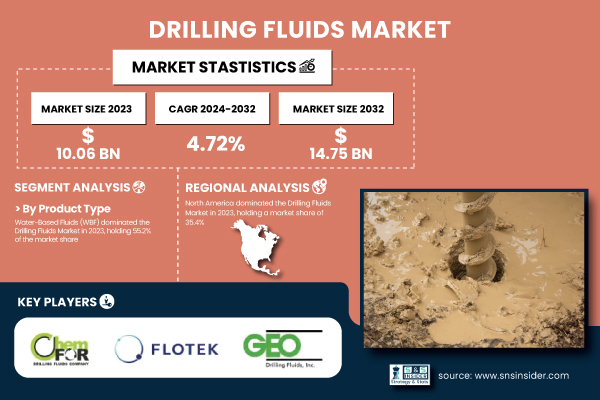

Austin, March 07, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Drilling Fluids Market Size was valued at 10.06 Billion in 2023 and is expected to reach USD 14.75 Billion by 2032, growing at a CAGR of 4.72% over the forecast period of 2024-2032.”

Drilling Fluids Market Surges Amid Rising Offshore Exploration and Technological Advancements

The global Drilling Fluids market is experiencing substantial expansion, driven by growing oil and gas exploration and production activities, especially in offshore regions. The demand for advanced drilling fluids with greater functionality and a lower environmental footprint is being fuelled by technological developments in deepwater and ultra-deepwater drilling, and more stringent environmental regulations. U.S. crude oil production hit a record of 13.3 million barrels per day in October 2023, according to the U.S. Energy Information Administration (EIA), further boosting demand for drilling fluids.

Furthermore, in 2023, BP revealed a significant investment of USD 12 billion in offshore drilling operations, emphasizing the importance of high-performance drilling fluids. The increasing usage of water-based fluids because they are eco-friendly and help increase operational efficiency driving the market growth. According to the International Energy Agency (IEA), approximately 30% of global crude production in 2023 was from offshore oil, cementing drilling fluids as a critical component of the drilling process, according to the International Energy Agency (IEA).

Download PDF Sample of Drilling Fluids Market @ https://www.snsinsider.com/sample-request/5836

Key Players:

- AES Drilling Fluids, LLC (SureFlow, SureMul, Performance Plus WBM)

- Anchor Drilling Fluids USA (QMAX Solutions - Parent Company) (QMax Star, QMax Supreme, QMax Aqua)

- Canadian Energy Services (CES) Ltd. (Seal-AX, PureDrill, LiquidBreak)

- ChemFor Drill Fluid Technologies (ChemDrill, ChemThix, ChemLube)

- Drilling Fluid Solutions (DFS Invert, DFS AquaVis, DFS LubriFlow)

- Flotek Industries, Inc. (Complex nano-Fluid, CnF, HydroClear)

- Geo Drilling Fluids, Inc. (GeoVis, GeoLube, GeoThix)

- Global Drilling Fluids & Chemicals Ltd. (DrillVis, DrillThix, DrillGel)

- Gumpro Drilling Fluids Private Limited (GumDrill OBM, GumThix, GumVis)

- International Drilling Fluids & Engineering Services (IDFES) (IDF Poly, IDF Lube, IDF Gel)

- Kinetic Drilling Fluids (KineticGel, KineticPol, KineticLube)

- Newpark Resources, Inc. (Evolution, OptiDrill, DeepDrill)

- Oren Hydrocarbons Middle East Inc. (OrenVis, OrenDrill, OrenLube)

- Parchem Fine & Specialty Chemicals (ParVis, ParLube, ParThix)

- Petrochem Performance Chemicals Ltd. LLC (PetroMul, PetroThix, PetroDrill)

- Prime Eco Group, Inc. (PrimeThix, PrimeVis, PrimeLube)

- Q’Max Solutions Inc. (QMax Star, QMax Gold, QMax Supreme)

- Scomi Group Bhd (Scomi WBM, Scomi OBM, Scomi SBM)

- Soltex Inc. (Soltex Additive, Soltex HT, Soltex RMT)

- TETRA Technologies, Inc. (TETRAVis, TETRALube, TETRAThix)

Drilling Fluids Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 10.06 Billion |

| Market Size by 2032 | USD 14.75 Billion |

| CAGR | CAGR of 4.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Water-Based Fluids (WBF), Oil-Based Fluids (OBF), Synthetic-Based Fluids (SBF), Others) •By Well Type (Conventional Wells, Unconventional Wells) •By Function (Lubrication & Friction Reduction, Cooling & Heat Dissipation, Pressure Control & Well Control, Wellbore Stability & Hole Cleaning, Others) •By Application (Onshore Drilling, Offshore Drilling) |

| Key Drivers | • Growing Adoption of Water-Based and Synthetic-Based Fluids Enhances Sustainability in the Drilling Fluids Market. |

If You Need Any Customization on Drilling Fluids Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/5836

Technological Innovations in Drilling Fluids

- Biodegradable drilling fluids to reduce environmental impact

- Nanotechnology adoption for improved lubrication and wellbore stability.

- Real-time monitoring integration system to optimize the performance of that fluid.

- Synthetic-based fluids developments for drilling performance optimization in extreme conditions.

- Automated Mixing Systems to Produce Higher Consistency and Minimize Waste.

By Product Type, Water-Based Fluids (WBF) Dominated the Drilling Fluids Market in 2023 with a 55.2% Market Share

Water-Based Fluids (WBF) have been widely adopted due to their lower toxicity, biodegradability, and cost-effectiveness in comparison to oil-based and synthetic-based fluids. These fluids are extensively used for onshore and offshore drilling operations in environmentally sensitive habitats where there are stringent regulatory limitations on oil-based fluids. Also, developments in Water-Based Fluids (WBF) systems, especially their performance at high-temperature and high-pressure (HTHP) conditions will enable them to be used for deepwater drilling. Top oil and gas companies like ExxonMobil and Chevron have turned to Water-Based Fluids (WBF) to meet environmental mandates while still getting wells drilled. With industry trends moving in the direction of eco-friendly and sustainable options, it would only makes sense that Water-Based Fluids (WBF) will continue to lead the market.

By Well Type, Conventional Wells Dominated the Drilling Fluids Market in 2023 with a 60.1% Market Share

These wells remain the first choice with established drilling techniques, lower operational costs, and a higher success rate at hydrocarbon extraction. Drilling fluids have long been used in conventional wells to stabilize the wellbore, control pressure, and improve lubrication. Due to the large proven reserves in areas like the Middle East, North America, and Russia, the demand for conventional drilling has remained consistent. Furthermore, the increasing investments in mature oil fields for enhanced oil recovery (EOR) have also driven the market growth for drilling fluids in conventional wells. Companies like Schlumberger and Halliburton are playing an active role in the provision of high-performance fluid systems that have been designed specifically for conventional drilling activities. Conventional wells will be utilized for a longer as they are more reliable and economically viable versus the modern ways of unconventional drilling.

By Application, Onshore Drilling Dominated the Drilling Fluids Market in 2023 with a 68.9% Market Share

Onshore drilling is preferred due to lower operational costs, logistics is easier, and huge reserves in land oil fields exist. Onshore drilling activities have increased significantly in regions like North America, the Middle East, and Asia-Pacific due to growth in energy demand and technological developments associated with hydraulic fracturing. This segment is further consolidated by growth in shale gas exploration in the U.S. and conventional onshore fields in Saudi Arabia and China. Government incentives that favor domestic oil production have also been driving onshore drilling investments. There are a number of efforts being made by companies to enhance the performance of such operations in different geologic environments, allowing this segment to maintain its lead in the market.

North America Region Dominated the Drilling Fluids Market In 2023, Holding A 35.4% Market Share.

The North America dominated the drilling fluids market, with shale gas and tight oil exploration growth in both the U.S. and Canada in 2023. Hydraulic fracturing's increase and supporting government policies drove demand for high-performance fluids. Key Industry Developments: Global oilfield services market growth is also driven by large players such as Baker Hughes & Halliburton who are investing in new technologies to improve efficiency and sustainability.

Recent Highlights

September 2024: SCF Partners acquired Newpark Fluids Systems (NFS) from Newpark Resources Inc. for a net consideration of $56 million. The transaction sought to further NFS’s development in the sector of drilling and completion fluids, underpinned by a new management team with deep experience in the energy sector.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Drilling Fluids Market Segmentation, by Product Type

8. Drilling Fluids Market Segmentation, by Well Type

9. Drilling Fluids Market Segmentation, by Function

10. Drilling Fluids Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practice

14. Conclusion

Buy Full Research Report on Drilling Fluids Market 2024-2032 @ https://www.snsinsider.com/checkout/5836

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.