Tax Credit Not Enough to Push Housing Prices Into Positive Territory

Northeast Leads the Way Down as IAS360 House Price Index Slides Again in October

| Source: Integrated Asset Services

DENVER, CO--(Marketwire - December 8, 2009) - Integrated Asset Services®, LLC (IAS®)

(www.iasreo.com), a leader in default management and residential collateral

valuations, today released the latest IAS360® House Price Index (HPI).

Based on the timeliest and most granular data available in the industry,

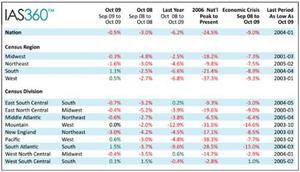

the index for national house prices fell 0.5% in October.

Following its 3.1% drop in September, the Northeast census region slipped

another 1.6% in October, in no small part due to an outsized decline in the

Boston commuting region, which includes Essex, Middlesex, Norfolk, Suffolk,

and Plymouth counties. The Midwest also lost ground for the month, slipping

0.3%. The South, despite the continued woes of Florida's hardest-hit

neighborhoods, jumped 1.1% in October, while the West gained 0.5%, mostly

the result of several positive trends in California.

Overall housing activity for the month was almost certainly stimulated by

home buyers scrambling to close transactions before the original November

30 deadline for the $8,000 First Time Home Buyers Credit. Congress has

since extended and expanded the tax credit that noticeably boosted sales

during the summer.

"I have no doubt that the tax credit persuaded some buyers to make their

purchase sooner than they otherwise would have," said Dave McCarthy,

President and CEO of Integrated Asset Services. "It's reasonable to think

the broader market will reflect that reality at some point down the road."

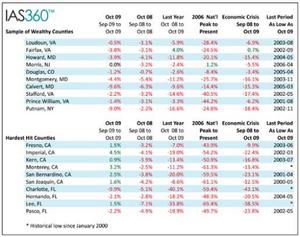

The leading U.S. housing benchmark has fallen by more than 25% since its

peak in July of 2006, and is roughly back to its January 2004 level.

McCarthy warns that the home-price slide could continue as rising

unemployment causes more Americans to fall behind on their mortgage

payments and end up in foreclosure.

"There is potential for another wave of inventory next year, both from

private sellers and banks," says McCarthy. "The risk of renewed home price

declines remains significant."

The IAS360 uses "next-generation" trending methodology to identify market

trends earlier than any other index. IAS data includes non-conforming,

bank-owned, and conventional sales transactions segmented by property type

in addition to those insured by the FHA and VA. The IAS360 also considers

REO transactions along with arms-length transactions. The index is

published weeks earlier than competing HPIs and refreshes historical trends

as new data becomes available. The IAS360 is designed to report changes

when they happen for the most accurate and useful view of the U.S. housing

market.

Integrated Asset Services offers full service, end-to-end mortgage service

solutions including valuation and data analytics. The company's i-Series®

collateral valuation platform (http://www.iasreo.com/iseries.html) delivers

a comprehensive combination of collateral valuation services that

individually offer distinct and critical data, and when combined, a

complete view of market volatility, local expert opinions and subject

value. Its data analytics provide vital data on the U.S. residential

housing market.

Editor's note: IAS360 HPI data, charts, and interviews are available upon

request. Data for 2008 and since the peak of 2006 are available at levels

from national to MSA to neighborhood for a fee.

About Integrated Asset Services, LLC

IAS (www.iasreo.com) is a privately held Colorado-based corporation

specializing in default mortgage services including valuation,

reconciliation and full cycle REO disposition. The Company's advanced

valuation and volatility technology combined with its expert professional

services help its clients reduce exposure while expediting the entire asset

management process. Founded by REO industry experts, IAS provides services

that go beyond industry expectations, from the level of integrity of its

employees to the measurably better service it routinely provides.

This press release contains various forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 regarding

future results of operations and market opportunities that are based on

IntelliReal and IAS' current expectations, assumptions, estimates and

projections about the company and its industry. Investors are cautioned

that actual results could differ materially from those anticipated by the

forward-looking statements as a result of the success of IAS' branding and

consumer awareness campaign and other marketing efforts; competition from

existing and potential competitors; and IAS' ability to continue to develop

and integrate new products, services and technologies. Due to the

timeliness of the data, the IAS360 House Price Index is subject to

revisions on a monthly basis.