Ottawa, Feb. 22, 2024 (GLOBE NEWSWIRE) -- The global automotive artificial intelligence (AI) market size accounted for USD 3.87 billion in 2024 and is poised to grow at a CAGR of 28% from 2024 to 2033. The market is anticipated to reach around USD 19.99 billion by 2031.

Automobile AI is transforming the automobile sector by incorporating technological advances into vehicles, enhancing safety, efficiency, and overall driving experience. AI automobile applications include autonomous driving, predictive maintenance, and smart navigation systems. Machine learning algorithms analyze large datasets, allowing vehicles to adapt to diverse road conditions and identify potential issues to improve performance. Advanced driver assistance systems (ADAS) use AI to improve collision avoidance and emergency response. Natural Language Processing (NLP) enables voice-activated controls, enabling hands-free communication. AI's impact on automotive innovation is growing, offering the potential of self-driving automobiles, smart traffic management, and seamless connection. As AI advances, its incorporation into vehicles marks a transformative period, driving the automotive sector to unparalleled innovations and enhanced road safety.

Factors such as the rise in demand for autonomous vehicles, enhancement of user experience and convenience, focus on improved safety and traffic management and connectivity, and big data integration are driving the growth of the market. However, high cost and technological complexity, data privacy and security concerns, and regulatory and infrastructure challenges are the factors limiting the growth of the market. Furthermore, the market is segmented by offering, technology, application, process, component, and region.

Download the Sample Pages@ https://www.precedenceresearch.com/sample/2165

Key Insights:

- North America led the global market with the largest market share of 36.8% in 2023.

- The hardware segment has contributed the largest market share of 72.6% in 2023.

- The semi-autonomous segment has held the biggest market share of 46% in 2023.

- The machine learning segment has accounted the highest revenue share of 34.8% in 2023.

- The natural language processing segment is expected to record the fastest rate of growth from 2024 to 2033.

- The voice recognition segment has captured the largest revenue share of 32.8% in 2023.

Automotive Artificial Intelligence (AI) Revenue, By Regions (USD Million)

| By Region | 2019 | 2020 | 2021 | 2022 | 2023 |

| North America | 673.4 | 759.3 | 868.9 | 1,008.10 | 1,185.50 |

| Europe | 395.6 | 443.9 | 505.4 | 583.4 | 682.6 |

| Asia Pacific | 464.3 | 539.9 | 637.2 | 762.4 | 924.5 |

| LAMEA | 236.9 | 269.1 | 309.7s | 360.9 | 425.6 |

Automotive Artificial Intelligence (AI) Revenue, By Offering (USD Million)

| By Offering | 2019 | 2020 | 2021 | 2022 | 2023 |

| Hardware | 1,265.20 | 1,443.90 | 1,672.30 | 1,963.60 | 2,337.10 |

| Europe | 360.2 | 407 | 466.7 | 542.6 | 639.3 |

| Software | 144.8 | 161.3 | 182.2 | 208.6 | 241.8 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2165

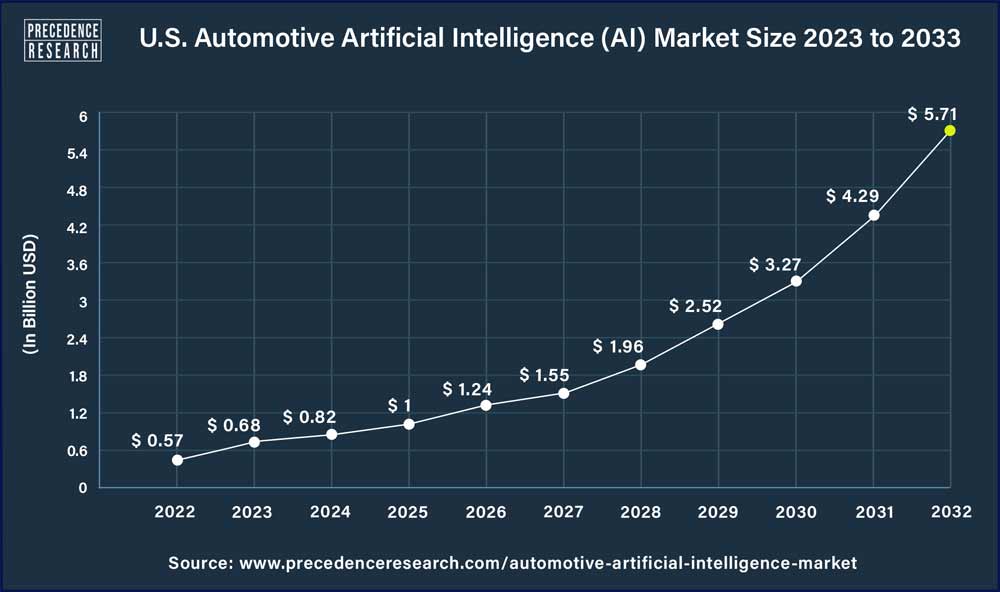

U.S. Automotive Artificial Intelligence (AI) Market Size 2024 to 2033

The U.S. automotive artificial intelligence (AI) market size was USD 0.57 billion in 2023, grew to USD 0.68 billion in 2024, and is anticipated to reach around USD 5.71 billion by 2033, growing at a CAGR of 26.6% from 2024 to 2033.

In 2023, North America dominated the market. The growth in this region is driven by the presence of major leading tech companies such as Alphabet Ince, Nvidia, Microsoft, Intel, IBM, Tesla, Ford Motor Company, General Motors, and the mature automotive industry. Tech giants such as Waymo and Nvidia are transforming the market by providing advanced AI solutions and developing entire hardware and software ecosystems for automakers. This integration effectively incorporates AI into recently introduced automobiles, meeting the high demand for technological innovation in North America.

For instance, in 2022, Nvidia introduced the Drive Hyperion 8 self-driving platform, which includes the Drive Orin chip, 12 cameras, radar, and backup systems for safety. Electric car manufacturers, robotaxi services, and freight companies, specifically TuSimple, have all adopted it. The objective is to address the driver shortage. Automotive suppliers are included on board. Omniverse Avatar was used to make bookings by Drive Concierge, an always-on digital assistant. Nvidia uses Omniverse for vehicle testing, and it is expected to appear in automobiles this year. Moreover, the well-established automotive infrastructure in the region further contributes to the growth, while government and venture capital investments actively fuel innovation.

Automotive Artificial Intelligence (AI) Market Scope

| Report Coverage | Details |

| Global Growth Rate from 2023 to 2033 | CAGR of 28% |

| Global Market Size in 2023 | USD 3.22 Billion |

| Global Market Size by 2033 | USD 35.71 Billion |

| U.S. Market Size in 2023 | USD 0.57 Billion |

| U.S. Market Size by 2033 | USD 5.71 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Offering, Technology, Application, Process, Component, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa (MEA) |

Offering insights

The hardware segment led the market with the largest share in 2023. AI algorithms used in automotive applications, such as autonomous driving systems, advanced driver assistance systems (ADAS), and in-vehicle infotainment systems, require significant computational power for processing large amounts of data in real-time. Specialized hardware, such as AI processors, GPUs, and FPGAs, are essential for handling the complex computations involved in AI tasks like object detection, image recognition, and decision-making. Hardware components play a crucial role in integrating AI capabilities into existing automotive platforms and architectures.

Automotive manufacturers and suppliers rely on hardware solutions that seamlessly integrate with vehicle electronics, sensors, actuators, and communication networks. Dedicated AI hardware offerings are designed to facilitate easy integration and compatibility with automotive systems, enabling efficient deployment of AI functionalities in vehicles.

Technology insights

The machine learning segment held the dominating share of the market in 2023. Machine learning algorithms are crucial components of ADAS, which enhance vehicle safety and driver assistance features. These systems rely on machine learning for tasks such as object detection, pedestrian recognition, lane departure warning, adaptive cruise control, and collision avoidance. Machine learning enables vehicles to interpret and respond to complex real-world driving scenarios, making them safer and more autonomous.

The automotive industry generates vast amounts of data from sensors, cameras, GPS systems, and other sources within vehicles. Machine learning excels at analyzing and extracting insights from large datasets, allowing automotive companies to leverage this data for various applications such as predictive maintenance, personalized driving experiences, and fleet management. By harnessing machine learning, automotive manufacturers can improve vehicle performance, efficiency, and customer satisfaction.

Customize this study as per your requirement@

https://www.precedenceresearch.com/customization/2165

Application Insights

The semi-autonomous driving segment held the largest share in 2023. Semi-autonomous driving features, such as adaptive cruise control, lane-keeping assistance, and automated parking, enhance both safety and convenience for drivers. These AI-powered systems help reduce the risk of accidents by assisting drivers with tasks like maintaining safe distances from other vehicles, staying within lanes, and navigating parking spaces. As a result, there is a strong demand from consumers and regulatory bodies for AI technologies that improve driving safety and comfort. Semi-autonomous driving features are already available in a wide range of vehicles across various price points, making them accessible to a broader consumer base. As more vehicles come equipped with semi-autonomous capabilities, the market for automotive AI continues to grow. Consumers increasingly value the convenience and safety benefits offered by these features, further driving adoption and market dominance.

On the other hand, the autonomous driving segment is predicted to grow at the highest CAGR between 2024 and 2033. The potential market for autonomous driving technology is vast, encompassing not only traditional automotive manufacturers but also technology companies, ride-sharing services, logistics companies, and other industries. The prospect of self-driving vehicles holds promise for transforming transportation, reducing congestion, improving accessibility, and unlocking new business models and revenue streams.

Process Insights

The voice recognition segment held the largest share of the market in 2023. Voice recognition technology enables drivers to interact with various features and functions of the vehicle without taking their hands off the wheel or their eyes off the road. This hands-free operation enhances safety by reducing distractions and minimizing the risk of accidents caused by manual or visual distractions while driving. Voice recognition systems provide drivers with convenient and intuitive ways to control in-car infotainment systems, navigation, climate control, phone calls, and other features. By simply speaking commands or requests, drivers can access information and perform tasks more efficiently, enhancing the overall driving experience and comfort.

The image recognition segment is another lucrative segment of the market. Image recognition is emerging as an essential component in the automotive market's AI-driven transition. Image recognition is fundamental in the field of Advanced Driver Assistance Systems (ADAS), allowing vehicles to read visual clues from their surroundings and improve safety through features such as obstacle detection and lane-keeping assistance.

- According to the World Health Organization, 50 million people get injured, and 1.3 million people die every year in road accidents, out of which 94%-96% of accidents are due to the carelessness of drivers or misreading road signs.

Image recognition is critical in developing autonomous vehicles, allowing automobiles to analyze and comprehend complicated surroundings, distinguish between distinct things, and navigate with high precision. AI-powered image recognition is used in traffic sign recognition, pedestrian detection, and parking assistance, contributing to increased road safety and driving convenience. Furthermore, image recognition is being used in in-cabin apps to monitor driver behavior for safety measures such as drowsiness detection. The continuous expansion of image recognition in the automobile sector, as AI technologies advance, represents an enormous shift toward smarter, safer, and more efficient vehicles.

Market Dynamics

Drivers:

The incorporation of artificial intelligence (AI) in automobile manufacturing is driving the automobile AI market into a new era of efficiency, safety, and competitive advantage. This innovative technology addresses long-standing industrial difficulties by providing solutions that reinvent established production processes. AI impacts different aspects of automotive production, from precision assembly to painting and quality inspection. AI-powered robotics and machine learning algorithms have become vital, improving process efficiency and product quality. Wearables such as the Hyundai Vest Exoskeleton (H-VEX) highlight AI's role in increasing worker safety by reducing the risk of injuries, promoting a healthier work environment, and increasing overall productivity.

Automation requires an enormous advance by incorporating Automated Guided Vehicles (AGVs) navigating autonomously within factories. These AI-powered vehicles deliver items efficiently, responding to changing conditions and overcoming hurdles. As an outcome, logistics and material management are optimized, increasing the efficiency of production operations.

AI's effect extends beyond the factory floor and into supply chain management. Around 30,000 parts from different suppliers are needed to build a single car. Integration of AI in the supply chain can reduce the complexities during the supply of all the essential parts. The use of AI-powered audits by the Volkswagen Group to check the sustainability standards of over 13,000 suppliers highlights how technology ensures compliance and pushes environmentally conscious production processes. This not only connects with global sustainability goals but also contributes to vehicle manufacturers' total corporate social responsibility. AI's continuous learning transforms automotive manufacturing, improving efficiency, reducing production times, and minimizing errors. Its adoption allows companies to rapidly adapt to market demands, putting them at the center of innovation. In addition to productivity enhancement, AI in automotive manufacturing promotes a competitive edge by enabling the production of complex, technologically advanced vehicles without proportional cost or time increases.

Restraints:

The high initial investment required for AI implementation in the manufacturing process is limiting the growth of the market. Acquiring the necessary AI infrastructure and robotics and providing workforce training involves considerably high costs, potentially posing a financial strain on automotive companies. Furthermore, the challenge of incorporating AI into existing production processes can cause interruptions and increased downtime when systems are modified.

Data security is another concern, with AI systems relying heavily on sensitive information related to design, production, and supply chain. Safeguarding against data breaches and unauthorized access becomes vital. These limitations, which include labor shifts, regulatory compliance, ethical considerations, a scarcity of AI ability, and reliance on data quality, highlight the complex obstacles in realizing the full potential of AI in the automotive industry.

Opportunity:

Technological advancement is expected to provide opportunities in the market. For instance, the integration of ChatGPT into the automotive industry, as demonstrated by DS Automobiles, is a groundbreaking opportunity. This connection goes beyond standard voice commands to provide an additional intuitive and dynamic in-car experience. DS intends to reinvent user engagement by utilizing ChatGPT's conversational AI capabilities across its DS 3, DS 4, DS 7, and DS 9 product lines. Beyond DS, big players such as Mercedes-Benz and General Motors are exploring ChatGPT integration in their vehicles, indicating a broader industry trend. ChatGPT enables customers to converse naturally with their automobiles, asking various queries and receiving helpful responses. This enhances the user experience and prioritizes safety, with voice commands initiated without taking eyes off the road.

The subscription model for ChatGPT integration used by DS Automobiles displays distinctive monetization strategies that potentially influence the industry's future business models. The trial phase, which began with a "SoundHound AI powered by ChatGPT," intends to evaluate customer experience, opening the way for eventual expansion within the Stellantis group, which includes brands such as Jeep and Citroen. The successful integration of ChatGPT in the automotive sector is expected to indicate a broader trend toward AI-powered interactions and services in automobiles, influencing the future of in-car technology and user engagement.

Related Reports:

- Generative AI in Automotive Market: The global generative AI In automotive market size was estimated at USD 312.46 million in 2022 and is expected to hit around USD 2,691.92 million by 2032 with a double-digit CAGR of 24.03% during the forecast period 2023 to 2032.

- Automotive Active Safety Systems Market: The global automotive active safety systems market size was valued at USD 98.27 billion in 2022, and it is projected to be worth around USD 227.35 billion by 2032, poised to grow at a CAGR of 8.80% during the forecast period 2023 to 2032.

- Automotive Starter Motor Market: The global automotive starter motor market size was estimated at USD 31.4 billion in 2022 and is expected to be worth around USD 48.53 billion by 2032, expanding at a CAGR of 4.50% during the forecast period from 2023 to 2032.

- Automotive Fuel Filter Market: The global automotive fuel filter market size reached USD 2.6 billion in 2022 and is projected to hit around USD 4.68 billion by 2032, growing at a CAGR of 6.1% during the forecast period from 2023 to 2032.

- Automotive Data Management Market: The global automotive data management market size surpassed USD 2.19 billion in 2022, and it is predicted to reach around USD 14.29 billion by 2032, poised to grow at a CAGR of 20.63% during the forecast period 2023 to 2032.

Recent Developments:

- In Jan 2024, among the cutting-edge digital innovations Mercedes-Benz unveiled at CES 2024 was the MBUX Virtual Assistant, which runs on generative AI and offers state-of-the-art 3D graphics on the new Mercedes-Benz Operating System (MB.OS). With the release of an assistant that provides a hyper-personalized user experience through natural interaction, proactive intelligence, and expanded app capabilities, Mercedes-Benz is showcasing its commitment to revolutionizing the customer experience.

- In Dec 2023, in partnership with Microsoft, Renesas Electronics introduced AI Workbench, a cloud-based development environment aimed at automotive AI engineers. Engineers can use the platform to build, simulate, and fine-tune automotive software utilizing Microsoft Azure services. AI Workbench follows a "Shift-Left" approach, allowing software creation and testing earlier in the design cycle, even before hardware availability. This single development platform supports Renesas' automotive SoCs and MCUs, allowing for the creation of AI-enabled apps for ADAS and autonomous driving. The collaboration intends to improve the security and cost-effectiveness of embedded project development in the automobile industry.

- In Oct 2023, Sensigo, a California-based AI firm focused on enhancing vehicle servicing, was founded by German automaker Porsche and investor UP. Partners. Sensigo's platform uses artificial intelligence to diagnose, resolve, and forecast repair issues, with the goal of improving customer experience, increasing service center profitability, and lowering repair costs. It is the second of six mobility startups Porsche intends to create in collaboration with UP. Partners over the next three years.

- In Aug 2023, Tech Mahindra announced a partnership with Spanish deep-tech firm Anyverse to accelerate AI adoption in the automotive industry. Using Anyverse's hyperspectral synthetic data generation technology, the cooperation intends to ease the training, testing, and validation of AI systems for autonomous applications. Tech Mahindra will use this platform to create synthetic datasets for training and fine-tuning artificial intelligence (AI) systems linked to advanced driver assistance systems (ADAS), in-cabin systems, and autonomous vehicles. The partnership aims to cut AI adoption and software validation times by 30-40%. Anyverse's hyperspectral synthetic data platform will be utilized to simulate accurate sensor data.

Key Players:

- Intel Corporation

- Waymo, LLC.

- IBM Corporation

- Microsoft Corporation

- Nvidia Corporation

- Xilinx, Inc.

- Micron Technology, Inc.

- Tesla, Inc.

- General Motors Company

- Ford Motor Company

Market Segmentation

By Offering

- Hardware

- Software

- Service

By Technology

- Computer Vision

- Context Awareness

- Deep Learning

- Machine Learning

- Natural Language Processing

By Application

- Autonomous Driving

- Human–Machine Interface

- Semi-autonomous Driving

By Process

- Signal Recognition

- Image Recognition

- Voice Recognition

- Data Mining

By Component

- Graphics processing unit (GPU)

- Field Programmable Gate Array (FPGA)

- Microprocessors (Incl. ASIC)

- Image Sensors

- Memory and Storage systems

- Biometric Scanners

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@

https://www.precedenceresearch.com/checkout/2165

You can place an order or ask any questions; please feel free to contact us at

sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semiconductors, chemicals, automotive, aerospace, and defense, among different ventures present globally.

Web: https://www.precedenceresearch.com/

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For the Latest Update, Follow Us:

Linkedin | Facebook | Twitter