Dublin, March 06, 2024 (GLOBE NEWSWIRE) -- The "Dietary Supplement Testing Services Global Market Report 2024" report has been added to ResearchAndMarkets.com's offering.

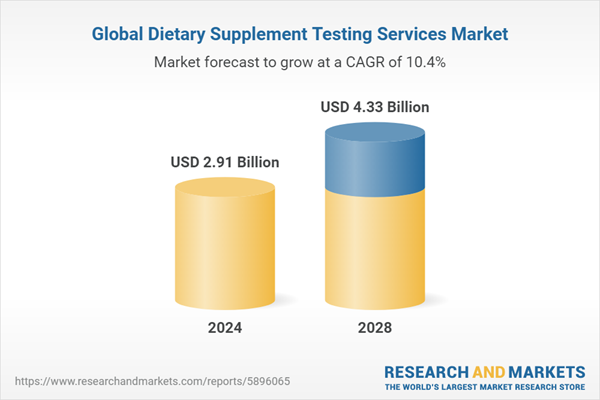

The dietary supplement testing services market size has grown strongly in recent years. It will grow from $2.65 billion in 2023 to $2.91 billion in 2024 at a compound annual growth rate (CAGR) of 10%. The rise in the historical period can be credited to a heightened awareness of healthy foods and nutrition, a growing emphasis on an active lifestyle, an increased demand for dietary supplements, a greater need to validate nutritional information, and an upsurge in the prevalence of supplement use.

The dietary supplement testing services market size is expected to see rapid growth in the next few years. It will grow to $4.33 billion in 2028 at a compound annual growth rate (CAGR) of 10.4%. The anticipated growth in the forecast period can be ascribed to rising consumer awareness, the growing impact of urbanization and modern lifestyles, an increased demand for preventive healthcare solutions, a heightened focus on quality and safety, and a growing array of dietary supplement products. Prominent trends expected in the forecast period encompass continual technological advancements, stringent regulations governing dietary supplements, an augmented emphasis on quality control, an increased focus on safety and efficacy, and the adoption of innovative testing methodologies.

The anticipated growth in the dietary supplement testing services market is expected to be propelled by an increase in healthcare spending. For instance, a report published by the UK-based Office for National Statistics revealed a 9.4% increase in healthcare spending in the UK between 2020 and 2021, both in nominal and real terms. Notably, spending on preventive care reached $45.72 billion in 2021, more than doubling from the previous year. Hence, the rise in healthcare spending is a key driver of the growth in the dietary supplement testing services market.

Furthermore, the anticipated growth in the dietary supplement testing services market is expected to be driven by the increasing health consciousness. For instance, a survey of 5,000 adults by Public Health England in January 2021 revealed that around 80% of adults over 18 have opted for a healthy lifestyle, with 40% choosing to eat healthily. Thus, the growing health consciousness is a key driver of the dietary supplement testing services market's growth.

The growth of the dietary supplement testing services market is expected to be fueled by the increasing geriatric population. According to a report by The Administration for Community Living (ACL), a US-based entity under the United States Department of Health and Human Services, the population aged 65 and older witnessed a 36% increase, rising from 39.6 million in 2009 to 54.1 million in 2019. Projections indicate that this demographic will reach 94.7 million by 2060, surpassing 80.8 million by 2040 and constituting 21.6% of the total population, compared to 16% in 2019. Therefore, the expanding geriatric population serves as a driving force for the growth of the dietary supplement testing services market.

Major players in the dietary supplement testing services market are adopting a strategic partnership approach to introduce dietary supplements into new markets. Strategic partnerships involve companies leveraging each other's strengths and resources for mutual benefits and success. An example is the partnership between HealthLoq, a US-based Blockchain-Powered Nutraceutical Information Platform, and UL Solutions, a US-based safety science company, announced in May 2022. This collaboration combines HealthLoq's blockchain-based transparency platform with UL's expertise in independent testing, inspection, and audit activities. The aim is to facilitate the launch of dietary supplements into new markets, ensuring manufacturers deliver quality and safety. The HealthLoq platform provides consumers with reliable, detailed information about specific nutraceutical products, contributing to the expansion of the dietary supplement testing services market.

In December 2021, Merieux Nutrisciences, a France-based food safety company, acquired Dyad Labs for an undisclosed amount. This acquisition expands Merieux's presence in the US and reinforces its position as a leading player in the dietary supplement sector. Dyad Labs, a US-based nutraceutical company, provides dietary supplement testing services for the food and beverage and nutraceutical sectors.

North America was the largest region in the dietary supplement testing services market in 2023. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the dietary supplement testing services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dietary supplement testing services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Report Scope

Markets Covered:

1) By Service: Stability Testing; Analytical Testing; Microbiological Testing; Regulatory Testing and Compliance; Other Services

2) By Ingredient: Herbal; Vitamins; Minerals; Amino Acids; Enzymes; Other Ingredients

3) By Service Provider: Testing laboratories; Contract research organizations (CROs); Regulatory consultants; Other Service Providers

4) By End-user: Manufacturers; Contract manufacturers; Distributors; Regulatory bodies

Key Companies Mentioned: Eurofins Scientific Pvt. Ltd.; SGS S.A.; Bureau Veritas S.A.; Intertek Group PLC.; UL LLC

Time Series: Five years historic and ten years forecast

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments

Key Attributes

| Report Attribute | Details |

| No. of Pages | 175 |

| Forecast Period | 2024-2028 |

| Estimated Market Value (USD) in 2024 | $2.91 Billion |

| Forecasted Market Value (USD) by 2028 | $4.33 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes:

- Eurofins Scientific Pvt. Ltd.

- SGS SA

- Bureau Veritas SA

- Intertek Group PLC

- UL LLC

- TUV SUD

- Element Materials Technology

- ALS Limited

- LGC Limited

- NOW Foods

- NSF International

- Certified Laboratories Inc.

- United States Pharmacopeia (USP)

- Modern Testing Services

- Applied Technical Services Inc.

- Merieux NutriSciences

- Microbac Laboratories Inc.

- ChromaDex Corp.

- EAG Laboratories

- Spectro Analytical Labs

- Nutrasource Diagnostics Inc.

- Auriga Research Limited

- Q Laboratories Inc.

- Pacific BioLabs Inc.

- Columbia Laboratories Inc.

- Advanced Laboratories Inc.

- ConsumerLab.com LLC

- Purity-IQ Inc.

- Alkemist Labs

- Flora Research Laboratories

- Foodscan Analytics Limited

For more information about this report visit https://www.researchandmarkets.com/r/6oyykl

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment