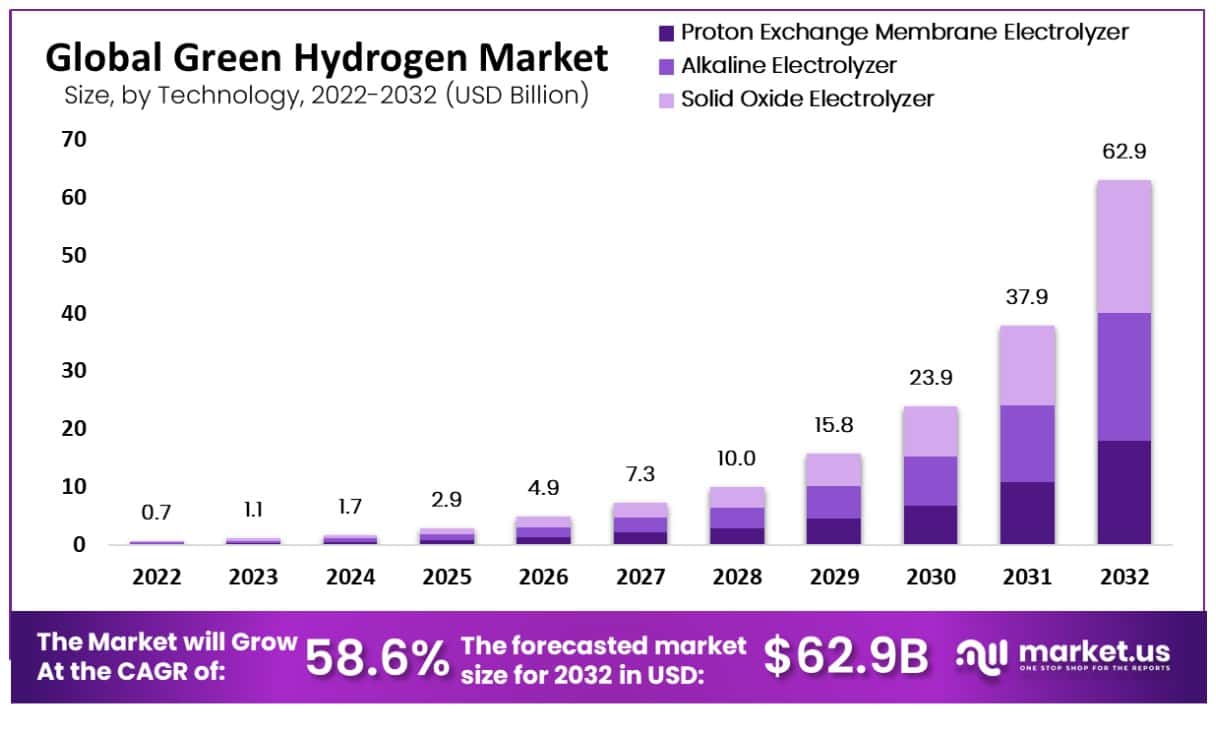

New York, April 06, 2023 (GLOBE NEWSWIRE) -- The Green Hydrogen Market size is expected to be worth around USD 62.9 Billion by 2032 from USD 0.7 Billion in 2022, growing at a CAGR of 58.6% during the forecast period 2022 to 2032. The hydrogen produced by water splitting by electrolysis is called green hydrogen. In this process, hydrogen is used, and oxygen is left in the air, which has no negative environmental impact. In addition, electricity generated by Renewable energy sources is supplied for the electrolysis such as wind and solar. This makes the green hydrogen the cleanest without using carbon dioxide as the by-product. Therefore, renewable energy generation is expected to increase in the forecast period.

Get additional highlights on major revenue-generating segments, Request a Green Hydrogen Market sample report at https://market.us/report/green-hydrogen-market/request-sample/

Key Takeaway:

- By technology, the alkaline electrolyzer segment generated the highest revenue in the global Green Hydrogen Market share in 2022.

- By application, the transportation segment is dominating the market, and it is growing significantly over the forecast period 2023 to 2032.

- In 2022, Europe Region dominated the market with the highest revenue share of 35.8%.

- North-America Region held the second-largest market revenue share in 2022.

The main factor driving the market's growth is the increase in government policies for developing green hydrogen and renewable energy. The strict regulation imposed by the government to reduce GHG emissions from power generation facilities is driving the market's growth. In addition, there is a rise in the demand for renewable energy sources due to the strict government regulations related to the environment and an increase in the pressure to reduce the consumption of energy of hydrocarbons to reduce carbon emissions. This, in turn, is projected to propel the growth of the global green hydrogen market.

Factors affecting the growth of the Green Hydrogen Market

There are several factors that can affect the growth of the Green Hydrogen Market. Some of these factors include:

- Low variable electricity cost: The decrease in the cost of the production of renewable energy for green hydrogen is anticipated to increase the demand for green hydrogen, consequently helping the market grow.

- Decrease in the cost of electrolyzers: The decrease in the cost of electrolyzers, which is expected to fall in the forecast period, is also expected to propel the growth of the market globally.

- The high initial cost of the infrastructure: The high initial investment for setting up the Green Hydrogen plant may hinder the growth of the market globally.

- Rising awareness for green hydrogen: The rising awareness of the use of green Hydrogen to reduce carbon emissions may drive the growth of the market globally.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/green-hydrogen-market/#inquiry

Top Trends in Green Hydrogen Market

Using hydrogen as an energy carrier has the advantage of only actively interacting with oxygen, which can produce heat and water. People are becoming aware of using hydrogen as energy, driving the market's growth. The use of hydrogen fuel cells does not produce carbon emissions and does not produce greenhouse gases or any other pollutants. A study finds that hydrogen fuel cells are more efficient than the internal combustion engine. The rise in environmental issues has driven the growth of the market. These major global market trends can fuel the market's expansion.

Market Growth

Due to the ability to reduce carbon emissions, Green hydrogen demand has been increasing in the last few years. It also helps in meeting the growing energy demand worldwide. The market is expected to grow due to increased awareness of using hydrogen as an energy carrier. The rising environmental issue is the main factor driving the market's growth, which highlights the need to adopt green energy and reduce carbon emissions.

Regional Analysis

Europe holds the largest market share globally and dominates the market's growth. The market growth in the region is seen due to the increase in the number of manufacturers in the region. Companies such as Siemens Energy AG, Nel ASA, etc., are the largest manufacturing companies for green hydrogen in Europe. The increase in manufacturing facilities in Europe will result in the significant market growth in the forecast period. On the other hand, North America is expected to hold a prominent CAGR over the forecast period and the second-largest market share globally.

Competitive Landscape

Key major companies are mainly focusing on innovations and technological advancements to increase the production of green hydrogen and reduce the cost of renewable energy. Companies are adopting various organic and inorganic strategies to increase their market share in the green hydrogen market. Such strategies are expected to dominate the market's growth and commercialize the use of green hydrogen rather than fossil fuels.

Recent Development of the Green Hydrogen Market

- Lhyfe and WPD formed a joint venture in April 2022 for the largest production of renewable green hydrogen at the Soderhamn municipality facility and Storgrundet offshore wind farm.

- Air Liquide S.A. and Siemens Energy collaborated in June 2022 in Europe to produce renewable energy which can be used on an industrial scale. This collaboration will enable the emergence of sustainable hydrogen energy in Europe. The production of renewable energy is expected to begin in mid-2023 and will produce around three gigatons per year by 2025

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 0.7 Billion |

| Market Size (2032) | USD 62.9 Billion |

| CAGR (from 2023 to 2032) | 58.6 % from 2023 to 2032 |

| Europe Revenue Share | 35.8% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The cost of producing renewable energy from all sources has drastically reduced during the last few decades. The majority of the cost for the production of green hydrogen is the cost that is needed for the energy input. Solar and wind energy costs are continuously declining with the development of new composites. These changes are due to high product efficiency, reduction in raw material cost, technical advancement, and production advancement. Fixed installation and marginal maintenance costs are the main cost associated with renewable energy. Therefore, the cost of producing green hydrogen will decline with continuous operations, which will eventually drive the market's growth globally.

Market Restraints

The energy which is going to be used in the production of green hydrogens must ensure to come from renewable energy. This energy can be achieved from the plants which produce their own electricity, but energy tracking becomes difficult for the plants that utilize grid power for green hydrogen production. Furthermore, the high costs of establishment & maintenance of the hydrogen infrastructure force the green hydrogen industry to look for an alternative renewable energy source, i.e., the initial investment required is the main restraint for the growth of the market globally.

Market Opportunities

The cost of the electrolyzer is decreasing rapidly, and it has dropped over 50% in the last five years. This decrease in the price of electrolyzers is expected to fall over the forecast period. The decrease in the cost of renewable energy sources is another factor that is affecting the final cost. The investment in the research and development of the technology is the major reason for the fall in the cost of the investments

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=99200

Report Segmentation of the Green Hydrogen Market

Technology Insight

Based on the technology segment, the alkaline electrolyzer segment dominates the market's growth and holds the largest market share globally for the forecast period. A wide range of electrolytes that are both inexpensive and readily available to generate is used by alkaline electrolysis. The rapid expansion of the market and market dominance are the advantages of the technology, which is based on alkaline electrolysis, over other technologies based on manufacturing. Furthermore, electrolytes that are easily interchangeable and replicated and which have low corrosive effects on both electrodes are used by solid oxide electrolysis. Eventually, the solid oxide electrolyzer segment is anticipated to grow significantly during the forecast period. This factor influences the long life of an electrolyzer. In addition, alkaline electrolysis tends to create green hydrogen due to the problematic diffusion of the hydrogen ions in the electrolyte solution.

Application Insight

The transportation segment dominates the market globally. The utilization of hydrogen can be done in internal combustion engines or fuel cells for the transportation of vehicles. Due to in high efficiency of the hydrogen fuel cell, a hydrogen fuel cell is 2-4 times more than internal combustion engines.

End-User Insight

The petrochemical segment dominates the market. This is because there are no tailpipe emissions rather than water emitted by the hydrogen fuel cell, eliminating the carbon entirely. The demand for green hydrogen in the petrochemical sector is expected to increase with the potential for rapid development in the petrochemical sector. According to a study, cars that run on hydrogen fuel cells produce zero carbon compared to petrol, diesel, and CNG cars.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/green-hydrogen-market/request-sample/

Market Segmentation

By Technology

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Solid Oxide Electrolyzer

By Application

- Power Generation

- Transport

- Others

By End-User

- Food & Beverages

- Medical

- Chemical

- Petrochemicals

- Glass

- Others

By Geography

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Market Players

- Green Hydrogen Systems

- Solena Group

- Air Products Inc.

- Siemens Energy

- Cummins Inc.

- FuelcellWorks

- Plug Power

- Fuelcell Energy

- Hydrogenics

- Ballard Power Systems

- Nikola Motors

- Linde Plc

- Plug Power Inc.

- Syzygy Plasmonics

- Other Key Players

Related Reports:

- Solid oxide fuel cells market was worth USD 1,100 million in 2021. It is estimated to grow at a compound annual rate (CAGR of 33.2%) between 2023 and 2032.

- Fuel Cell Electric Vehicles Market size is expected to be worth around USD 199.4 Billion by 2032 from USD 3.7 Billion in 2022, growing at a CAGR of 50.50% during the forecast period from 2023 to 2032.

- PEMFC and Fuel Cell Electric Vehicle Market size were valued at USD 5.02 Bn in 2022 & expected to hit around USD 473.99 Bn by 2032 with a CAGR of 51.2%.

- Fuel Cell Stacks Market is expected to grow at a CAGR of 10 % over the next ten years and will reach USD 9.42 Bn in 2032, from USD 3.63 Bn in 2022.

- EV Charging Connector Market is projected to reach a valuation of USD 323.56 Mn by 2032 at a CAGR of 18.5%, from USD 59.26 Mn in 2022.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: