Dublin, Jan. 24, 2024 (GLOBE NEWSWIRE) -- The "Asia Pacific Wealth Management Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)" report has been added to ResearchAndMarkets.com's offering.

The Asia Pacific wealth management industry is witnessing a significant surge, with assets under management expected to expand from a substantial USD 18.50 trillion in 2023 to an impressive USD 33.00 trillion by 2028. This equates to a robust compound annual growth rate (CAGR) of 12.27% during the forecast period, according to a newly published research report.

The wealth management market within the Asia-Pacific region is experiencing remarkable growth, characterized by an evolving maturity marked by automation, operational process optimization, and a broadening asset distribution. The market is rapidly adapting to meet burgeoning client demands for sustainable investment strategies, despite previously lagging globally in this area.

In the wake of the COVID-19 pandemic, the Asia-Pacific wealth management market has seen a significant uptake in digital initiatives propelled by a shift towards remote working conditions. This digital transformation is setting a new standard in client engagement and operational efficiency within the financial sector.

Asia Pacific Wealth Management Market Trends

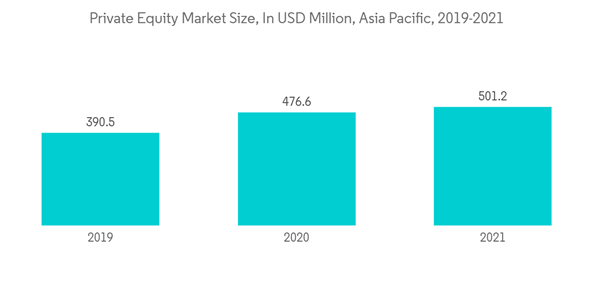

- Highly Liquid Private Equity Market in APAC Signifying Growth in Market: With a cash reserve exceeding USD 600 billion, representing over 20% of the global total, the Asia-Pacific private equity market indicates a robust growth trajectory for the wealth management sector.

- Growing Market Capitalization of China's Stock Market Shows Strengthening the Market: The rapid increase in market capitalization of China's stock market underlines the ongoing fortification of the wealth management market in the Asia-Pacific region.

Asia Pacific Wealth Management Industry Overview

The competitive landscape of the Asia-Pacific wealth management market encompasses a spectrum of influential players across key countries such as India, China, and Japan. The market's competitive dynamism is also shaped by strategic mergers and acquisitions, as well as traditional investment channels led by dominant economies like China. Among the eminent entities in the market are powerhouses such as Aberdeen Standard Investments, China Life Private Equity, UBS, BlackRock, and ICICI Prudential Asset Management.

This extensive analysis underscores the wealth management sector's growth trends, forecasts, and pivotal market tendencies in the Asia-Pacific region. It paints a comprehensive picture of the prospective opportunities and challenges that lie ahead for stakeholders in this burgeoning financial arena.

For detailed insights and further information, interested parties are encouraged to access the full research publication on the Asia Pacific Wealth Management Market, which is now available.

A selection of companies mentioned in this report includes

- UBS

- Citi Private Bank

- HSBC Private Bank

- Aberdeen Standard Investments

- Credit Suisse

- BlackRock

- Franklin Templeton

- ICICI Prudential Asset Management

- BNP Paribas Wealth Management

- China Life Private Equity

- Other Key Players

For more information about this report visit https://www.researchandmarkets.com/r/d8uy2p

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment