Pune, March 21, 2025 (GLOBE NEWSWIRE) -- Clinical Diagnostics Market Size & Growth Analysis:

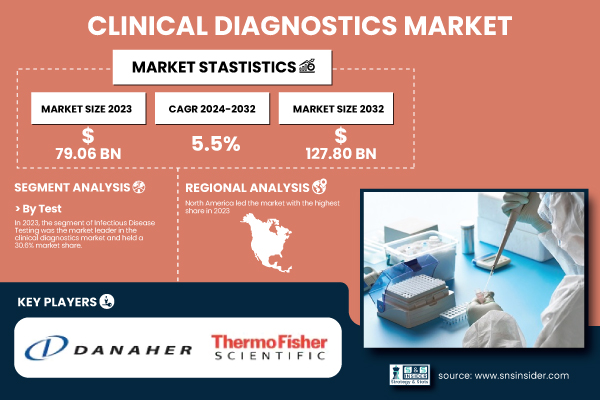

“According to SNS Insider, The Clinical Diagnostics Market was valued at USD 79.06 billion in 2023, is projected to reach USD 127.80 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.5% during the forecast period of 2024-2032.”

This growth is primarily attributed to technological advancements in diagnostic tools and an increasing prevalence of chronic and infectious diseases worldwide.

The increasing prevalence of chronic diseases, like cardiovascular disease, diabetes, and cancer, has increased the need for early and precise diagnostic products. Technological advancements in molecular diagnostics, like polymerase chain reaction (PCR) and next-generation sequencing, have increased the accuracy and efficiency of disease diagnosis, allowing for timely intervention. The increasing focus on personalized medicine worldwide has driven the demand for customized diagnostic tests, thus driving market expansion.

Get a Sample Report of Clinical Diagnostics Market@ https://www.snsinsider.com/sample-request/5675

Key Clinical Diagnostics Companies Profiled

- Abbott – Architect, Alinity

- bioMérieux SA – VITEK 2, VIDAS

- QuidelOrtho Corporation – Sofia, QuickVue

- Siemens Healthineers AG – ADVIA, Atellica

- Bio-Rad Laboratories, Inc. – Unity, Droplet Digital PCR

- Qiagen – QIAamp, Rotor-Gene

- Sysmex Corporation – Sysmex XN-series, HemoCue

- Charles River Laboratories – In Vitro Diagnostic Testing Solutions

- Quest Diagnostics Incorporated – Quest Diagnostics Lab Testing

- Agilent Technologies, Inc. – Agilent SureSelect, Bioanalyzer

- Danaher Corporation – Beckman Coulter, Cepheid

- F. Hoffmann-La Roche Ltd. – Cobas, Elecsys

- Thermo Fisher Scientific – Thermo Scientific, Ion Torrent

- Becton, Dickinson and Company – BD Veritor, BD Vacutainer

Clinical Diagnostics Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 79.06 billion |

| Market Size by 2032 | US$ 127.80 billion |

| CAGR | CAGR of 7.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Test

In 2023, Infectious Disease Testing was the leading segment in the clinical diagnostics market, with a market share of 30.6%. This position is attributed to the worldwide concern for preventing infectious diseases through early detection and management. The COVID-19 pandemic highlighted the need for strong infectious disease testing infrastructure, thereby registering high investments in this sector.

At the same time, the Complete Blood Count (CBC) segment is projected to be the most rapidly growing in the forecast period. The rising incidence of disorders like anemia, infections, and hematologic malignancies makes routine CBC tests a necessity for proper diagnosis and monitoring, propelling the growth of this segment. The cost-effectiveness, availability, and routine use of CBC tests continue to drive demand for them.

By Product

The reagents segment dominated the clinical diagnostics industry in 2023, holding the largest market share and revenue overall. Reagents are critical reagents used in diagnostic tests to deliver precise and trustworthy test results. The ongoing innovation of new reagents designed for individual tests has fueled their demand. Moreover, greater research and development efforts have helped diversify the number of reagents available, further cementing this segment's leadership.

In contrast, the instruments segment is also anticipated to experience strong growth over the coming years. Advances in technology have led to the creation of automated and integrated diagnostic instruments that increase laboratory throughput and efficiency. Increasing demand for point-of-care testing devices and miniaturized diagnostic instruments will further fuel this segment's growth.

By End User

In 2023, hospital labs maintained a large percentage of the clinical diagnostics market. Hospitals are the main bases for patient diagnosis and treatment and depend greatly on in-house labs for a broad range of diagnostic tests. The extensive testing capacity and instant result availability in hospitals are factors in their market leadership.

On the other hand, the Point-of-Care Testing (POCT) segment is expected to grow at a high rate shortly. The trend towards decentralized healthcare and the urgency for quick diagnostic results have boosted the use of POCT, which allows for real-time clinical decisions and enhanced patient outcomes. The increasing demand for home healthcare and the growth of portable diagnostic equipment further drive the growth of this segment.

Need Any Customization Research on Clinical Diagnostics Market, Enquire Now@ https://www.snsinsider.com/enquiry/5675

Clinical Diagnostics Market Segmentation

By Test

- Lipid Panel

- Liver Panel

- Renal Panel

- Complete Blood Count

- Electrolyte Testing

- Infectious Disease Testing

- Other Tests

By Product

- Instruments

- Reagents

- Other Products

By End User

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Other End Users

Regional Analysis

North America was the leader of the clinical diagnostics market in 2023, commanding the largest share. The reasons include a well-established healthcare infrastructure, high adoption rates of modern diagnostic technologies, and an immense burden of chronic diseases. Also, positive reimbursement policies and increased government efforts toward the prevention and early diagnosis of diseases promote market growth within the region.

The Asia-Pacific region is likely to witness the highest growth rate in the forecast period. Improving healthcare infrastructure, growing healthcare expenditure, and raising awareness on early disease diagnosis are fueling demand for clinical diagnostics in the region. Nations like China, India, and Japan are witnessing substantial investments in healthcare technologies, thus fueling market growth even more.

Recent Developments in the Clinical Diagnostics Market

- In December 2024, Roche received CE mark approval for its cobas Mass Spec solution, featuring the cobas i 601 analyzer and Ionify reagent pack for steroid hormone assays. The solution will offer over 60 analytes, including tests for steroid hormones, vitamin D metabolites, and drugs of abuse.

- In November 2024, Amprion was honored with the 2024 BioTech Breakthrough Award for 'Clinical Diagnostics Solution of the Year' for its innovative SAAmplify-ɑSYN assay, which helped in diagnosing various neurodegenerative conditions.

- In January 2025, Deciphex, a Dublin-based medical technology firm utilizing AI for diagnostics, secured €31 million in series C funding. The company's platforms, Diagnexia and Patholytix, are used to help pathologists diagnose diseases more efficiently, addressing the global shortage of pathologists.

Statistical Insights and Trends Reporting

The global burden of chronic diseases continues to rise, with cardiovascular diseases, diabetes, and cancer being the leading causes of morbidity and mortality. The increasing prevalence of these conditions has significantly boosted demand for clinical diagnostics.

The demand for diagnostic tests has surged, particularly for infectious disease testing and routine blood tests. The increasing use of point-of-care testing has also driven a significant rise in test volume.

The market for diagnostic devices, including laboratory-based and point-of-care instruments, has witnessed steady growth. The adoption of automated diagnostic solutions has fueled market expansion, with device sales expected to increase consistently.

Global healthcare expenditures on diagnostics have increased, with government, commercial, and private sectors investing heavily in early disease detection and precision medicine. This has been particularly notable in developed regions.

Buy a Single-User PDF of Clinical Diagnostics Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5675

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Regulatory and Compliance Trends (2023-2032)

5.2 Emerging Trends in Personalized and Precision Medicine (2023-2032)

5.3 Digital and Remote Diagnostics Market Trends (2023-2032)

5.4 Investment and M&A Trends in the Clinical Diagnostics Market (2023-2032)

6. Competitive Landscape

7. Clinical Diagnostics Market by Test

8. Clinical Diagnostics Market by Product

9. Clinical Diagnostics Market by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Clinical Diagnostics Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/clinical-diagnostics-market-5675

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.