Dublin, March 20, 2024 (GLOBE NEWSWIRE) -- The "U.S. Pharmacy Benefit Management (PBM) Market - Focused Insights 2024-2029" report has been added to ResearchAndMarkets.com's offering.

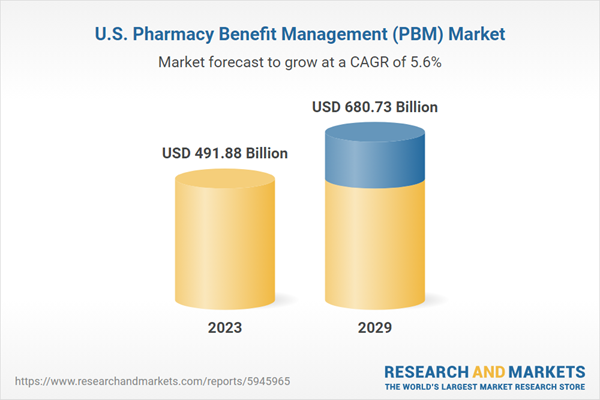

The U.S. pharmacy benefit management (PBM) market was valued at USD 491.88 billion in 2023 and is expected to reach a value of $680.73 billion by 2029, growing at a CAGR of 5.56% from 2023-2029.

The U.S. pharmacy benefit management (PBM) market report includes exclusive data on 27 vendors. CVS Health, Cigna Healthcare, United Health Group, Prime Therapeutics, MedImpact, and Humana dominate the U.S. Pharmacy Benefit Management market. The major players focus on strategic acquisitions and collaborations with emerging players to enter the pharmacy benefit management market and gain a competitive advantage.

The southern region dominated the segment of the U.S. pharmacy benefit management (PBM) market, with a share of 30% in 2023. The growth of this region is due to the presence of high rates of chronic disease and poor health conditions, as well as a high percentage of insurers in the southern states. Kentucky, West Virginia, Virginia, and Louisiana are the top states with a high percentage of insurers among the southern states in the U.S.

MARKET TRENDS

Specialty drugs Continuing to Drive Rx Spend: Specialty drugs represent the fastest-growing area of pharmacy spend. Over the years, specialty drug growth has been driven by adopting innovative drugs, such as those for oncology and autoimmune therapies. According to the IQVIA Institute, 50-55 new specialty drugs will be launched annually over the next four years.

Specialty drugs will continue evolving, helping cure or curb symptoms for patients with complex or chronic medical conditions. As new drugs hit the market and prices continue to rise, health plan sponsors will continue to look to their pharmacy benefit management markets (PBMs) to help address the cost and accessibility of prescription drugs.

The Growth Of Innovative PBM Pricing Strategies: The continued evolution of the pharmacy benefit management (PBM) market contracting model and pricing strategies is expected to continue. For example, to counteract the high prices of specialty drugs, PBMs are embracing outcomes-based contracting. According to a recent national healthcare consulting firm study, 58% of payers had entered outcomes-based contracts as of 2022. Another alternative PBM pricing strategy includes the growing use of innovative utilization tools.

U.S. PHARMACY BENEFIT MANAGEMENT MARKET HIGHLIGHTS

- The medicare plan of health plan segment is growing significantly, with the fastest-growing CAGR of 6.74% during the forecast period. The growth of this segment is attributed to several factors, which include a shift towards virtual care delivery, more home care, and the adoption of value-based care models.

- The insurance companies & retail pharmacies segment dominates the share with over 75% of the U.S. pharmacy benefit management (PBM) market. Many reasons, including the expanding access to testing and diagnosis and growing awareness among the general population across the U.S., contribute to the growth of this segment.

- The claim processing in the service segment is the fastest-growing in the U.S. pharmacy benefit management (PBM) market during the forecast period. The growth of this segment is mainly due to the benefits it offers from pharmacy benefit management (PBM) market claims auditing, which monitors payment integrity and fraud, waste, abuse of health plans, employers, Medicare Advantage Part D plans, brokers, Taft-Hartley funds, and other pharmacy plans.

KEY QUESTIONS ANSWERED

- How big is the U.S. pharmacy benefit management market?

- What is the growth rate of the U.S. pharmacy benefit management market?

- Who are the dominating players in the U.S. pharmacy benefit management market?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 96 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $491.88 Billion |

| Forecasted Market Value (USD) by 2029 | $680.73 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | United States |

VENDORS LIST

Key Vendors

- CVS Health

- Cigna Healthcare

- UnitedHealth Group

- Prime Therapeutics

- MedImpact

- Humana

Other Prominent Vendors

- Abarca

- Elevance Health

- AscellaHealth

- CaptureRx

- Centene

- Change Healthcare

- CitizensRx

- Elixir

- MedalistRx

- MaxorPlus

- Navitus Health Solutions

- PerformRx

- WellDyne

- ProCare Rx

- NirvanaHealth

- Anthem

- BeneCard PBM

- Shields Health Solutions

- Magellan Rx Management

- Walgreens Boots Alliance

- RITE AID

Segmentation & Forecast

By Health Plan

- Commercial Health Plans

- Medicare Plan

- Medicaid Plan

- Others

By Business Model

- Insurance Companies & Retail Pharmacies

- Pure Play PBMs

By Service

- Special Pharmacy Services

- Retail Pharmacy Networks

- Mail-order pharmacy services

- Claims Processing

- Formulary Management

- Drug Utilization Review

- Price, Discount & Rebate Negotiations

- Disease Management & Adherence Initiatives

By Region

- South

- Mid-West

- West

- Northeast

For more information about this report visit https://www.researchandmarkets.com/r/uxyar

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment