, electrical, and thermal properties, is expected to provide a boost to the growth of the thin film’s material market over the forecast period. For example, manufacturers use thin films of certain materials for coatings in automotive, aerospace, telecommunications, etc.

Download PDF Sample of Thin Film Material Market @ https://www.snsinsider.com/sample-request/3012

Key Players:

- Ascent Solar Technologies, Inc. (USA)

- Cicor Management AG (Switzerland)

- Hanergy Thin Film Power Group (China)

- Vital Materials Co. Ltd (China)

- Indium Corporation (USA)

- Umicore (Belgium)

- Kyoto Thin Film Materials Institute (Japan)

- Geomatec Co. Ltd (Japan)

- Ferroperm Optics (Denmark)

- JX Nippon Mining & Metals (Japan)

- First Solar, Inc. (USA)

- Solar Frontier K.K. (Japan)

- SunPower Corporation (USA)

- Sharp Corporation (Japan)

- Canadian Solar Inc. (Canada)

- REC Group (Norway)

- Trina Solar Limited (China)

- LONGi Green Energy Technology Co., Ltd. (China)

- Q CELLS (South Korea)

- Taiyo Yuden Co., Ltd. (Japan)

Thin Film Material Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 13.03 Billion |

| Market Size by 2032 | USD 19.04 Billion |

| CAGR | CAGR of 4.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (a-Si, CdTe, and CIGS) • By End User (Electrical, MEMS, Photovoltaic Solar cells, Semiconductors, Optical coating, Other) |

| Key Drivers | • Increased demand for healthcare and biomedical devices drives market growth. |

If You Need Any Customization on Thin Film Material Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/3012

Regional Insights

North America accounted for nearly 44% of the thin film material market in 2023.

The demand for thin film materials for solar cells is expected to increase due to the efficiency and cost-effectiveness of thin film materials used in solar cells and North America is primarily focusing on the renewable energy, especially solar power. The proximity of top semiconductor manufacturers and research institutions also boosts the innovation and adoption of advanced thin film technologies. In addition, further impetus for the market in the region is being provided by government initiatives as well as funding to promote clean energy solutions and high-tech manufacturing. In consequence, North America excels within the thin film materials market, exhibiting wide industrial base and visionary technologies which drive its market growth.

Market Segmentation

By Type, In 2023, a-Si accounted for the largest market share of about 42%.

These are noticeably high production-output costs, however its fabrication is simple and its performance is well-documented in certain applications as well. As the most commercial thin film solar cell, a-Si has a number of advantages up to the consumer level. The ballpark benefit of a-Si is almost totally due to the fact that it is a less expensive thin-film material to produce, versus for example, cadmium telluride (CdTe) or copper indium gallium selenide (CIGS), which makes it well-suited for mass manufacturing and thus a good fit for economics at least in the solar arena. A-Si absorbs sunlight efficiently, including low-light situations and can be manufactured over a flexible substrate, hence retaining a greater share of the market.

By Application, photovoltaic (PV) solar cells accounted for the largest market share of around 32% in 2023.

These technologies are very often employed in renewable energy applications and the increasing global trend towards green energy production. As nations and sectors strive for climate objectives and lower carbon footprints, it's no wonder that various clean, renewable energy sources have become increasingly sought-after (especially solar power). Now, thin film materials, a PV solar cell-related technology, can provide several benefits in comparison to silicone-based panels, such as lower manufacturing expense, flexibility, and the power to be integrated into other surfaces, such as buildings, vehicles, and portable devices.

Recent Developments

- 2023: First Solar, a leading manufacturer of thin-film solar panels, announced the expansion of its production capacity in the U.S. The new plant will focus on producing high-efficiency cadmium telluride (CdTe) thin-film solar panels, contributing to the country’s renewable energy goals.

- 2023: Oerlikon Solar, a prominent player in the thin-film materials market, introduced a new high-performance equipment line for the production of CIGS thin-film solar cells. This innovation aims to reduce production costs and improve the efficiency of CIGS technology, further enhancing the competitiveness of thin-film solar cells in the renewable energy market.

- 2023: Samsung Display announced advancements in flexible OLED technology, which utilizes thin film materials to create high-quality displays for smartphones and televisions. The company’s innovations in flexible electronics are expected to accelerate the adoption of thin films in the consumer electronics industry.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Thin Film Material Market Segmentation, By Type

8. Thin Film Material Market Segmentation, By Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Buy Full Research Report on Thin Film Material Market 2024-2032 @ https://www.snsinsider.com/checkout/3012

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.