Dublin, Jan. 02, 2024 (GLOBE NEWSWIRE) -- The "Global BFSI Crisis Management Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028" report has been added to ResearchAndMarkets.com's offering.

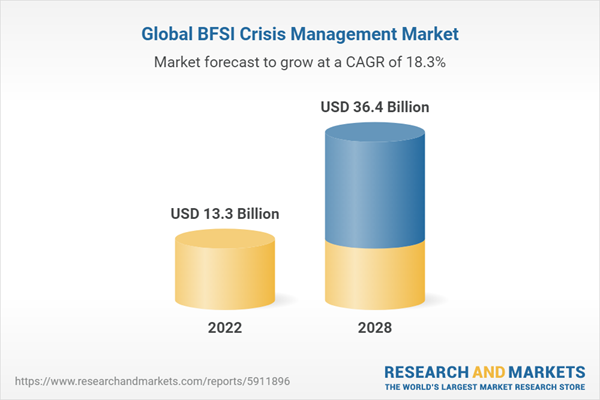

The BFSI sector is currently witnessing a significant transformation with the integration of cutting-edge technologies aimed at enhancing financial stability and incident management. In line with these developments, the global BFSI crisis management market size which stood at US$ 13.3 Billion in 2022, is forecasted to burgeon to an impressive US$ 36.4 Billion by 2028, growing at a CAGR of 18.27% during the forecast period of 2022-2028.

The pivotal role of artificial intelligence (AI), cloud computing, machine learning (ML), and big data analytics has been instrumental in propelling the BFSI crisis management market forward. The solutions being offered in the market are revolutionizing areas such as lending, international money transfers, personal finance, equity financing, and insurance.

Moreover, a surge in data production by large enterprises has catalyzed the adoption of digital platforms and network solutions. This, in turn, is fueling a bullish outlook for the market globally.

Market Dynamics

The BFSI crisis management market is being driven by the critical necessity to safeguard organizational reputation and manage financial, employee, and public safety threats. These comprehensive solutions are rapidly being adopted as they cover an array of business processes within the financial sector.

In regions such as Asia-Pacific and other developing economies, the expansion of financial institutions coupled with regulatory compliance, is providing burgeoning opportunities for crisis management solution providers. Contributing further to this market expansion is the heightened awareness of financial technology and substantial growth in the BFSI sector.

Another key factor bolstering the growth of the BFSI crisis management market is the focus on enhancing the customer experience in financial services, which is reinforcing the demand for sophisticated crisis management tools.

Competitive Landscape

The BFSI crisis management market is competitive, with major players offering innovative solutions to aid financial institutions in effectively managing crises. These key players are constantly evolving through technological advancements and strategic alliances to address the burgeoning demand for robust BFSI crisis management tools.

To encapsulate, this seismic shift towards inventive crisis management solutions in the BFSI sector is anticipated to maintain its upward trajectory, largely due to the relentless technological advancements and the ever-increasing requirement for comprehensive data analysis and incident management capabilities.

The analysis presented in the BFSI Crisis Management Market report is crucial for industry stakeholders, investors, and participants who are seeking in-depth understanding and clear insights into this rapidly shifting market landscape.

For additional information on this dynamic market and its future prospects, the full BFSI Crisis Management Market report is now available for further exploration.

Segmentation Analysis

By Component:

- Software

- Services

By Deployment Type:

- On-premises

- Cloud-based

By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

By Application:

- Disaster Recovery and Business Continuity

- Risk and Compliance Management

- Crisis Communication

- Incident Management and Response

By End User:

- Banks

- Insurance Companies

For more information about this report visit https://www.researchandmarkets.com/r/oary7f

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment