Dublin, April 24, 2024 (GLOBE NEWSWIRE) -- The "Global Payment Gateway Market by Type (Hosted, Self-hosted), Vertical (Retail & E-commerce, BFSI, Telecom, Healthcare, Media & Entertainment, Travel & Hospitality, IT & ITeS) and Region - Forecast to 2029" report has been added to ResearchAndMarkets.com's offering.

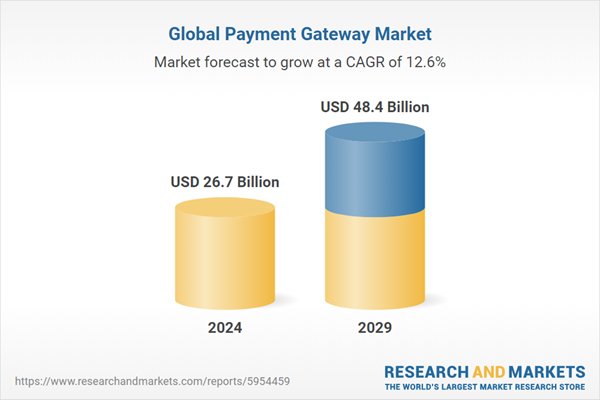

The payment gateway market is estimated at USD 26.7 billion in 2024 to USD 48.4 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 12.6%. Blockchain technology holds immense potential to revolutionize payment processing by offering a secure, decentralized, and transparent ledger system. Payment gateways that explore blockchain integration can position themselves for future advancements in the industry. By leveraging blockchain technology, payment gateways can streamline transaction processes, reduce fees, and enhance security through cryptographic protocols and distributed consensus mechanisms.

Additionally, blockchain-based payment solutions offer greater transparency, enabling real-time tracking of transactions and providing an immutable record of payment history. This transparency not only enhances trust between merchants and consumers but also mitigates the risk of fraud and disputes. Furthermore, blockchain technology enables cross-border payments to be executed more efficiently, eliminating the need for intermediaries and reducing transaction times and costs. As the adoption of blockchain technology continues to grow, payment gateways that embrace blockchain integration stand to benefit from greater efficiency, security, and innovation in payment processing, positioning themselves as leaders in the evolving fintech landscape.

The other payment gateway types segment is expected to hold the second largest market size during the forecast period.

Integrating with local banks presents a significant opportunity for payment gateways to leverage existing security protocols and fraud prevention measures implemented by these institutions. By aligning with the security infrastructure of trusted local banks, payment gateways can enhance the overall security and reliability of their payment processing services. This integration not only helps to mitigate the risk of fraud but also builds trust with customers who may be hesitant to use unfamiliar payment methods or platforms.

Customers often place a high value on the security measures implemented by their banks, and by partnering with these institutions, payment gateways can reassure customers that their financial transactions are conducted in a secure environment. Moreover, integrating with local banks allows payment gateways to offer a wider range of payment options, including bank transfers and direct debits, catering to the preferences of customers who prefer traditional banking methods. Overall, this collaboration between payment gateways and local banks not only enhances security but also fosters customer trust and satisfaction, driving greater adoption and usage of digital payment solutions.

The media & entertainment segment to register the fastest growth rate during the forecast period.

In-game virtual currencies have become a staple of modern gaming, serving as a means for players to make microtransactions for various in-game items, enhancements, or additional content. Payment gateways play a crucial role in facilitating these transactions by integrating with the systems managing these virtual currencies. By doing so, users can securely purchase these virtual currencies with real money, enhancing their gaming experience without the need for cumbersome payment processes.

This integration not only streamlines the purchasing process for gamers but also ensures the security and reliability of transactions, instilling confidence in users as they engage in microtransactions within the gaming ecosystem. Furthermore, by enabling seamless integration with in-game virtual currency systems, payment gateways contribute to the monetization strategies of game developers, allowing them to leverage microtransactions as a lucrative revenue stream. As the gaming industry continues to evolve and embrace digital economies, payment gateways that facilitate the seamless exchange between real money and in-game virtual currencies are poised to play an increasingly vital role in shaping the future of gaming commerce.

North America to hold second largest highest market size during the forecast period.

North America stands out as a leader in the adoption of digital wallets, with widely embraced platforms such as Apple Pay, Google Pay, and regional players like Venmo gaining significant traction among consumers. Payment gateways that seamlessly integrate with these popular digital wallet options play a pivotal role in catering to consumer preferences and streamlining the checkout process. By offering compatibility with these widely used digital wallets, payment gateways provide customers with a convenient and familiar payment experience, allowing them to securely complete transactions with just a few taps or clicks.

This integration not only enhances the overall convenience of the checkout process but also instills confidence in consumers, as they can rely on trusted digital wallet providers to safeguard their payment information. Moreover, by facilitating seamless integration with popular digital wallets, payment gateways enable merchants to capitalize on the widespread adoption of these platforms, driving higher conversion rates and fostering customer loyalty in the competitive North American market. As digital wallet usage continues to soar, payment gateways that prioritize integration with these popular options are well-positioned to meet the evolving needs of consumers and merchants alike, driving further growth and innovation in the payment ecosystem.

Research Coverage

The market study covers the payment gateway market size across different segments. It aims at estimating the market size and the growth potential across different segments, including By type (hosted, self-hosted, other types) vertical (BFSI, retail & ecommerce, telecom, healthcare, media and entertainment, travel and hospitality, it & ites, other verticals)and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 227 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value (USD) in 2024 | $26.7 Billion |

| Forecasted Market Value (USD) by 2029 | $48.4 Billion |

| Compound Annual Growth Rate | 12.6% |

Key Topics Covered:

Executive Summary

- Payment Gateway Market to Witness Significant Growth During Forecast Period

- Payment Gateway Market: Regional Snapshot

Premium Insights

- Attractive Opportunities for Players in Payment Gateway Market - Rapid Digital Transformation in Developing Economies to Drive Market

- Payment Gateway Market: Top Growing Segments - Top Growing Segments in 2024

- Payment Gateway Market, by Type - Hosted Segment to Lead Market During Forecast Period

- Payment Gateway Market, by Vertical - Retail & E-Commerce to Hold Largest Market During Forecast Period

- North America: Payment Gateway Market, by Offering and Vertical - Hosted Segment and Retail & E-Commerce Estimated to Hold Largest Market Shares in 2024

Key Market Dynamics

Drivers

- Rapid Growth in E-Commerce

- Mobile Payment Adoption

- Globalization of Business Transactions

Restraints

- Regulatory Compliance

- Dependency on Banking Infrastructure

Opportunities

- Blockchain and Cryptocurrency Integration

- Value-Added Services

Challenges

- Customer Trust and Data Privacy

- Changing Consumer Behavior

Case Study Analysis

- Case Study 1: Razorpay Optimizer Helped Craft Fabindia's Payments Success Story

- Case Study 2: Sri Balaji University Reduced 90% of Reconciliation Efforts Using Feesbuzz and Forms

- Case Study 3: Pan Home Collaborated with Amazon Payment Services to Transform Customer Experience

- Case Study 4: Coingate Empowered Bacloud with Cryptocurrency Payment Solutions

- Case Study 5: Stripe Helped Increase Twilio's 10% Authorization Rate

- Case Study 6: Namely Streamlined Payments and Boosted Efficiency with Bluesnap Integration

Technology Analysis

- Key Technologies

- Encryption and Tokenization

- Artificial Intelligence

- Contactless Payments

- Adjacent Technologies

- Biometric Authentication

- IoT

- Blockchain

- Complementary Technologies

- 5G Technology

- Voice Recognition Technology

Best Practices in Payment Gateway Market

- Security Compliance

- Fraud Prevention

- Reliability and Uptime

- User-Friendly Interface

- Fast Transaction Processing

- Scalability

- Transparent Pricing

- Global Payment Support

- Robust API Documentation

- Customer Support

- Regular Updates and Innovation

- Compliance with Regulatory Standards

Current and Emerging Business Models

- Transaction-based Model

- Subscription-based Models

- Value-Added Services Model

- API-First Approach

- Integrated Service Models

- Cross-Border Payment Solutions

- Contactless and NFC Payments

- Embedded Finance

Companies Profiled

- Paypal

- Fiserv

- Stripe

- Visa

- Amazon

- Mastercard

- FIS

- Block

- Global Payments

- Adyen

- Apple

- J.P. Morgan

- Alibaba Group

- Razorpay

- Phonepe

- Paysafe

- Verifone

- Fidelity Payment Services

- Easebuzz

- Bluesnap

- Windcave

- Helcim

- Infibeam Avenues Limited (IAl)

- Nowpayments

- Instamojo

- Coingate

- Ippopay

- Payjunction

- Lyra Network

For more information about this report visit https://www.researchandmarkets.com/r/vmzxlv

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment