Tallinn, Estonia, April 14, 2022 (GLOBE NEWSWIRE) -- Since the origin of DeFi in 2017, DeFi has been changing the way people perceive the world just by being a part of it. Shackles and inefficiencies of the old CeFi world were replaced by something truly technologically superior. Suddenly everything was possible.

However, soon after its initial appearance, after Uniswap and the likes went live, the thrill and initial enthusiasm wore off for many crypto users. Issues such as high gas fees and significant impermanent losses were quickly identified.

Since then, these issues have mostly gotten worse and have not been properly addressed.

Until now.

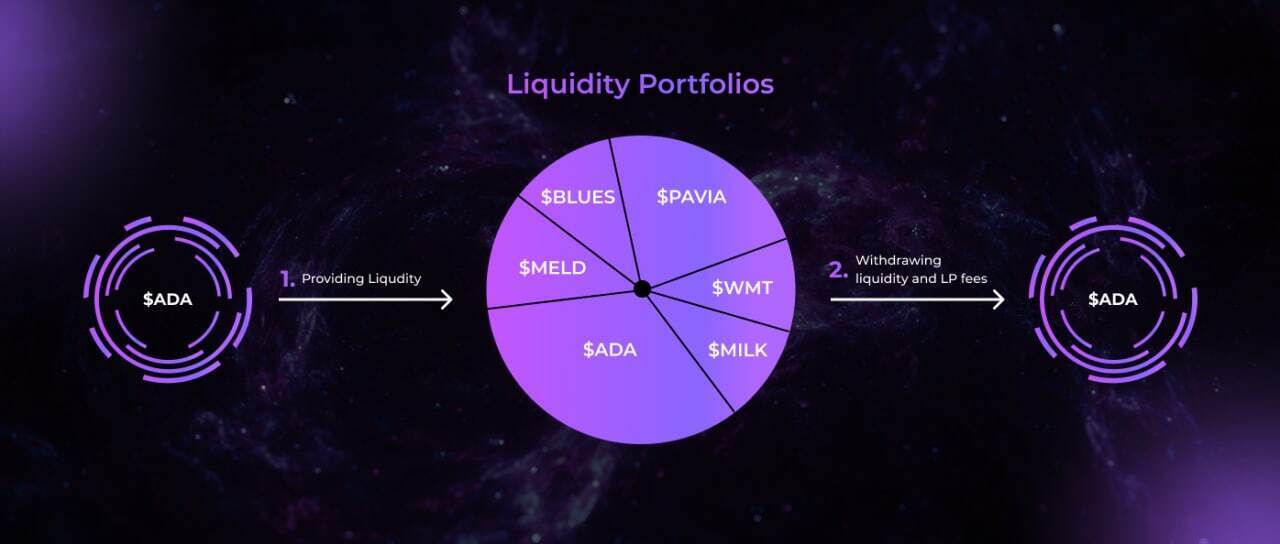

With the launch of Blueshift’s Liquidity portfolios that can contain up to 40 different cryptocurrencies, and many other innovations—these issues become legacy issues that will soon be forgotten by many…

There is much more to Blueshift than ‘just’ a completely reinvented AMM mathematical model that makes the existence of liquidity portfolios possible. Several other significant inventions were fused together to give a DeFi user access to opportunities that were always blocked by inefficiencies such as hefty gas fees or low liquidity.

DeFi is about to be shifted up by several gears! To learn how to use Blueshift technology as an advantage and to be in the first wave of Blueshift’s technological progress adoption—keep reading!

How to utilize Blueshift’s innovative DeFi technology

Single-sided liquidity provision

A DeFi user’s favourite—provide liquidity with a reduction in impermanent loss of up to 10 times! Another reason why it's preferred by many users is certainly the simplicity of providing a single token type as liquidity—as opposed to providing a token pair, and even wrapping one of the assets.

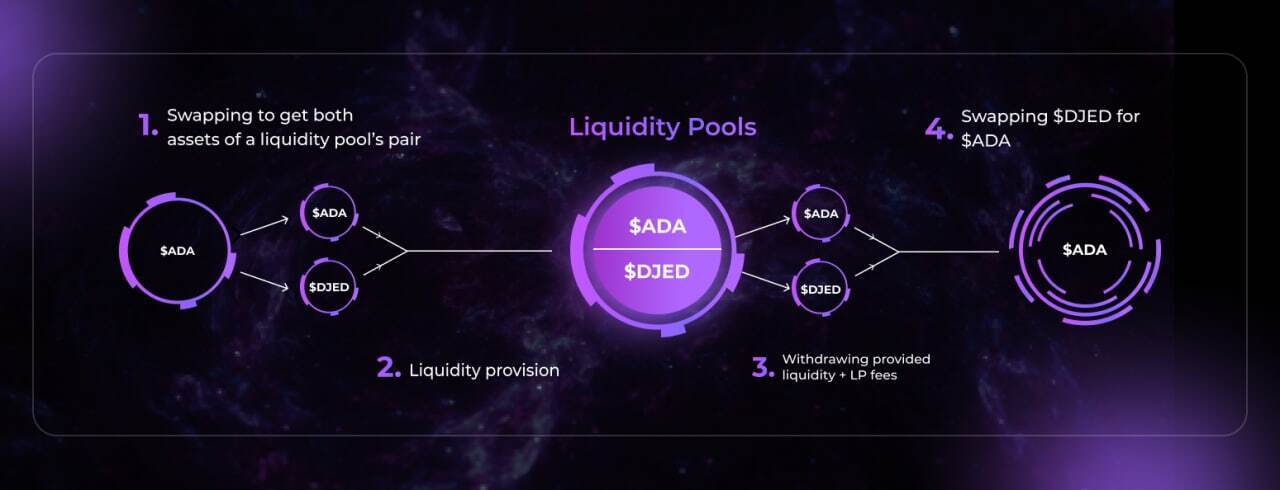

‘Traditional’ Liquidity Provision

Liquidity Provision on Blueshift:

The significant reduction of impermanent loss is achieved by evening out the losses across a greater number of tokens in a single portfolio. Likewise, existing target portfolio weights attempt to keep the liquidity of the portfolio in balance—essentially minimizing impermanent loss and maximizing trade volume & fees.

An important note related to weights is the following—Single sided liquidity provision is only possible when there is a token imbalance in a Liquidity Portfolio!

Cross-Chain environment

By utilizing Milkomeda’s crosschain technological feature—Blueshift will allow users to tap into assets from various blockchains such as Solana, Avalanche, and others. For now, assets from the Ethereum, BNB, and Cardano chains are available.

Cross-chain is Blueshift’s cornerstone. It is the key characteristics of a successful blockchain network & Dapp. That is why the team has set the following blockchain integration roadmap: Arbitrum, BSC, Avalanche, Solana, and afterward—other EVM compatible chains.

Soon a multitude of blockchains will be accessible from one single point, one single wallet. By utilizing the Milkomeda bridges, it will be possible for smart contracts on different chains to communicate and for crypto users to engage a smart contract that is operating on a different chain than the one the crypto user is on.

Zero-fee Arbitrage

Zero-fee Arbitrage is an option always readily available for utilization on the Blueshift DEX. Traders can execute a trade transaction that was not incurred with ANY trading fees—as long as virtual reserves were used.

Virtual reserves are ten times smaller than actual reserves—which drastically increases slippage. Increased slippage reduces losses for Liquidity Providers, but increases losses for the Traders themselves. As long as the slippage loss is smaller than the potential trading fee loss that did not take place due to the zero-fee arbitrage utility—the transaction could be considered a success.

This utility is readily usable right now via the Blueshift dApp—all one needs to do is pay attention to the “Target” and “Portfolio share” values and snatch an opportunity—when it presents itself!

Watch out for the “Price Impact” warning that comes with red and green UI flashing! Users might be utilizing Blueshift’s technology that facilitates super-low impermanent loss, however, due to price impact there most likely will be significant losses due to low liquidity in a portfolio, and set token weights.

