Austin, Jan. 05, 2026 (GLOBE NEWSWIRE) -- High-Speed PCB Market Size & Growth Insights:

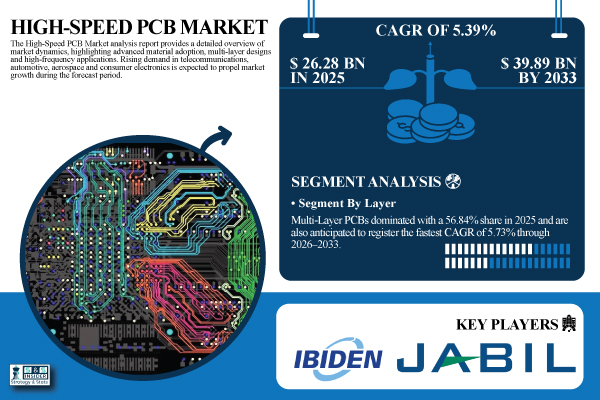

According to the SNS Insider, “The High-Speed PCB Market Size is valued at USD 26.28 Billion in 2025E and is projected to reach USD 39.89 Billion by 2033, growing at a CAGR of 5.39% over 2026–2033.”

Surging Growth in High-Speed Data Transmission Across 5G, AI, and Cloud Infrastructure is Driving Market Growth Globally

One of the main factors propelling the growth of the high-speed PCB market is the explosive expansion of high-speed data transmission across 5G, AI, and cloud infrastructure. Advanced PCB materials and multi-layer designs are becoming more and more necessary as next-generation networks and data centers demand ultra-low latency, great signal integrity, and dependable performance. Faster processing, less signal loss, and better temperature control are made possible by high-speed PCBs in routers, servers, base stations, and AI accelerators.

Get a Sample Report of High-Speed PCB Market Forecast @ https://www.snsinsider.com/sample-request/9147

Leading Market Players with their Product Listed in this Report are:

- Zhen Ding Technology Holding Limited

- Unimicron Technology Corporation

- TTM Technologies

- Compeq Manufacturing Co., Ltd.

- Nippon Mektron Ltd.

- AT&S Austria Technologie & Systemtechnik AG

- Ibiden Co., Ltd.

- Sanmina Corporation

- Flex Ltd.

- Jabil Inc.

- Shenzhen Fastprint Circuit Tech

- LG Innotek

- Shennan Circuits Co., Ltd.

- Tripod Technology Corporation

- Bomin Electronics

- Suntak Technology

- Nan Ya PCB

- Kingboard Holdings Limited

- HannStar Board Corporation

- SEMCO

High-Speed PCB Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 26.28 Billion |

| Market Size by 2033 | USD 39.89 Billion |

| CAGR | CAGR of 5.39 % From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Rigid PCMs, Flexible, Rigid-Flex, Others) • By Material (FR4, Rogers, Polyimide, Ceramic, Others) • By Layer (Single-Layer, Double-Layer, Multi-Layer) • By Application (Telecommunications, Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical Devices, Others) • By End-Use (Original Equipment Manufacturers, Electronics Manufacturing Services, Others) |

Purchase Single User PDF of High-Speed PCB Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9147

High Manufacturing Complexity, Material Costs, and Stringent Signal Integrity Requirements May Hinder Market Expansion Globally

The expansion of the high-speed PCB market is severely constrained by high production complexity, high material prices, and strict signal integrity requirements. The cost of production rises because it requires specialist materials, such as low-loss laminates, precise impedance control, and sophisticated design skills. Signal deterioration, rework, or product failure can result from small design or production mistakes. Scalability is further constrained by the scarcity of highly qualified engineers and expensive production machinery.

Key Industry Segmentation Analysis

By Type

Rigid PCBs held the largest market share of 48.37% in 2025 due to their cost efficiency, mechanical stability and widespread use in telecom infrastructure, servers and industrial electronics. Rigid-Flex PCBs are expected to grow at the fastest CAGR of 6.94% during 2026–2033 driven by demand for compact, lightweight and space-efficient electronics in automotive, aerospace and wearables.

By Material

FR4 accounted for the highest market share of 41.26% in 2025 owing to its affordability, acceptable dielectric properties and suitability for a wide range of high-speed electronic applications. Rogers materials are projected to expand at the fastest CAGR of 7.18% over the forecast period due to their superior signal integrity, low dielectric loss and high-frequency performance.

By Layer

Multi-Layer PCBs dominated with a 56.84% share in 2025 and are also anticipated to register the fastest CAGR of 5.73% during 2026–2033 as advanced electronic systems increasingly require dense interconnections, improved signal routing and reduced electromagnetic interference.

By Application

Telecommunications led the market with a 29.42% share in 2025 due to massive investments in 5G infrastructure, data centers and fiber-optic networks. Automotive applications are forecasted to record the fastest CAGR of 7.21% during the forecast timeline supported by AI accelerators, cloud infrastructure and autonomous systems.

By End-Use

Original Equipment Manufacturers held the largest share of 62.58% in 2025 as they control product design, system integration and direct sourcing of high-speed PCBs for mission-critical electronics. Electronics Manufacturing Services are expected to grow at the fastest CAGR of 6.37% from 2026–2033 due to outsourcing trends and rising complexity of PCB fabrication.

Regional Insights:

The Asia Pacific High-Speed PCB Market dominated with a market share of 42.76% in 2025. Growth is driven by rapid adoption of 5G networks, AI infrastructure and high-performance electronics across China, Japan, South Korea and India.

North America is the fastest-growing High-Speed PCB Market, projected to expand at a CAGR of 6.77% during 2026–2033. Rising deployment of 5G networks, AI data centers and electric vehicles is fueling demand for advanced multi-layer and high-frequency PCBs in the region.

Do you have any specific queries or need any customized research on High-Speed PCB Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/9147

Recent Developments:

- In October 2025, Zhen Ding showcased advanced high‑frequency, high‑density PCB and IC substrate solutions at SEMICON Taiwan, targeting AI, 5G and semiconductor integration, reinforcing its leadership in next‑generation electronic applications.

- In May 2025, TTM launched five new high-performance RF components, including broadband transformers and hybrid couplers, supporting 5G infrastructure, telecommunications and aerospace applications, expanding its advanced PCB and RF solutions portfolio.

Exclusive Sections of the High-Speed PCB Market Report (The USPs):

- MARKET PERFORMANCE & REVENUE DYNAMICS – helps you evaluate global production capacity, pricing trends by region, revenue mix between new and replacement PCBs, and market share concentration among leading high-speed PCB manufacturers.

- ADOPTION & DEMAND ACCELERATION METRICS – helps you understand penetration of high-speed PCBs across electronics manufacturing, demand growth for high-frequency applications, product-level PCB intensity, and customer retention trends.

- CAPACITY UTILIZATION & OPERATIONAL EFFICIENCY INDICATORS – helps you assess manufacturing yield efficiency, defect rates, inventory turnover, and working capital cycles to identify supply-side constraints and cost pressures.

- SUPPLY CHAIN & TRADE RISK EXPOSURE INDEX – helps you identify regional import-export dependencies, supplier concentration risks for critical materials, logistics cost impacts, and lead-time volatility across global PCB supply chains.

- TECHNOLOGY & INNOVATION ADOPTION BENCHMARKS – helps you uncover investment opportunities by tracking adoption of advanced PCB technologies, R&D intensity, patent activity, and performance gains in signal integrity and impedance control.

- QUALITY, COMPLIANCE & SUSTAINABILITY METRICS – helps you gauge regulatory alignment and operational risk through standards compliance levels, failure and warranty trends, recycling adoption, and exposure to material or compliance-related disruptions.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.