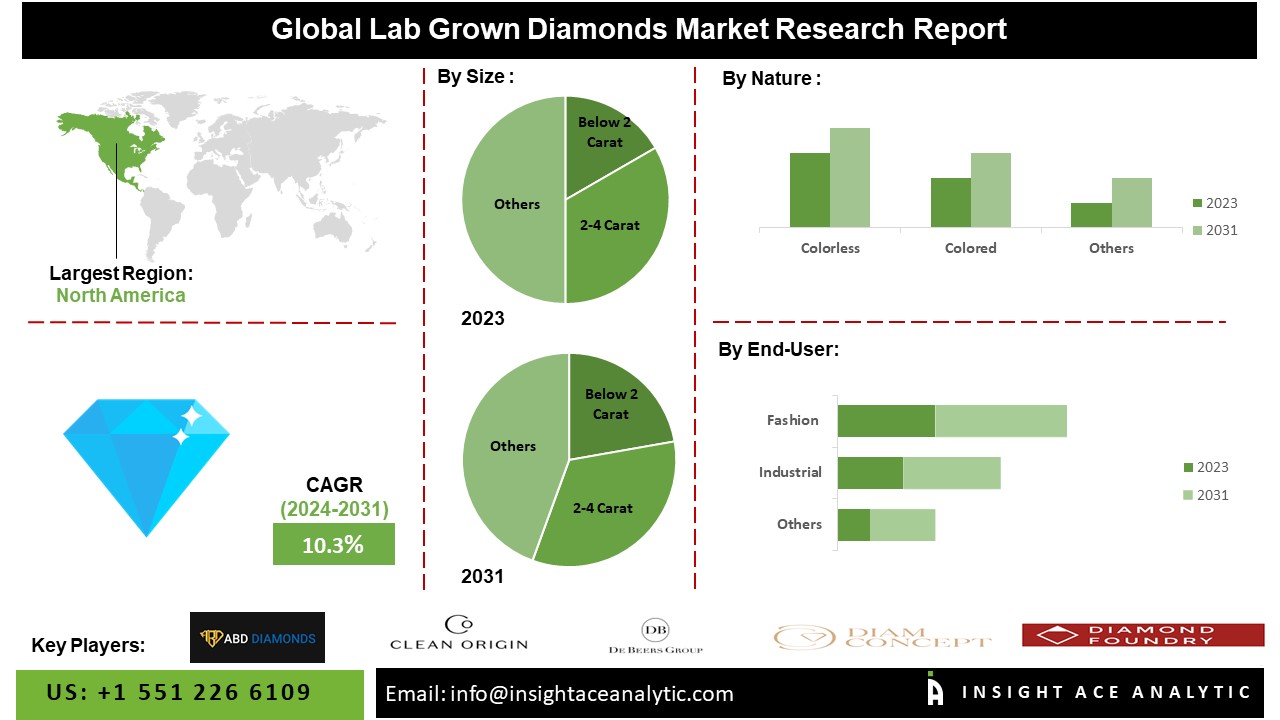

Jersey City, NJ, April 09, 2024 (GLOBE NEWSWIRE) -- According to the latest research by InsightAce Analytic, the Global Lab-grown Diamonds Market is expected to grow with a CAGR of 10.3% during the forecast period of 2024-2031.

The lab-grown diamonds market has emerged as a dynamic and rapidly expanding segment within the gemstone industry. These diamonds, cultivated through controlled laboratory processes rather than mined from the earth, have gained traction due to their ethical and sustainable credentials. The market has witnessed major growth driven by heightened consumer awareness regarding the environmental and social impacts of traditional diamond mining practices.

Furthermore, the increasing preference for conflict-free and eco-friendly diamond options has propelled the demand for lab-grown diamonds. Technological advancements in diamond synthesis techniques have led to improved quality, reduced production costs, and enhanced market competitiveness. While the market faces challenges such as competition from natural diamond producers and regulatory complexities, strategic initiatives by key players and collaborations are fostering market penetration and innovation. Geographically, the lab-grown diamonds market is poised for continued expansion, offering promising opportunities for stakeholders across the value chain.

Download Free Sample Pages of Report : https://www.insightaceanalytic.com/request-sample/2426

List of Prominent Players in the Lab-grown Diamonds Market:

- Abd Diamonds Pvt. Ltd

- Clean Origin LLC.,De

- De Beers Group

- Diam Concept

- Diamond Foundry Inc

- Henan Huanghe Whirlwind CO., Ltd.

- Mittal Diamonds

- New Diamond Technology LLC

- Swarovski AG

- WD Lab-grown Diamonds

Market Dynamics:

Drivers:

The lab-grown diamonds market is propelled by a multitude of drivers contributing to its rapid expansion and adoption. Foremost among these is the growing consumer consciousness regarding the ethical and environmental implications of traditional diamond mining. As consumers increasingly prioritize sustainability and ethical sourcing, lab-grown diamonds, which are free from the controversies surrounding mining practices, have gained significant traction.

Moreover, the rising demand for conflict-free and eco-friendly diamond alternatives further fuels the market growth. Technological advancements in diamond synthesis techniques have also played a pivotal role by enhancing the quality and scalability of lab-grown diamonds while reducing production costs. Additionally, the allure of customization and innovation offered by lab-grown diamonds has attracted consumers seeking unique and personalized jewelry options.

Challenges:

One of the primary challenges is the persistent perception among consumers that natural diamonds hold a higher value and authenticity compared to lab-grown ones. This perception poses a considerable restraint to the widespread acceptance and adoption of lab-grown diamonds, limiting the market growth. Moreover, the need for standardized certification and regulatory frameworks specific to lab-grown diamonds complicates market entry and consumer trust. Additionally, fluctuations in production costs and pricing volatility present challenges for market players in maintaining profitability and competitiveness.

Competition from traditional diamond mining companies, which often hold substantial market share and brand recognition, further complicates the landscape for lab-grown diamonds. Overcoming these restraints will require concerted efforts from industry stakeholders, including enhanced consumer education, establishment of clear industry standards, and continued innovation to improve quality and reduce production costs.

Regional Trends:

The North American lab-grown diamonds market is anticipated to capture a major market share in terms of revenue, owing to factors such as a large consumer base, heightened awareness regarding ethical and sustainable diamond options, and a robust economy supporting consumer spending. Additionally, the region benefits from advanced technological infrastructure and a well-established distribution network, further driving market growth. However, it's essential to note that the Asia-Pacific (APAC) region also presents substantial growth opportunities for the lab-grown diamonds market.

APAC, with its populous countries like China and India, is witnessing a surge in disposable income levels and a growing preference for sustainable and ethically sourced products among consumers. Moreover, rapid urbanization and increasing awareness about environmental concerns contribute to the growing demand for lab-grown diamonds in the APAC region. As a result, while North America holds a prominent position in the lab-grown diamonds market, APAC also emerges as a key region driving market expansion, presenting lucrative opportunities for industry players.

Curious about this latest version of the report? @ https://www.insightaceanalytic.com/enquiry-before-buying/2426

Recent Developments:

- In June 2022, De Beers Group, operating through its subsidiary, Element Six, initiated a collaboration with Thorlabs, a firm specializing in the design and production of photonics equipment. Through this alliance, De Beers Group will offer a range of CVD products, featuring optical diamond-enabled solutions.

- In June 2021, WD Lab-grown Diamonds unveiled Latitude, a fresh brand aimed at expanding its product range. Latitude specializes in the sale of traceable Lab-grown diamonds.

Segmentation of Lab-grown Diamonds Market-

Lab-grown Diamonds Market- By Manufacturing Method

- HPHT

- CVD

Lab-grown Diamonds Market- By Size

- Below 2 Carat

- 2-4 Carat

- Above 4 Carat

Lab-grown Diamonds Market- By Nature

- Colorless

- Colored

Lab-grown Diamonds Market- By Application

- Fashion

- Industrial

Lab-grown Diamonds Market- By Region

North America-

- The US

- Canada

- Mexico

Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific-

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

Latin America-

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa-

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Order the Full Report Copy @ https://www.insightaceanalytic.com/buy-report/2426