Blueshift Reserve Model

Another innovative step, along with reduced trading fees and zero-fee arbitrage. was taken to provide DeFi users with the best opportunities. By offering Arbitrageurs the option to perform an arbitrage with increased slippage—in exchange for not being charged a trade fee—Arbitrage with under 0,3 % price difference becomes possible. Albeit with a higher slippage, but nonetheless—possible, and likely—profitable.

This innovation was combined with an automatization that detects price changes of an asset in a liquidity portfolio—below or above EMA because of pump and dump schemes or similar manipulation. If such an occurrence is detected—the portfolio automatically decreases reserves for virtual pairs with this asset. This makes price slippage higher and protects LPs from dramatic losses.

Virtual Pairs

When a swap is initialized by the user, virtual pairs are constructed based on the Blueshift Reserve Model and the swap is executed. This means that pairs are created “on the fly” which allows for the best use of the totality of asset liquidities via virtual pairings.

Virtual pairs are virtual cryptocurrency pairs that do not exist permanently on the Blueshift platform. They are created dynamically to provide minimal slippage and impermanent losses for users of the platform.

The CeFi equivalent of virtual pairs are so-called “synthetic pairs”.

Both synthetic and virtual pairs do not exist on platforms, however, they are created and can be utilized—by combining multiple pairs into one single pair.

There is, however, a big difference between synthetic pairs on CeFi platforms and on Blueshift. On Blueshift they are created automatically, according to best price-performance calculations—and in the background as a ‘hands-free’ utility.

Example trading pairs:ADA<>BLUES, BLUES<>ETH and ETH<>AGIX.

By combining these multiple trading pairs, users get a virtual pair ADA<>AGIX, that might have a different and better price for either ADA, or AGIX, when compared to the standard ADA<>AGIX pair.

Expert liquidity portfolio managers

The Blueshift project will enable the community to work hand-in-hand with expert crypto veterans that are very well acquainted with both the crypto technology and market movements.

Liquidity portfolio managers are selected by the DAO councilors which are selected by the community.

Liquidity portfolio managers will provide advice intended to protect a portfolio from low-quality assets as well as advice on how to increase a portfolio value by adding new assets with high growth potential.

This liquidity portfolio manager mechanism will be additionally improved by offering liquidity managers bonuses for advice that generated a lot of value—as well as enabling the community to remove poor-performing liquidity portfolio managers.

In the near future—DeFi users will be able to build their own custom liquidity portfolios, however, this feature will only be utilizable by advanced users through a terminal, and not via the Blueshift dApp UI.

Significant APY via various blockchain mechanisms

The unprecedented APY that Blueshift offers to DeFi users is derived from four different APY generating mechanisms:

1) Portfolio APY, related to the growing market value of their portfolio shares

2) DEX APY, related to trading fees

3) Farm APYs, related to gains from farming and yield pools

4) External protocol APYs, related to revenues gained from supplying liquidity to partner protocols, e.g. lending. (integration in development)*

Significant Blueshift Milestone reached

After reaching agreements with extremely important partners such as Occam.fi, Shima Capital, Wave Financial, Next Chymia—Blueshift deployed its technology. This tech deployment followed days before the IDO and it is no surprise then that the IDO was swiftly concluded on the OccamRazer in just 3 waves!

Price performance after the first secondary market listing on MEXC has been extremely rewarding for loyal Blueshift fans that believe in fundamentals.

In the following days, the Blueshift team will be adding more liquidity portfolios that are tied to specific trends, industries or blockchain niche markets. Likewise, the team will continue to add new tokens to existing portfolios. Once the foundation of tokens within portfolios and portfolios has been set—there will be few changes to the portfolios—until the DAO is online in Q3 of 2022.

Either way, trading via Blueshift Liquidity Portfolios, or trading $BLUES—things are about to get even more interesting with the rollout of upcoming technological releases.

Stay tuned via Blueshift Twitter page and Discord.

Website: https://blueshift.fi/

igorm@blueshift.fi

Disclaimer : There is no offer to sell, no solicitation of an offer to buy, and no recommendation of any security or any other product or service in this article. Moreover, nothing contained in this PR should be construed as any recommendation. Readers are encouraged to do there own research.Newsroom: socials.submitmypressrelease.com