Austin, Texas, Jan. 05, 2026 (GLOBE NEWSWIRE) -- Veterinary Point of Care Diagnostics Market Size & Growth Analysis:

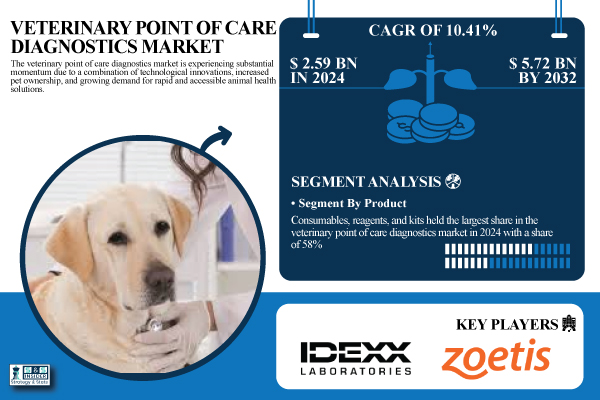

According to SNS Insider, The Veterinary Point of Care Diagnostics Market size was valued at USD 2.59 billion in 2024 and is projected to reach USD 5.72 billion by 2032, expanding at a CAGR of 10.41% over the forecast period of 2025–2032.

The strong growth trajectory of the market is driven by the increasing adoption of point-of-care testing solutions in veterinary clinics and hospitals, enabling faster diagnosis and treatment decisions. These diagnostic tools support immediate clinical insights for conditions such as infectious diseases, metabolic disorders, and hematological abnormalities, reducing dependency on centralized laboratories and improving workflow efficiency. The growing emphasis on preventive veterinary care, coupled with rising expenditure on animal health, is further supporting the market expansion.

Get a Sample Report of Veterinary Point Of Care Diagnostics Market: https://www.snsinsider.com/sample-request/7924

U.S. Veterinary Point of Care Diagnostics Market Insights:

The U.S. veterinary point of care diagnostics market size was valued at USD 0.97 billion in 2024 and is expected to reach USD 2.09 billion by 2032, growing at a CAGR of 10.02% during the forecast period of 2025–2032.

Market growth in the U.S. is supported by a well-established veterinary healthcare infrastructure, high companion animal adoption rates, and increasing awareness among pet owners regarding early disease detection. Veterinary practices across the country are increasingly integrating point-of-care diagnostic systems to enhance service efficiency, improve patient outcomes, and manage rising caseloads. Additionally, technological advancements in portable diagnostic devices and strong investment in animal healthcare innovation continue to reinforce the U.S. market’s leadership position.

Major Players Analysis Listed in the Veterinary Point Of Care Diagnostics Market Report are

- IDEXX Laboratories

- Zoetis

- Heska Corporation

- Virbac

- Thermo Fisher Scientific

- Mindray

- Woodley Equipment

- FUJIFILM Corporation

- Getein Biotech

- Eurolyser Diagnostica

- Randox Laboratories

- AniPOC

- Carestream Health

- NeuroLogica

- bioMérieux

- Biotangents

- Esaote

- GE Healthcare

- Skyla Corporation

- Scil Animal Care

- Abaxis

- Bionote

- Chison Medical Technologies

- IDvet

- QGenda

Segmentation Analysis:

By Product

Consumables, reagents, and kits held the largest share in the veterinary point of care diagnostics market in 2024 with a share of 58%. The growth is driven by their high frequency of usage, low cost, and practicality, they are indispensable for day-to-day diagnostics both in the veterinary hospital and at the field level. The instruments and devices segment is the fastest growing segment in the market due to innovative and technology-driven development of portable analyzers, imaging systems, and integrated devices, which facilitate rapid testing and decision making.

By Test Type

Immunodiagnostics accounted for the largest share of around 37% in the market as these tests are commonly used because they provide fast and accurate results for infectious diseases, hormone levels, and other biomarkers. The emergence of miniaturized PCR systems and isothermal amplification methods was improving the capacity for field- and clinic-based molecular testing, particularly for high-value animals and herd health initiatives.

By Animal Type

Companion Animals was the largest segment in the global veterinary point of care diagnostics market holding a share of 60% in 2024 due to an increase in rate of pet ownership, rise in humanization of pets, and surge in awareness about preventative health care. The demand for livestock animals is anticipated to propel at the fastest CAGR on account of increasing demand of animal protein, economic losses faced by countries owing to the outbreaks.

By Sample Type

The blood/plasma/serum samples segment dominated, accounting for around 56% of the veterinary point of care diagnostics market as they are powerful and cover a multitude of PoC diagnostic modalities such as immunodiagnostic testing, hematology, and molecular testing. The urine sample type is the most rapidly expanding, gaining prevalence in diagnoses of renal diseases, urinary tract infections, and metabolic diseases, such as diabetes.

By Application

In 2024, infectious diseases dominated the market with around 48% share. Growing fears over zoonotic infections and the rapid spread of disease among herds and pets are fueling demand for quick diagnostics that can be deployed on-site or in clinics. Heredity disorder and congenital disorders are the highest growing applications, as the use of genetic screening kits and PoC devices is increasing.

By End-Use

Veterinary hospitals and clinics were the leading end-user segment in 2024 and accounted for 68% share due to the rise in pet visits and rise in veterinarians’ awareness of early detection and disease prevention favor segment dominance. The fastest growing end-use segment is home care settings, led by an increasing trend of tele-veterinary services, direct-to-consumer diagnostics, and pet owners' inclination for convenience.

Need Any Customization Research on Veterinary Point Of Care Diagnostics Market, Enquire Now: https://www.snsinsider.com/enquiry/7924

Key Veterinary Point Of Care Diagnostics Market Segments

By Product

- Consumables, Reagents, and Kits

- Instruments and Devices

- Others (software platforms, diagnostic accessories, and disposables used in PoC testing setups)

By Test Type

- Immunodiagnostics

- Clinical Biochemistry

- Molecular Diagnostics

- Hematology

- Urinalysis

- Others (microbiology-based methods, rapid strip tests, and emerging nanotechnology-based diagnostic methods)

By Animal Type

- Companion Animals

- Dogs

- Cats

- Horses

- Others (rabbits, ferrets, guinea pigs, and exotic pets)

- Livestock Animals

- Cattle

- Swine

- Poultry

- Others (sheep, goats, and aquaculture species like fish)

By Sample Type

- Blood / Plasma / Serum

- Urine

- Fecal

- Others (saliva, skin scrapings, nasal swabs, and other tissue samples)

By Application

- Infectious Diseases

- Non-Infectious Conditions

- Hereditary and Congenital Disorders

- Acquired Health Conditions

- Others (nutritional deficiencies, toxicological screenings, and wellness assessments)

By End Use

- Veterinary Hospitals and Clinics

- Diagnostic Laboratories

- Home Care Settings

- Others (mobile veterinary units, research institutes, and NGOs involved in animal welfare)

Regional Insights:

The North American region accounted for the largest share of the global veterinary point of care diagnostics market in 2024, driven by its well-established veterinary healthcare system, increasing pet adoption, and high expenditure on animal healthcare.

Asia Pacific is the fastest-growing region in the global veterinary point of care diagnostics market, due to the growing pet humanization, rising income, and the surge in livestock population.

Recent Developments:

- In June 2025, eight veterinary clinics in Victoria, Australia, began trailing the AI-powered Atrio Pet Pulse wearable ECG monitor, enabling 24-hour cardiac rhythm tracking in dogs and facilitating early detection of heart disease at the point of care.

- In June 2025, Zoetis introduced AI Masses, enhancing its Vetscan Imagyst analyzer with deep‑learning cytology analysis for lymph node and skin lesions, delivering results in minutes to support rapid in-clinic cancer screening and streamline workflows.

Purchase Single User PDF of Veterinary Point Of Care Diagnostics Market Report (20% Discount): https://www.snsinsider.com/checkout/7924

Exclusive Sections of the Report (The USPs):

- DIAGNOSTIC PENETRATION & USAGE METRICS – helps you understand utilization differences between companion animal and livestock settings, revealing demand concentration, testing frequency, and purchasing behavior across veterinary end users.

- REGIONAL PoC DEVICE ADOPTION INDEX – helps you identify high-growth and underpenetrated regions by analyzing geographic variation in veterinary point-of-care diagnostic deployment and infrastructure readiness.

- SMART & AI-ENABLED PoC TECHNOLOGY ADOPTION RATE – helps you uncover innovation opportunities by tracking the adoption of AI-driven and smart diagnostic devices that enhance accuracy, speed, and decision-making in veterinary practices.

- CLOUD-CONNECTED & REMOTE MONITORING READINESS – helps you assess digital maturity by evaluating the uptake of cloud-integrated PoC devices and remote monitoring solutions supporting data sharing, herd management, and preventive care.

- INVESTMENT, FUNDING & M&A ACTIVITY TRACKER – helps you gauge market momentum by analyzing venture funding trends, acquisition activity, and strategic investments in veterinary diagnostic start-ups between 2020 and 2024.

- PRODUCT INNOVATION & REGULATORY APPROVAL LANDSCAPE – helps you evaluate commercialization potential by tracking new product launches by technology type alongside regulatory approvals and market authorization trends across key regions.

Veterinary Point Of Care Diagnostics Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 2.59 billion |

| Market Size by 2032 | USD 5.72 billion |

| CAGR | CAGR of 10.41% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Access Complete Report Details of Veterinary Point Of Care Diagnostics Market Analysis & Outlook: https://www.snsinsider.com/reports/veterinary-point-of-care-diagnostics-market-7924

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.