NEW YORK, Nov. 04, 2022 (GLOBE NEWSWIRE) -- Cytus is a BridgeFi protocol bringing investment opportunities to blockchain users looking for ways to invest in Real World Assets (RWA). Cytus "crowdfunds" money through their BridgeFi application to finance loan deals and purchase assets. Initially focused on onboarding commercial real estate loans located in the U.S, Cytus will also offer additional assets such as U.S treasuries in their current launch.

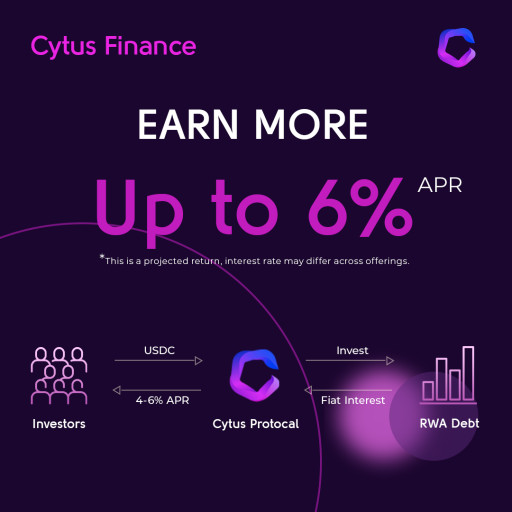

"Earn 6% passive income on your USDC" is the slogan that encapsulates their offering. Cytus uses an innovative corporate and legal mechanism to ensure their tokens comply with all SEC and U.S regulations. Their first several offerings were made available to anyone with a non-U.S identification. Cytus has successfully sold out their first two loan investments for a total of $500K.

The U.S Treasury pool launch is the first of its kind in BridgeFi. In short, investors pool their money together to buy a mix of 1-month treasuries and 1-year treasuries at a 1:9 ratio. Investors can expect returns of 2-3% with many chances to "leverage up." The target utilization rate of funds in the pool is 90%, allowing for liquidity, however, when the utilization rate is below 90%, more treasuries will be purchased. More information on this can be found in the Cytus whitepaper.

The proposed real estate project is a seven-story for-sale contemporary condominium, offering an upscale urban living experience. This Project is located in Rego Park, Queens borough, close to Flushing in New York. The Property is in the cross-section of 64th avenue and Queens Boulevard.

Property Summary:

23 Units

7 Story

20,552.8 Total zoning sq. ft

New Construction

Rating: A

Investment Summary:

Total offering: $400,000

Price per token: $1

Total tokens: 400,000

Estimated APR: 5%

Investment type: First lien

Cytus will be taking in investments starting Nov. 4, 2022, before the funds will be deployed into the construction loan. Unlike past projects, this investment will be a "Dynamic Rate Pool," which means the greater the demand for investment above the $400k funding threshold, the lower APR due to dilution. The pool mechanism is meant to increase liquidity while having the APR adjust in relation to demand. For more details, visit Cytus' website.

There are several Decentralized Finance applications out there offering real-world investments, but Cytus is pioneering new possibilities on both the legal and fixed-income front. Cytus has developed the process to legally connect RWA's to BridgeFi while staying compliant with U.S laws. Cytus is also the first movers in BridgeFi to onboard credible fixed-income as most other investment opportunities fall under the equity categorization. In order to earn strong passive yield from risk-free investments, bringing your funds off-chain is no longer the only option.

The explosion of RWA's on-chain is no coincidence. Since real-world interest rates are at unprecedented highs and continually rising, fixed-income products are more sought after than ever. With risk-free investments in DeFi often less than 1%, bringing real-world interest on-chain is the problem Cytus seems to have solved.

Cytus is certainly making waves in the blockchain ecosystem, and truly reimagining the relationship between Real World Finance and BridgeFi.

Contact Information:

Cytus Finance

Admin

admin@cytus.io

Related Images

This content was issued through the press release distribution service at Newswire.com.

Attachment