Dublin, Nov. 09, 2023 (GLOBE NEWSWIRE) -- The "Global Hydrogen Generation Market" report has been added to ResearchAndMarkets.com's offering.

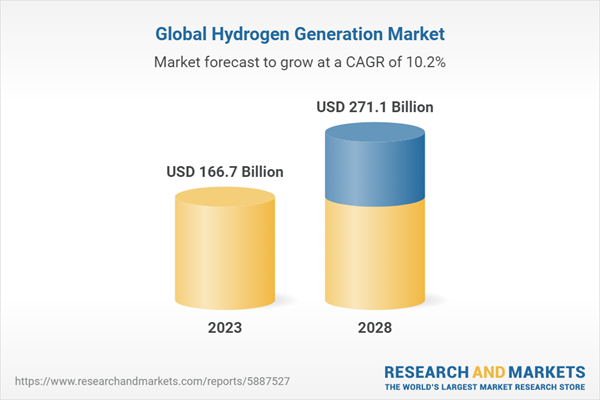

Global Hydrogen Generation Market is projected to reach a value of $271.1 billion by 2028 from $166.7 billion, growing at a CAGR of 10.2% during 2023-2028

This report provides an analysis of the global market for hydrogen generation. Using 2022 as the base year, the report provides estimated market data for 2023 through 2028.

Hydrogen production encompasses various industrial methods for generating hydrogen gas, a flexible and clean energy source with applications in industries, power generation, transportation, and fuel cells. There are different processes for hydrogen production, including electrolysis, biomass conversion, and fossil fuel reforming.

Steam methane reforming (SMR) is one of the most widely used processes for hydrogen production, where natural gas and steam are combined to produce hydrogen and carbon dioxide as byproducts. A significant portion of global hydrogen generation relies on this method.

Electrolysis is another important method for hydrogen production, which involves using electricity to split water molecules into hydrogen and oxygen. This process can be sustainable when powered by renewable energy sources like solar and wind power. Electrolysis-based hydrogen production is experiencing rapid growth and is expected to have a significant impact on the hydrogen economy in the future.

In recent years, there has been a strong emphasis on increasing hydrogen production capacity, with several countries and companies investing in large-scale hydrogen manufacturing facilities. China is currently the leading producer of hydrogen, and other nations like Germany, South Korea, Japan, and the United States are also making significant investments in hydrogen technology and infrastructure.

Hydrogen production plays a crucial role in the transition to a sustainable energy future. With multiple production methods and increasing investments, hydrogen is poised to become a significant component of the global energy mix. The report covers various market factors, including the impact of COVID-19, geopolitical considerations like the Russia-Ukraine war, Porter's five forces analysis, use case analysis, and the regulatory landscape. However, it does not consider hydrogen generation from seawater.

Additionally, the report provides detailed profiles of major hydrogen generation players and their strategies to enhance their market presence. It includes a competitive landscape chapter that discusses the market ecosystem of the top hydrogen generation providers in 2022.

Report Includes

- Analyses of the global market trends, with historical market revenue data (sales figures) for 2022, estimates for 2023, forecasts for 2024, and projections of compound annual growth rates (CAGRs) through 2028

- Estimate of the actual market size and revenue forecast for the hydrogen generation market in USD millions, and a corresponding market share analysis based on type, technology, source, delivery mode, application and region

- In-depth information (facts and figures) concerning the market drivers, challenges, opportunities and prospects, as well as the technologies, regulatory scenarios and the impacts of COVID-19 and the Russia-Ukraine war

- Discussion of the importance of ESG in the hydrogen generation market, as well as consumer attitudes, risks and opportunities assessment, and ESG practices followed by leading market participants

- Analysis of the market growth opportunities with a holistic review of Porter's Five Forces and value chain analyses, taking into consideration the prevailing micro

- and macroeconomic factors in the market

- A look at the major vendors in the global market, and an analysis of the industry structure with respect to company market shares, venture fundings, and recent mergers and acquisitions (M&A) activity

- An analysis of new and existing patents on hydrogen generation

- Identification of the major stakeholders and analysis of the competitive landscape based on recent developments, key financials and segmental revenues, and operational integration

Company Profiles

- Introduction

- Air Liquide

- Air Products and Chemicals Inc.

- Cummins Inc.

- Enapter S.R.L.

- Engie

- Green Hydrogen Systems

- Itm Power plc

- Iwatani Corp.

- Linde plc

- Mcphy Energy S.A.

- Nel Asa

- Orsted A/S

- Plug Power Inc.

- Siemens AG

- Uniper Se

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 260 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $166.7 Billion |

| Forecasted Market Value (USD) by 2028 | $271.1 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

Key Topics Covered:

Chapter 1 Introduction

Chapter 2 Summary and Highlights

Chapter 3 Market Overview

- Introduction

- Evolution of Hydrogen Generation

- Value Chain Analysis

- Input Materials

- Production

- Transport and Storage

- Distribution

- Utilization

- End-Of-Life/Recycling

- Porter's Five Forces Model

- Supplier Power

- Buyer Power

- Threat of New Entrants

- Threat of Substitute

- Competitive Rivalry

- Impact of Covid-19 on the Global Market

- Market Contraction and Initial Disruptions

- Supply Chain Disruptions

- Change in Government Priorities

- Accelerated Research and Innovation

- Renewing Government Commitments and Incentives

- Global Partnerships and Collaborations

- Ukraine-Russia War Impact on the Global Market

- Impact on Disruptions in the Supply Chain

- Impact on Investment and Geopolitical Uncertainty

- Impact on Hydrogen Infrastructure Projects

- Impact on Market Dynamics at the Regional and World Levels

- Impact on International Cooperation and Energy Security

- Impact on the Development of Green and Blue Hydrogen Strategies

Chapter 4 Market Dynamics

- Overview

- Key Market Drivers

- Green Hydrogen-Generating Systems Are Being Developed and Researched Constantly

- Increasing Adoption of Fuel Cell Electric Vehicles

- Growing Demand for Clean Energy

- Reduction of Carbon Emissions

- Market Restraints

- Loss of Energy During the Production of Hydrogen

- Lack of Development in the Hydrogen Infrastructure

- Key Challenges for the Hydrogen Generation Market

- Production of Green Hydrogen Comes at a High Expense

- Hydrogen's Integration into Natural Gas Networks is Difficult

- Market Opportunities

- Hydrogen Becoming An Attractive Fuel Source for Heavy-Duty Applications

- Government Programs to Quicken Deployment of Hydrogen Fueling Stations

- Increased Emphasis on Meeting the Net Zero Emission Goal by 2050

- Short-Term and Long-Term Impact of Market Dynamics

Chapter 5 Market Breakdown by Type

- Overview

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

Chapter 6 Market Breakdown by Source

- Overview

- Natural Gas

- Oil

- Coal

- Coal Gasification to Produce Hydrogen

- Systems With An Integrated Gasification Combined Cycle (Igcc)

- Steam Methane Reforming (Smr) With Coal Pyrolysis

- Carbon Capture and Storage (Ccs) With Coal-Based Hydrogen

- Environmental Challenges and Impacts

- Future Opportunities and Research Projects

- Renewable and Grid Electricity

- Solar Energy

- Wind Energy

- Hydropower

- Biomass and Bioenergy

- Geothermal Energy

- Tidal and Wave Energy

- Grid Integration, Electrolysis and Potential Difficulties

Chapter 7 Market Breakdown by Technology

- Overview

- Steam Methane Reforming (Smr)

- Tubular Reforming

- Autothermal Reforming (Atr)

- Combined or Integrated Reforming

- Partial Oxidation (Pox)

- Non-Catalytic Pox

- Catalytic Pox

- Coal Gasification

- Electrolysis

Chapter 8 Market Breakdown by Delivery Mode

- Overview

- Captive

- Merchant

Chapter 9 Market Breakdown by Application

- Overview

- Petroleum Refinery

- Ammonia Production

- Methanol Production

- Others

- Transportation

- Power Generation

Chapter 10 Market Breakdown by Region

- Overview

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- South America

Chapter 11 ESG Development

- Overview

- Importance of ESG in Hydrogen Generation

- Future of ESG With Hydrogen Generation

- Case Study: Examples of Successful Implementation of ESG

- Concluding Remarks

Chapter 12 Emerging Technologies and Developments

- Introduction

- Current Market Trends

- Emergence of India's Hydrogen Market

- Inflation Reduction Act Will Boost North American Hydrogen Investment

- Transition to Africa's Clean Hydrogen Hub

- Global Policy Changes to Accelerate Final Investment Decisions

- Hydrogen as An Energy Storage Solution

- Emerging and Upcoming Trends in Hydrogen Generation

- Hydrogen Fuel Cells

- Renewable Hydrogen

- Advanced Electrolysis

- X-To-Hydrogen-To-X

- Hydrogen Carriers

Chapter 13 Patent Analysis

- Overview

- Key Patents

Chapter 14 M&A and Venture Funding Outlook

- M&A Analysis

- Startups Funding in Hydrogen Generation

Chapter 15 Competitive Intelligence

- Overview

- Market Share Analysis

- Market Strategy Analysis for Hydrogen Generation

- Key Market Developments

- Agreements

- Partnerships

- Investments

- Expansions

For more information about this report visit https://www.researchandmarkets.com/r/925z2m

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment