GOLDEN, CO--(Marketwire - Jan 11, 2012) - Golden Minerals Company (

Velardeña Operations

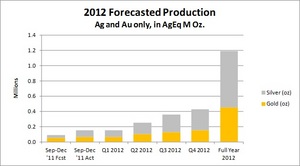

Payable metals production for September through year-end 2011 exceeded guidance previously provided in September by approximately 30% for gold and 114% for silver, primarily due to the increase in head grades resulting from reduced dilution. The following table shows actual production compared to the previous forecast for September through December 2011. Also shown is the updated 2012 forecast production for gold and silver.

| Sep-Dec '11 Fcst | Sep-Dec '11 Act | Q1 2012 | Q2 2012 | Q3 2012 | Q4 2012 | Full Year 2012 | ||||||||

| Production (payable metals) | ||||||||||||||

| Gold (oz) | 1,000 | 1,300 | 1,300 | 2,000 | 2,600 | 3,100 | 9,000 | |||||||

| Silver (oz) | 42,000 | 90,000 | 90,000 | 150,000 | 230,000 | 270,000 | 740,000 | |||||||

The 2012 Forecasted Production chart shows gold and silver production in silver equivalent ounces. Lead and zinc production are not included. Amounts shown are September through December 2011 actual gold and silver production compared to the previous forecast production, and forecast production for 2012.

Since the merger with ECU Silver, Golden has made significant operating improvements at the Velardeña Operations. Golden's primary focus has been on improving head grade in the feed supplied to the mills and on moving underground mine development outside the mineral veins. The December average head grade for gold and silver in material supplied to the oxide mill has improved by approximately 70% over the August average head grade (from approximately 1.5 grams per tonne to 2.5 grams per tonne for gold and approximately 90 grams per tonne to 150 grams per tonne for silver). The December average head grade in material supplied to the sulfide mill has also improved significantly to approximately 2.0 grams per tonne gold, 174 grams per tonne silver, 1.7% lead and 2.0% zinc. The improvements are primarily related to moving underground development outside the vein, resulting in reduced dilution of plant feed. The Company has completed approximately 1,200 meters of mine development since early September and has commenced excavation on the San Mateo Ramp, the main production ramp that will access six major ore zones.

Golden has also commenced plant optimization and other work to improve recoveries and product quality in both the oxide and sulfide plants. The Company plans to add a flotation circuit ahead of the current oxide plant to recover and divert to the sulfide plant more of the sulfide material that is currently mixed with the oxides. Based on these efforts, the Company expects the Velardeña Operations to be operationally cash flow positive in mid-year 2012 at current metals prices.

Safety related improvements at the Velardeña Operations have included the installation of 15 face ventilation fans, establishment of three trained and equipped mine rescue teams and safety refresher training for all personnel.

In addition, the Company has commenced engineering studies for a phased expansion of the sulfide plant by adding an additional ball mill, flotation cells and concentrate handling equipment. The phased expansion is expected to increase the sulfide plant's capacity from 320 to 650 tonnes per day which, along with operational improvements to the existing 500 tonne per day oxide plant, could result in annual production rates of up to 2 million ounces of silver and 29,000 ounces of gold by 2013. Expenditures for this phased expansion will be available later in the first quarter and are expected to be in the range of $10.0 million. The phased expansion would allow for an interim production increase pending completion of the proposed 2,000 tonne per day plant, which might occur as early as 2015. The 2,000 tonne per day sulfide plant could result in annual production of up to approximately 4 million ounces of silver and 80,000 ounces of gold.

As was previously announced, the Company expects to complete an updated NI 43-101 compliant resource estimate for the Velardeña Operations towards the end of the first quarter 2012. The independent consulting firm of Chlumsky Armbrust and Meyer (CAM) has been retained to provide the updated resource estimate.

The Company also expects to complete a Preliminary Economic Assessment (PEA) by the end of the third quarter 2012. The PEA will be based on the updated resource estimate and proposed expansion plans for the Velardeña Operations.

Exploration Portfolio

Golden has commenced a process of rationalizing the Company's current exploration portfolio of approximately 80 projects in Mexico, Peru and Argentina. The Company expects the potential monetization of selected assets to generate value as well as significantly reduce greenfield exploration expenditures in 2012 and going forward.

Jeffrey Clevenger, Golden Minerals Chairman, President and CEO, commented, "Management's primary focus is on growing production and establishing the company as an emerging producer." In addition, Mr. Clevenger noted, "This business strategy should allow Golden Minerals to more quickly become self-sufficient and less dependent on raising capital."

El Quevar

An updated NI 43-101 compliant mineral resource estimate on El Quevar is being prepared by the independent consulting firm of Pincock, Allen and Holt (PAH). The updated resource estimate for the El Quevar project is now expected by the end of first quarter 2012. PAH has been asked to include an additional 23 drill holes for which assays have just been received.

About Golden Minerals

Golden Minerals is an emerging precious metals producer with a large silver and gold resource base in Mexico and a large silver resource base in Argentina. The Company, which is a Delaware corporation, is listed on both the NYSE Amex and TSX. Golden Minerals is primarily engaged in the ramp-up and expansion of existing production at the Velardeña Operations in Mexico and advancement of the El Quevar project in Argentina. The Company also has a large portfolio of exploration projects, including the advanced stage Zacatecas project in Mexico.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, and applicable Canadian securities laws, including statements regarding forecasts of production from the Velardeña Operations and the effects on such forecasts of development work, mining and process improvements, operational changes, processing facility improvements, planned phased expansion of the existing sulfide plant and the planned construction of a new sulfide plant; anticipated improvements in feed head grades, metal recoveries, and concentrate production and quality; anticipated progress and rates of progress on the San Mateo ramp and its effectiveness in providing haulage access to undeveloped ore; planned construction of a new sulfide plant and the timing thereof; anticipated updates of resource estimates for the Velardeña properties and El Quevar and the timing thereof; anticipated achievement of cash flow positive operations at Velardeña by mid-year 2012; interpretation of the results of drilling programs and other geological information; planned rationalization of the Company's exploration portfolio for value and reduction of Greenfield exploration efforts and costs. These statements are subject to risks and uncertainties, including unexpected events at the Velardeña Operation, including lower than anticipated production or greater than anticipated costs; unexpected events at the El Quevar project or the exploration properties; variations in ore grade and relative amounts, grades and metallurgical characteristics of oxide and sulfide ores; delays or failure in receiving required board or government approvals or permits; technical, permitting, mining, metallurgical or processing issues; failure to achieve anticipated increases in production and improvements in head grades, recoveries and concentrate production and quality at the Velardeña Operation; delays in or failure to realize anticipated benefits of plant optimization efforts; timing and availability of external funding on acceptable terms to construct the planned sulfide plant, advance the development of El Quevar and other efforts; unfavorable interpretations of geologic information; inability to complete the phased expansion of the sulfide plant on time or at all or failure to realize anticipated production improvements from the phased expansion; unfavorable results of new resource estimates; loss of and inability to adequately replace skilled mining and management personnel; possible disputes with customers or joint venture partners; unanticipated difficulties or delays in completing the San Mateo ramp and failure of the ramp or the undeveloped ore accessed by the ramp to meet expectations; delays in the arrival of or loss of equipment being procured for the Velardeña operation; development of unfavorable information or conclusions regarding the economic or technical aspects of the planned sulfide plant for the Velardeña Operation, the amenability of the El Quevar deposit to bulk mining, or interpretations of geologic information; inability to generate value from the Company's exploration portfolio; failure to reduce greenfield exploration activities or costs; volatility or other changes in the U.S. and Canadian securities markets; availability and cost of materials, supplies and electrical power required for mining operations and exploration; fluctuations in silver, gold, zinc and lead prices, costs and general economic conditions; changes in political conditions, tax, environmental and other laws, diminution of physical safety of employees in Mexico, and other conditions in the countries in which the Company operates. Additional risks relating to Golden Minerals Company may be found in the periodic and current reports filed with the Securities Exchange Commission by Golden Minerals Company, including the Annual Report on Form 10-K for the year ended December 31, 2010.

For additional information please visit http://www.goldenminerals.com.