Dublin, Feb. 21, 2024 (GLOBE NEWSWIRE) -- The "Additive Manufacturing and Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2019-2029" report has been added to ResearchAndMarkets.com's offering.

The global Additive Manufacturing and Materials Market is estimated at USD 78.93 billion in 2024, and is expected to reach USD 202.17 billion by 2029, growing at a CAGR of 20.7% during the forecast period (2024-2029). Production companies of all sizes currently view Additive Manufacturing as an essential component of their factories. With additive manufacturing, industries can manufacture finished goods that are stronger, lighter, and redesigned to have fewer parts while overcoming supply chain interruption.

Key Highlights

- Industrial 3D printing technology is essential for factories to operate in plug-and-play mode. According to a survey by Sculpteo, 41% of the companies confirm that Additive Manufacturing has helped them complete their task more efficiently while improvising their process. 59% of users desire to use more sustainable materials, driven by the increasing number of bio-based materials in recent years. At the same time, 47% of 3D printing reduces the need for multiple resources because some designs are 'impossible' to achieve using traditional techniques.

- Additive Manufacturing is used widely in many industries, and the aerospace industry was the first to embrace 3D printing. In healthcare, medical devices and dentistry use 3D printing in items such as dental prostheses, inlays, and other implants. For further developments in 3D printing, imaging methods will measure the patient's knee or jaw and then send a CAD blueprint of the required implant directly to the 3D printer, which will immediately start building it.

- The Covid-19 pandemic allowed 3D printing to rise to the challenge. The rapid production of 3D-printed face masks and shields was possible using this technology. When new 3D printing materials, machines, and additive manufacturing techniques enter the market, companies proficient in 3D printing architectures can expand their services as the industries will approach them for innovative skills.

- UK-based Bently Motors adopted 3D printing with an investment of 3 million USD. This investment was used in multi-jet fusion technology and FDM machines. With powder-based technology, the automotive player could manufacture a batch of parts in a day and a half, thereby increasing its productivity compared to its counterparts.

Additive Manufacturing Materials Market Trends

Automotive to is expected Hold a Significant Share

- 3D printing is very helpful in manufacturing the final car parts. Automotive players like Volkswagen, BMW, and Ford use additive technology to manufacture final car parts. Fused Filament Fabrication (3F or FFF) is the latest improvement in 3D printing, where different materials are examined to have properties similar to plastics. With a 3D printer, the required parts and designs can be created, which makes the companies independent of external suppliers and further streamlines the production processes.

- Additive Manufacturing allows for toolless production with almost endless design flexibility. For instance, Ford Automotive uses 3D printing technology for production parts. The company is integrating AI with 3D technology to enhance its business capabilities. In March 2022, the automotive leader developed a robotic system to operate 3D printers. This interface allows machines from different suppliers to speak to each other in the same language and operate parts of the production line autonomously.

- General Motors plans to turn its entire fleet into zero-emission vehicles by 2035. Additive Manufacturing plays a vital role in designing intricate parts and lightweight vehicles with extended battery performance. When General Motors faced hindrances in producing a component needed to deliver the 2022 Chevrolet Tahoe, it turned to HP's 3D printing platform. After switching to HP's Multi Jet Fusion (MJF) 3D printing technology, GM was able to reduce the drying time, which sped up the manufacturing schedule for full-sized SUVs. Over five weeks, the necessary 60,000 parts for about 30,000 vehicles were successfully made and polished.

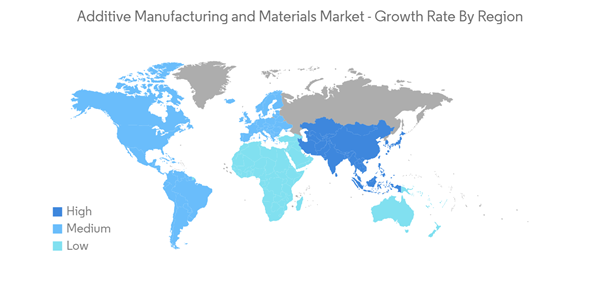

Asia Pacific is expected to witness significant growth rate

- China has set targets to increase industrial competitiveness as part of its Made in China 2025 strategy. They will do this by investing in cutting-edge technologies, like 3D printing, and preparing the future workforce. A survey conducted by Materialise among Chinese manufacturing companies stated 30% of companies agree that the use of 3D printing that will become more important than traditional manufacturing.

- China's aviation sector has begun using cutting-edge 3D printing technologies on next-generation warplanes, with 3D printed components being used to construct aircraft that had their maiden flight recently.

- The 3D bio-printing technique was developed by the Pohang University of Science and Technology (POSTECH) in South Korea for realistic engineered organs. As per the research institute, more automatized and elaborate methods for generating organ substitutes would be possible if 3D printing is integrated with AI and robotic technologies.

- JGC Holdings Corporation, a Japanese conglomerate, installed COBOD 3D printer in its construction work. Adopting COBOD technology will drastically reduce formwork construction time. The firm calculated that 3D printing might have cut this process from 16 days down to eight.

Additive Manufacturing Materials Industry Overview

The additive manufacturing and materials market is quite competitive. The major players with a significant market share are concentrating on developing generative design capabilities for 3D printing techniques. By adopting software capabilities optimized for additive manufacturing, companies want to increase their customer bases across international markets and utilize strategic collaborative initiatives to increase their market share and profitability. Stratasys, ExOne, and 3D Systems Corporation are some of the major players serving this industry.

- August 2022 - The polymer 3D printing company Stratasys acquired Covestro AG, which supports the additive manufacturing materials business. Innovative materials are proficient in creating new use cases for 3D printing, particularly in producing end-use parts like dental aligners and automotive components. Through this acquisition, Stratasys can advance its business strategy of providing the industry's best and most complete polymer 3D printing portfolio. The company can also accelerate its investments in cutting-edge developments in 3D printing materials.

- August 2022 - Carbon acquired ParaMatters, which provides software for additive manufacturing. The acquisition will help the product development teams of Carbon to create higher-performance part designs in less time using automation techniques of this software. These designs will feature advanced geometries and improved performance characteristics.

Key Topics Covered

1 INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

4.1 Market Overview

4.2 Industry Value Chain Analysis

4.3 Industry Attractiveness - Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMNICS

5.1 Market Drivers

5.1.1 New and Improved Technologies to Drive Product Customization

5.1.2 Demand for Lightweight Construction in Automotive and Aerospace Industries

5.2 Market Restraints

5.2.1 Concerns over Intellectual Property Protection

6 MARKET SEGMENTATION

6.1 By Technology

6.1.1 Stereo Lithography

6.1.2 Fused Deposition Modelling

6.1.3 Laser Sintering

6.1.4 Binder Jetting Printing

6.1.5 Other Technologies

6.2 By End User

6.2.1 Aerospace and Defense

6.2.2 Automotive

6.2.3 Healthcare

6.2.4 Industrial

6.2.5 Other End Users

6.3 By Material

6.3.1 Plastic

6.3.2 Metals

6.3.3 Ceramics

6.4 Geography

6.4.1 North America

6.4.2 Europe

6.4.3 Asia-Pacific

6.4.4 Latin America

6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

7.1 Company Profiles

7.1.1 3D Systems Corporation

7.1.2 General Electric Company (GE Additive)

7.1.3 EnvisionTEC GmbH

7.1.4 EOS GmbH

7.1.5 Exone Company

7.1.6 Mcor Technologies Ltd.

7.1.7 Materialise NV

7.1.8 Optomec Inc.

7.1.9 Stratasys Ltd.

7.1.10 SLM Solutions Group AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

For more information about this report visit https://www.researchandmarkets.com/r/bvmnkq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment