Dublin, June 10, 2024 (GLOBE NEWSWIRE) -- The "Global PFAS Filtration Market by Technology (Water Treatment Systems, Water Treatment Chemicals), Place of Treatment (In-Situ, Ex-Situ), Remediation Technology, Environmental Medium, Contaminant Type, and Region - Forecast to 2029" report has been added to ResearchAndMarkets.com's offering.

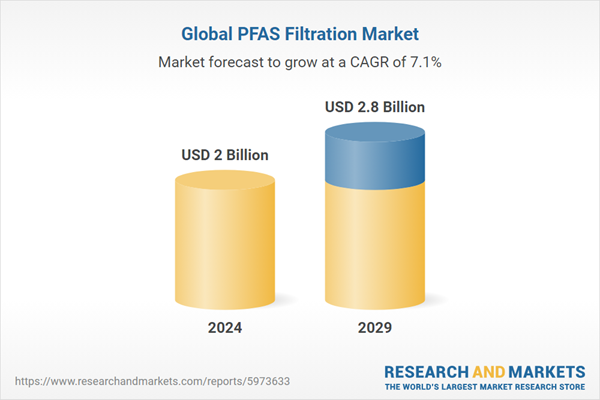

The PFAS filtration market is projected to reach USD 2.8 billion by 2029, at a CAGR of 7.1% from USD 2 billion in 2024.

The semiconductor industry extensively employs PFAS-containing chemicals in various manufacturing processes, such as etching and cleaning agents. Similarly, the chemical processing industry relies on PFAS compounds for their unique properties, using them in applications like lubricants, surfactants, and stain repellents. According to recent data from the EPA and industry reports, the manufacturing sector in the US accounts for a significant portion of PFAS emissions into the environment, with estimates suggesting that thousands of facilities across the country use PFAS-containing substances in their operations.

Moreover, the semiconductor industry, which plays a crucial role in technology manufacturing, relies on PFAS chemicals for various processes. The chemical processing industry contributes to PFAS contamination through its use of these substances in manufacturing processes and product formulations. As these industries expand, there is a growing need to address the environmental impact of PFAS contamination. Regulatory standards set by agencies such as the EPA and state-level environmental authorities necessitate stringent measures to mitigate PFAS pollution. Consequently, there is an increasing demand for PFAS filtration systems within these industries to comply with regulatory requirements and ensure environmental sustainability. PFAS treatment becomes imperative to prevent the release of these persistent and harmful contaminants into the environment, safeguarding water resources and public health.

Based on Technology type, water treatment systems segment is expected to be the fastest growing market during the forecast period, in terms of value.

Water treatment systems for PFAS filtration utilize several advanced technologies to effectively remove these persistent chemicals from water sources. Reverse Osmosis (RO) employs semipermeable membranes to physically block PFAS molecules based on their size and charge, ensuring high removal efficiency. Similarly, High-Pressure Membrane Filtration methods like nanofiltration and ultrafiltration operate on the principle of excluding contaminants through membranes, targeting PFAS effectively.

Advanced Oxidation Processes (AOPs), such as ozone or hydrogen peroxide treatments, degrade PFAS molecules into less harmful components through oxidation reactions, though these processes can be complex and costly. Electrochemical Oxidation/Reduction techniques apply electric currents to water, breaking down PFAS molecules into less toxic substances, showcasing potential as a promising yet evolving method. Each of these technologies offers distinct advantages depending on factors like water quality, scale of treatment, and regulatory requirements, highlighting the need for tailored solutions in combating PFAS contamination effectively.

Based on remediation technology, activated carbon has the largest market share during the forecast period, in terms of value.

Activated carbon is pivotal in PFAS filtration due to its exceptional ability to adsorb these persistent chemicals from water. PFAS molecules, known for their hydrophobic nature, are attracted to the porous surface of activated carbon, where they adhere through physical forces such as Van der Waals interactions. This adsorption process effectively traps PFAS contaminants within the carbon structure, removing them from the water stream. Activated carbon filtration systems are widely used across various scales, from municipal treatment plants to household filters, offering reliable removal of PFAS like PFOA and PFOS. Moreover, the regenerative nature of activated carbon allows for prolonged use and cost-effectiveness, making it a preferred choice in combating PFAS contamination in drinking water and industrial processes alike.

Based on region, Asia Pacific is the fastest growing market for PFAS filtration in 2023, in terms of value.

The Asia-Pacific region is experiencing rapid growth in PFAS filtration primarily due to several factors. Firstly, industrialization and urbanization across countries in this region have led to increased chemical usage and manufacturing activities, which in turn contribute to higher levels of PFAS contamination in water sources. As awareness of environmental and health risks associated with PFAS grows, there is a greater demand for effective water treatment solutions. Additionally, regulatory frameworks in countries like China, India, and Australia are becoming more stringent regarding water quality standards, necessitating the adoption of advanced filtration technologies like activated carbon and membrane processes for PFAS removal. The region's economic growth has also enabled investment in water infrastructure, including modern filtration technologies, to meet these regulatory requirements and address public health concerns.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 216 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value (USD) in 2024 | $2 Billion |

| Forecasted Market Value (USD) by 2029 | $2.8 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

Key Topics Covered:

Executive Summary

- Water Treatment Systems to be Larger Technology Type Between 2024 and 2029

- Activated Carbon to Lead Pfas Filtration Market Between 2024 and 2029

- PFOA & PFOS Contaminant Type to Lead Pfas Filtration Market Between 2024 and 2029

- Groundwater Environmental Medium Type to Lead Pfas Filtration Market Between 2024 and 2029

- Ex-Situ to Lead Pfas Filtration Market Between 2024 and 2029

- Off-Site to Lead Pfas Filtration Market Between 2024 and 2029

- Municipal to Lead Pfas Filtration Market Between 2024 and 2029

- North America to Lead Pfas Filtration Market, 2024-2029

Premium Insights

- Attractive Opportunities for Players in PFAS Filtration Market - Emerging Economies to Witness Higher Demand for Pfas Filtration Products During Forecast Period

- PFAS Filtration Market, by Technology Type - Water Treatment Systems to be Faster-Growing Market During Forecast Period

- PFAS Filtration Market, by Remediation Technology - Ro Membrane & Nanofiltration to Grow at Highest CAGR During Forecast Period

- PFAS Filtration Market, by Place of Treatment - Pfas Multiple Compounds to Grow at Higher CAGR During Forecast Period

- PFAS Filtration Market, by Service Type - On-Site Service Type to Grow at Higher CAGR During Forecast Period

- PFAS Filtration Market, by Environmental Medium - Soil Remediation to Grow at Highest CAGR During Forecast Period

- PFAS Filtration Market, by Contaminant Type - Ex-Situ Treatment to Grow at Higher CAGR During Forecast Period

- PFAS Filtration Market, by End-use Industry - Industrial Segment to Grow at Highest CAGR During Forecast Period

- PFAS Filtration Market, by Country - Market in Australia to Register Highest CAGR from 2024 to 2029

Market Dynamics

Drivers

- Increasing Regulatory Scrutiny and Tightening of Environmental Regulations Regarding Pfas Contamination

- Growing Public Awareness of Health Risks Associated with PFAS Exposure

- Expansion of Manufacturing, Chemical Processing, and Semiconductor Industries

Restraints

- Expensive and Complex Filtration Process

- Limited Availability of Trained Professionals

Opportunities

- Significant Potential to Expand Globally

- Significant Government Funding and Support for Pfas Research, Development, and Filtration Efforts

Challenges

- Proper Management of Treatment Residuals Generated During Pfas Treatment

- Addressing Emerging Pfas Compounds and Understanding Their Potential Risks and Treatment Requirements

Technology Analysis

- Coated Sand

- Foam Fractionation

- Modified Clay Technology

- Zeolite & Clay Minerals

Case Study Analysis

- Veolia

- Evoqua Water Technologies

- Calgon Carbon Corporation

Companies Featured

- Veolia

- Aecom

- Wsp

- Xylem

- Jacobs

- Clean Earth

- John Wood Group

- TRC Companies, Inc.

- Battelle Memorial Institute

- Cyclopure

- Calgon Carbon Corporation

- Regenesis

- Mineral Technologies, Inc.

- Cdm Smith, Inc.

- Pentair

- Aquasana Inc.

- Newterra Corporation

- Lanxess

- Eurowater

- Aqua-Aerobic Systems, Inc.

- Hydroviv

- Saltworks Technologies, Inc.

- Aclarity, Inc.

- Aquagga, Inc.

- Onvector

For more information about this report visit https://www.researchandmarkets.com/r/5p08kj

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment