NEW YORK,NY, Aug. 25, 2022 (GLOBE NEWSWIRE) -- There are currently about 7,000 different privately-owned digital currencies with a combined market value of hundreds of billions of dollars, and billions of dollars are already traded daily across all digital currency trading platforms around the world. However, as digital cryptocurrencies are characterized by the anonymity and irreversibility of transactions, and free cross-border capital flow, choosing a reliable digital trading platform is crucial for investors to avoid risks. Among existing platforms, IB Coin is favored by investors for its secure and reliable trading environment.

Digital currency trading platform is a kind of online platform built for digital currency transactions. In other words, it is a “distributing center” of digital currency transactions. However, among so many digital currency trading platforms, how should investors choose a reliable one? According to interviews with veterans of IB Coin, different trading platforms have different characteristics. Some trading platforms can only trade one or several digital currencies, while others only provide legal tender exchange services for certain digital currencies. Broadly speaking, exchanges can be divided into three categories: specialized online trading platforms, digital currency broker platforms and direct trading exchanges.

Not all exchanges are trustworthy, according to veterans of IB Coin. Most digital currencies are hard to track, and platforms are typically unable to protect the account funds of investors in cases of technical failure or hacking. Therefore, it is of paramount importance to choose a secure and reliable digital trading platform.

How to choose a reliable trading platform? Veterans of IB Coin believe that as a digital currency trader, there are several factors to consider when choosing a trading platform: transaction fee, capital security, privacy protection, customer services, timely handling of problems, Internet security (hacking), technical failure, order execution efficiency, etc.

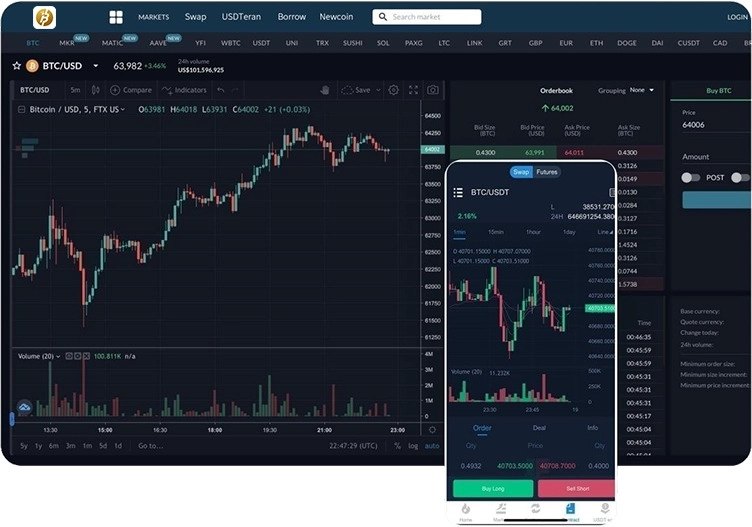

IB Coin Digital Currency Trading Platform is widely trusted in the industry. First, it does not charge any opening fee, account maintenance fee, transaction fee, stop loss fee, deposit fee, storage/distribution fee, etc. Second, it provides physical trading and leveraged trading services. Small transactions can be conducted from about $100 with the narrowest point spread in the industry. Leverage transactions can be conducted with cash balance as collateral, and only IB Coin can charge leverage fees. Third, it provides a variety of trading options. Some experienced traders often have higher requirements for digital currency trading, such as: Does the exchange offer margin trading? Can stop loss be placed? Are there related derivatives trading? Can the trading interface be mapped (trend lines, Fibonacci lines, triangles, etc.)?

In addition, IB Coin, renowned for its reliable security services, is developing one of the largest integrated Internet financial services in the United States. The platform is building robust technical defense systems and implementing various security measures to safely and securely protect customers’ assets.

It is reported that IB Coin Digital Currency Trading Platform was founded on May 26, 2017, with years of market services unanimously praised by industry investors. A veteran of IB Coin says: “Crypto asset is an important breakthrough of financial innovation of science and technology. As a digital currency trading platform, IB Coin will continue adhering to the secure, professional, caring and extreme service concept that lives up to every customer’s trust, advancing towards the goal of becoming an international top digital asset exchange.”

Company Name: IB Coin

Official Website: ibcoin.com

Contact Person: Wang Xia

E-mail: support@ibcoin.com

Disclaimer:

The information provided in this release is not investment advice, financial advice or trading advice. It is recommended that you practice due diligence (including consultation with a professional financial advisor before investing or trading securities and cryptocurrency.