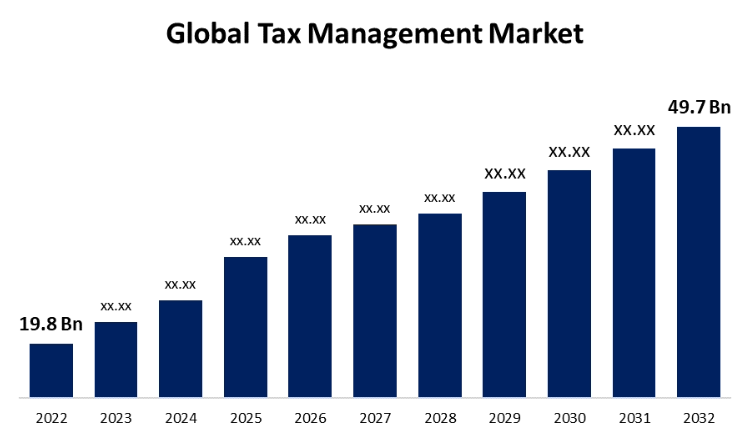

New York, United States, Dec. 18, 2023 (GLOBE NEWSWIRE) -- The Global Tax Management Market Size is to Grow from USD 19.8 Billion in 2022 to USD 49.7 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 9.6% during the projected period. The financial industry gained significantly from technological development and digital innovation in terms of system connectivity, processing power and cost, and the production of new and useful data. As a result of these advancements, transaction costs have decreased, new business models have emerged, and new players have entered the tax management sector. The rate of transactions has increased due to the greater information interchange and decreased transaction costs brought about by technology. Due to the rise in popularity of mobile devices and tablets, everyone may simply conduct financial transactions using a smartphone or tablet.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/2834

According to the rise in demand from businesses for a single tax solution that can help them resolve business difficulties, the market for tax management is growing. With its ability to combine a variety of applications, including accounting and employee payroll systems, sales and billing software, purchasing software, and other financial applications, businesses are increasingly embracing tax management software. It can be implemented across corporate networks on a range of platforms customized for specific business needs. Financial organizations and businesses can make decisions by using tax software to examine the huge quantities of data generated by financial transactions. Through their financial activities, Goods and Service Tax (GST) and Value Added Tax (VAT) payers are providing data to tax and customs officials. In addition, financial data gathered from indirect tax is processed and analyzed electronically by tax administrations. The program enables tax administrators to conduct VAT/GST audits using data collected from taxpayers' systems. An emerging market driver is thought to be the adoption of data analytics solutions to improve eVAT/GST compliance. An electronic communication technique has a variety of possible weaknesses. Private information sharing, data breaches, identity theft, and other cybercrime platforms are examples of these risks. However, due to the sensitive and priceless nature of the data, there is a significant threat to tax administration.

COVID-19 Impact

After the pandemic, the market is anticipated to expand quickly due to a global trend toward more people working from home, which will increase demand for tax management software. According to the increased application of lockdowns by governments in the vast majority of countries and the suspension of international travel to stop the spread of the virus, the market for tax management software has experienced substantial growth in recent years. After the COVID-19 pandemic has passed and the economy has stabilized, the tax management sector is expected to expand quickly in the years to come. This component accelerates market expansion on a global scale.

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on the "Global Tax Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Tax Type (Indirect Tax, Direct Tax), By Deployment mode (On-premise, Cloud), By Organization Size (Large Enterprise, Small & Medium Size Enterprise), By Industry Vertical (Manufacturing, BFSI, Healthcare, Retail & E-Commerce, Telecom & IT, Energy & Utility, Media & Entertainment, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/2834

The services segment dominates the market with the largest revenue share over the forecast period.

The worldwide tax management market is divided into software and services based on components. With the highest revenue share of more than 36.8% during the anticipated period, the services sector is leading the market. As the use of tax management software grows throughout important industries, so does the need for supporting services among businesses. Consulting services help a business choose the best tax management software to suit its particular requirements. These services offer guidance to end customers and help them integrate and deploy software that corresponds to their requirements. They help identify the level of integration required by firms to satisfy tax requirements. They also assist companies at every step of software utilization.

The direct tax segment is witnessing significant CAGR growth over the forecast period.

The worldwide tax management market is divided into direct tax and indirect tax segments based on the kind of tax. Among them, the direct tax segment is expected to experience a considerable CAGR increase. Taxpayers give the government their money directly, avoiding any third parties. They are imposed on firms and considered in the research. Among the direct taxes taken into account are corporate tax, wealth tax, estate duty, gift tax, fringe benefit tax, and professional tax. Vendors are offering simple and comprehensive direct tax solutions to meet changing market demands. Multistate and multinational businesses may find it challenging to file taxes due to the many jurisdictions. However, federal, state, and local tax filing is made simpler, faster, and more secure by direct tax management software.

The cloud segment is expected to hold the largest share of the Global Tax Management Market during the forecast period.

The global tax management market is divided into two categories based on deployment: on-premise and cloud. For the duration of the forecast, the cloud segment is anticipated to account for the lion's share of the tax management market. Software for cloud-based tax management is becoming more popular among businesses. Users who select a cloud-based deployment strategy can access the solution from any location using any computer, laptop, or mobile device. Cloud solutions lighten the burden of system administration and maintenance, allowing management to focus on responsibilities that add value to the company. To avoid data loss, the cloud deployment mode is constantly online.

The large enterprise segment accounted for the largest revenue share of more than 57.2% over the forecast period.

Based on organization size, the global tax management market is segmented into large enterprises and small & medium size enterprises. Among these, the large enterprise segment dominates the market with the largest revenue share of 57.2% over the forecast period. A growing number of big enterprises are switching to tax management solutions to manage taxes and control adherence duties. Tax management can be challenging for any small business owner, but it is a crucial component of managing a small business. Small and medium-sized firms pay comparatively low taxes, which promote job creation and economic growth. SMEs require tax software to handle their tax filings and financial operations because they acquire loans at lower interest rates than the average.

Rising implementation of tax management software to boost BFSI segment growth.

Based on industry vertical, the global tax management market is segmented into manufacturing, BFSI, healthcare, retail & e-commerce, telecom & IT, energy & utility, media & entertainment, and others. During the projected period, the BFSI segment is expected to lead the global tax management market in terms of revenue contribution. Increasing digital transformation and a growing number of clients using banking services are predicted to drive growth in the BFSI business. As a result, the BFSI industry's data volumes are rapidly growing. The national laws guiding this industry are complicated as well as vulnerable. The growing amount of financial transactions internationally is another major element pushing the usage of tax management software in the BFSI business.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/2834

North America dominates the market with the largest market share over the forecast period.

With a market share of more than 38.7% during the forecast period, North America is the industry leader. As a result of constant modifications and rules in the regional taxation system, the region has witnessed spectacular growth in the adoption of tax software, with North America now holding the greatest market share. Owing to the area's different tax and labor laws and the complexity of the tax system, software developers and major vendors have an excellent chance to invest in the market. Software providers in the region have started collaborating with outside developers to increase the effectiveness of the taxing system. Companies in North America use cutting-edge channels and technologies to remain competitive and grow rapidly. Both the tax environment and product adoption in North America are being greatly impacted. Asia-Pacific market is expected to grow the fastest during the forecast period. The Asia Pacific market is anticipated to expand at a moderate rate in the coming years. Governments in this region will continue to be driven to defend their tax bases, therefore tax changes and the frequency of tax audits will be in the spotlight. Utilizing dependable tools to manage tax records will be simpler as a result.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Tax Management Market include Avalara, Inc., TaxSlayer LLC., SAP SE, Thomson Reuters Corporation, Wolters Kluwer N.V., Sovos Compliance LLC, Sailotech Pvt Ltd., HRB Digital LLC., Intuit, Inc., Vertex, Inc., and among others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/2834

Recent Developments

- On February 2023: Asure Software Inc., a provider of HR and payroll solutions for small businesses, and Intuit Turbotax teamed. The cooperation would accelerate tax refunds, reduce the number of errors, and speed up the employee's tax filing process.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2032. Spherical Insights has segmented the global tax management market based on the below-mentioned segments:

Tax Management Market, Component Analysis

- Software

- Services

Tax Management Market, Tax Type Analysis

- Indirect Tax

- Direct Tax

Tax Management Market, Deployment Mode Analysis

- On-premise

- Cloud

Tax Management Market, Organization Size Analysis

- Large Enterprise

- Small & Medium Size Enterprise

Tax Management Market, Industry Vertical Analysis

- Manufacturing

- BFSI

- Healthcare

- Retail & E-Commerce

- Telecom & IT

- Energy & Utility

- Media & Entertainment

- Others

Tax Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Japan Outplacement Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Group Outplacement and Personal Outplacement), By Application (BFSI, IT & Telecom, Retail, Media & Entertainment, Government, Public Sector, Manufacturing/Healthcare), and by Japan Outplacement Services Market Insights Forecasts 2022 – 2032

Japan Auto Loan Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By End-User (Individuals, Enterprises), and Japan Auto Loan Market Insights Forecasts to 2032

South Korean Life and Non-life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Types (Life Insurance and Non-life insurance), By Distribution Channels (Banks, Agencies, Direct, and Others), and South Korean life and Non-life Insurance Market Insights Forecasts 2022 – 2032

Japan Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Type (Digital Assets, Returnable Transport Assets, In-transit Assets, Manufacturing Assets, Personnel/ Staff), By Type of Mandate (Investment Funds, Discretionary Mandates), and Japan Asset Management Market Insights Forecasts to 2032

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter