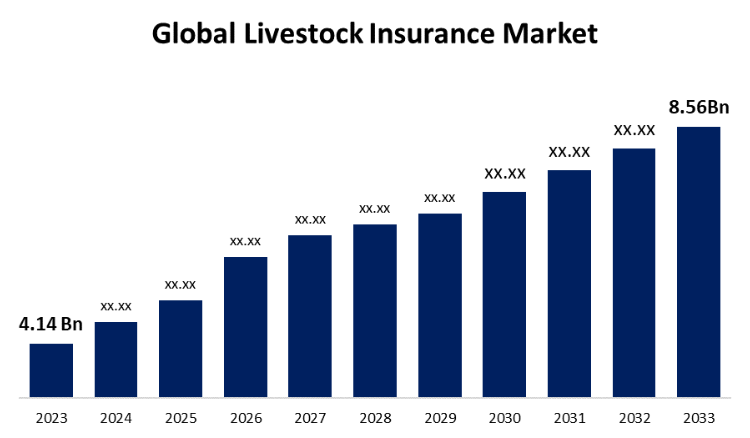

New York, United States, July 09, 2024 (GLOBE NEWSWIRE) -- The Global Livestock Insurance Market Size is to Grow from USD 4.14 Billion in 2023 to USD 8.56 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 7.53% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4875

Livestock insurance is a type of policy designed specifically to protect livestock owners from financial losses resulting from animal theft, accidental injury, or death. Among the several kinds of animals it includes are cattle, sheep, goats, pigs, horses, and chickens. It provides monetary compensation to the insurance bearer for losses incurred as a result of unanticipated events that affect the well-being or health of their cattle. It is supplied by traditional and specialized agricultural insurance companies that deal with farm and farm operations. Furthermore, the increasing value of livestock as a result of factors including shifting preferences for nutrition, rising demand for animal products, and an expanding global population is the main driver of the need for livestock insurance. The financial risks associated with potential losses have increased due to the rising expenses on cattle. Sales of livestock insurance have increased as a result, ensuring that these priceless assets are protected against loss, theft, and other calamities. Livestock insurance provides the financial assurance that the agriculture sector needs. Furthermore, livestock insurance provides a safety net that allows farmers to recover their investments and continue operating their businesses without experiencing catastrophic losses. The necessity for livestock insurance stems from the desire to lower these risks and safeguard the financial stability of livestock operations. However, the majority of small-scale farmers substantially refrain from getting this insurance coverage. Consequently, this poses a significant barrier to the expansion of the livestock insurance industry.

Browse key industry insights spread across 280 pages with 110 Market data tables and figures & charts from the report on the "Global Livestock Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Mortality, Revenue, and Other), By Animal Type (Bovine, Swine, Sheep & Goats, Poultry, and Other Animal), By Distribution Channel (Direct, Agency/Broker, Bancassurance, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4875

The morality segment is anticipated to hold the greatest share of the global livestock insurance market during the projected timeframe.

Based on the coverage, the global livestock insurance market is divided into mortality, revenue, and other. Among these, the morality segment is anticipated to hold the greatest share of the global livestock insurance market during the projected timeframe. The policyholder receives benefits under the livestock insurance coverage known as mortality whenever an insured animal passes away due to one of the covered hazards (diseases, illnesses, accidents, natural calamities, theft, etc.). It helps owners protect their possessions and financial stability, particularly in the case of expensive pets. The insurance policy's provisions state that the animal's value at the time of death determines the reimbursement amount.

The bovine segment is expected to grow at the fastest CAGR in the global livestock insurance market during the projected timeframe.

Based on the animal type, the global livestock insurance market is divided into bovine, swine, sheep & goats, poultry, and other animals. Among these, the bovine segment is expected to grow at the fastest CAGR in the global livestock insurance market during the projected timeframe. This is due to more people becoming aware of the benefits of cattle insurance plans and using them to reduce production risks. Insurance for cows covers losses to cattle brought on by bad weather, such as illness, injury, or decreased output as a result of insufficient feed or infrastructure damage. Additionally, it provides security against price risk and market volatility, ensuring dairy and beef producers a certain level of income stability. Due to it covers livestock mortality, medical costs, and biosecurity precautions, cow insurance is essential for reducing the financial losses brought on by disease outbreaks. It is anticipated that these advantages will aid in the segment's expansion.

The direct segment is projected for the largest revenue share in the livestock insurance market during the estimated period.

Based on the distribution channel, the global Livestock Insurance market is divided into direct, agency/broker, bancassurance, and others. Among these, the direct segment is projected for the largest revenue share in the livestock insurance market during the estimated period. At present, sales of livestock insurance policies distributed directly that is, without the use of intermediaries are increasing. Through several channels, including call centers, internet forums, and in-person meetings, the insurance firm directly interacts with farmers and livestock owners. The company distributes and sells its insurance products in addition to responding to policy inquiries, gathering premiums, and actively managing claims. This distribution channel allows for a direct line of communication between the policyholder and the insurer, giving both sides convenience and control.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4875

North America is expected to hold the largest share of the global livestock insurance market over the forecast period.

North America is expected to hold the largest share of the global livestock insurance market over the forecast period. North American livestock farmers have embraced livestock insurance to the point where reliable insurance companies have built a strong market for it. The greatest cow insurance market in North America is a result of the region's substantial cattle sector. Insurance firms offer a range of cow insurance policies, including death, illness, and accident insurance in addition to coverage for pasture, fodder, and range. To improve risk assessment, increase production, and save costs

Asia Pacific is predicted to grow at the fastest pace in the global livestock insurance market during the projected timeframe. Due to the region's expanding population, growing rate of urbanization, and growing demand for animal products. In addition, the propensity of Asia Pacific for a range of natural disasters, including typhoons, floods, earthquakes, and droughts, poses risks to livestock farmers' animals, infrastructure, and feed supply. As a result, livestock insurance serves as an essential safety net for farmers, allowing them to continue operating their livestock enterprises while coping with the effects of natural disasters and shifting weather patterns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Livestock Insurance Market include Allianz SE, Farmers Mutual Hail Insurance Company, XL Catlin, Chubb Limited, American International Group, Zurich Insurance Group Ltd., Tokio Marine Holdings Inc., QBE Insurance Group Ltd., The Hartford Financial Services Group, RSA Insurance Group plc, Sompo Holdings, Fairfax Financial Holdings Limited, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4875

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Livestock Insurance Market based on the below-mentioned segments:

Global Livestock Insurance Market, By Coverage

- Mortality

- Revenue

- Other

Global Livestock Insurance Market, By Animal Type

- Bovine

- Swine

- Sheep & Goats

- Poultry

- Other Animal

Global Livestock Insurance Market, By Distribution Channel

- Direct

- Agency/Broker

- Bancassurance

- Others

Global Livestock Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global Revenue Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Billing & Payment, Price Management, Revenue Assurance & Fraud Management, Channel Management, Others), By Deployment Mode (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (Telecom, Hospitality, Transportation, Healthcare, Retail & eCommerce, BFSI, Utilities, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter