Dublin, Jan. 30, 2026 (GLOBE NEWSWIRE) -- The "Cowl Screen Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2021-2031" has been added to ResearchAndMarkets.com's offering.

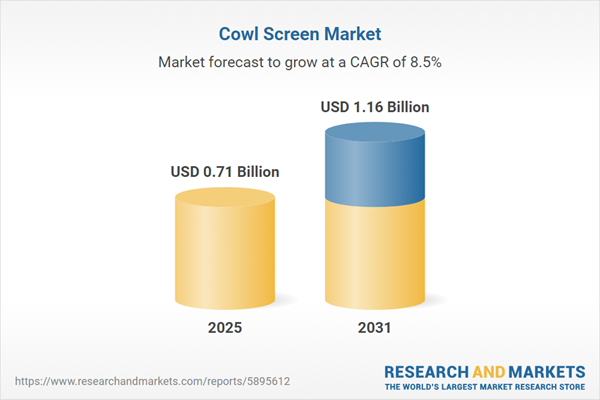

The Global Cowl Screen Market is projected to expand from USD 0.71 Billion in 2025 to USD 1.16 Billion by 2031, registering a CAGR of 8.53%

This market segment focuses on the protective automotive components located between the hood and windshield, which are essential for shielding wiper mechanisms and cabin air intakes from debris while managing water drainage.

Growth is primarily driven by the rising volume of global automotive manufacturing and strict environmental regulations that demand lightweight composite materials to improve fuel efficiency. According to the International Organization of Motor Vehicle Manufacturers, global motor vehicle production reached 92.5 million units in 2024, ensuring a consistent demand for these critical exterior parts.

However, the market faces potential headwinds due to the volatility of raw material prices, particularly for petroleum-based polymers used in fabrication. Unpredictable fluctuations in crude oil costs can destabilize production expenses and compress profit margins, creating financial pressure on manufacturers. These economic variables complicate the formulation of long-term pricing strategies within the supply chain, presenting a significant challenge to sustained market expansion.

Market Drivers

The rapid growth of the electric vehicle market necessitates aerodynamic optimization to maximize battery range, significantly influencing the design and material makeup of cowl screens. Manufacturers are increasingly focusing on flush-mounted, composite screens to lower drag coefficients at the base of the windshield, which is essential for maintaining energy efficiency in battery-powered models.

This shift drives the production of high-precision components capable of withstanding environmental stress while aiding vehicle streamlining. As reported by the International Energy Agency in the 'Global EV Outlook 2024', global electric car sales neared 14 million in 2023, securing ongoing demand for these specialized aerodynamic parts.

Additionally, the recovery of regional automotive sales volumes serves as a major driver, boosting the need for exterior protective components across both passenger and utility segments. As vehicle registrations rise in established markets, the demand for OEM cowl screens increases, particularly for commercial fleets where durability is essential.

The European Automobile Manufacturers' Association reported in January 2024 that new van sales in the EU grew by 14.6% in 2023. Furthermore, the immense scale of manufacturing in Asian hubs continues to anchor the global supply chain, with the China Association of Automobile Manufacturers noting that annual production in China exceeded 30.16 million units in 2023.

Market Challenges

A significant obstacle facing the Global Cowl Screen Market is the volatility of raw material prices, especially for the petroleum-based polymers required for fabrication. Because these components depend heavily on materials such as polypropylene for lightweight durability, manufacturers are acutely sensitive to unpredictable changes in crude oil costs. Sudden spikes in energy markets quickly result in increased expenses for resin feedstocks, making it difficult for companies to maintain stable production budgets or ensure consistent supply rates.

This financial instability directly impedes market growth by squeezing profit margins and complicating pricing negotiations with automotive original equipment manufacturers. When input costs rise unexpectedly, suppliers often struggle to absorb the financial impact without compromising operational efficiency or delaying expansion efforts. This sector-wide pressure is reflected in recent data from the Plastics Industry Association, which estimated that plastic products manufacturing production in 2024 was 1.7% lower than the previous year, illustrating the ongoing challenge manufacturers face in sustaining growth amidst material price instability.

Market Trends

To align with global sustainability objectives, industry participants are increasingly integrating recycled plastics and bio-based materials into the manufacturing of cowl screens. This transition is driven by stricter legislation concerning end-of-life vehicles (ELV), which compels automakers to decrease their reliance on virgin petrochemicals for exterior parts. Consequently, manufacturers are re-engineering cowl units to ensure that recycled polypropylene retains the necessary thermal stability and impact resistance. According to a Plastics Today report from April 2025, the European Parliament has set a mandatory target requiring that plastic used in new vehicles contain at least 20% recycled content, significantly reshaping supply chain standards.

Simultaneously, cowl screens are evolving to accommodate advanced driver-assistance system (ADAS) components, such as lidar and cameras, necessitating designs with specialized mounting points. As vehicle autonomy advances, the interface between the hood and windshield is becoming a crucial area for sensor placement, requiring designs that prevent obstruction and allow for cleaning nozzles.

This development transforms the cowl from a passive barrier into an active technology hub. Highlighting this scale, TPRS Glass noted in July 2025 that over 90 million cars globally are expected to be equipped with ADAS windshield technologies by 2025, driving the need for compatible housing components.

Key Players Profiled in the Cowl Screen Market

- Valeo SA

- Bright Brothers Ltd.

- RESTOPARTS

- Alsons Group

- Dorman Products, Inc.

- Original Equipment Reproduction (OER)

- Sherman & Associates Inc.

- Continental AG

- Magna International Inc.

- Inergy Automotive Systems

Report Scope

Cowl Screen Market, by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Cowl Screen Market, by Material Type:

- Stainless Steel

- Aluminium Billet

- Plastic

- Polycarbonate

- Carbon Fiber

- Fiber Glass

Cowl Screen Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 181 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value (USD) in 2025 | $0.71 Billion |

| Forecasted Market Value (USD) by 2031 | $1.16 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

For more information about this report visit https://www.researchandmarkets.com/r/pcmwht

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment