TRUCKEE, Calif., May 7, 2013 (GLOBE NEWSWIRE) -- Clear Capital®, the premium provider of data and solutions for real estate asset valuation and collateral risk assessment, today released its Home Data Index™ (HDI) Market Report with data through April 2013. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

April 2013 highlights include:

- National yearly gains notched up to 7.2%, a stark contrast to the -1.40% declines a year ago.

- Quarterly prices for nation and region continue to stabilize at close of April 2013, a good position for the start of the spring buying season. In fact, quarterly rates of growth around 1% demonstrate the market is on track to hit annual forecasted gains. 4% national growth is in line with average historical rates of growth.

- Regionally, markets continue to correct at a rate commensurate with their stages in the housing recovery.

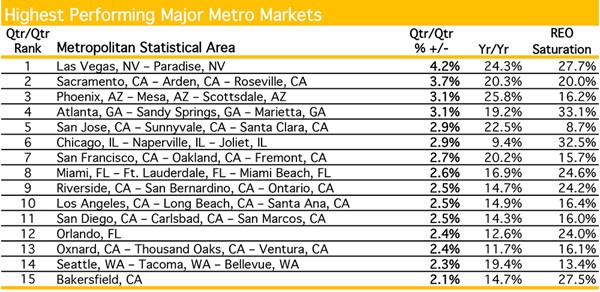

- Las Vegas saw impressive trends in April, with yearly growth accelerating to 24.3%, second to only Phoenix. Las Vegas is representative of a First In, First Out (FIFO) recovering market.

- Phoenix, another FIFO market, saw a slight pull back in yearly gains to 25.8%, a signal to the start of more normal rates of growth.

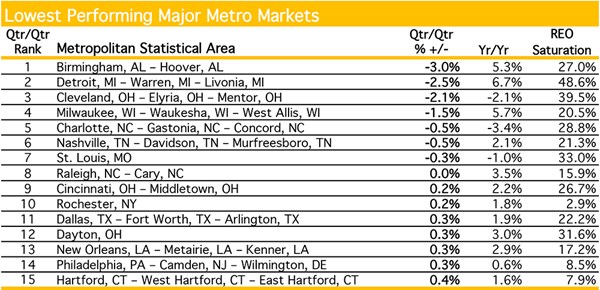

- Lowest performing markets, Birmingham, Detroit and Cleveland, struggle with low price points and short-term trend volatility. Their median price-per-square-foot (PPSF) is under $70, $40 lower than the national median PPSF average.

- Contact Alanna Harter for your April 2013 file of the Top 30 MSAs or access our data on the Bloomberg Professional service by typing CLCA <GO>.

"National yearly gains in April continued to ramp up to 7.2%," said Dr. Alex Villacorta, director of research and analytics at Clear Capital. "But market observers shouldn't be fooled by the large headline numbers. Last year was a turning point for the market where the year started with prices at virtually their lowest point and saw a very strong correction through the year. Now, however, the market is stabilizing and the large yearly and even quarterly gains of 2012 are starting to subside, which is a good thing as markets return to more normal rates of growth. Much of the gains we see right now in the yearly trends are a reflection of the market lows in 2012, rather than a function of recent short-term momentum.

Having said that, we are still confident in the sustainability of the recovery as the market continues to adjust to the new normal. Moderate improvements in the broader economic landscape likely haven't offered potential homebuyers strong reason to jump back in at the start of the season. We do expect to see more buyers and sellers ready to take action over the next several months as rising prices continue to free up some underwater mortgages. And while the national market waits for a spring boost in short-term gains, markets like Las Vegas offer a reminder that pockets of the housing market will continue to vastly outperform national and regional markets."

For the complete file of the Top 30 MSA price trends for April 2013, please contact Alanna Harter.

Tables of Highest Performing and Lowest Performing Major Metro Markets are available at http://www.globenewswire.com/newsroom/prs/?pkgid=18561 and http://www.globenewswire.com/newsroom/prs/?pkgid=18562.

About Clear Capital®

Clear Capital (www.ClearCapital.com) is the premium provider of data and solutions for the mortgage finance industry. The Company's products include appraisals, broker price opinions, property condition inspections, value reconciliations, automated valuation models, quality assurance services, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff, and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date, and well documented valuation data and assessments. The Company's customers include the largest U.S. banks, investment firms, and other financial organizations. Clear Capital's home price data can be accessed on the Bloomberg Professional service by typing CLCA <GO>.

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.