Ottawa, March 08, 2024 (GLOBE NEWSWIRE) -- The personal care packaging market size accounted for USD 34.36 billion in 2024 and is projected to surpass around USD 52.35 billion by 2030, a study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

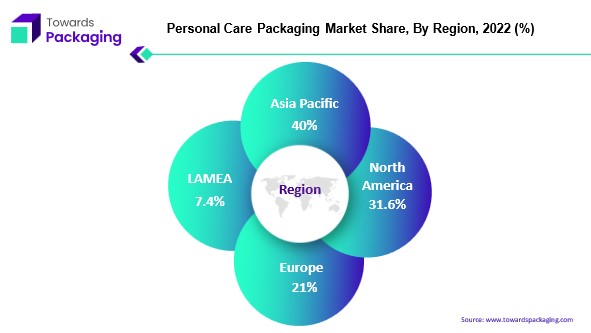

- Asia Pacific's dominance in shaping the global landscape of personal care packaging.

- Changing tactics in North America's personal care packaging industry.

- Plastic's domination and the sustainability surge in personal care packaging.

- Ascendance of skincare and its transformative impact on the personal care packaging industry.

The packaging industry that specialises in designing, manufacturing and delivering packaging solutions for a variety of personal care products is called The Personal Care Packaging market. These products include cosmetics, skincare, hair care, fragrances and toiletries, among others. Personal care packaging is designed not simply to hold and protect products, but also to improve their visual appeal, functionality and overall consumer experience. This market frequently entails the employment of novel materials and designs to satisfy the special requirements of personal care items, taking into account elements such as product preservation, simplicity of use and visual appeal in order to attract customers.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5108

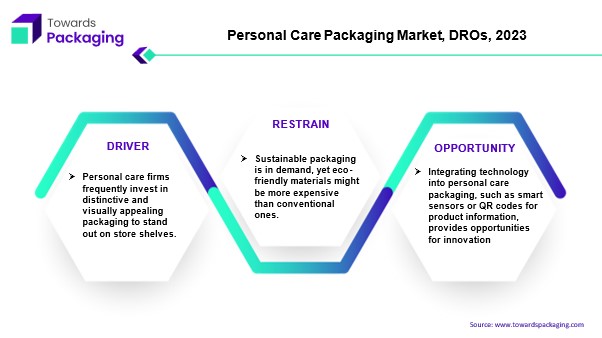

E-commerce has bolstered personal care sales, with online sales accounting for more than 27% of total revenue this year. Nonetheless, sustainability requirements change the sector, including increased demands, promises, and product lines. Companies are reconsidering their net carbon emissions while consumers aim for a zero-waste lifestyle. Reusable packaging was especially popular among consumer-packaged goods brands; 48 percent of personal care and 50 percent of home care companies chose it as the best option for environmentally friendly packaging.

For Instance,

- In July 2022, the first of on Top Cosmetics' four main face cream products, Renewal Oil Cream, debuted with 50% certified recycled Eastman Cristal Renew copolyester packaging.

The personal care packaging market refers to the industry segment specializing in designing, manufacturing and distributing packaging solutions specifically tailored for personal care products. These products encompass a wide range of items related to personal hygiene, skincare, cosmetics, hair care and toiletries. The primary purpose of personal care packaging is to provide protective enclosures for these products, ensuring their integrity, quality and safety throughout the supply chain, from manufacturing to retail shelves and ultimately into the hands of consumers. The significance of personal care packaging extends beyond functional protection. It also plays a crucial role in branding and marketing, contributing to the overall visual appeal of products on store shelves and influencing consumer purchasing decisions. Innovations in this industry frequently focus on increasing user experience, product dispensing techniques, and incorporating interactive and informational technologies. Smart package solutions, such as QR codes, NFC (near-field communication), and other digital features, are becoming more common, giving consumers additional information or engaging experiences about the personal care goods they buy.

Personal Care Packaging Market Trends

Asia Pacific's Commanding Role in the Global Personal Care Packaging Arena

The Asia Pacific region emerges as the major player in the personal care packaging market, accounting for 43% of total global sales. Within this vast industry, China, Japan and Korea stand out as the principal customers, accounting for an astounding 70% of total market value. This regional domination establishes Asia Pacific as a major player in the personal care packaging sector. Despite its importance, some difficulties loom over the market's near-term prospects in key markets such as China and Korea. The ongoing fight against the pandemic has created a dynamic and ever-changing set of government restrictions in reaction to the shifting scenario. This volatility makes the short-term picture less appealing to investors and business participants.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

The personal care packaging market in the Asia Pacific region has enormous long-term growth potential. The growing middle class, Western cultural influences, and rising earnings all help to fuel the market's upward trend. These socioeconomic variables increase the demand for personal care goods and feed the need for creative and appealing packaging solutions. The market's heterogeneity presents a hurdle to profitability, as businesses must traverse numerous submarkets with varying consumer preferences. Striking a balance between serving some clients' price-sensitive demands and achieving others' quality expectations is critical for long-term success in this diverse market.

The popularity of online shopping in countries such as Korea and China have considerably impacted the expansion of personal care packaging in the Asia-Pacific area. Due to their propensity towards the digital realm and inherent digital knowledge, these populations have made it easier for foreign firms to enter the market through social media channels. This digital integration promotes the smooth adoption of Western methods by making spreading trends and behaviours easier. It helps the personal care packaging industry flourish in the area. The dynamic nature of the current pandemic presents short-term hurdles. Still, the Asia Pacific area continues to lead the way in personal care packaging, offering significant long-term growth potential driven by changing demographics, cultural influences and the region's proficiency in technology population.

For Instance,

- In January 2024, Dow launched its most recent cutting-edge components at Bangkok, Thailand's in-cosmetics Asia 2023. One of the most extensive portfolios in the personal care sector, which emphasizes high-performance and sustainable solutions, is celebrated by the new product launches, which include the introduction of the Sustainable Hair Care Collection and Beauty Rebalanced 2.0 Concepts Collection.

Evolving Strategies in North America's Personal Care Packaging Industry

North America is the second largest region in the personal care packaging market, with the United States accounting for more than 80% of the overall value. This market is shared with Canada and Mexico, and in recent years, growth has been robust in the makeup goods area, outpacing other categories. The North American market is expected to be the most steady and consistent of the three major regions. The North American personal care packaging industry is renowned for its uniformity in buyer preferences, allowing marketers to develop a cohesive action plan to reach most customers. The region's high degree of customer taste homogeneity, particularly between the two biggest economies (the United States and Canada), opens up new markets and fosters a climate conducive to foreign corporations asserting dominance.

For Instance,

- In January 2024, skincare company introduced the first water-dissolvable wipe to the US market.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5108

The COVID-19 epidemic showed the region's excessive reliance on specialized supply strategies. To reduce operational risks, firms are increasingly embracing manufacturing-oriented strategies. This change improves operational resilience and corresponds with broader industry trends and consumer expectations. Unlike other markets with a diversified client base, the North American market is far more uniform, allowing for more significant consolidation. The existence of large firms that profit from economies of scale tends to erode the market position of smaller companies. Promoting sustainability and carbon neutrality also impacts the North American personal care packaging business. Businesses are changing their strategies, moving away from traditional and manufacturing-oriented sourcing models to capitalize on market gaps. This strategic shift is consistent with the increased emphasis on sustainability in consumer preferences and legislative frameworks, impacting the industry's trajectory in the region.

Plastic's Reign and the Sustainability Wave in Personal Care Packaging

Plastic is a dominant material in the personal care packaging industry, accounting for most industrial output. It accounts for a significant share, ranging from 50% to 60% of all available market products. Plastic's appeal is due to its shatterproof nature, lightweight properties and durability, making it a suitable alternative to glass, typically used in scent packaging. Furthermore, corporations are strategically minimizing the number of raw plastic materials required in production, increasing cost efficiency. Despite plastic's dominance in the personal care packaging industry, there is increasing awareness and pressure on companies to incorporate sustainable solutions and features into their offers. This has encouraged businesses to look for alternatives to traditional low-cost materials, resulting in biodegradable plastics and packaging made from cork and wood.

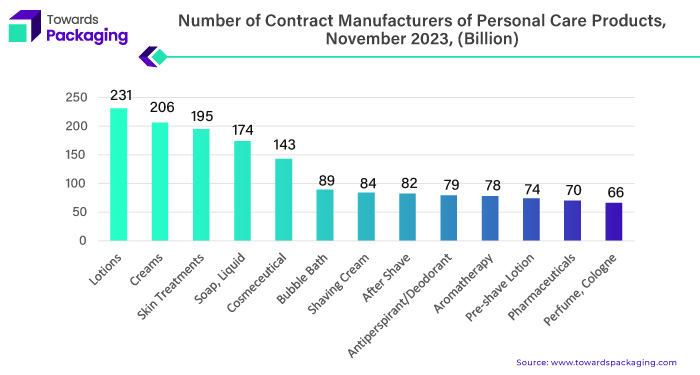

The personal care packaging market provides various sizes and formats, with tubes dominating the scene. While bottles and jars remain popular, businesses have taken advantage of the simplicity and portability provided by small tubes. This trend is consistent with consumer preferences for on-the-go items and supports the push for more practical and readily transportable packaging solutions. Plastic is popular in personal care packaging due to its practical properties. However, the industry is moving towards sustainability. Companies are looking at alternative materials to address environmental concerns, and the market is also responding to changing consumer desires for easy and portable packaging designs, particularly tubes.

For Instance,

- In June 2022, 'Design4Circularity' Introduces Plastic Personal Care Packaging Clariant, Siegwerk, Borealis, and Beiersdorf recycling partnership revolves around a colorless, sleeved, 100% PCR polyolefin cosmetic bottle.

Skincare's Rise is Reshaping the Personal Care Packaging Industry

Skincare is the dominant segment in the personal care packaging industry, accounting for two-fifths of the overall market value. According to L'Oréal, skincare products have accounted for roughly 60% of global market growth. Despite the problems provided by the epidemic, the skincare industry expanded significantly due to increased awareness of self-care. The increase in interest can be related to the widespread adoption of skincare routines, emphasizing having perfect skin, which is essential in social interactions. This trend has notably resonated with younger consumers, attracting them to the cosmetics industry—the pandemic-induced focus on general well-being and greater health awareness aided in developing skincare regimes. Notably, an upsurge in skincare can be ascribed to overusing high-alcohol products, indicating shifting consumer tastes and habits.

For Instance,

- In July 2023, Croxsons, a glass packaging business based in the United Kingdom, launched new primary packaging for Necessary Good, a refillable skincare brand.

Digital innovations are altering brand-customer relationships in the skincare industry. Digital services play an increasingly important part in client advice, helping firms to learn more about their consumers' preferences, wants and expectations. In a significant advance, market leader Shiseido announced Optune, an IoT-based service that provides personalized skincare advice based on a skin condition study. This convergence of technology and skincare exemplifies the industry's dedication to innovation and satisfying particular client needs. The skincare industry has been a significant driver in personal care packaging, growing significantly despite the pandemic's obstacles. The focus on skincare practices, the desire for perfect skin and the incorporation of digital services highlight how the cosmetics industry is changing and how companies are adjusting to satisfy the needs and tastes of a customer base, becoming more aware of health issues.

The five primary business segments of the global personal care market are skincare, haircare, color (make-up), fragrances and toiletries. These markets complement one another well, and because of their diversity, they can meet the demands and expectations of every customer when it comes to cosmetics. Beauty goods can also be separated into luxury and mass-production categories dependisng on the brand prestige, cost, and distribution methods.

Browse More Insights of Towards Packaging:

- The global protective packaging market size has reached USD 30,904.05 million in 2023 and is expected to reach USD 46,243.03 million by 2032, at a CAGR of 4.6% from 2023 to 2032.

- The global rigid plastic packaging market size was valued at USD 310.65 billion in 2023 and is estimated to reach around USD 542.91 billion by 2032, exhibiting a CAGR of 6.4% between 2023 and 2032.

- The global eco-friendly packaging market size is anticipated to hit around USD 430.38 billion by 2032, increasing from USD 222.61 billion in 2023, and growing at a CAGR of 7.6% between 2023 and 2032.

- The global artificial intelligence in packaging market size was at USD 2,021.3 million in 2022 to expected to hit USD 5,375.28 million by 2032, at 10.28% CAGR from 2023 to 2032.

- The global green packaging market size is estimated to grow from USD 303.83 billion in 2022 to reach an estimated USD 510.93 billion by 2032, at a 5.3% CAGR from 2023 to 2032.

- The global pet food packaging market size is estimated to grow from USD 11.38 billion in 2022 to set foot on USD 22.08 billion by 2032, at 6.9% CAGR from 2023 to 2032.

- The global corrugated packaging market size is expected to grow from USD 276 billion in 2022 and it is predicted to hit around USD 410.50 billion by 2032, at 4.10% CAGR from 2023 to 2032.

- The global cosmetic packaging market size accounted for USD 33.07 billion in 2022 to reach USD 54.13 billion by 2032 at 4.5% CAGR from 2023 to 2032.

- The global edible packaging market size current valuation, standing at USD 1.4 billion in 2022 projected to culminate zenith of USD 5.26 billion by 2032 at 14.2% CAGR between 2023 and 2032.

- The global active packaging market size is estimated to grow from USD 19.2 billion in 2022 at 7.5% CAGR to reach an estimated USD 39.51 billion by 2032, between 2023 and 2032.

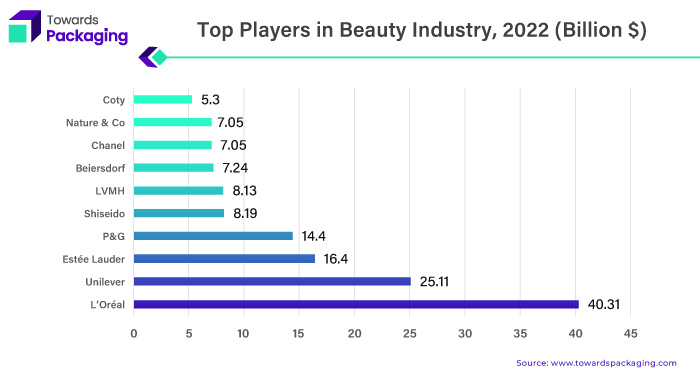

Competitive Landscape

The competitive landscape of the personal care packaging market is characterized by established industry leaders such as Amcor Plc, Gerresheimer Ag, Mondi Group, Ball Corporation, Albea SA, Cosmopak Ltd, Sonoco Products Company, Crown Holdings Inc., RPC Group Plc and HCT Packaging Inc. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

Personal Care Packaging Market Players

Personal Care Packaging Market Players are Amcor Plc, Gerresheimer Ag, Mondi Group, Ball Corporation, Albea SA, Cosmopak Ltd, Sonoco Products Company, Crown Holdings Inc., RPC Group Plc and HCT Packaging Inc.

Recent Developments:

- In October 2022, Dow announced two new ionomers to use regenerative and sustainable materials from streams of biowaste and plastic for packaging beauty items.

- In September 2023, The ShawKwei & Partners portfolio firm ICONS Beauty Group, which specializes in cosmetics, beauty, and health, announced that it had acquired 100% of CTL Packaging USA, Inc. (CTL). CTL is now going to be known as ICONS America LLC.

- In December 2023, Cosmoprof India's fourth edition joined distributors, retailers, brands, suppliers, and industry experts at Mumbai's Jio World Convention Centre. Presenting the newest fashions and product releases, the program also examined India's strategic importance as a central hub for the beauty industry.

- In December 2023, The South Korea Nest Filler, a product packaging supplier specializing in cosmetic products and beauty, was acquired by the global supplier of hybrid packaging, which offers plastic, glass, and metal containers to the premium cosmetics industries, along with a range of closures.

- In December 2023, L'Oréal acquired Copenhagen-based Lactobio, a probiotic and microbiome research firm, to expand its understanding of the microorganisms on the skin's surface.

Market Segments

By Material

- Plastic

- Paper

- Glass

- Metal

By Application

- Skin Care

- Hair Care

- Dental Care

- Others

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5108

Explore the statistics and insights concerning the packaging industry and its segmentation: Get a Subscription

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal@ https://www.towardshealthcare.com/

Browse our Consulting Website@ https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/