Dublin, April 16, 2024 (GLOBE NEWSWIRE) -- The "Global Open Banking Solutions Market by Offering (Solutions, Services), Application (Payment, Banking, Digital Lending), Digital Channel (Mobile, Web), Deployment Model, End User (Account Providers, Third-party Providers) and Region - Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

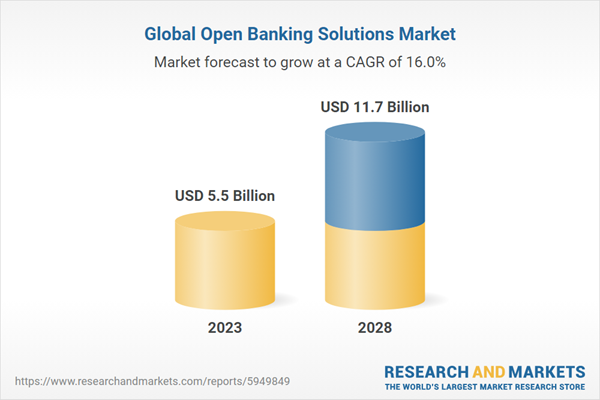

The global open banking solutions market is expected to grow from USD 5.5 billion in 2023 to USD 11.7 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 16% during the forecast period. The market has excellent growth opportunities, such as convenient deployment in remote areas with remote management support, flexibility and ease of access, redundancy for backup, demand for advanced technologies implementation/practice such as AI and 5G, and demand increase in government policies and schemes to leverage Open Banking solutions adoption across verticals and regions.

By Services, Professional Services segment to hold a larger market share during the forecast period

Professional services encompass a broad spectrum of offerings to assist financial institutions, businesses, and stakeholders in navigating the complexities of adopting and optimizing open banking frameworks. These services include consulting and advisory support, where firms provide strategic guidance, assess market trends, and identify relevant use cases to maximize the benefits of open banking initiatives. Implementation and integration partners offer expertise in deploying APIs, ensuring interoperability, scalability, and security across systems.

Training and education programs equip stakeholders with knowledge and skills related to API management, data security, and regulatory compliance. Security and compliance experts also help organizations mitigate cybersecurity risks and ensure adherence to regulatory requirements. Performance monitoring and optimization services track system performance, while customer support and maintenance services provide ongoing functionality and reliability. These professional services enable organizations to leverage open banking effectively, driving innovation, collaboration, and growth in the financial services industry.

By Application, the Wealth Management segment will record the highest CAGR during the forecast period

Open banking solutions are revolutionizing how investment advice is delivered, and portfolios are managed in wealth management. Wealth management firms can create personalized investment strategies tailored to individual goals, risk tolerance, and financial circumstances by analyzing customer data obtained through open banking APIs. This enables investors to access diversified investment options, track portfolio performance, and receive timely insights and recommendations to optimize investment decisions.

Open banking also facilitates greater collaboration and integration between wealth management platforms and banking services, allowing customers to transfer funds between accounts and execute investment transactions efficiently. Moreover, open banking in wealth management introduces behavioral finance insights, enabling wealth managers to understand investor behavior and decision-making processes better. Wealth managers can analyze customer data and transaction patterns to identify behavioral biases and preferences, tailoring investment strategies and recommendations to maximize investor outcomes.

By Solutions, the payment initiation segment is projected to hold the highest market share during the forecast period

The payment initiation segment has redefined how transactions are initiated and processed. By empowering businesses and consumers to seamlessly initiate payments directly from their bank accounts, payment initiation solutions streamline transactions, enhance convenience, and accelerate financial interactions. This innovation eliminates the need for traditional payment methods and fosters a more efficient and secure ecosystem for conducting financial transactions. With its ability to revolutionize the payment experience, payment initiation is a cornerstone of Open Banking, driving a future where financial transactions are more straightforward, faster, and more accessible.

Research Coverage

The market study covers the Open Banking solutions market across segments. It aims to estimate the market size and the growth potential across different segments such as offerings, solutions, services, deployment models, digital channels, applications, end users, and regions. It comprises a thorough competition analysis of the major market players, company biographies, important insights regarding their offers in terms of goods and services, current advancements, and crucial market strategies.

Key Players

Some of the key players operating in the Open Banking solutions market are Plaid (US), MX Technologies (US), Trustly (Sweden), Finicity (US), Tink (Sweden), Envestnet (US), Worldline (France), Volt.io (UK), Temenos (Switzerland), and Axway Software (US) among others.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 305 |

| Forecast Period | 2023-2028 |

| Estimated Market Value (USD) in 2023 | $5.5 Billion |

| Forecasted Market Value (USD) by 2028 | $11.7 Billion |

| Compound Annual Growth Rate | 16% |

| Regions Covered | Global |

Premium Insights

- Compliance with Regulatory Standards, Both Regional and Global, to Support Growth of Open Banking Solutions Market

- Solutions Segment to Account for Larger Market Share During Forecast Period

- Payment Initiation Segment to Account for Largest Market Share During Forecast Period

- Professional Services Segment to Hold Larger Market Share During Forecast Period

- Payment Segment to Hold Largest Market Share During Forecast Period

- Web Portals Segment to Hold Larger Market Share During Forecast Period

- Third-Party Providers Segment to Hold Larger Market Share During Forecast Period

- Middle East & Africa to Emerge as Lucrative Market for Investments in Next Five Years

Market Dynamics

- Drivers

- Increased Consumer Demand and Adoption of Cloud-based Solutions by Financial Institutions

- Increasing Compliance Requirements of New Data Laws and Regulations

- Need for Greater Visibility and Options for Borrowers and Lenders

- Focus on Development of Innovative Product Offerings with Evolving Consumer Requirements

- Restraints

- Lack of Digital Literacy in Certain Emerging Countries

- Opportunities

- Gradual Adoption of Open-Banking Apis

- Growing Demand for State-Of-The-Art Innovations and Improved Personalization

- Emphasis on Better Collaboration and Partnership Among Key Players

- Challenges

- Data Privacy Issues, Security Concerns, and Threat of Ransomware

- Technical Glitches Leading to Losses

Case Study Analysis

- Zip Achieved Cost Reduction and Improved Compliance Adherence with Plaid Monitor

- Cleo Adopted Stripe Solutions to Mitigate Fraud Occurrences

- Anna Deployed Optimized Transaction Module with Help of Truelayer API

- Moneywiz Adopted Salt Edge Tools for Automated Data Extraction and Transformation

- BNP Paribas Deployed Amplify Catalog to Provide API Gateways Across Businesses

Companies Featured

- Plaid

- Envestnet

- Tink

- Mx Technologies

- Finicity

- Worldline

- Trustly

- Bbva

- Gocardless

- Temenos

- Volt

- Axway Software

- Fabrick

- Akana

- Yapily

- Salt Edge

- Token.Io

- Fiorano

- Truelayer

- Bud Financial

- Openpayd

- Finastra

- Sopra Banking Software

- Intuit

- Ndgit

- Tesobe

- Directid

For more information about this report visit https://www.researchandmarkets.com/r/rbupiq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment