TRUCKEE, Calif., Oct. 1, 2013 (GLOBE NEWSWIRE) -- Clear Capital®, the premium provider of data and solutions for real estate asset valuation and collateral risk assessment, today released its Home Data Index™ (HDI) Market Report with data through September 2013. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

September 2013 highlights include:

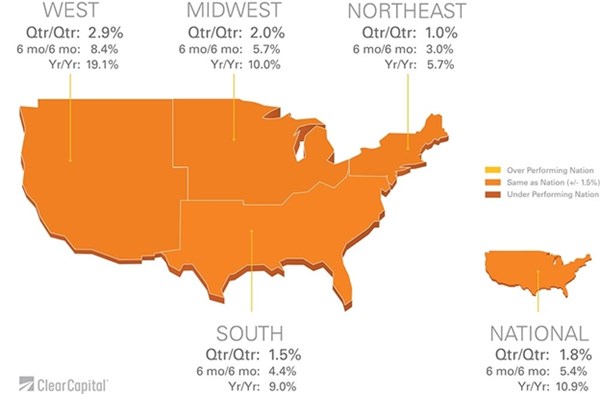

- National home price gains in September picked up to 10.9% year-over-year, evidence of residual summer buying activity. All regions saw small up-ticks in yearly price gains, with relative positions still in place (see map).

-

Metro-level performance highlights fresh storylines behind recovery front-runners.

- San Francisco led metro price performance in September, with 4.4% quarterly growth and 28.3% yearly growth. Close behind, Detroit home prices saw 4.3% and 23.3% in quarterly and yearly growth, respectively. Growth must be viewed contextually to local market dynamics and home price drivers fueling gains.

-- San Francisco median home prices hover at $600,000, while Detroit median home prices rest at just $107,500. The national median home price is $215,000.

-- San Francisco REO saturation remains low, at 6.3%, yet Detroit REO saturation remains relatively high and much improved, at 31.7%. Yet over the last four years, REO saturation in Detroit has been cut in half. Just over the last six months, REO saturation fell by 11.5 percentage points.

-- San Francisco home prices are now just 28.2% off peak prices, whereas Detroit is still down 64.5%.

-- Detroit growth percentages are more easily swayed by gains than San Francisco. For example, to see 1% growth, median home prices in San Francisco would need to rise by $6,000, but in Detroit by just $1,075. - Contact Alanna Harter for your September 2013 file of the Top 30 MSAs, or access our data on the Bloomberg Professional service by typing CLCA <GO>.

"While national and regional rates showed more of the same in September, an interesting dichotomy is unfolding beneath the surface," said Dr. Alex Villacorta, vice president of research and analytics at Clear Capital. "Strong performances in San Francisco and Detroit remind us that in a dynamic market, the only constant is change. For about a year and a half now, we've been focused on First-In, First-Out recoveries characterized by hard hit markets attracting investor interest, like Miami, Phoenix and Las Vegas. Now as the recovery matures, we see homebuyers re-engaging in markets that haven't fit the typical investor profile.

Detroit was arguably one of the hardest hit in the country and is finally seeing a recovery with 23.3% growth over the year. Detroit's struggle with relatively high REO saturation over the last several years delayed recovery. Now, low price points and recent improvements in REO saturation, a key precursor to recovery, are driving gains. On the other hand, San Francisco's median home price at $600,000 suggests non-investor homebuyer demand is materializing, supported by its relatively strong local economy.

As demand calibrates to local economic environments, markets will start to find their natural equilibriums with moderating gains ahead. This should invite new markets, such as San Francisco and Detroit to share the spotlight as their recoveries continue to evolve."

For the complete file of the Top 30 MSA price trends for September 2013, please contact Alanna Harter.

About Clear Capital

Clear Capital is the premium provider of data and solutions for the mortgage finance industry. The Company's products include appraisals, broker price opinions, property condition inspections, value reconciliations, automated valuation models, quality assurance services, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff, and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date, and well documented valuation data and assessments. The Company's customers include the largest U.S. banks, investment firms, and other financial organizations. Clear Capital's home price data can be accessed on the Bloomberg Professional service by typing CLCA <GO>.

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Graphics accompanying this news release are available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=21259