BALA CYNWYD, PA--(Marketwired - Aug 6, 2013) - A newly launched infographic by All Business Loans details how crucial small business is to the national economy and investigates the top reasons for small business success or failure. The infographic also gives an inside look into how important it is for our nation to support our small business owners.

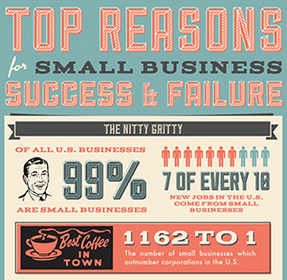

This visual representation of millions of entrepreneurial ventures and small businesses seeks to inform, instigate conversation, and reinforce the fact that small business owners need access to a variety of financial tools to increase their odds of success. Some of the most telling statistics on the infographic speak to the number of small business owners across the United States, the percentage of businesses that are considered small businesses, and the jobs that are created from these companies.

With a full 99% of the businesses in the country considered small businesses, the level of support and assistance these businesses require should be a national priority. Seven out of 10 U.S. jobs are created by small businesses, and this sector represents an area that can truly drive our national economy.

One of the most enlightening facts of this infographic revolves around the drivers of success for small businesses today -- namely the ability to invest in technological improvements and to manage cash flow. In these areas, traditional lenders like banks and credit unions deliver less than stellar approval rates for small business owners who are seeking funding. The infographic serves to demonstrate the higher approval rates of alternative lending sources for small businesses, which help drive a significant part of our national economy.

To view the infographic and learn more, visit http://allbusinessloans.com/top-reasons-for-small-business-success-and-failure/.

About All Business Loans

All Business Loans is a one-stop-shop that matches small- to medium-sized businesses with experienced lenders. In the lead-generation space for about a decade, All Business Loans provides approval rates higher than traditional lending sources through its large lender network. Businesses can receive approval for merchant cash advance solutions and unsecured business loans in as little as 24-48 hours through the company website http://AllBusinessLoans.com.

Contact Information:

Contact

Michael Kevitch

COO

All Business Loans

(p) 800-746-6227

(e) info@smallbusinessfunding.com