Dublin, March 21, 2024 (GLOBE NEWSWIRE) -- The "Sea Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2020 - 2029" report has been added to ResearchAndMarkets.com's offering.

The Sea Freight Forwarding Market size is estimated at USD 75.21 billion in 2024, and is expected to reach USD 96.86 billion by 2029, growing at a CAGR of 5.19% during the forecast period (2024-2029).

Key Highlights

- The global sea freight forwarding market is booming, owing to the growing internet penetration, increasing Purchasing Power Parity, and developments in infrastructure and services designed particularly for the e-commerce industry. The epidemic negatively impacted the shipping industry as workforces in these sectors were shut down for safety and to prevent the spread of COVID-19.

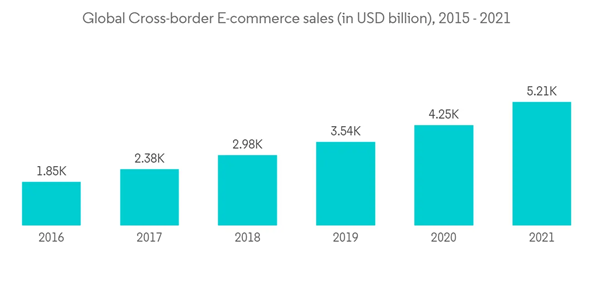

- Sea freight forwarding has emerged as a preferred mode among several end-user industries and several strategic partnerships are also likely to promote the growth of sea freight forwarding during the forecast period. The growing global cross-border e-commerce market is driving the LCL volume and is positively impacting the sea freight forwarding market growth.

- Sea freight has been an important means of transporting goods, products, and people for thousands of years. Today, ships transport vital commodities such as coal, oil and gas, supporting the global economy. In 2021 alone, about 1.5 million tonnes of coal and about 1.10 million tonnes of oil were shipped.

- More importantly, about 85% of all goods are transported by sea, mainly by container ships. Compared to other means of transport, vessels have vast capacities suitable for transporting large, heavy, and bulky items that are more economical while producing relatively small amounts of emissions.

- Shipping rates are expected to drop further for the rest of the year and into 2023, according to shipowners and analysts. With a number of new vessels entering service over the next two years, net growth in the fleet size is expected to be over 9% through 2023 to 2024. By contrast, container volume growth in 2024 could be slightly negative according to Braemer.

Rising Cross Broder E-Commerce is driving the Market

In 2021, retail e-commerce sales worldwide amounted to around USD 5,211 Billion and e-retail revenues are projected to grow even further at a quicker pace in the coming few years. Further, as online shopping is one of the most popular online activities worldwide is driving both the domestic and cross-border e-commerce in developing markets such as China, India, and Indonesia. This encompasses not just direct-to-consumer retail, but also shipments of electronics, pharmaceuticals, and consumer packaged goods.

Growth in e-commerce is tied very closely to the consumption growth in the region as developing economies make the gradual shift from growth by manufacturing for export to higher levels of consumption by expanding middle classes.

In China, cross-border e-commerce transactions already accounted for up to 25 percent of total import and export trading volumes. Compared to China, in other regions, the size of e-commerce related businessess is much smaller, but the growth is also rapid. One of the most preferred modese for e-commerce freight forwarding is through sea and many business are favoring that as evidenced by the growing of ocean freight volumes to 20 billion tons in 2021.

A selection of companies mentioned in this report includes

- Kuehne + Nagel

- Sinotrans

- DHL

- DB Schenker

- DSV Panalpina

- Expeditors

- C.H Robinson

- Ceva Logistics

- Kerry Logistics

- Nippon Express

- Hellmann Worldwide Logistics

- Geodis

- Fr. Meyer's Sohn

- Yusen Logistics

- Bollore Logistics

For more information about this report visit https://www.researchandmarkets.com/r/mkju3v

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment