Fayetteville, AR, April 24, 2013 (GLOBE NEWSWIRE) -- Later this year, equity crowdfunding is expected to go into effect, allowing non-accredited investors to invest in startups in exchange for ownership. EquityNet (www.equitynet.com), the original equity crowdfunding platform, has released a new patented platform technology that promises to revolutionize the crowdfunding industry. The new technology provides campaign and communication abilities for entrepreneurs combined with the industry's most advanced screening technology for investors. The underlying technology of EquityNet is based on standardization, patented analytics, and the largest business benchmarking database in North America.

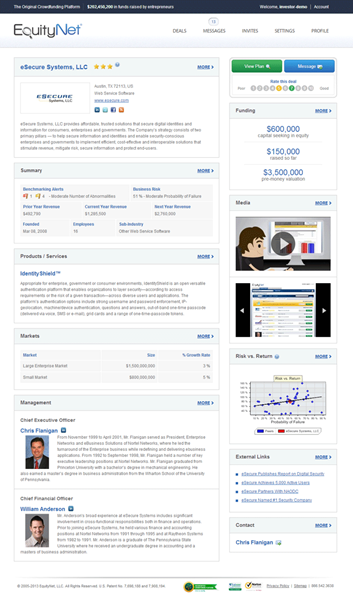

According to EquityNet's Chief Technology Officer, Dr. Josh Eno, "Entrepreneurs in EquityNet now have the industry's most comprehensive set of crowdfunding tools, including an account dashboard with activity tracking, a private business profile for investors to review, a public business profile to share within social networks, advanced business plan software and business analysis reports, a funding networkof thousands of investors, and an integrated messaging system."

Dr. Eno added, "Investors in EquityNet are empowered with the capabilities needed to screen thousands of business deals efficiently and to make informed investment decisions - namely, standardization, analytics, and comparable data. Investors can search and sort businesses by multiple factors such as industry, location, risk, and EquityNet's patented 5-Star Rating. Investors can then review a summary profile for each business that provides the detail necessary to decide whether they want to spend further time to review an in-depth Business Plan Analysis™ report on the business."

Later this year, the JOBS Act (Jumpstart Our Business Startups) is expected to go into effect, allowing non-accredited investors to invest in startups in exchange for equity. Experts have estimated that crowdfunding could expand the population of potential investors from 2 million to over 50 million investors. These new investors are expected to increase the amount of potentially available capital from $1 trillion currently to over $5 trillion. Most importantly, the increase in investments could add 1.5 million jobs over the next 5 years.

EquityNet's Founder & CEO, Judd Hollas, stated that "Crowdfunding is the most significant financial innovation since public market investing moved online in the late 90's. Crowdfunding is designed to improve the most limiting factor in modern capitalism - the capitalization of young businesses. EquityNet has operated an equity-based crowdfunding platform for Reg D investments and accredited investors since 2005 and is fully prepared to accommodate crowdfunding with non-accredited investors when the SEC completes its rule-making for the JOBS Act."

Since the JOBS Act became law in April of 2012, dozens of new crowdfunding platforms have emerged to capitalize on the new crowdfunding opportunity. Hollas added "The new competition and hundreds of millions in capital that have entered the domain serve to validate the opportunity that we envisioned in 2003, the systems that we patented in 2005, and the new technology that we continue to develop."

To learn more about EquityNet's crowdfunding technology, visit equitynet technology.

About EquityNet

Launched in 2005, EquityNet is a pioneering equity crowdfunding platform with multiple patents granted for its advanced capabilities. It is used by thousands of entrepreneurs, angel investors, government entities, business incubators, and other members of the entrepreneurial community to plan, analyze, and capitalize privately-held businesses. EquityNet provides access to 12,000+ individual investors and has helped entrepreneurs across North America raise over $202 million in capital. For more information, visit www.equitynet.com.

A photo accompanying this release is available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=18315