TORONTO, Oct. 27, 2022 (GLOBE NEWSWIRE) -- Grit Capital Corporation ("Grit"), a finance media company built for the new era of investors that is democratizing access to Wall Street insights, has acquired Alpha Letter ("Alpha") and Free Press Report ("Free Press"), two leading finance publications with a combined reach of over 125,000 subscribers and each possessing thousands of paid subscribers.

The acquisition of Alpha and Free Press more than doubles Grit's total subscriber base to over 213,000 free subscribers and several thousand paid subscribers. Both Alpha and Free Press have dedicated writing teams providing synergistic financial, economic and political content and have built large established and engaged communities, which Grit will leverage and cross-sell as part of its integrated media offering.

Grit's mission is to democratize Wall Street insights previously held by the 1% and make them available to the other 99%. Grit continues to see significant organic growth and remains focused on reaching its goal of reaching 1 million subscribers across all its publications within the next 24 months. Grit is on an aggressive organic and acquisition growth path that it continues to execute on, made evident by the closing of these exciting, synergistic acquisitions.

Genevieve Roch-Decter, CEO of Grit Capital, commented:

"I launched Grit with the intention to build a community for investors where they could consume and understand complicated financial insights easily, quickly and in an entertaining fashion. We have made significant progress and I'm proud of how fast the company and team has grown. In less than 24 months, we've grown from one newsletter with 5k subscribers to over 12 themed publications with over 213,000 subscribers, thousands of paying subscribers and a social media reach of over 600,000. From a one-person startup to an experienced team across operations, sales, social and content. From zero revenue to a profitable, financially sustainable business, generating multiple revenue streams. Not only have we seen incremental growth, we have also established credibility within the industry as a leading financial voice. Moving forward, we will remain laser-focused on getting to 1 million subscribers and democratizing institutional insights to the global investor community."

The pandemic era introduced a new generation of market participants that have caused a dramatic shift in the finance media landscape. With this influx, investors have never been more important to the financial markets or its institutions. The shift also highlights the vast differences in the new way investors want to receive and consume their information today compared to the traditional investor of old.

More than ever, today's investor is rejecting the long, stuffy, boardroom-style market commentary in favor of quick news and entertaining insights on social media. According to a 2022 survey by Vericast, TikTok and YouTube are Gen Z's most trusted sources for financial advice - even more than financial advisors and institutions.

Boasting over 600,000 followers across social media and ranked the #1 free finance newsletter on Substack—a leading newsletter publishing platform—Grit is positioned at the forefront of today's evolving finance content scene and leading the transition from long-form text to short, digestible bites. This is where the future lies for financial information consumption.

Click HERE to find out more and sign-up for GRIT.

About Grit Capital Corporation

Grit Capital Corporation is a financial media platform democratizing investment knowledge built by former +$100MM money manager Genevieve Roch-Decter, CFA. Grit's mission is to democratize Wall Street insights held by the 1% and make them available to the other 99%. Ranked the #1 Free Finance newsletter on Substack, the platform has +600,000 investor followers across social media and over 213,000 subscribers on its newsletters including thousands of paid subscribers.

Contact Information:

Grit Media

media@gritcap.io

Related Images

Image 1

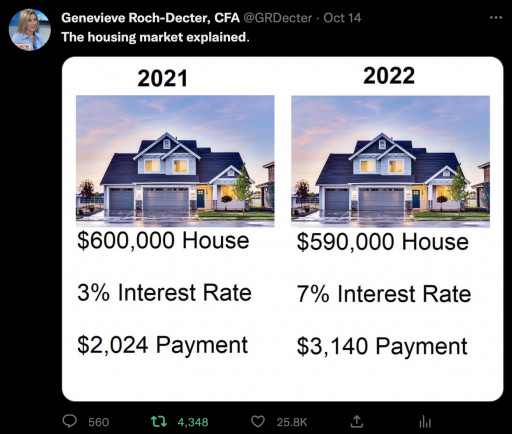

Grit creates viral content. This Tweet had +4 million impressions, 103k engagements, 25k likes, 4.3k retweets.

This content was issued through the press release distribution service at Newswire.com.

Attachment