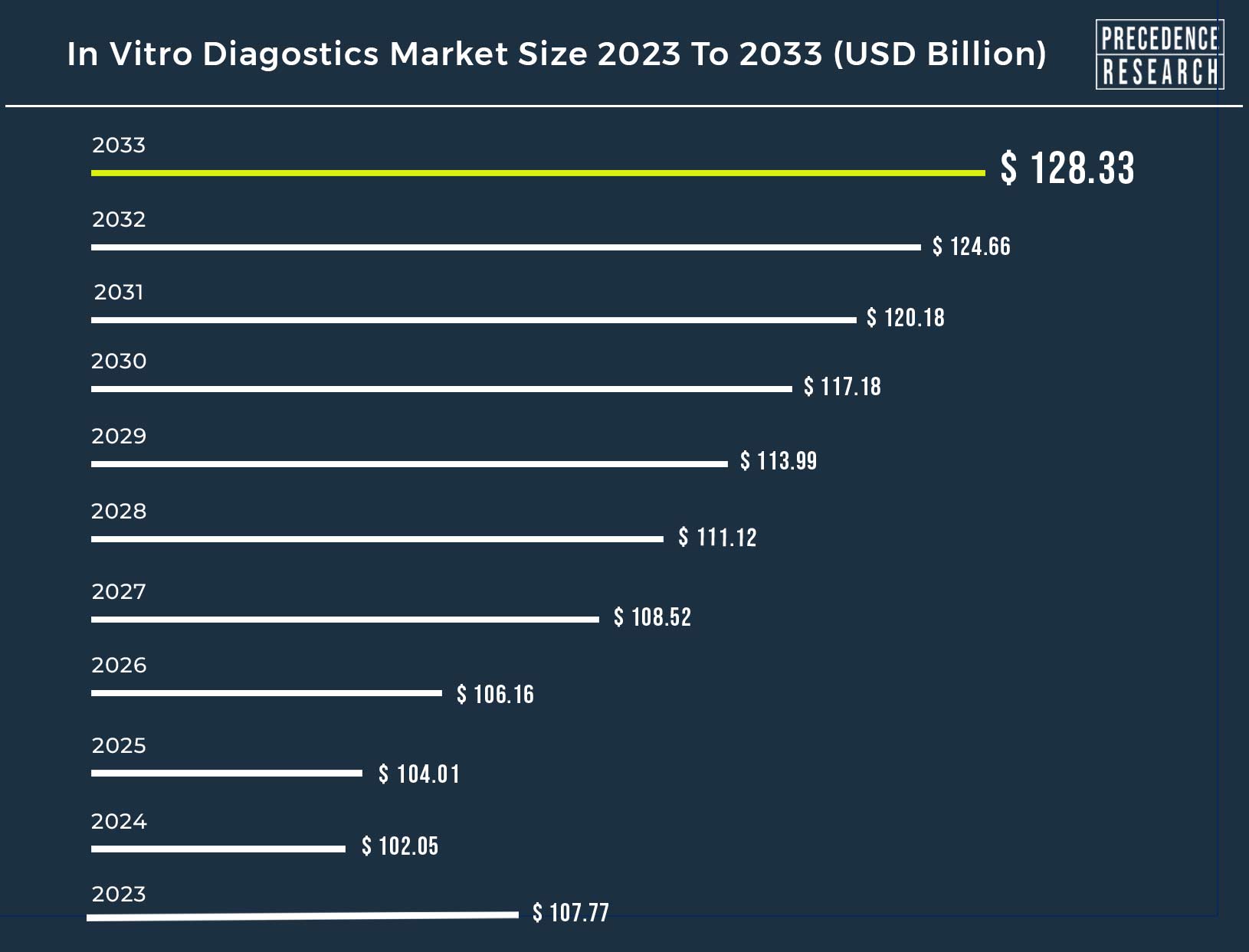

Ottawa, March 08, 2024 (GLOBE NEWSWIRE) -- The global in vitro diagnostics (IVD) market size is estimated to grow from USD 102.05 billion in 2024 to USD 124.66 billion by 2032, According to Precedence Research.

The in vitro diagnostics market is driven by growing infectious diseases, an increase in chronic diseases, and rising technological advancements.

The in vitro diagnostic (IVD) market is essential in healthcare, encompassing medical equipment and reagents used to analyze samples outside the body to identify illnesses. It is necessary in healthcare since it allows for early illness identification and monitoring. Chronic and infectious diseases, technology breakthroughs, and tailored treatment all impact this sector.

Global In Vitro Diagnostics Market Revenue, By Region, (USD Million)

| Region | 2020 | 2021 | 2022 | 2023 |

| North America | 39,164.72 | 44,180.30 | 48,989.06 | 45,485.13 |

| Europe | 24,322.71 | 27,520.30 | 30,607.72 | 28,504.19 |

| APAC | 20,745.86 | 23,755.46 | 26,738.20 | 25,200.01 |

| Latin America | 4,151.22 | 4,725.20 | 5,286.90 | 4,953.16 |

| MEA | 3,022.90 | 3,450.29 | 3,866.78 | 3,624.70 |

Global In Vitro Diagnostics Market Revenue, by Product Type (USD Million)

| Product Type | 2020 | 2021 | 2022 | 2023 |

| Instruments | 23,094.68 | 26,080.42 | 28,950.51 | 26,909.55 |

| Reagents | 59,746.90 | 67,914.11 | 75,883.86 | 70,996.28 |

| Services | 8,565.84 | 9,637.02 | 10,654.28 | 9,861.36 |

Global In Vitro Diagnostics Market Revenue, by Application (USD Million)

| Application | 2020 | 2021 | 2022 | 2023 |

| Testing Infectious Diseases | 48,788.73 | 55,092.11 | 61,149.94 | 56,833.27 |

| Diabetes | 7,341.85 | 8,265.43 | 9,146.65 | 8,475.36 |

| Oncology | 6,613.66 | 7,663.08 | 8,727.73 | 8,323.38 |

| Cardiology | 7,134.35 | 8,128.89 | 9,104.25 | 8,538.03 |

| Nephrology | 5,356.73 | 6,012.37 | 6,633.27 | 6,127.88 |

| Autoimmune Diseases | 4,243.36 | 4,806.02 | 5,350.55 | 4,987.83 |

| Drug Testing | 3,093.19 | 3,541.92 | 3,986.64 | 3,757.30 |

| Others | 8,835.55 | 10,121.74 | 11,389.60 | 10,724.14 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1130

Key Insights:

- By region, North America dominated the market with the largest market share of 42.2% in 2023.

- By region, Asia-Pacific is anticipated to be the fastest-growing region.

- By products, the reagents segment has contributed the biggest market share of 65.9% in 2023.

- By technology, molecular diagnostics has generated more than 33% of market share in 2023.

- By technology, immunoassay is the most prominent and fastest-growing segment.

- By application, the infectious disease segment has accounted for more than 53% of the market share in 2023.

- By end-uses, the laboratory segment has captured 38% revenue share in 2023.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1130

Regional Stances

The North American region dominated the in vitro diagnostics market in 2023. It is one of the world's largest and most advanced regions, with the United States dominating.

The U.S. in vitro diagnostics (IVD) market size surpassed USD 37.17 billion in 2023 and is anticipated to reach around USD 41.62 billion by 2033. Key trends include the increased frequency of chronic illnesses such as diabetes, cardiovascular disease, and cancer, which need ongoing monitoring and care. North America is also at the forefront of technical developments, particularly in molecular diagnostics, next-generation sequencing, and digital health technology. The regulatory environment in North America is strict and complicated, with the FDA overseeing IVD goods and mandating substantial testing and paperwork. The country's high healthcare expenditures, aging population, and modern healthcare infrastructure drive rising demand for diagnostic tests. Personalized medicine is also a developing trend, with the desire for companion diagnostics and other customized.

The Asia-Pacific region's in vitro diagnostics market is expanding rapidly due to rising healthcare costs, a high frequency of infectious illnesses, and an increasing chronic disease burden. The area uses modern diagnostic technologies like molecular diagnostics, next-generation sequencing, and point-of-care testing to drive innovation and growth. Government programs also promote healthcare access and quality by investing in infrastructure and encouraging the use of new diagnostic technology. The region's diversified population, expanding healthcare infrastructure, and rising demand for healthcare services all create considerable prospects for market development. However, legislative difficulties, reimbursement concerns, and infrastructure development in rural and isolated places persist.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

In Vitro Diagnostics Market Report Scope

| Report Coverage | Details | |

| Market Size in 2023 | USD 107.77 Billion | |

| Market Size by 2033 | USD 128.33 Billion | |

| Largest Market | North America | |

| North America Market Share in 2023 | 42.2 | % |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2033 | |

| Base Year | 2023 | |

| Forecast Period | 2024 to 2033 | |

| Segments Covered | Product, Technology, Application, and Regions | |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America | |

Report Highlights:

By Products

The reagents segment holds the largest market share. Reagents are used to detect, quantify, and evaluate particular components in a sample. These reagents are classified into analytical, control, calibration, detection, substrate, and buffer types. Analytical reagents prepare samples for analysis, calibrate equipment, and ensure correct test findings. Control reagents monitor test performance, whereas calibration reagents guarantee that devices reliably measure analytes. Detection reagents identify particular analytes in a sample, such as antibodies, enzymes, and fluorophores. Substrate reagents give observable signals during enzymatic reactions and are commonly employed in enzyme-linked immunosorbent tests (ELISAs). Buffer reagents keep a reaction mixture's pH and stability consistent, enabling diagnostic test accuracy and repeatability.

The instruments segment is growing at the fastest rate in the in vitro diagnostics market. Analyzers are standard, as they automate and analyze samples for various procedures, including hematology, clinical chemistry, immunoassays, and molecular diagnostics. Hematology analyzers examine blood samples for parameters such as CBC, white blood cell differential, and red blood cell indices, whereas clinical chemistry analyzers evaluate organ function and metabolic diseases. Immunoassay analyzers identify particular proteins or antibodies in samples, whereas molecular diagnostics tools examine nucleic acids for genetic problems, viral illnesses, and cancer. POCT devices produce speedy results in a variety of contexts.

Personalized your customization here: https://www.precedenceresearch.com/customization/1130

By Technology

Among different diagnostics, molecular diagnostics segment dominated the market, and immunoassay is the fastest-growing segment. Immunoassays detect specific antigens or antibodies, while clinical chemistry tests assess organ function and metabolic disorders. Molecular diagnostics detect genetic material, while hematology tests analyze blood cells and parameters. Microbiology tests identify microorganisms, while coagulation tests assess blood clotting. Point-of-care testing (POCT) provides rapid results for immediate treatment decisions. Genetic testing analyzes DNA to detect genetic mutations.

By Application

The infectious diseases segment dominated the market in 2023, and the oncology segment is anticipated to be the fastest-growing segment. Diabetes is diagnosed using blood glucose monitors and hemoglobin A1c testing, while heart problems are evaluated with cardiac biomarker studies. Nephrology assesses kidney function and diagnoses illnesses using tests such as serum creatinine and estimated glomerular filtration rate. HIV, hepatitis, TB, influenza, and sexually transmitted illnesses are all infectious diseases that are detected through testing. Oncology uses IVD testing for cancer diagnosis, prognosis, and therapy. IVD tests are used to screen for drugs and monitor their levels. Autoimmune illnesses are identified utilizing autoimmune panels and particular antibody assays.

Browse More Insights:

Oncology Market: The global oncology market size was valued at US$ 203.42 billion in 2022 and is expected to reach over US$ 470.61 billion by 2032, poised to grow at a noteworthy CAGR of 8.8% from 2023 to 2032.

Artificial Intelligence in Diagnostics Market: The global artificial intelligence in diagnostics market size is estimated for USD 1.1 billion in 2022 and it is predicted to hit around USD 7.4 billion by 2032, registering at a CAGR of around 21% from 2023 to 2032.

Blood Coagulation Testing Market: The global blood coagulation testing market size reached USD 3.78 billion in 2022 and is expected to hit around USD 6.74 billion by 2032, growing at a CAGR of 5.96% from 2023 to 2032.

IVD Contract Manufacturing Market: The global IVD contract manufacturing market size was estimated at USD 17.12 billion in 2023 and is projected to hit around USD 45.59 billion by 2032, registering a CAGR of 11.50% from 2023 to 2032.

Regenerative Medicine Market: The global regenerative medicine market size accounted for USD 22.24 billion in 2022 and it is predicted to be worth around USD 174.72 billion by 2032 with a remarkable CAGR of 22.8% from 2023 to 2032.

DNA Sequencing Market: The global DNA sequencing market size is expected to be worth around USD 37.99 billion by 2032 from USD 11.06 bn in 2023, with a CAGR of 14.7% from 2023 to 2032.

Market Dynamics

Drivers:

Increasing prevalence of chronic and infectious diseases

The in vitro diagnostics market is booming as chronic and infectious illnesses become more prevalent. Chronic diseases such as diabetes and cancer need constant monitoring and care, resulting in a need for precise diagnostics. Rapid diagnosis is required for infectious illnesses such as HIV/AIDS, hepatitis, TB, and respiratory infections to be treated effectively.

The rising frequency of these diseases is pushing the need for diagnostic tests, notably immunoassays, molecular diagnostics, and point-of-care testing. Technological improvements allow more sensitive, precise, and quick testing for specific disorders. Furthermore, increased knowledge of preventative healthcare is boosting demand for early identification and monitoring of chronic disorders, which leads to better patient outcomes.

Technological Advancements

Technological improvements have substantially influenced the in vitro diagnostics market, strengthening accuracy and sensitivity, increasing efficiency and throughput, and allowing downsizing and point-of-care testing. Molecular diagnostics breakthroughs like PCR and NGS have transformed disease identification and surveillance. Remote monitoring and real-time data exchange are now possible thanks to digital health technology, allowing for more tailored healthcare interventions.

Artificial intelligence and machine learning algorithms are utilized to examine large datasets, resulting in more accurate interpretations and individualized treatment suggestions. Personalized medicine is also being developed, which involves using diagnostic tests to adapt treatment strategies to individual patients based on their unique genetic composition or biomarker profiles.

Restraints:

Limited Awareness and Education

The in vitro diagnostics market is hampered by a lack of knowledge and education on the benefits of diagnostic testing. This results in underutilization of tests, limited patient involvement, sluggish acceptance of new technology, uneven testing procedures, and access restrictions. Healthcare practitioners may request tests infrequently, resulting in underdiagnosis or delayed illness diagnosis. Patients may refuse to undergo testing due to misunderstandings or fear, resulting in missed early identification and treatment possibilities.

Regulatory Challenges

In vitro diagnostics has substantial regulatory obstacles, including rigorous clearance processes by authorities such as the FDA and EMA, continually developing regulatory criteria, worldwide harmonization, reimbursement approval, and stringent quality assurance standards. These processes can be time-consuming and expensive, delaying the market introduction of new items.

Harmonization across regions can be complex since each country has unique criteria. Furthermore, gaining reimbursement clearance for IVD products can be complicated, adding to the regulatory burden. Finally, producers must adhere to rigorous quality assurance requirements to ensure product safety and efficacy.

Opportunity

Personalized Medicine

Personalized medicine, often precision medicine, is a healthcare strategy that considers individual genetic, environmental, and lifestyle characteristics. It provides different chances for in vitro diagnostics (IVD), such as companion diagnostics, pharmacogenomics, cancer diagnostics, disease risk assessment, biomarker monitoring, and patient stratification. Companion diagnostics enable healthcare practitioners to identify the efficacy of a particular therapy based on an individual's genetic or molecular traits, enhancing treatment outcomes.

Pharmacogenomic testing predicts an individual's reaction to a treatment, allowing for more precise dosing and alternative medications. Cancer diagnostics detect particular genetic alterations or biomarkers, which inform therapy recommendations. Personalized medicine also enables disease progression tracking and patient classification, resulting in more focused clinical trials for potential therapies. Other specialties include fertility, thyroid function, allergy, and genetic testing for inherited disorders.

Recent Developments

- In March 2024, The Indian Council of Medical Research (ICMR) and the Central Drugs Standard Control Organization (CDSCO) launched a ground-breaking agreement to strengthen the Testing and Validation Ecosystem for In Vitro Diagnostics (IVDs).

- In Oct 2023, The World Health Organization (WHO) announced its 2023 Essential Diagnostics List, an evidence-based registry of in vitro diagnostics that includes three hepatitis E virus tests and suggestions to add personal glucose monitoring devices alongside existing diabetic management guidelines.

- In Oct 2023, The IMT/PAHO department translated the WHO's guideline paper on choosing critical in vitro diagnostics at the country level, creating and updating a national list based on the WHO model.

- In May 2023, the 76th World Health Assembly adopted a resolution urging Member States to establish national diagnostics strategies, including the creation of essential lists and the inclusion of both in-vivo and in-vitro diagnostics in health planning.

Key Market Players

- Arkray

- Alere, Inc.

- Bio-Rad laboratories

- Abbott Laboratories

- Danaher

- Becton Disckinson

- Hoffmann-La Roche Ltd.

- Sysmex Corporation

- Beckman Coulter

Market Segmentation

By Product

- Reagents

- Instruments

- Services

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Diabetes

- Cardiology

- Nephrology

- Infectious Disease

- Oncology

- Drug Testing

- Autoimmune Diseases

- Others

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1130

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: