Dublin, March 19, 2024 (GLOBE NEWSWIRE) -- The "Southeast Asia Construction Equipment Market - Strategic Assessment & Forecast 2024-2029" report has been added to ResearchAndMarkets.com's offering.

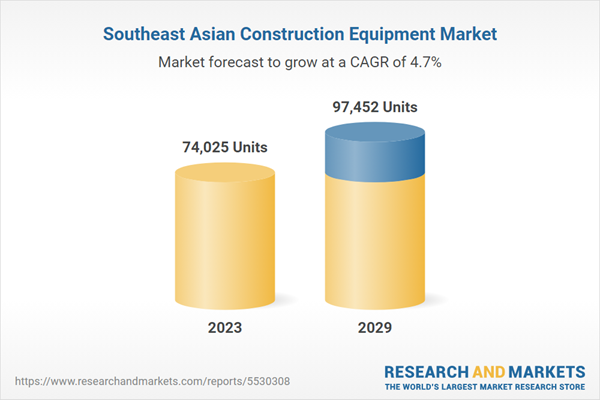

The Southeast Asia construction equipment market by volume was valued at 74,025 in 2023 and is expected to grow at a CAGR of 4.69% from 2023-2029.

Earthmoving equipment accounted for the largest market share of the Southeast Asia construction equipment market in 2023. Excavators in the earthmoving segment accounted for the largest share in 2023. Rising investment in housing, port expansion, and public infrastructure projects is expected to drive the demand for excavators in the Southeast Asia construction equipment market.

In February 2023, LG Energy Solution announced a USD 1.4 billion investment in a nickel processing plant in Indonesia. The plant is expected to produce 60,000 tonnes of battery-grade nickel per year. In March 2023, Sumitomo Metal Mining Co. declared a USD 300 million investment in a copper mine in the Philippines. This mine aims to yield an annual output of 100,000 tonnes of copper. According to the Indonesian Heavy Equipment Single Agent Association, heavy equipment sales were estimated to reach at least 18,000 units in 2023, whereas the 2022 sales were recorded at 20,300 units (an 11.3% decrease).

Increased Investment in Public Infrastructure Projects

The Southeast Asia construction equipment market by revenue is expected to reach USD 9.1 billion by 2029. Government policies, manufacturing relocation, infrastructure investments, and rising commodity prices have boosted market demand, turning Southeast Asia into a lucrative market for construction machinery.

Indonesia prioritizes infrastructure in its "National Medium-term Development Plan 2020-2024," allocating a significant USD 359.2 billion investment. The approval of the National Capital Law Draft on January 18, 2022, announced the capital's shift from Jakarta to East Kalimantan. This move has prompted the need for a substantial amount of engineering machinery and equipment due to the upcoming construction of the new capital.

Zoomlion has a strong presence in the Southeast Asian "Belt and Road" market, employing a localized channel management approach. The company dominates with its crane products, holding approximately 65% share in Malaysia and being recognized as Thailand's most familiar Chinese brand.

Many major construction projects are in progress in Thailand. The Eastern Economic Corridor (EEC) is a plan by the government to turn three provinces in eastern Thailand into a center for new ideas and technology development. As part of this project, they're building new roads, railways, and airports and setting up places for industries and logistics.

The government spending in Thailand's construction sector is boosting the economy. The government anticipates a 4% growth in the industry in 2024, generating more than a million jobs. In 2023, private investment hit USD 9.2 billion, and this trend will likely keep rising. By 2030, Singapore aims to increase the railway system to approximately 360 km. This objective entails linking eight out of every ten households within a 10-minute of a train station. A 360-km rail network will position Singapore with a total railway span surpassing prominent cities like Tokyo or Hong Kong.

MARKET TRENDS & DRIVERS

Rise in Investments in the Renewable Energy Sector Across Southeast Asia

Indonesia's PLN's USD 172 billion investment plan focuses on renewable energy projects and grid upgrades to add 60 GW of new renewable power capacity. The Institute for Essential Services Reform (IESR) also planned the 'Central Java Renewable Energy Investment Forum 2023' to encourage investment opportunities in the country.

In 2023, Thailand witnessed a large amount of investment in the green energy sector. Within the initial eight months of 2023, the Board of Investment approved applications for energy projects valued at approximately USD 1.1 billion, recording an increase of 112% compared to the same period in 2022.

Rising Focus on Compact and Electric Construction Equipment

The electric equipment market in the Southeast Asia construction equipment market is anticipated to be driven by factors like government initiatives, growing demand for eco-friendly construction projects, and the trend toward industrialization. However, a significant challenge is the substantial cost of electric construction machinery, which might impede industry growth. However, to align with the global net zero emission target, the companies are focusing on capitalizing on lithium-ion battery technology in electric excavators and other products to reduce their carbon footprint.

Rise in Waste-To-Energy Projects in the Region to Drive the Market for Wheel Loaders in the Southeast Asia Construction Equipment Market

Waste-to-energy is vital for Indonesia's renewable energy goals, aiming to increase its share to 23% in the energy mix by 2025, highlighting a significant rise from the current 13% in 2023. Therefore, the government focuses on effective waste management to drive environmental and sustainable energy initiatives. In Indonesia, several waste-to-energy projects are underway in 2023. For instance, the Denpasar waste-to-energy power plant is a 20MW biopower project costing USD 400 million. Construction is expected to commence in 2026 and achieve commercial operation by 2027.

Surge in Investments in the Construction Industry Across Southeast Asia to Boost the Sales of Earthmoving Construction Equipment

According to the Building & Construction Authority (BCA), the total value of construction projects 2023 in Singapore is between USD 19.8 and USD 23.5 billion. The public sector attracts the highest demand, contributing to nearly 60% of total construction demand 2023. This is supported by pipeline public housing projects and the Housing Development Board's ramping up of Build-To-Order flats.

Further, the government is significantly investing in projects in Laos, Cambodia, Malaysia, and the Philippines. The Philippines government is significantly investing in affordable housing. The Pambansang Pabahay para pa Philipino Housing Program (4PH) aims to build one million housing units annually between 2023 and 28. The growth of the construction industry in various region countries is projected to support the Southeast Asia construction equipment market growth.

High Expenditure in Green Hydrogen Projects to Encourage the Sales of Construction Equipment

In 2023, the Singaporean government invested heavily in the hydrogen initiative. In Jan 2023, the government unveiled an investment of USD 55 million for 12 R&D projects focused on hydrogen. Moreover, the government has also invested in low-carbon technologies. In July 2023, the government announced its participation in the Castor Initiative to explore the potential benefits of hydrogen economy development. In Oct 2023, Vietnam organized the National Green Hydrogen Summit to explore advancements in the country's green hydrogen sector.

The Prominent Mining Sector in Southeast Asia Strengthens the Southeast Asia Construction Equipment Market

The Thai government has invested substantially in mining in the past few years, aiming to enhance the nation's gold, copper, and tin resources. In 2023, the government allocated a budget of USD 580 million for mining development projects under the Department of Mineral Resources (DMR). The DMR has undertaken thorough exploration and geological mapping to pinpoint new mineral reserves. These efforts have played a crucial role in attracting foreign mining investments.

The government has allocated USD 50 million to boost research and development in the mining sector through the Singapore Mining Research and Technology Centre (SMART). Additionally, USD 100 million has been invested in establishing a new mineral processing and logistics hub at Jurong Port.

INDUSTRY RESTRAINTS

Skilled Labour Shortage in the Region to Impact the Growth of Construction Industry

In 2023, Indonesia witnessed a significant deficit in its skilled labor aggregate, recording approximately 17.2 million workers. Indonesia depends on cheap foreign labor, and the political backlash impacts foreign participation. Additionally, Thailand's service sector, which constitutes about 58.7% of the GDP and employs 20.8 million workers, representing 53% of the total employment, has witnessed a labor shortage issue in 2023.

Rising Construction Costs in the Region to Hamper the Pace of Construction Projects

The countries in the region are also witnessing increasing mortgage rates in Southeast Asia, impacting the residential demand in the area. Indonesia has been increasing the cost of borrowing to address the inflationary pressure. The Bank of Indonesia raised its interest rates by 250 basis points in 2023.

In Singapore, construction expenses have consistently risen for different types of buildings over the last three years. Residential flat construction costs have seen a significant 26% surge from 2021 to 2023. The tender price index from the Building and Construction Authority also confirms this pattern, showing a 30% increase in construction costs for commercial buildings during the same period.

High Demand for Rental Construction Equipment to Hinder the Southeast Asia Construction Equipment Market Growth

- The global pandemic and geopolitical crises have resulted in supply chain disruptions for construction equipment manufacturing, ultimately driving prices upwards. For example, the semiconductor chips required for equipment engines have recently risen manifold times.

- The price of some microcontroller chips in Malaysia has increased by approximately 400% in 2022. Additionally, chip manufacturing costs in Singapore increased by 20% in 2022.

- Other raw materials, such as steel prices, have also magnified. The cost of iron ore and choking coal, critical inputs in steel production, has also risen.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 337 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 74025 Units |

| Forecasted Market Value by 2029 | 97452 Units |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Asia Pacific |

VENDOR LANDSCAPE

Key Vendors

- Caterpillar

- Hitachi Construction Machinery

- Komatsu

- Liebherr

- Volvo Construction Equipment

- Kobelco

- Kubota

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- SANY

- Xuzhou Construction Machinery Group (XCMG)

- Hyundai Construction Equipment

- SUMITOMO CONSTRUCTION MACHINERY CO., LTD.

- Develon

- JCB

Other Prominent Vendors

- Yanmar

- Tadano

- Takeuchi Manufacturing

- Manitou

- Toyota Material Handling

- AUSA

- KATO WORKS CO., LTD.

- Haulotte

- MERLO S.p.A.

- Bobcat

- Terex Corporation

- LiuGong

- CNH Industrial

- Sunward Intelligent Equipment Group

- Shantui Construction Machinery Co., Ltd.

- AMMANN

Distributor Profiles

- Sia & Yeo Heavy Equipment Pte Ltd

- TIONG LEE HUAT MACHINERY & CONSTRUCTION PTE LTD

- PLS MACHINERY PTE LTD

- Ricon

- LAND EQUIPMENT PTE LTD

- Italthai Industrial

- Leadway Heavy Machinery Co., Ltd.

- Ariya Group

- Paragon Machinery

- PT Indotruck Utama

- United Tractors

- Multicrane Perkasa

- PT Airindo Sakti

- SIN LOY HENG Engineering Sdn Bhd

- UM Construction Equipment Sdn Bhd

- Topspot Heavy Equipment Inc.

- BinhLoi CO., LTD

For more information about this report visit https://www.researchandmarkets.com/r/jj454z

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment